PARON

No content yet

Pin

PARON

0

0

Capital Expenditures (CAPEX) in 2026:

Amazon $200 billion

Meta $185 billion

Microsoft $110 billion

The trio will spend approximately $600 billion, compared to their spending of $350 billion in 2025 and $250 billion in 2024.

The AI frenzy is one of the main reasons for this massive spending!

View OriginalAmazon $200 billion

Meta $185 billion

Microsoft $110 billion

The trio will spend approximately $600 billion, compared to their spending of $350 billion in 2025 and $250 billion in 2024.

The AI frenzy is one of the main reasons for this massive spending!

MC:$2.48KHolders:2

0.01%

- Reward

- like

- Comment

- Repost

- Share

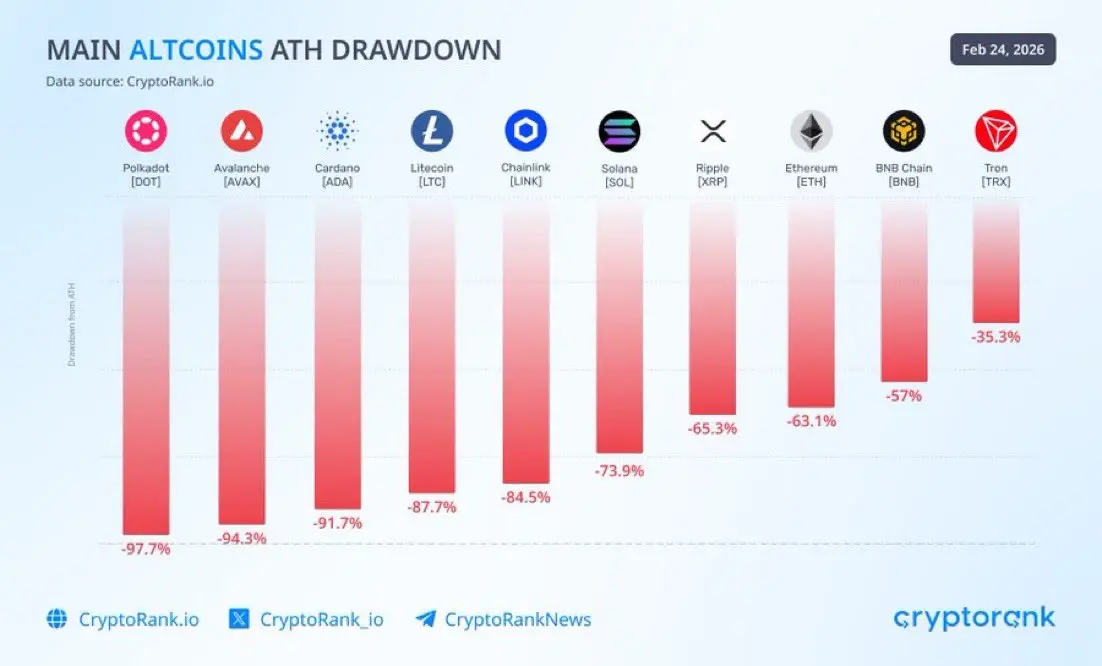

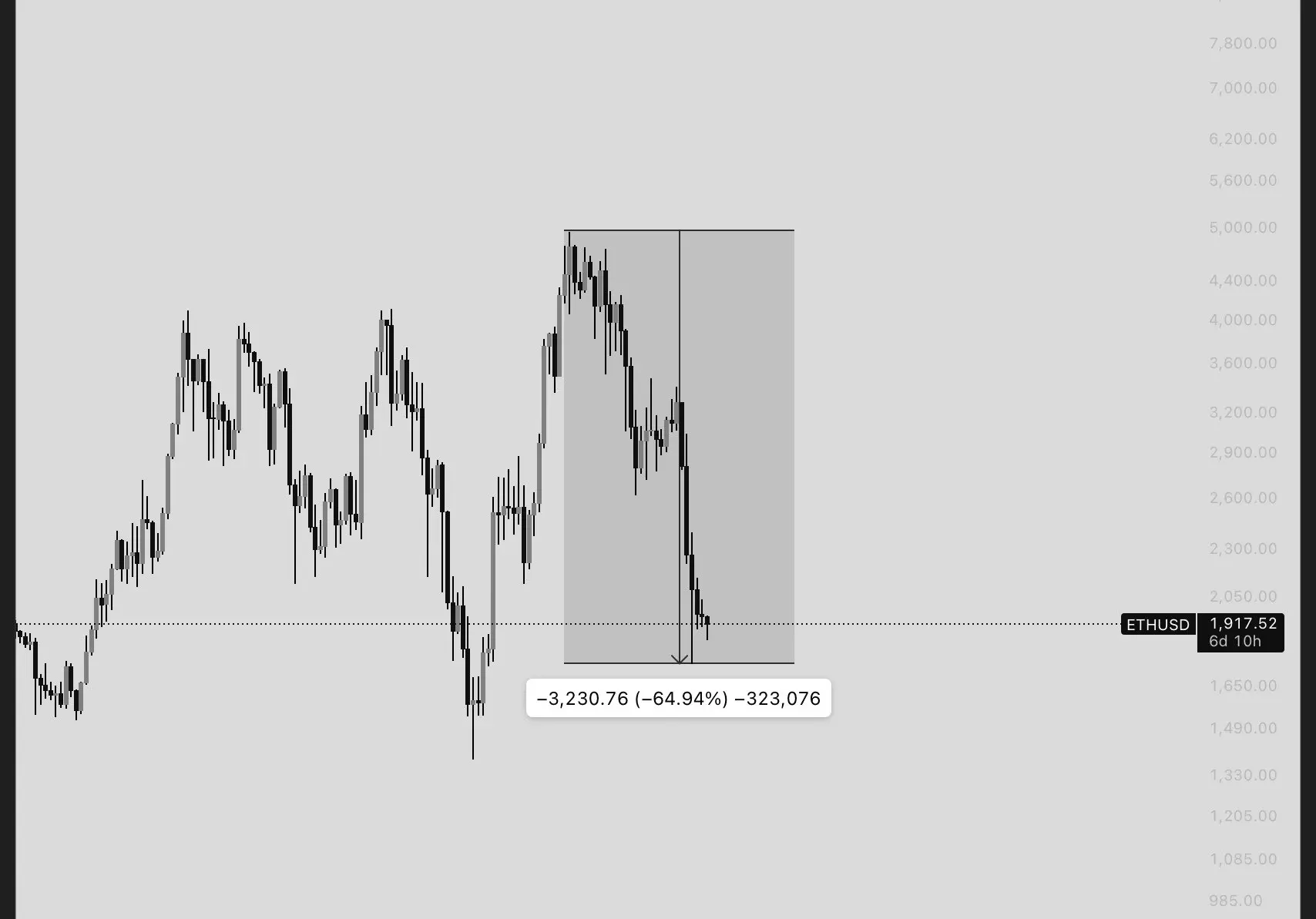

If you bought $100 worth of $DOT at the peak, today your coins are worth less than $3.

Don't be surprised by the term "buying at the peak"; many people are attached to the peaks.

This is the size of losses in the main cryptocurrencies only, let alone speculative coins.

These numbers should make you review yourself 1000 times before putting any cent into the digital currency market.

#TrumpAnnouncesNewTariffs #BitcoinMarketAnalysis

Don't be surprised by the term "buying at the peak"; many people are attached to the peaks.

This is the size of losses in the main cryptocurrencies only, let alone speculative coins.

These numbers should make you review yourself 1000 times before putting any cent into the digital currency market.

