Kaff

No content yet

Kaff

✨ The Statement Of On-chain Gold

instead of buying gold in a brokerage account, crypto-native capital is buying ERC-20 gold.

tokenized gold trades 24/7, settles instantly on-chain, and can be swapped against stablecoins without waiting T+2 which is massive for a market that never sleeps.

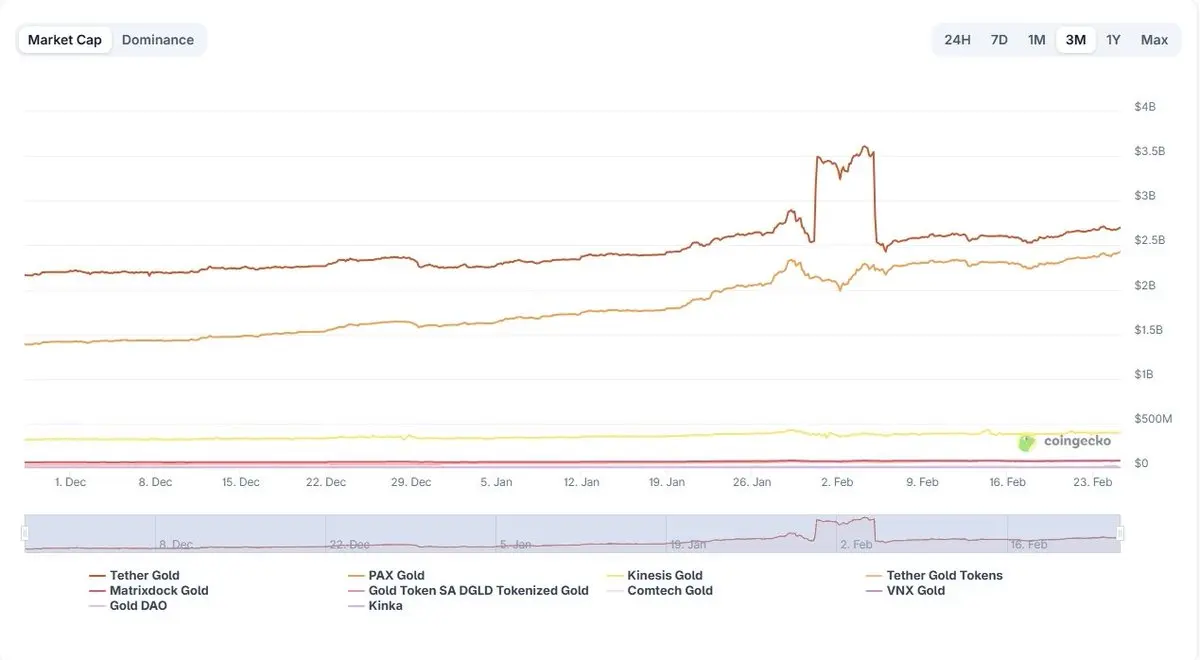

onchain gold just casually crossed $5.6B mcap making it a 4x since late 2024.

– $XAUt: $2.69B cap, 520k oz backed, ~16.2 tonnes

– $PAXG: $2.42B cap, 465k oz backed, ~14.5 tonnes

– $KAU: smaller at ~$400M cap

trading volume for tokenized gold absolutely ripped to $126B in Q4 2025 and flipped major gold ETFs in

instead of buying gold in a brokerage account, crypto-native capital is buying ERC-20 gold.

tokenized gold trades 24/7, settles instantly on-chain, and can be swapped against stablecoins without waiting T+2 which is massive for a market that never sleeps.

onchain gold just casually crossed $5.6B mcap making it a 4x since late 2024.

– $XAUt: $2.69B cap, 520k oz backed, ~16.2 tonnes

– $PAXG: $2.42B cap, 465k oz backed, ~14.5 tonnes

– $KAU: smaller at ~$400M cap

trading volume for tokenized gold absolutely ripped to $126B in Q4 2025 and flipped major gold ETFs in

