阿亿Allin

No content yet

阿亿Allin

12.10 BTC Morning Market Analysis

I. Logic Support

1. Macro Event Pre-positioning: The US Federal Reserve's December interest rate decision will be released tonight, and the market is already active in anticipation. The current 92,100 level is at the center of a tug-of-war between "rate cut expectations pricing" and "pre-decision caution," with volatility likely to remain high.

2. Technical Bull-Bear Divergence: The daily chart previously broke through the strong 94,000 resistance and then pulled back. It is currently supported by the EMA convergence zone (90,300-90,400), but the 1-hour K-line

View OriginalI. Logic Support

1. Macro Event Pre-positioning: The US Federal Reserve's December interest rate decision will be released tonight, and the market is already active in anticipation. The current 92,100 level is at the center of a tug-of-war between "rate cut expectations pricing" and "pre-decision caution," with volatility likely to remain high.

2. Technical Bull-Bear Divergence: The daily chart previously broke through the strong 94,000 resistance and then pulled back. It is currently supported by the EMA convergence zone (90,300-90,400), but the 1-hour K-line

- Reward

- 2

- 1

- Repost

- Share

YaoQianshuA :

:

The point of the wolf12.10 ETH Morning Market Analysis

- Divergence between institutions and sentiment: Institutions continue to accumulate (BlackRock and Bitmine together bought over $270 million at the bottom), whale addresses increased holdings by 218,000 ETH in a single week, but short-term ETF inflows have slowed, with fierce long-short battles;

- Key level resonance: 3290 precisely touched the upper boundary of the previous 3250-3300 target range and is below the strong resistance zone of 3350-3400, creating a double contention point of "target level + pre-resistance" from a technical perspective;

- Macro ex

View Original- Divergence between institutions and sentiment: Institutions continue to accumulate (BlackRock and Bitmine together bought over $270 million at the bottom), whale addresses increased holdings by 218,000 ETH in a single week, but short-term ETF inflows have slowed, with fierce long-short battles;

- Key level resonance: 3290 precisely touched the upper boundary of the previous 3250-3300 target range and is below the strong resistance zone of 3350-3400, creating a double contention point of "target level + pre-resistance" from a technical perspective;

- Macro ex

- Reward

- 2

- 1

- Repost

- Share

GateUser-f4c88d26 :

:

Bull Run 🐂12.10 BTC Early Morning Market Express

Final Volatility Before the Decision! If 94,000 breaks, a surge to 96,000; if 92,500 breaks, a direct test of 91,000

I. Logic Support: Triple Game Determines Short-Term Direction

1. Macro Core: Countdown to the Fed decision (to be announced at 3 a.m. tomorrow), market has priced in an 89.4% probability of a 25bps rate cut, the focus shifts to "dovish cut" or "hawkish guidance," funds are positioned delta neutral, waiting for liquidity signals to be confirmed;

2. Capital Flow: Consecutive days of net ETF inflows provide bottom support, but there is dense s

View OriginalFinal Volatility Before the Decision! If 94,000 breaks, a surge to 96,000; if 92,500 breaks, a direct test of 91,000

I. Logic Support: Triple Game Determines Short-Term Direction

1. Macro Core: Countdown to the Fed decision (to be announced at 3 a.m. tomorrow), market has priced in an 89.4% probability of a 25bps rate cut, the focus shifts to "dovish cut" or "hawkish guidance," funds are positioned delta neutral, waiting for liquidity signals to be confirmed;

2. Capital Flow: Consecutive days of net ETF inflows provide bottom support, but there is dense s

- Reward

- 3

- 1

- Repost

- Share

PortalofAspiration :

:

Benefit 1: During the event period, watch for at least 5 minutes for the first time to receive 50 Heat Points and get 1 instant lucky draw chance. Benefit 2: Enter the event page and complete any task to start accumulating Heat Points. For every 50 Heat Points accumulated, you get 1 lucky draw opportunity. The more active you are in completing tasks, the more chances you have to win. The prize pool includes gold bars, GT, Christmas gift boxes, and other generous prizes.

Benefit 3: Share the event page and invite 3 or more new users to register. According to the number of valid new users invited, the top 10 users will receive an exquisite peripheral gift.

Benefit 4: The top 10 users on the Heat Points leaderboard will receive 2 random peripheral gifts.