#TrumpAnnouncesNewTariffs #BitcoinMarketAnalysis

DOT-2,68%

- Reward

- like

- Comment

- Repost

- Share

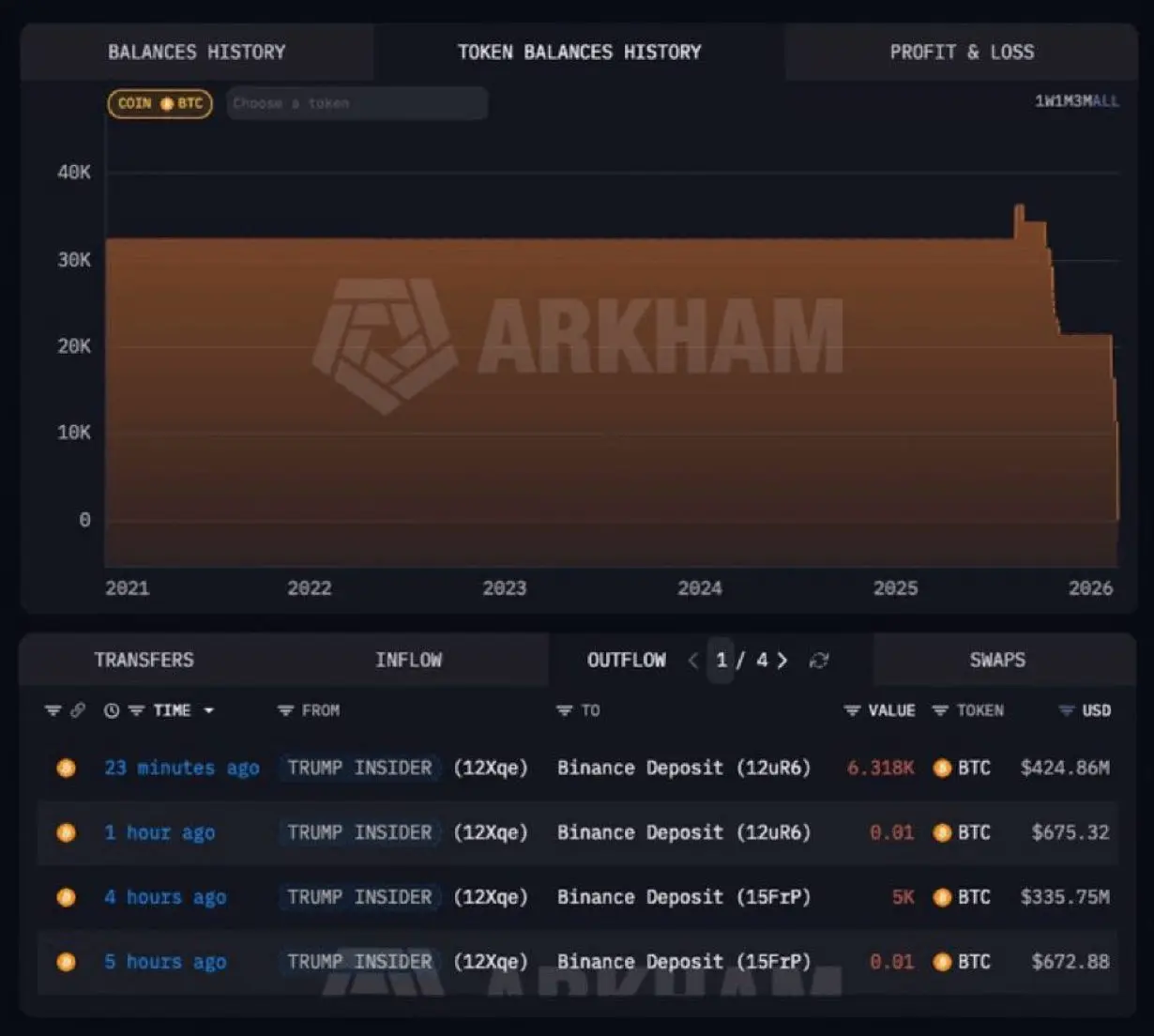

Satoshi Nakamoto's wealth declines by over $68 billion since October 2025

The legendary Bitcoin creator, Satoshi Nakamoto's, wealth has decreased by approximately $68.2 billion, after losing more than 49.6% since its peak in October 2025.

According to Arkham Intelligence, the value of Satoshi's 1.1 million Bitcoin holdings dropped from $137.46 billion in October to about $69.26 billion at the time of publication.

Despite the magnitude of his wealth, Forbes and other billionaire lists do not officially list Satoshi due to legal ownership ambiguity and the fact that the coins have remained unuse

The legendary Bitcoin creator, Satoshi Nakamoto's, wealth has decreased by approximately $68.2 billion, after losing more than 49.6% since its peak in October 2025.

According to Arkham Intelligence, the value of Satoshi's 1.1 million Bitcoin holdings dropped from $137.46 billion in October to about $69.26 billion at the time of publication.

Despite the magnitude of his wealth, Forbes and other billionaire lists do not officially list Satoshi due to legal ownership ambiguity and the fact that the coins have remained unuse

BTC-3%

- Reward

- like

- Comment

- Repost

- Share

The trading company sued now due to the Terra collapse worth $40 billion

- Jane Street

- Founded in 2000

- Quantitative trading firm

- Major cryptocurrency market maker

May 2022:

- TerraUSD (UST) loses its peg to the US dollar

- LUNA experiences hyperinflation

~$40 billion wiped out

May 7, 2022:

- Terraform removes 150 million UST from Curve 3pool

- This move was not publicly announced

Minutes later:

- An account linked to Jane Street withdraws 85 million UST

- Liquidity drains even faster

- Value declines accelerate

May 9, 2022:

- UST crashes below $0.50

- The death spiral begins

- Billions a

- Jane Street