- Reward

- like

- Comment

- Repost

- Share

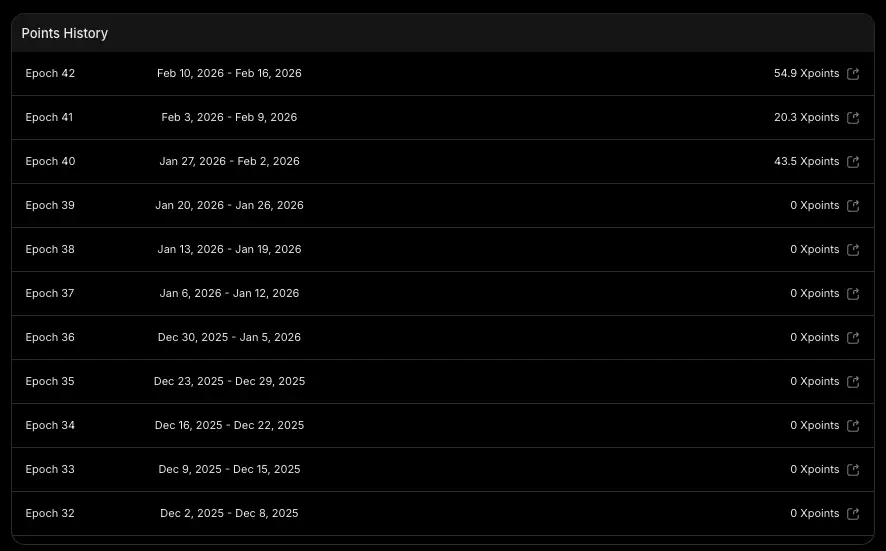

perp dexs are quietly distributing insane money every week through points.

based on otc pricing, here’s what it looks like:

Extended: $2.4M/week ($2/point)

Nado: $1.14M/week ($1.2/point)

Variational: $3.75M/week ($25/point)

GRVT: $2.25M/week ($15/point)

Paradex: $720K/week ($0.18/XP)

Edgex: $30M/week ($25/XP)

and people still ask if perp farming is worth it.

based on otc pricing, here’s what it looks like:

Extended: $2.4M/week ($2/point)

Nado: $1.14M/week ($1.2/point)

Variational: $3.75M/week ($25/point)

GRVT: $2.25M/week ($15/point)

Paradex: $720K/week ($0.18/XP)

Edgex: $30M/week ($25/XP)

and people still ask if perp farming is worth it.