12.10 ETH Early Morning Market Analysis

Consolidation and Game Theory Before the Fed Decision, Key Levels Determine Direction

ETH is currently in a high-level consolidation breakout phase in the short term. The core opportunity lies in a confirmed breakout of the 3240-3300 resistance zone, while the main risk stems from liquidity contraction and leveraged liquidation pressure ahead of the Fed decision.

II. Technical Anchors

- Core resistance: 3295-3310 (previous rebound high overlapping with intraday sentiment resistance level), strong resistance at 3350 (daily rebound trend suppression line)

View OriginalConsolidation and Game Theory Before the Fed Decision, Key Levels Determine Direction

ETH is currently in a high-level consolidation breakout phase in the short term. The core opportunity lies in a confirmed breakout of the 3240-3300 resistance zone, while the main risk stems from liquidity contraction and leveraged liquidation pressure ahead of the Fed decision.

II. Technical Anchors

- Core resistance: 3295-3310 (previous rebound high overlapping with intraday sentiment resistance level), strong resistance at 3350 (daily rebound trend suppression line)

- Reward

- 3

- 3

- Repost

- Share

ComeOnEveryDay :

:

Haha😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃View More

[Who just got liquidated by the volatility? Raise your hand!]

BTC/ETH have been swinging back and forth these past two days—chasing the pump gets you dumped on, trying to catch the bottom gets you squeezed up. Feels like the whales have welded your wallet onto the candlestick chart, right?

(Check the strategy screenshots: entry/stop/target all specified, not a single word of hindsight)—When I, Ah Yi, make a strategy, it’s always “give precise entry, control risk, earn clear profits.”

[This is a money-making window—do you dare to take it?]

The Fed’s rate cut expectations are maxed out for tonig

View OriginalBTC/ETH have been swinging back and forth these past two days—chasing the pump gets you dumped on, trying to catch the bottom gets you squeezed up. Feels like the whales have welded your wallet onto the candlestick chart, right?

(Check the strategy screenshots: entry/stop/target all specified, not a single word of hindsight)—When I, Ah Yi, make a strategy, it’s always “give precise entry, control risk, earn clear profits.”

[This is a money-making window—do you dare to take it?]