- Founded in 2000

- Quantitative trading firm

- Major cryptocurrency market maker

May 2022:

- TerraUSD (UST) loses its peg to the US dollar

- LUNA experiences hyperinflation

~$40 billion wiped out

May 7, 2022:

- Terraform removes 150 million UST from Curve 3pool

- This move was not publicly announced

Minutes later:

- An account linked to Jane Street withdraws 85 million UST

- Liquidity drains even faster

- Value declines accelerate

May 9, 2022:

- UST crashes below $0.50

- The death spiral begins

- Billions a

BTC-3%

- Reward

- like

- Comment

- Repost

- Share

"Selling Bitcoin... for what?

If you sell Bitcoin, what do you buy instead? Which asset has better properties? What do you exchange for the absolute digital scarcity of Bitcoin? And a comparison of Bitcoin with other assets."

An article by Bram Kanstain, translated with some adaptation.

A perspective from the first principles of each asset class, and why nothing else approaches Bitcoin.

A recurring question whenever someone tells me they are "making profits" on their Bitcoin, whether from friends, private messages, or financial podcasts treating Bitcoin as a traded tech stock.

The simple quest

If you sell Bitcoin, what do you buy instead? Which asset has better properties? What do you exchange for the absolute digital scarcity of Bitcoin? And a comparison of Bitcoin with other assets."

An article by Bram Kanstain, translated with some adaptation.

A perspective from the first principles of each asset class, and why nothing else approaches Bitcoin.

A recurring question whenever someone tells me they are "making profits" on their Bitcoin, whether from friends, private messages, or financial podcasts treating Bitcoin as a traded tech stock.

The simple quest

BTC-3%

- Reward

- 3

- 1

- Repost

- Share

Alkhtry55 :

:

Bullish market at its peak 🐂Breaking | Bitcoin deepens its losses and crashes an additional $2,000, dropping to $62,000 levels before rebounding again.