- Reward

- 1

- Comment

- Repost

- Share

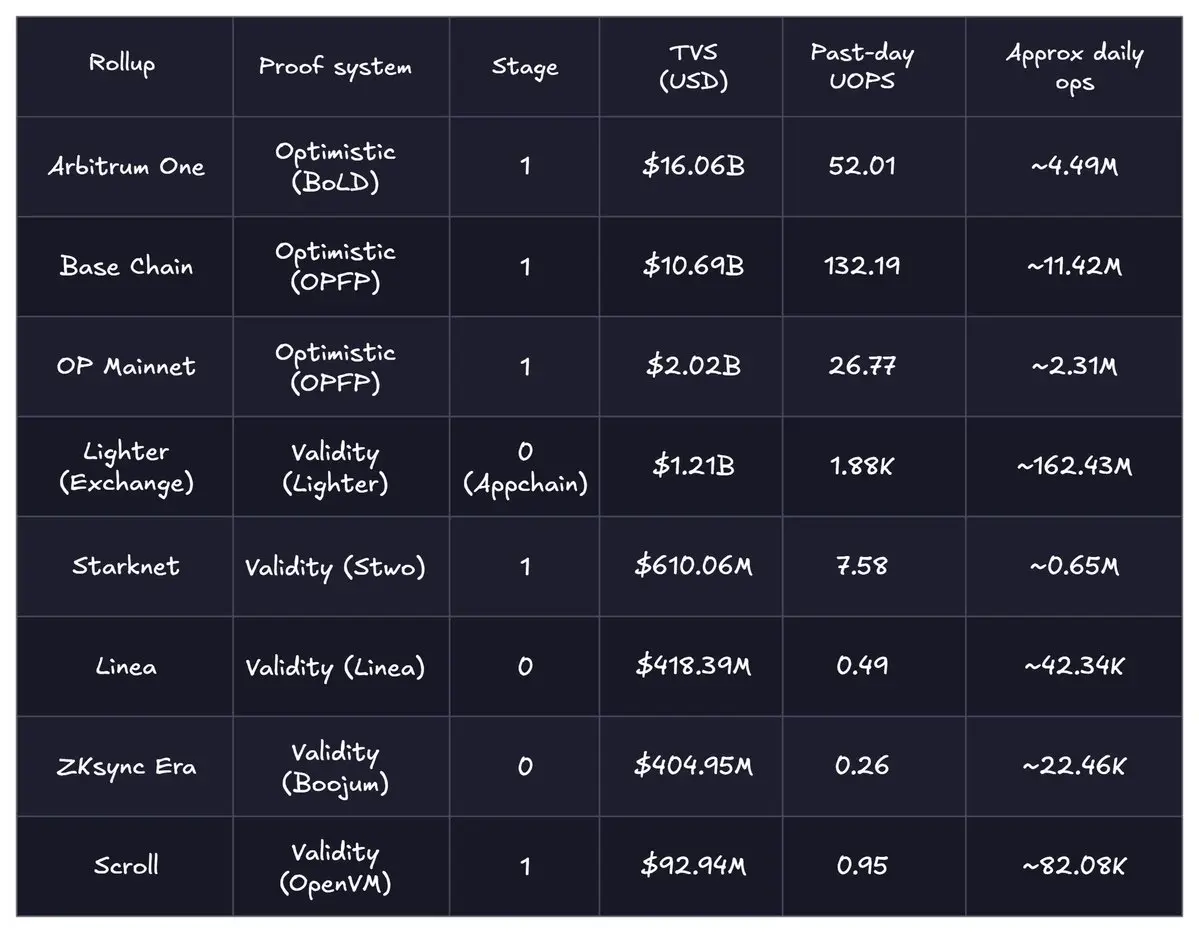

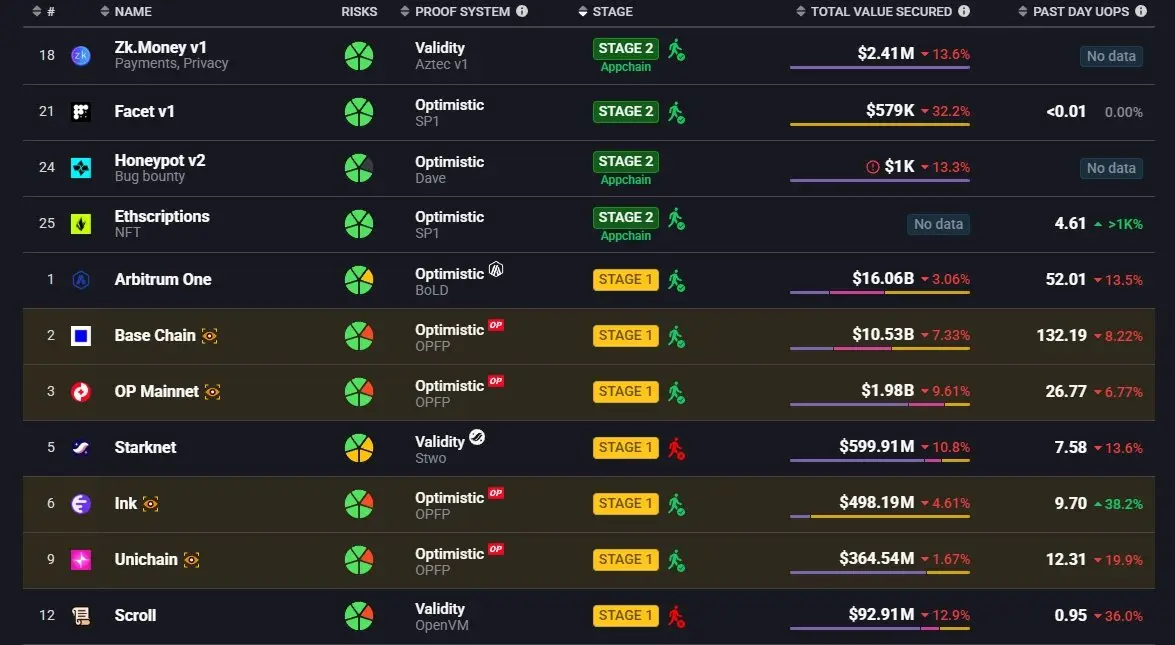