The Fed’s rate cut expectations are maxed out for tonig

- Reward

- 1

- Comment

- Repost

- Share

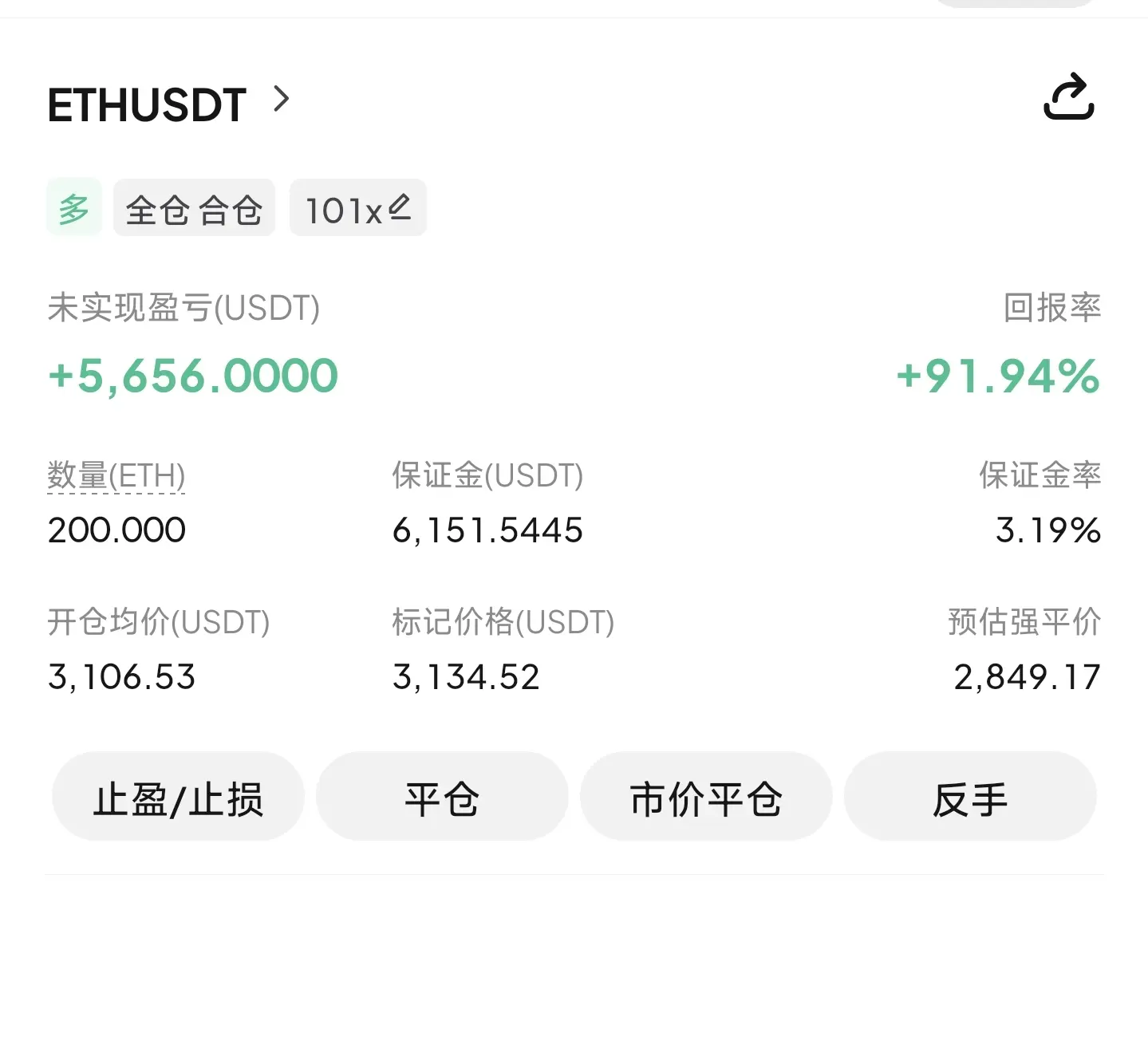

This isn't luck—last week when ETH was at 3000, I said "If ETH dares to drop, I'll dare to go all in." Some people said I was crazy, but what about now? With contracts, it's all about daring to pick up chips when others are cutting their losses, daring to leverage up when others are hesitating.

Now ETH just touched 3160, still 200 points away from the previous high, but I'm only taking 10 brothers with me to make profits.

#美联储降息预测 #比特币活跃度走高 #广场发帖领$50 #十二月行情展望 #加密市场回暖 $BTC $ETH

View OriginalNow ETH just touched 3160, still 200 points away from the previous high, but I'm only taking 10 brothers with me to make profits.

#美联储降息预测 #比特币活跃度走高 #广场发帖领$50 #十二月行情展望 #加密市场回暖 $BTC $ETH

- Reward

- 1

- Comment

- Repost

- Share

For those who understood this ETH move tonight, they've already made easy profits!

Market characterization: oscillating with a bullish bias, tonight is the breakout window!

Right now ETH is hovering between 3100-3160, but on the capital side (ETF buying frenzy + exchanges running out of supply) and sentiment side (expectations of a Fed "dovish" stance), everything is bullish—this move is all about "building up for takeoff."

The core logic is simple: tight supply, capital scramble, and news catalysts!

- Those holding ETH are refusing to sell (exchange balances have hit recent lows). Anyone want

Market characterization: oscillating with a bullish bias, tonight is the breakout window!

Right now ETH is hovering between 3100-3160, but on the capital side (ETF buying frenzy + exchanges running out of supply) and sentiment side (expectations of a Fed "dovish" stance), everything is bullish—this move is all about "building up for takeoff."

The core logic is simple: tight supply, capital scramble, and news catalysts!

- Those holding ETH are refusing to sell (exchange balances have hit recent lows). Anyone want

BTC0.7%

- Reward

- 3

- 1

- Repost

- Share

Don'tWantToBePoor. :

:

666Evening BTC Market Analysis

1. Macroeconomic Policy Vacuum: The anticipation of a Fed rate cut in December (probability 89.6%) clashes with concerns about "buy the rumor, sell the news" ahead of policy implementation. As a result, funds are hesitant to increase positions, leading to a sell-off after this morning's spike to $92,259.

2. Divergence in Capital Flows: There was a short-term net outflow of $195 million from ETFs (short-term risk aversion), but exchange balances hit a new low since 2017 (long-term institutional support), resulting in intense long-short position swapping.

3. Technical

View Original1. Macroeconomic Policy Vacuum: The anticipation of a Fed rate cut in December (probability 89.6%) clashes with concerns about "buy the rumor, sell the news" ahead of policy implementation. As a result, funds are hesitant to increase positions, leading to a sell-off after this morning's spike to $92,259.