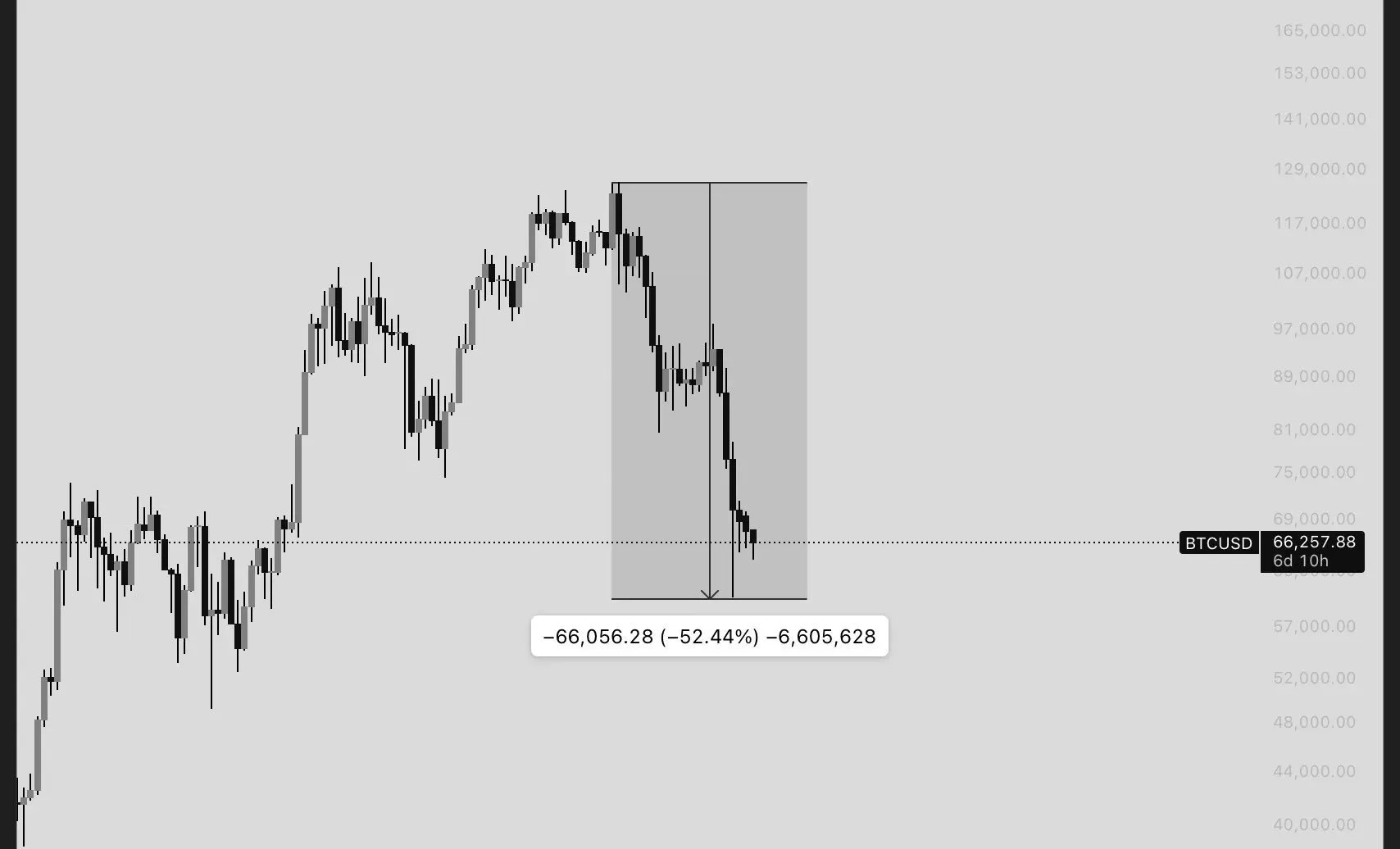

Something broke in the crypto market on October 10, 2025, and it hasn't been fixed yet.

This behavior we see today in the world's largest digital currency has never happened before.

Passing through all these waves of decline without a single green candle is an unprecedented event.

God willing, we will have a full article explaining this distortion in the digital currency markets.

$BTC

#TrumpAnnouncesNewTariffs #BitcoinMarketAnalysis #LatestMarketInsights #VitalikSells21.7

Something broke in the crypto market on October 10, 2025, and it hasn't been fixed yet.

This behavior we see today in the world's largest digital currency has never happened before.

Passing through all these waves of decline without a single green candle is an unprecedented event.

God willing, we will have a full article explaining this distortion in the digital currency markets.

$BTC

#TrumpAnnouncesNewTariffs #BitcoinMarketAnalysis #LatestMarketInsights #VitalikSells21.7

BTC-3%

- Reward

- 1

- Comment

- Repost

- Share

When a dump happens in the market, it looks like everyone agrees on a decline... a real farce.

We don't see a single coin hold its ground; everyone collapses at the same moment.

This only happens in the cryptocurrency market.

Truly a strange and bizarre phenomenon.

$BTC $ETH $SOL

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #

View OriginalWe don't see a single coin hold its ground; everyone collapses at the same moment.

This only happens in the cryptocurrency market.

Truly a strange and bizarre phenomenon.