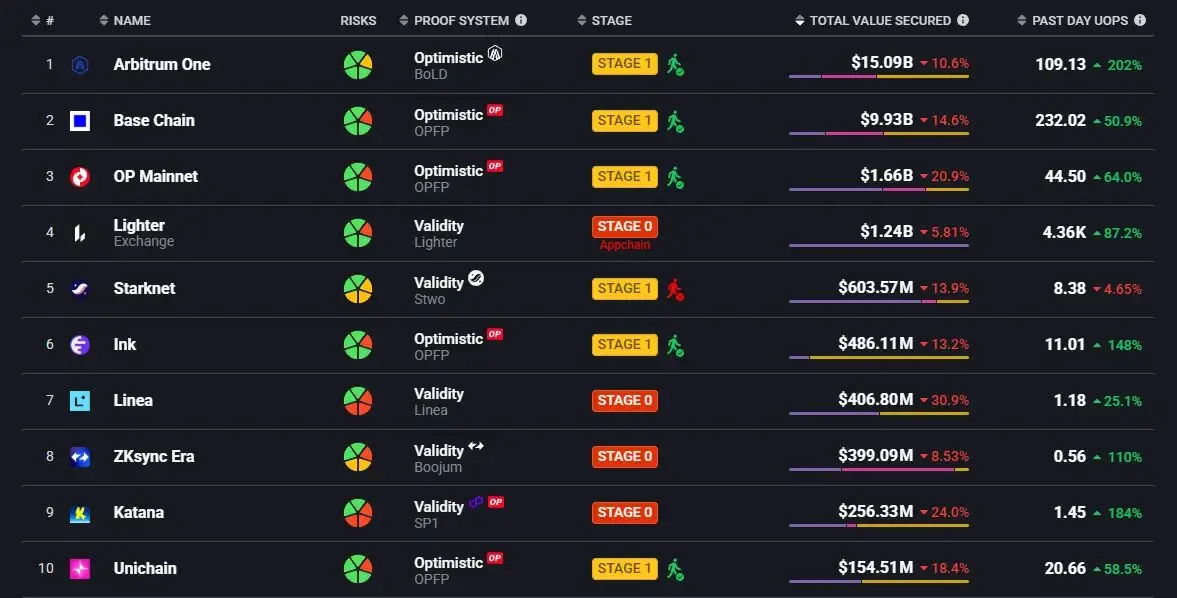

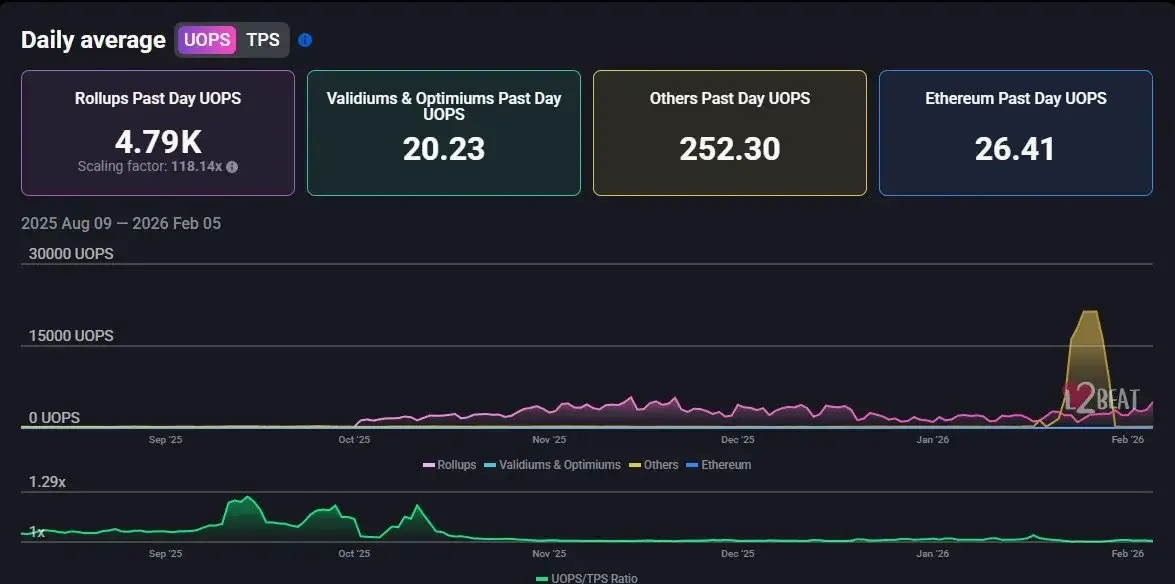

Are L2s Dying?

