ZhaoLusi

No content yet

ZhaoLusi

This Bitcoin chart isn’t about catching tops or bottoms.

It’s about structure over time.

Bitcoin keeps printing higher highs and higher lows.

Volatility shakes weak hands.

Patience gets rewarded.

🤝🤝

It’s about structure over time.

Bitcoin keeps printing higher highs and higher lows.

Volatility shakes weak hands.

Patience gets rewarded.

🤝🤝

BTC1,29%

- Reward

- like

- Comment

- Repost

- Share

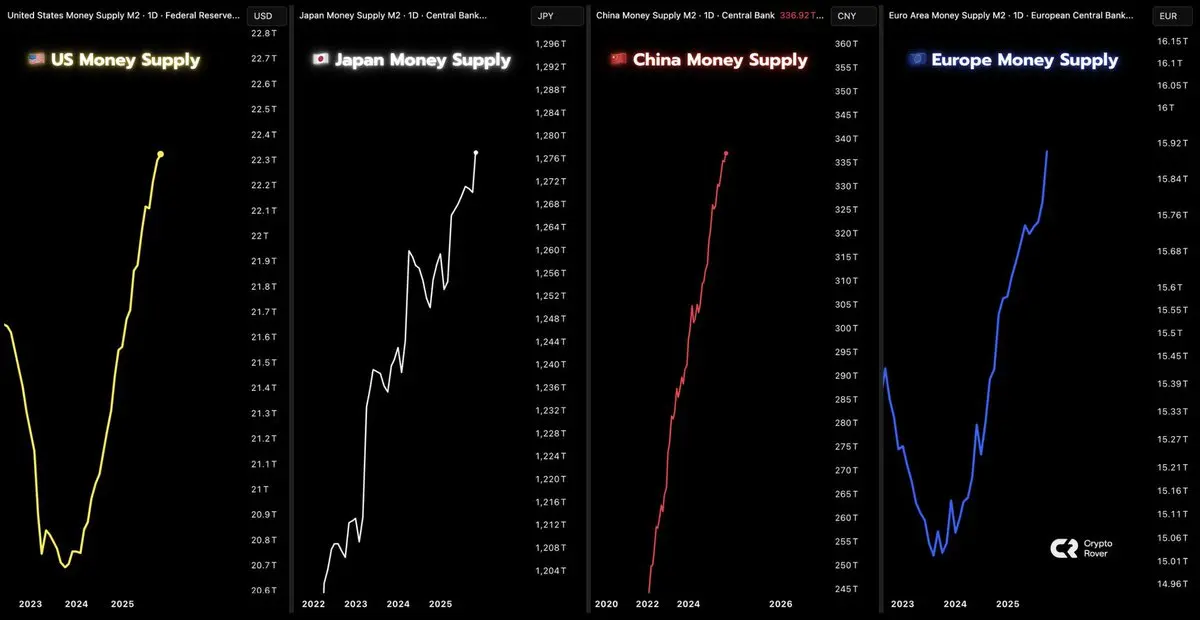

Global money supply is moving higher again.

The US, China, Japan, and Europe are all expanding liquidity at the same time.

History shows markets tend to notice when this happens.

The US, China, Japan, and Europe are all expanding liquidity at the same time.

History shows markets tend to notice when this happens.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨Breaking:

Momentum is building in Washington SEC Chair Paul Atkins says crypto market structure legislation is on the verge of passing Congress.

A major regulatory shift may be closer than expected.

Momentum is building in Washington SEC Chair Paul Atkins says crypto market structure legislation is on the verge of passing Congress.

A major regulatory shift may be closer than expected.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

ASTER Holds Strong at $0.92 Despite Market Volatility

While most altcoins struggled through sharp swings, ASTER kept its footing around the $0.92 mark, showing signs of a potential bottom forming

Whales are watching closely, and early accumulation hints are beginning to appear

While most altcoins struggled through sharp swings, ASTER kept its footing around the $0.92 mark, showing signs of a potential bottom forming

Whales are watching closely, and early accumulation hints are beginning to appear

ASTER6,05%

- Reward

- 2

- 1

- Repost

- Share

DragonFlyOfficial :

:

Good post- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More19.62K Popularity

49.08K Popularity

57.52K Popularity

98.78K Popularity

3.85K Popularity

Pin