$BTC $ETH $SOL

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #

- Reward

- like

- Comment

- Repost

- Share

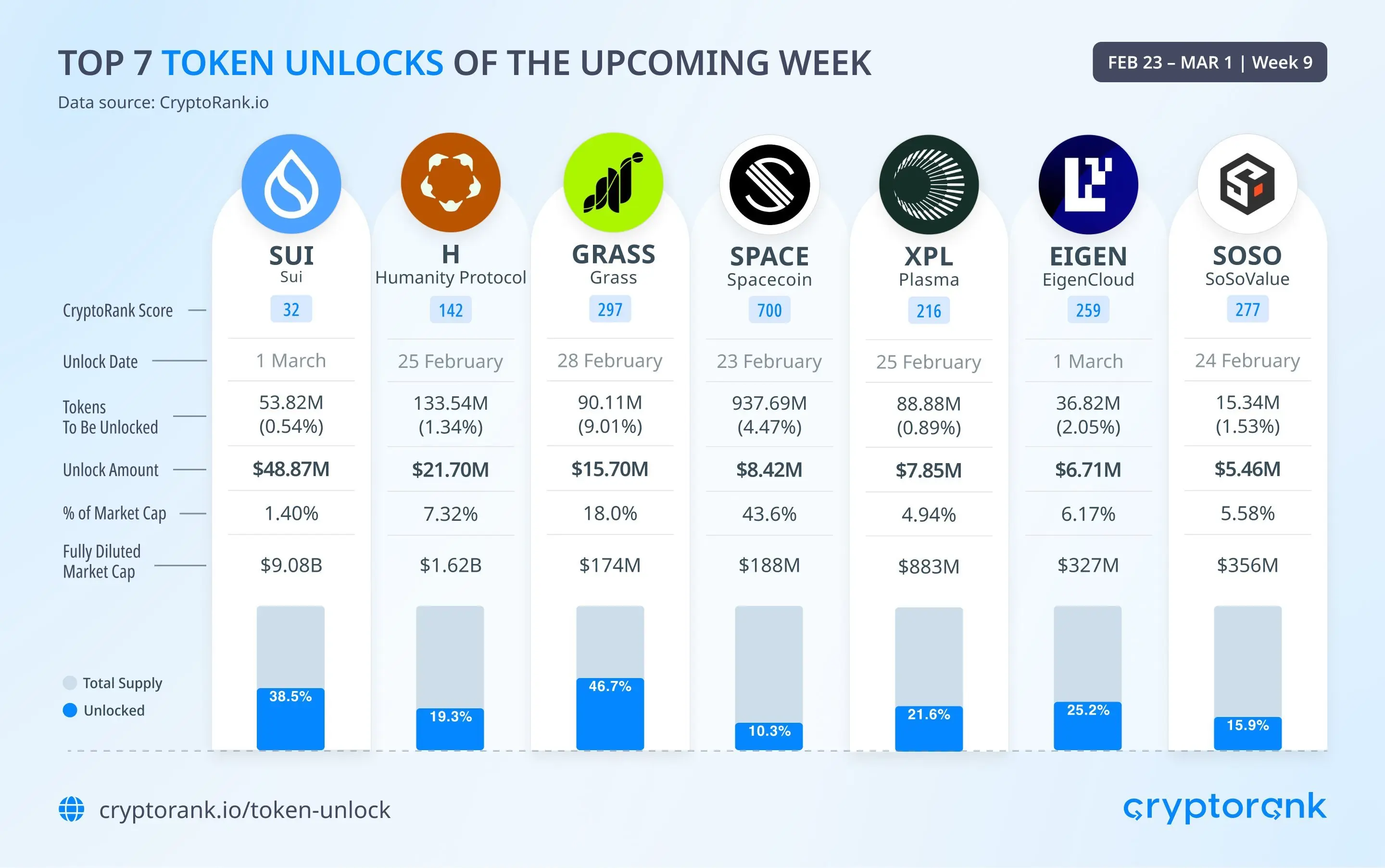

Top 7 Token Releases This Week!

The following tokens will see the largest releases by value:

• Sui ( $SUI) — $48.87 million

• $H — $21.70 million

• $GRASS — $15.70 million

• $SPACE — $8.42 million

• $XPL — $7.85 million

• EigenLayer ( $EIGEN) — $6.71 million

• $SOSO — $5.46 million

Increased supply may raise volatility levels, especially if it coincides with low liquidity

Risk management becomes essential during weeks of large releases

$XRP $SOL $ETH

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #BuyTheDipOrWaitNow?

View OriginalThe following tokens will see the largest releases by value:

• Sui ( $SUI) — $48.87 million

• $H — $21.70 million

• $GRASS — $15.70 million

• $SPACE — $8.42 million

• $XPL — $7.85 million

• EigenLayer ( $EIGEN) — $6.71 million

• $SOSO — $5.46 million

Increased supply may raise volatility levels, especially if it coincides with low liquidity

Risk management becomes essential during weeks of large releases

$XRP $SOL $ETH

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #BuyTheDipOrWaitNow?

- Reward

- like

- Comment

- Repost

- Share

Strategy company purchases 592 #بيتكوين worth approximately $39.8 million, at an average price of $67,286 per Bitcoin.