It’s all 3 at once: growth at the system level, saturation at the general-purpose layer, and a reset in security + economics.

First, growth is undeniable.

On an activity frame, rollups are doing ~2.13K user ops/sec vs Ethereum L1 ~33.13 UOPS. That’s ~100x scaling in raw execution demand.

Converted, that’s ~184M user ops/day on rollups vs ~2.86M on L1.

-----

But the structure just changed.

- #Base alone is sitting >60% of all L2 txn share

- Base roughly 47% of rollup DeFi TVL, Arbitrum ~31%, OP mainnet ~6%, everyone else fighting for scraps.

- Base is migrating off the Optimism O

It’s all 3 at once: growth at the system level, saturation at the general-purpose layer, and a reset in security + economics.

First, growth is undeniable.

On an activity frame, rollups are doing ~2.13K user ops/sec vs Ethereum L1 ~33.13 UOPS. That’s ~100x scaling in raw execution demand.

Converted, that’s ~184M user ops/day on rollups vs ~2.86M on L1.

-----

But the structure just changed.

- #Base alone is sitting >60% of all L2 txn share

- Base roughly 47% of rollup DeFi TVL, Arbitrum ~31%, OP mainnet ~6%, everyone else fighting for scraps.

- Base is migrating off the Optimism O

- Reward

- 2

- Comment

- Repost

- Share

Extended volumes are down 75% from ATH two weeks ago.

$2B daily → now barely $500M.

This week i actually received much more extended points than the week before, b/c low volume = fewer farmers = less competition

this is why i think now is one of the best windows for perp farming.

btw, my auto farming bot is still running quietly in the background.

just crossed $3M trading volume.

with that size, i’m ready to start market-neutral strategy on Extended + GRVT this weekend.

Bot farming:

Extended:

$2B daily → now barely $500M.

This week i actually received much more extended points than the week before, b/c low volume = fewer farmers = less competition

this is why i think now is one of the best windows for perp farming.

btw, my auto farming bot is still running quietly in the background.

just crossed $3M trading volume.

with that size, i’m ready to start market-neutral strategy on Extended + GRVT this weekend.

Bot farming:

Extended:

PERP-6%

- Reward

- 1

- Comment

- Repost

- Share

Do you think $ETH should be treated as a tech company, where if fees are down and revenue is down then $ETH is cooked?

Now trading at ~$233B FDV, I think fair value should reflect that $ETH is getting repriced as the world’s most trusted settlement layer for EVM finance.

The trigger for this shift is basically the roadmap narrative flipping.

For many years, when L2 was booming, the assumption was that L2s were the core carrier for scaling.

But the real-world version of fully decentralized L2s is just slower than everyone hoped, and L1 throughput is still expected to climb a lot over the next f

Now trading at ~$233B FDV, I think fair value should reflect that $ETH is getting repriced as the world’s most trusted settlement layer for EVM finance.

The trigger for this shift is basically the roadmap narrative flipping.

For many years, when L2 was booming, the assumption was that L2s were the core carrier for scaling.

But the real-world version of fully decentralized L2s is just slower than everyone hoped, and L1 throughput is still expected to climb a lot over the next f

ETH-1,45%

- Reward

- like

- Comment

- Repost

- Share

Vitalik just re-priced the whole L2 trade in public. The easy era of cheaper Ethereum is over.

Two numbers explain the shift:

→ L2 user activity is down about 50% from peak, while mainnet activity snapped back hard once fees got cheap again

→ blobs made rollup data so cheap it’s not the bottleneck anymore, around $0.04 per MB

So what happens when the only edge is low fees, and the base chain starts handing out low fees too?

A lot of quiet deaths. Major L2 token market cap is down to ~$6.8B, with $ARB, $OP and friends down ~90% from highs.

Look at who’s still alive on pure activity:

▫️ Base is

Two numbers explain the shift:

→ L2 user activity is down about 50% from peak, while mainnet activity snapped back hard once fees got cheap again

→ blobs made rollup data so cheap it’s not the bottleneck anymore, around $0.04 per MB

So what happens when the only edge is low fees, and the base chain starts handing out low fees too?

A lot of quiet deaths. Major L2 token market cap is down to ~$6.8B, with $ARB, $OP and friends down ~90% from highs.

Look at who’s still alive on pure activity:

▫️ Base is

- Reward

- like

- Comment

- Repost

- Share