2. Divergence in Capital Flows: There was a short-term net outflow of $195 million from ETFs (short-term risk aversion), but exchange balances hit a new low since 2017 (long-term institutional support), resulting in intense long-short position swapping.

3. Technical

- Reward

- 2

- 1

- Repost

- Share

ABABBABA :

:

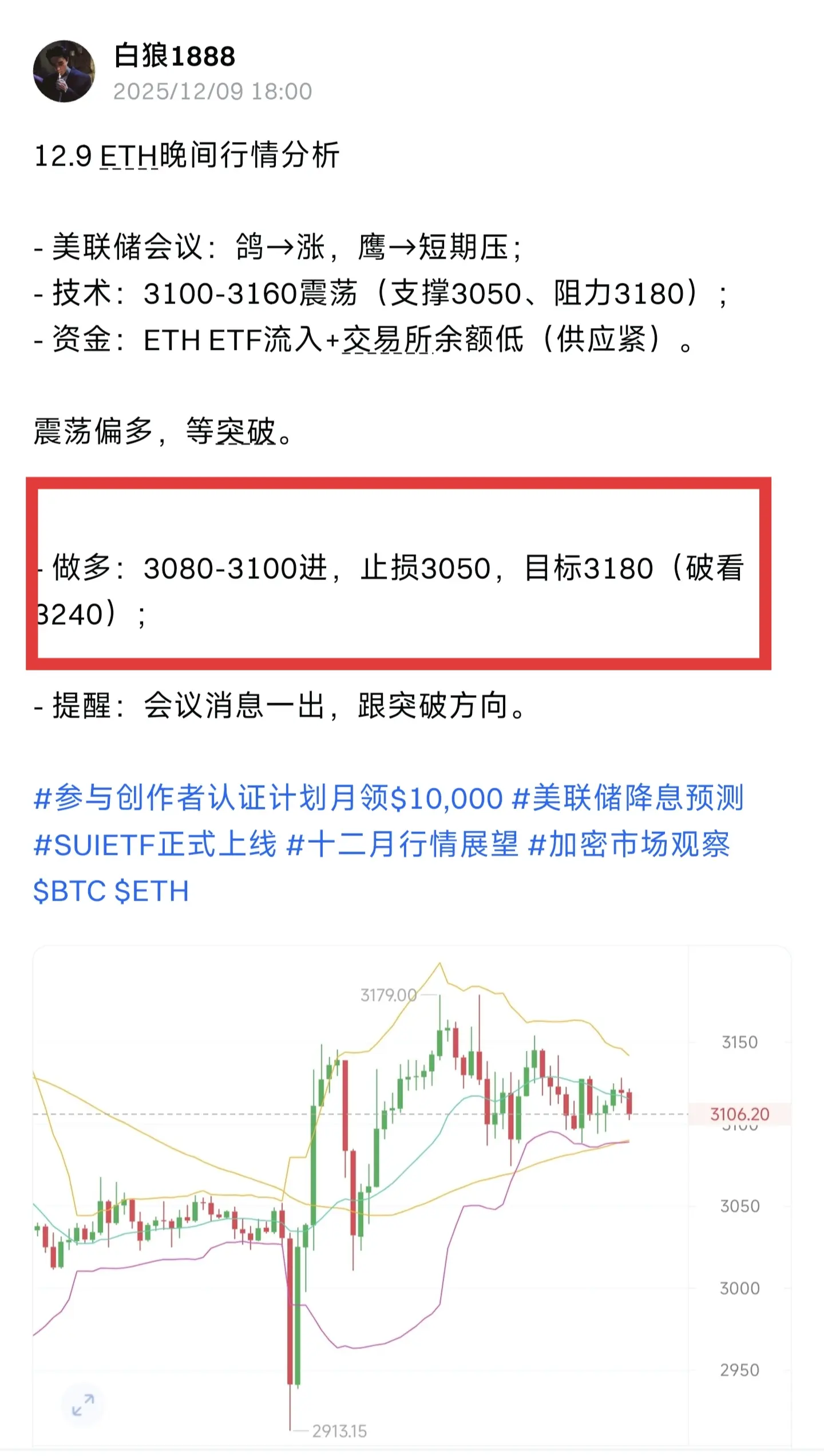

Diversified investment reduces single risk12.9 ETH Evening Market Analysis

- Fed Meeting: Dovish → increase, Hawkish → short-term pressure;

- Technicals: 3100-3160 range (support at 3050, resistance at 3180);

- Capital: ETH ETF inflows + low exchange balances (tight supply).