It now holds a total of 717,722 Bitcoins purchased for nearly $54.56 billion, with an average price of about $76,020 per Bitcoin.

$BTC

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #GateSpringFestivalHorseRacingEvent

It now holds a total of 717,722 Bitcoins purchased for nearly $54.56 billion, with an average price of about $76,020 per Bitcoin.

$BTC

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #GateSpringFestivalHorseRacingEvent

BTC-3%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is number 1 in digital currencies.

But can you mention the reason why?

$BTC

#WhenisBestTimetoEntertheMarket #CLARITYActAdvances

But can you mention the reason why?

$BTC

#WhenisBestTimetoEntertheMarket #CLARITYActAdvances

BTC-3%

- Reward

- like

- Comment

- Repost

- Share

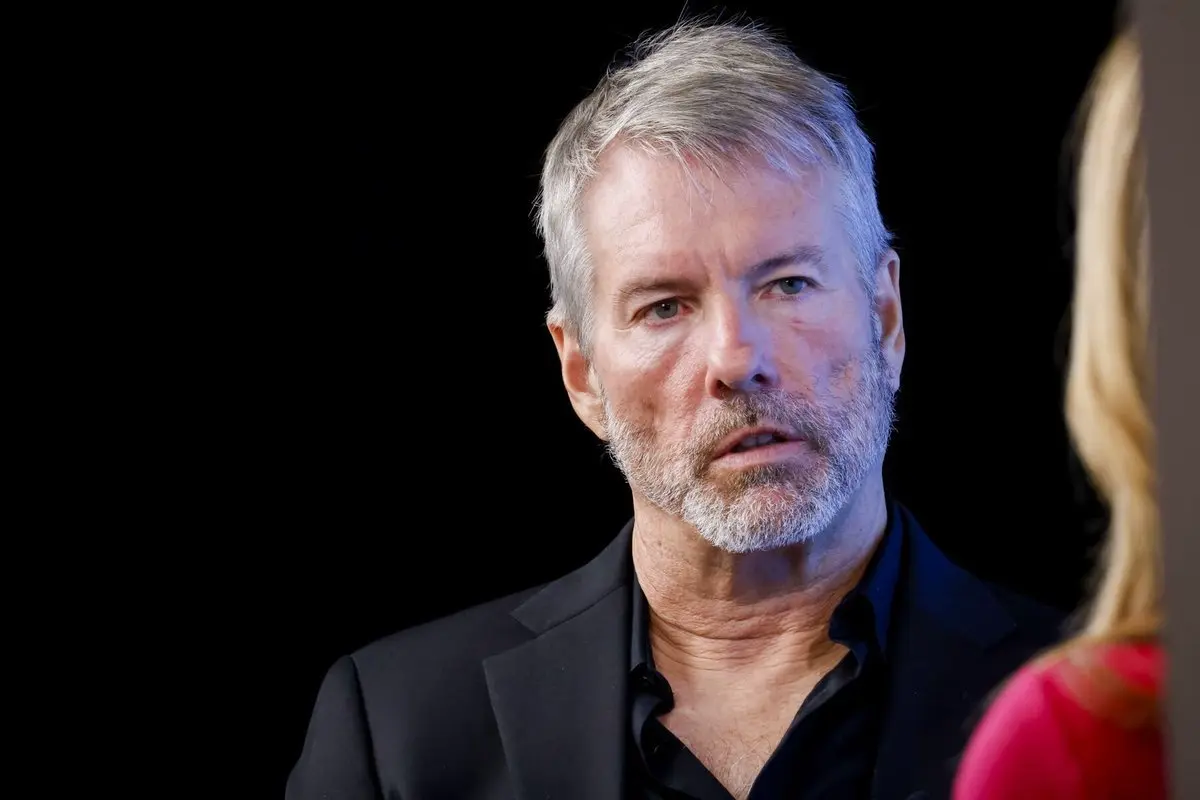

Michael Saylor is not buying "the currency"

He is betting on "scarcity."

-

At a time when the market is in panic with Bitcoin dropping today and testing the $64,000 levels,

Strategy (formerly MicroStrategy) announced the purchase of an additional 592 Bitcoins at an average price of $67,286.

This move raised the company's total holdings to a staggering number: 717,722 Bitcoins,

Equivalent to about 3.42% of all Bitcoin that will ever exist.

What’s notable about this purchase is not just the timing,

but the structural stability; the company now owns Bitcoin with an average total c

He is betting on "scarcity."

-

At a time when the market is in panic with Bitcoin dropping today and testing the $64,000 levels,

Strategy (formerly MicroStrategy) announced the purchase of an additional 592 Bitcoins at an average price of $67,286.

This move raised the company's total holdings to a staggering number: 717,722 Bitcoins,

Equivalent to about 3.42% of all Bitcoin that will ever exist.

What’s notable about this purchase is not just the timing,

but the structural stability; the company now owns Bitcoin with an average total c

BTC-3%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin reaching $64K caused liquidations worth $508 million in the last 24 hours

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #GateSpringFestivalHorseRacingEvent

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #GateSpringFestivalHorseRacingEvent

BTC-3%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin's targets that I never liked to share, but since I'll be absent for a while, I will post them; and I pray that they never come true 😔

Bitcoin below 74,000 will break the 60,000 bottom at any moment.

