Mrs_Yen

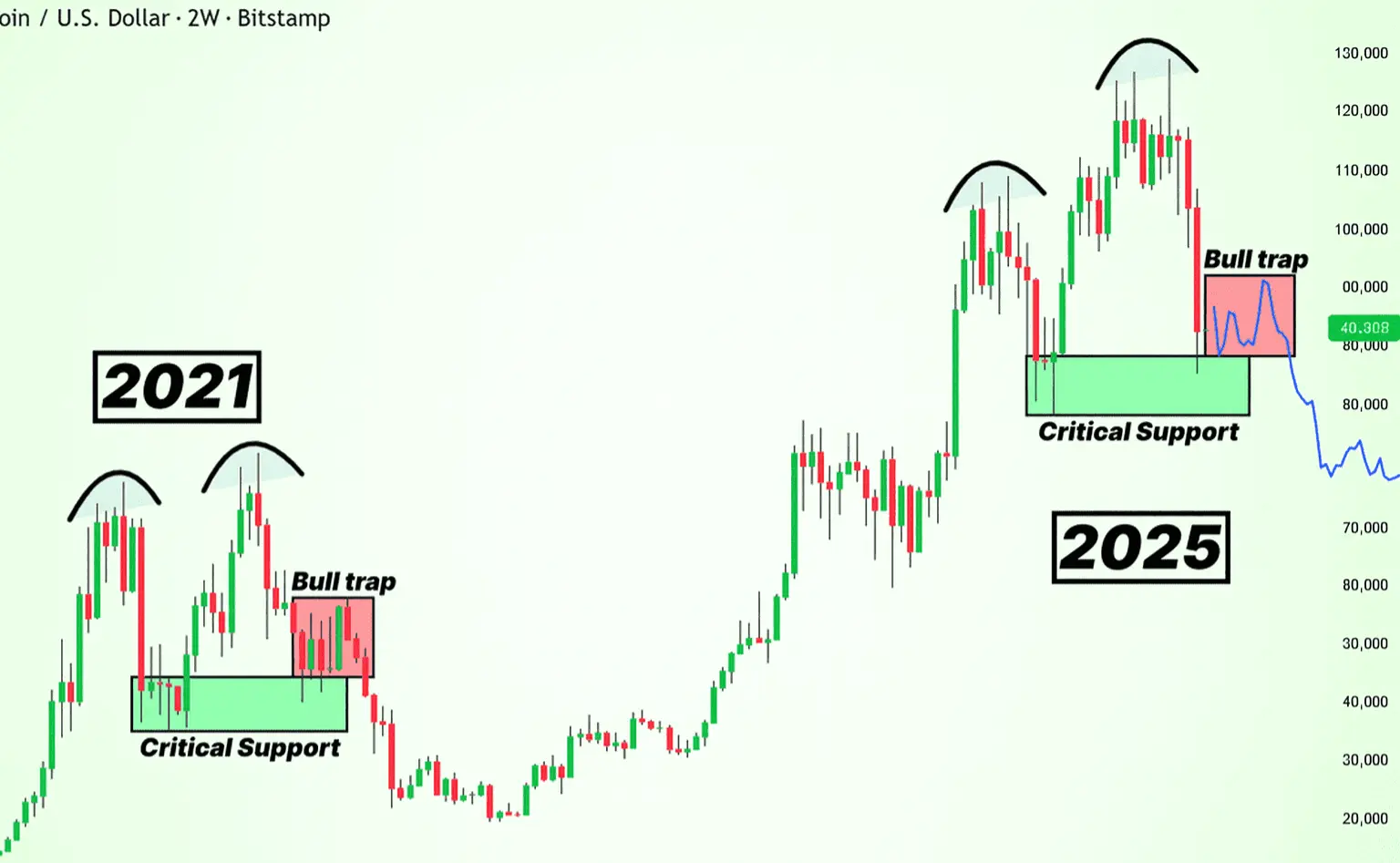

Is the range from $70,000 to $80,000 the weakest point for BTC price?

Historical data for $BTC is signaling that cryptocurrencies are moving within a fragile price range due to a lack of solid trading foundations in the past.

🔹 Statistically, BTC has experienced extremely short periods at all-time high prices:

The range from $70,000 to $79,900 lasted only 28 days.

The range from $80,000 to $89,900 lasted slightly longer at 49 days.

This is much less than nearly 200 days of accumulation at lower ranges from $30,000 to $50,000.

🔸 Actual UTXO Price Distribution

The chart also confirms a concen

Historical data for $BTC is signaling that cryptocurrencies are moving within a fragile price range due to a lack of solid trading foundations in the past.

🔹 Statistically, BTC has experienced extremely short periods at all-time high prices:

The range from $70,000 to $79,900 lasted only 28 days.

The range from $80,000 to $89,900 lasted slightly longer at 49 days.

This is much less than nearly 200 days of accumulation at lower ranges from $30,000 to $50,000.

🔸 Actual UTXO Price Distribution

The chart also confirms a concen

BTC1.04%