Range-bound with a bullish bias, wait for a breakout.

- Long: Enter at 3080-3100, stop loss at 3050, target 3180 (if broken, look to 3240);

- Reminder: Once the meeting news is released, follow the breakout direction.

#参与创作者认证计划月领$10,000 #美联储降息预测 #SUIETF正式上线 #十二月行情展望 #加密市场观察 $BTC $ETH

View Original- Fed Meeting: Dovish → increase, Hawkish → short-term pressure;

- Technicals: 3100-3160 range (support at 3050, resistance at 3180);

- Capital: ETH ETF inflows + low exchange balances (tight supply).

Range-bound with a bullish bias, wait for a breakout.

- Long: Enter at 3080-3100, stop loss at 3050, target 3180 (if broken, look to 3240);

- Reminder: Once the meeting news is released, follow the breakout direction.

#参与创作者认证计划月领$10,000 #美联储降息预测 #SUIETF正式上线 #十二月行情展望 #加密市场观察 $BTC $ETH

- Reward

- 2

- 1

- Repost

- Share

GateUser-de0c7d5d :

:

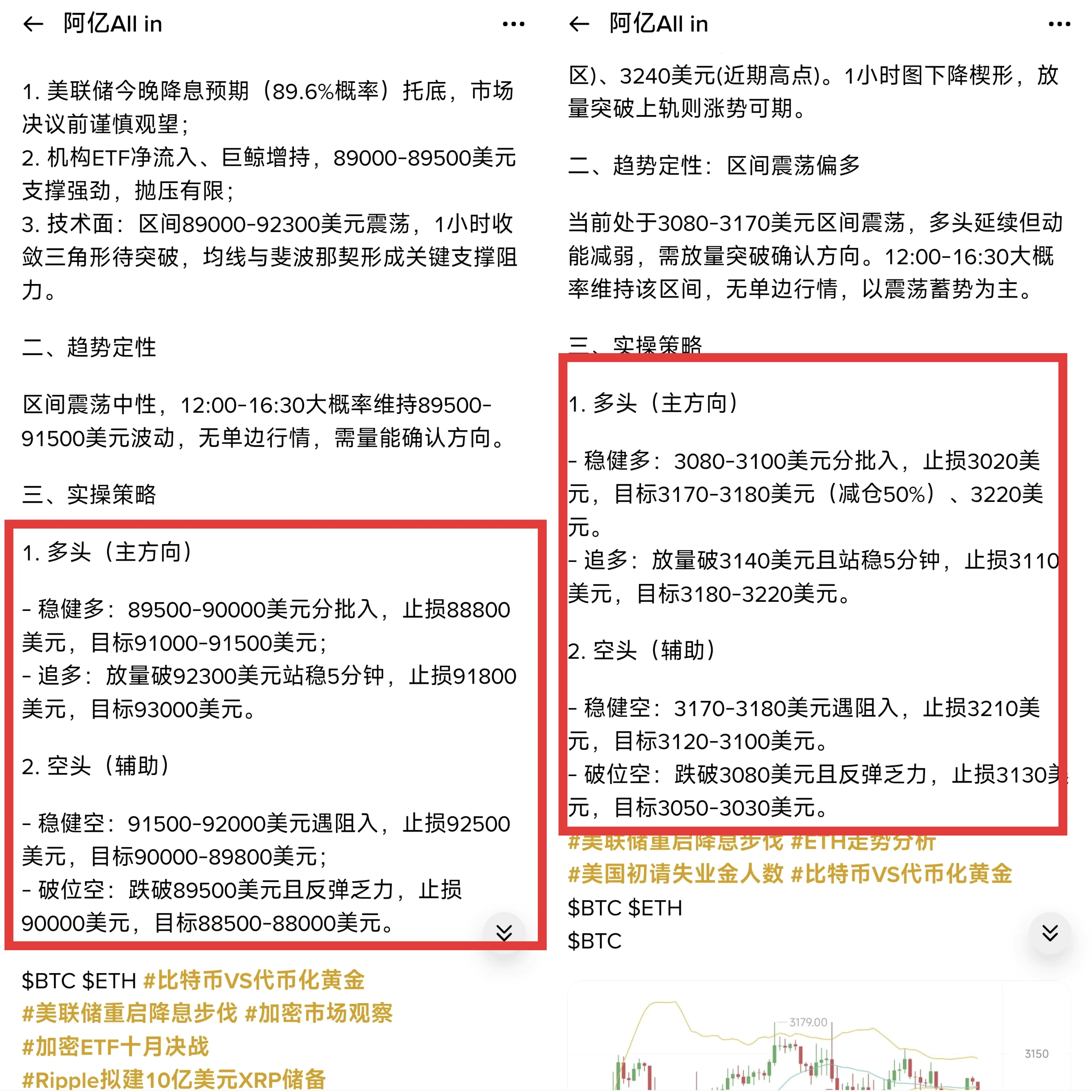

ggghjdygjfhjbcfff gghjjjj12.9 BTC Afternoon Market Analysis

I. Core Logic Support

1. The Federal Reserve is expected to cut rates tonight (89.6% probability), providing a market floor; investors are cautious ahead of the decision.

2. Institutional ETF net inflows and whale accumulation; strong support at $89,000-$89,500 with limited selling pressure.

3. Technicals: Oscillating between $89,000-$92,300; 1-hour converging triangle awaits breakout; moving averages and Fibonacci levels form key support and resistance.

II. Trend Assessment

Range-bound and neutral; from 12:00 to 16:30, the price is likely to fluctuate betwee

View OriginalI. Core Logic Support

1. The Federal Reserve is expected to cut rates tonight (89.6% probability), providing a market floor; investors are cautious ahead of the decision.

2. Institutional ETF net inflows and whale accumulation; strong support at $89,000-$89,500 with limited selling pressure.

3. Technicals: Oscillating between $89,000-$92,300; 1-hour converging triangle awaits breakout; moving averages and Fibonacci levels form key support and resistance.

II. Trend Assessment

Range-bound and neutral; from 12:00 to 16:30, the price is likely to fluctuate betwee

- Reward

- 4

- 1

- Repost

- Share

Long-shortEquityStrategyMaster :

:

Air force bayonet charge, gather, gather, gather, gather, send ETH to the grave, charge, charge, charge, charge, charge, charge, charge, charge, charge, charge, charge, charge, charge.12.9 ETH Afternoon Market Analysis

I. Core Logic Support

1. Macro Catalysts: Strong expectations for a Fed rate cut today, anticipated liquidity easing benefits high-beta ETH. Exercise caution before the decision, volatility will increase but downside is limited.

2. Capital Flow: Institutions are continuously buying in the $3050-$3100 range, net outflows from exchanges are increasing, selling pressure is easing.

3. Technicals: Support at $3050-$3080 (( moving average golden cross )), $3000 (( psychological level )); resistance at $3170-$3200 (( high-volume zone )), $3240 (( recent high )). 1-h

View OriginalI. Core Logic Support

1. Macro Catalysts: Strong expectations for a Fed rate cut today, anticipated liquidity easing benefits high-beta ETH. Exercise caution before the decision, volatility will increase but downside is limited.

2. Capital Flow: Institutions are continuously buying in the $3050-$3100 range, net outflows from exchanges are increasing, selling pressure is easing.

3. Technicals: Support at $3050-$3080 (( moving average golden cross )), $3000 (( psychological level )); resistance at $3170-$3200 (( high-volume zone )), $3240 (( recent high )). 1-h

- Reward

- 1

- 4

- Repost

- Share

GoldMedalADCalcium :

:

Hop on board!🚗View More

12.8 BTC Evening Market Analysis

I. Core Logic Support

1. Macro Long/Short Hedging: The end of the Fed's QT plus 87% rate cut expectations are long-term positives, but Japan's 91% probability of a rate hike could trigger carry trade unwinding and short-term selling pressure, leading to cautious market sentiment;

2. Contradictory Technical Signals: Daily chart breaking above the EMA15 trendline at 90,800 shows short-term bullish momentum, with MACD expanding upward, but EMA30 plus the golden ratio form a strong resistance zone at 93,600-94,200. The weekly chart still oscillates in the 90,000-95

View OriginalI. Core Logic Support

1. Macro Long/Short Hedging: The end of the Fed's QT plus 87% rate cut expectations are long-term positives, but Japan's 91% probability of a rate hike could trigger carry trade unwinding and short-term selling pressure, leading to cautious market sentiment;