Current bear market targets in order:

49,000

38,000

29,000

24,000

Our only exit is a return to full, comprehensive positivity in the market, a return of momentum, and a change in trend; and unfortunately, as we see, there is no liquidity or momentum other than downward movement!

I pray that God changes the situation for the better, and that these decline numbers never come true—neither som

Bitcoin below 74,000 will break the 60,000 bottom at any moment.

Current bear market targets in order:

49,000

38,000

29,000

24,000

Our only exit is a return to full, comprehensive positivity in the market, a return of momentum, and a change in trend; and unfortunately, as we see, there is no liquidity or momentum other than downward movement!

I pray that God changes the situation for the better, and that these decline numbers never come true—neither som

BTC-3%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin BTC is currently down 52% -

Ethereum ETH is currently down 62% -

We have actually completed more than half of the bear market financially and in terms of price.

It is expected that in the current bear market, Bitcoin's decline will be limited to around 65% -

As for timing and pinpointing the bottom, this is nonsense; don’t bother with it.

The previous cycle: Bitcoin peak in October 2025

The peak of cryptocurrencies and the crypto season was in December 2024 and also in March of the same year.

The last three months of 2025 are supposed to be green, but they all turned red.

View OriginalEthereum ETH is currently down 62% -

We have actually completed more than half of the bear market financially and in terms of price.

It is expected that in the current bear market, Bitcoin's decline will be limited to around 65% -

As for timing and pinpointing the bottom, this is nonsense; don’t bother with it.

The previous cycle: Bitcoin peak in October 2025

The peak of cryptocurrencies and the crypto season was in December 2024 and also in March of the same year.

The last three months of 2025 are supposed to be green, but they all turned red.

- Reward

- like

- Comment

- Repost

- Share

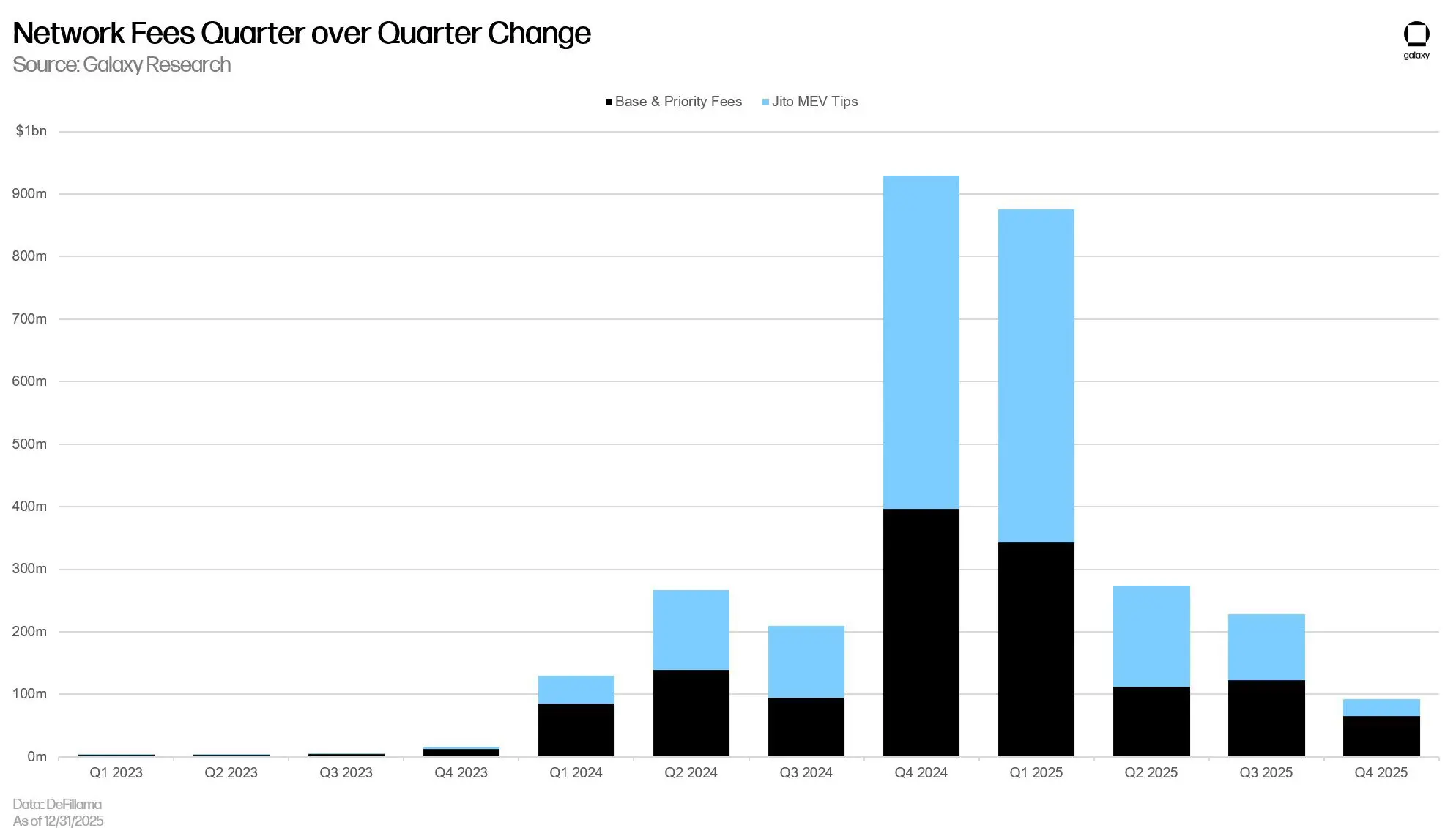

Solana network fees decreased by approximately 60% in Q4 as speculative activity on the network declined.

