Reached a new monthly high! The predicted market trading volume for December is $18.8 billion, but regulatory risks are also present.

The forecasted market trading volume in 2025 surged to $18.8 billion, with platforms like Kalshi leading the way, indicating that event-based predictions are shifting from niche gambling to mainstream financial tools.

Prediction markets in 2025 marked a perfect milestone. Driven by a surge in interest from both institutions and retail investors in event-based forecasting, platforms such as Kalshi and Opinion Labs achieved a record-breaking spot trading volume of $18.8 billion in December.

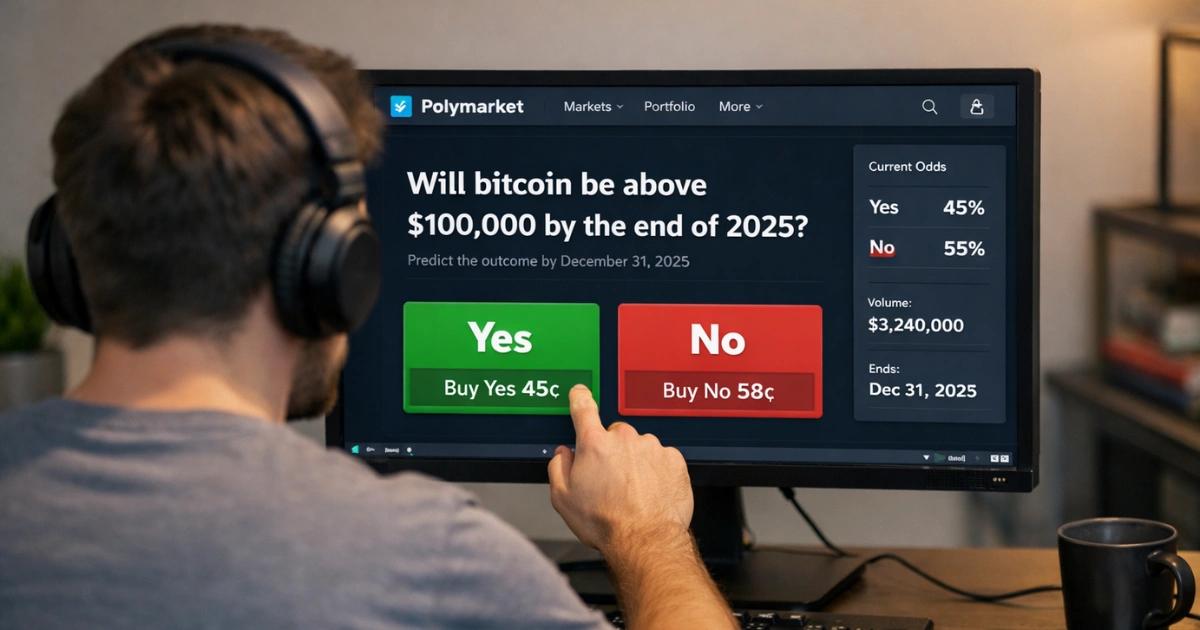

Data from analytics platform Artemis shows that trading volume steadily increased throughout the year, rising from less than $1 billion in January to a peak in December, reflecting that prediction markets are now more widely viewed as tools for hedging risks, measuring election, economic, and cultural sentiment. Kalshi and Opinion Labs each contributed $6.7 billion, accounting for about 36% of the total; followed by Polymarket ($5.3 billion), Limitless ($672 million), and Myriad ($13.8 million).

This milestone highlights the evolution of prediction markets from niche gambling venues to mainstream financial instruments. According to forecasts by research firms like Eilers & Krejcik, their annual trading volume could reach $40 billion in 2026 and approach $1 trillion within a decade.

Kalshi, as a regulated centralized platform in the United States, surpassed Polymarket in weekly trading volume at the end of the year. In the week ending December 21, Kalshi’s trading volume reached $2.3 billion, nearly double that of Polymarket; integration with exchanges like Coinbase and Robinhood significantly boosted its popularity.

Analysts attribute this boom to clearer US regulation and technological advances supporting real-time sentiment pricing. A market observer posted on X: “This is not noise, but ‘adoption’.” He pointed out that prediction markets are transforming into “real-time sentiment engines,” rivaling the $300 billion global sports betting industry.

As Bitcoin hovers around $88,000 and the total cryptocurrency market cap remains at $3 trillion, the growth in prediction markets demonstrates their potential to become embedded financial infrastructure, despite risks such as volatility and regulatory scrutiny.

- This article is reprinted with permission from: 《BlockBeats》

- Original title: 《Prediction Market December Trading Volume Reaches $18.8 Billion, Sets Monthly Record》

- Original author: Anfei