2. Contradictory Technical Signals: Daily chart breaking above the EMA15 trendline at 90,800 shows short-term bullish momentum, with MACD expanding upward, but EMA30 plus the golden ratio form a strong resistance zone at 93,600-94,200. The weekly chart still oscillates in the 90,000-95

- Reward

- 3

- 1

- Repost

- Share

ComeOnEveryDay :

:

Haha😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃😃12.8 ETH Evening Market Analysis

I. Core Logic Support

1. Macro + Capital Dual Support: The probability of a Fed rate cut in December is as high as 87%. The US stock market's strength signals increased risk appetite. ETH ETF saw a single-day net inflow of $315 million, with institutional funds continuously providing support and no signs of panic withdrawal.

2. Strengthening Technical Structure: On the 4-hour chart, highs and lows are rising; the 1-hour chart holds above the key 3050 moving average; ETH/BTC exchange rate has broken through the 30-day consolidation range, confirming a structural

View OriginalI. Core Logic Support

1. Macro + Capital Dual Support: The probability of a Fed rate cut in December is as high as 87%. The US stock market's strength signals increased risk appetite. ETH ETF saw a single-day net inflow of $315 million, with institutional funds continuously providing support and no signs of panic withdrawal.

2. Strengthening Technical Structure: On the 4-hour chart, highs and lows are rising; the 1-hour chart holds above the key 3050 moving average; ETH/BTC exchange rate has broken through the 30-day consolidation range, confirming a structural

- Reward

- 1

- Comment

- Repost

- Share

Accurate prediction! Those who followed this BTC+ETH rally made a killing

A day in crypto feels like a year in the real world?

But if you catch the right rhythm, one day can be worth half a year for others!

With today’s precise entry on BTC+ETH, who wouldn’t say it’s “solid”?

The strategy I shared this morning hit the market rhythm right on point this afternoon:

- BTC entry at 90,800-91,000, target 91,500/92,000 hit directly;

- ETH layout at 3,030-3,050, the expected 3,070/3,150 already reached!

This isn’t luck—it’s precise grasp of support/resistance and capital flow—

BTC held the 91,000 supp

View OriginalA day in crypto feels like a year in the real world?

But if you catch the right rhythm, one day can be worth half a year for others!

With today’s precise entry on BTC+ETH, who wouldn’t say it’s “solid”?

The strategy I shared this morning hit the market rhythm right on point this afternoon:

- BTC entry at 90,800-91,000, target 91,500/92,000 hit directly;

- ETH layout at 3,030-3,050, the expected 3,070/3,150 already reached!

This isn’t luck—it’s precise grasp of support/resistance and capital flow—

BTC held the 91,000 supp

- Reward

- 2

- 2

- Repost

- Share

JACKQIU :

:

Take me 😂View More

12.8 Afternoon BTC Market Analysis

Bitcoin has held above the key support at 91,000. After a period of consolidation, bullish momentum is gradually emerging. The structure has recovered after bottoming out at 87,688 without breaking down, and in the short term, the price is oscillating within the 90,000–92,000 range.

Core Support: The 87,500–88,000 strong support zone has solid buying interest; rate cut expectations (87% probability) and institutional funds are providing a floor, with macro and capital factors resonating; price has moved above the EMA15, signaling clear technical recovery.

Tre

Bitcoin has held above the key support at 91,000. After a period of consolidation, bullish momentum is gradually emerging. The structure has recovered after bottoming out at 87,688 without breaking down, and in the short term, the price is oscillating within the 90,000–92,000 range.

Core Support: The 87,500–88,000 strong support zone has solid buying interest; rate cut expectations (87% probability) and institutional funds are providing a floor, with macro and capital factors resonating; price has moved above the EMA15, signaling clear technical recovery.