#sol

$SOL $SOL

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances

#sol

$SOL $SOL

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances

SOL-6,61%

- Reward

- like

- Comment

- Repost

- Share

The #البيتكوين Australian Investment Fund managed by Monochrome Asset Management increases its holdings to 1,248 Bitcoin.

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances

BTC-3%

- Reward

- 4

- Comment

- Repost

- Share

Ethereum in brief

Perch flag with deviation

Break and retest, then break the order block, and today a retest was made

A sequence of negativity on the chart with no positivity unless it moves back above the order block

Otherwise, its target, as I previously explained, is 1400, which is the next step, but I don't say it's the bottom; I see the bottom when we reach that price action level

Pulling liquidity from last year's bottom will give a good retrace

But if a break occurs and trading stays below, the target will be $880, which is the 2022 bottom

Price action is the king of understanding movem

View OriginalPerch flag with deviation

Break and retest, then break the order block, and today a retest was made

A sequence of negativity on the chart with no positivity unless it moves back above the order block

Otherwise, its target, as I previously explained, is 1400, which is the next step, but I don't say it's the bottom; I see the bottom when we reach that price action level

Pulling liquidity from last year's bottom will give a good retrace

But if a break occurs and trading stays below, the target will be $880, which is the 2022 bottom

Price action is the king of understanding movem

- Reward

- like

- Comment

- Repost

- Share

An investor from Satoshi's era (2010–2011) sold approximately 11,300 Bitcoin after holding for about 15 years, worth nearly $750 million.

This transaction is considered significant psychologically and in the media, but from a market perspective, it does not represent a substantial percentage of the total daily Bitcoin liquidity, which is measured in billions of dollars.

$BTC

#TrumpAnnouncesNewTariffs #CLARITYActAdvances

This transaction is considered significant psychologically and in the media, but from a market perspective, it does not represent a substantial percentage of the total daily Bitcoin liquidity, which is measured in billions of dollars.

$BTC

#TrumpAnnouncesNewTariffs #CLARITYActAdvances

BTC-3%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin price dropped below $64,000, recording a 5% decline over the past 24 hours.

The currency traded around $63,971, amid a wave of declines that affected other cryptocurrencies, with Ethereum falling more than 4% to reach $1,864, while XRP declined over 2% to $1.35.

The biggest loss among major coins was in Solana, which decreased nearly 6% to $78.45 over the past 24 hours.

The decline in cryptocurrencies was driven by accelerated leveraged liquidations and increased selling pressures, which directly impacted investor sentiment, leading to a wave of rapid market volatility.

In less than fi

The currency traded around $63,971, amid a wave of declines that affected other cryptocurrencies, with Ethereum falling more than 4% to reach $1,864, while XRP declined over 2% to $1.35.

The biggest loss among major coins was in Solana, which decreased nearly 6% to $78.45 over the past 24 hours.

The decline in cryptocurrencies was driven by accelerated leveraged liquidations and increased selling pressures, which directly impacted investor sentiment, leading to a wave of rapid market volatility.

In less than fi

BTC-3%

- Reward

- like

- Comment

- Repost

- Share

• The biggest dilemma or problem traders face in markets in general and in the Bitcoin ( market #BTC ) and all digital currencies is the inability to make the right decision or at least:

Close to the correct!

Whether to enter or exit!

Those who bought #BITCOIN at a price of $90,000, what prevents them from buying now!

( I mean the believers in it, not the speculators )

Coins we used to buy 100,000 units of at a price of $70,000

And today we can buy ( a million units ) at a price of $40,000 or $60,000!

Knowing that some or most of them are classified as reliable coins!

#Making_Decision is abou

Close to the correct!

Whether to enter or exit!

Those who bought #BITCOIN at a price of $90,000, what prevents them from buying now!

( I mean the believers in it, not the speculators )

Coins we used to buy 100,000 units of at a price of $70,000

And today we can buy ( a million units ) at a price of $40,000 or $60,000!

Knowing that some or most of them are classified as reliable coins!

#Making_Decision is abou

BTC-3%

- Reward

- like

- Comment

- Repost

- Share

Violent liquidation in the market within one hour!

Buy orders totaling approximately $200 million were liquidated in the crypto market during the last 60 minutes alone.

()$BTC

$ETH $XRP

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs

View OriginalBuy orders totaling approximately $200 million were liquidated in the crypto market during the last 60 minutes alone.

()$BTC

$ETH $XRP

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs

- Reward

- like

- Comment

- Repost

- Share