Tre

BTC0.7%

- Reward

- 1

- Comment

- Repost

- Share

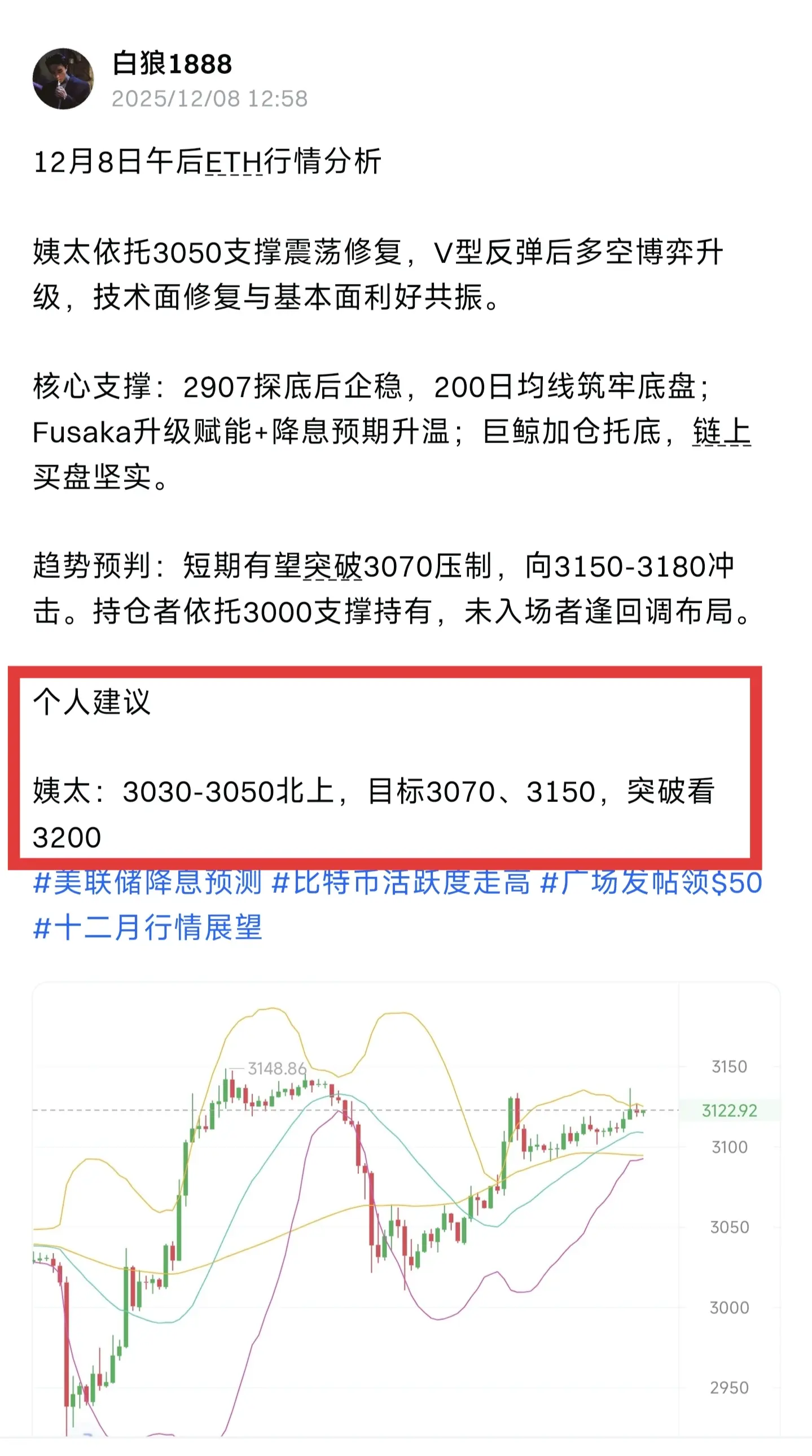

ETH Market Analysis for the Afternoon of December 8

ETH is consolidating and recovering around the 3050 support level, with a V-shaped rebound leading to intensified long-short battles. Technical recovery and fundamental bullish news are resonating.

Core Support: Stabilized after testing 2907, with the 200-day moving average reinforcing the base. Fusaka upgrade empowerment plus rising rate cut expectations. Whale accumulation provides a strong floor, with solid on-chain buying.

Trend Forecast: Short-term is expected to break through the 3070 resistance, aiming for 3150-3180. Holders should rel

ETH is consolidating and recovering around the 3050 support level, with a V-shaped rebound leading to intensified long-short battles. Technical recovery and fundamental bullish news are resonating.

Core Support: Stabilized after testing 2907, with the 200-day moving average reinforcing the base. Fusaka upgrade empowerment plus rising rate cut expectations. Whale accumulation provides a strong floor, with solid on-chain buying.

Trend Forecast: Short-term is expected to break through the 3070 resistance, aiming for 3150-3180. Holders should rel

ETH5.22%

- Reward

- like

- Comment

- Repost

- Share