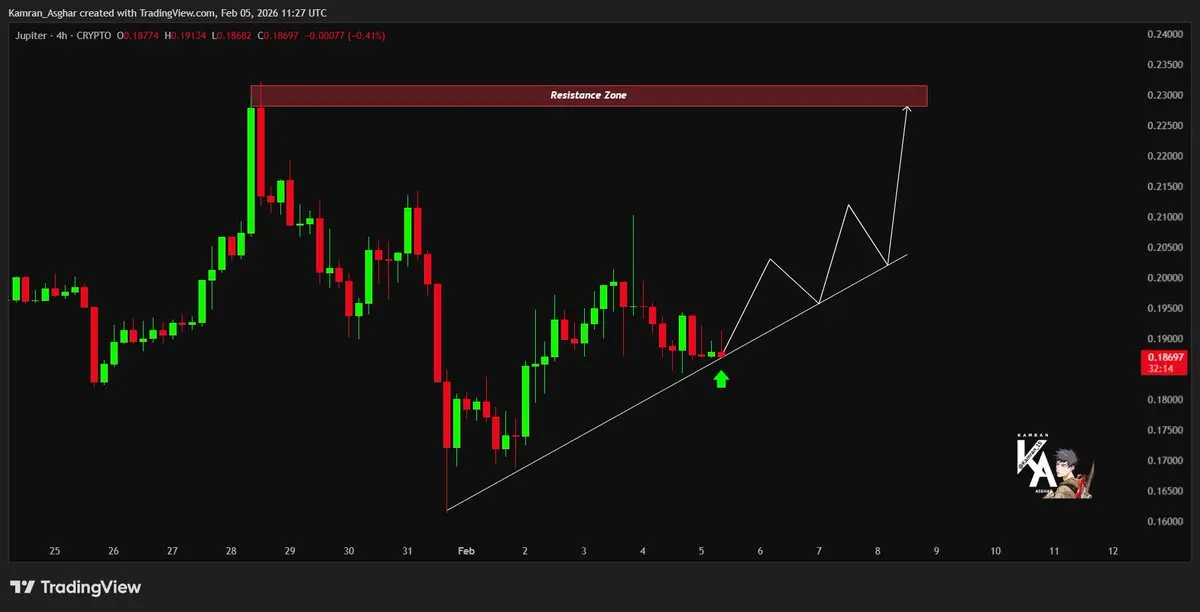

KamranAsghar

No content yet

KamranAsghar

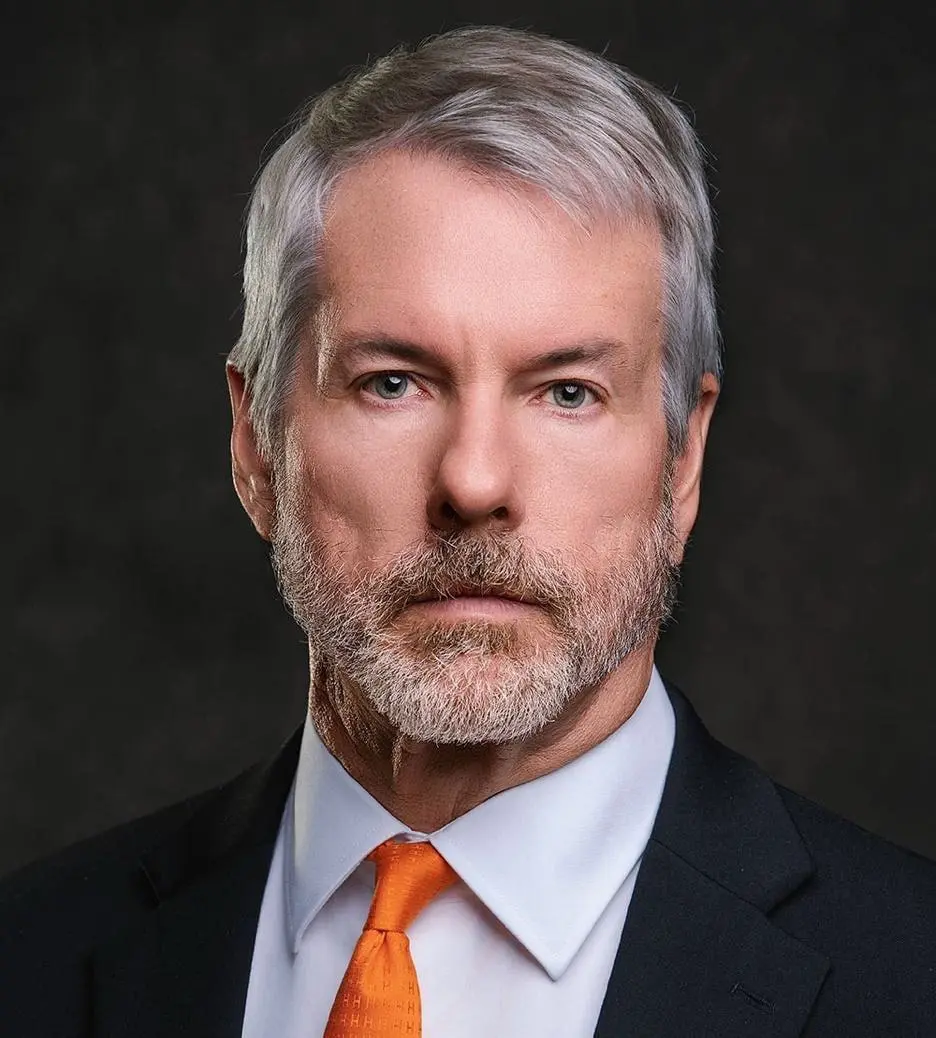

2026 Value Destruction: Top 10 Biggest Losers So Far

- Reward

- like

- Comment

- Repost

- Share

CRAZY CLAIM: Since the United States withdrew from the WHO, 6 major cancer cure milestones have reportedly been achieved. 🚨

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

GM Crypto Fam!Can i get GM back?

- Reward

- like

- Comment

- Repost

- Share

INSANE BREAKTHROUGH: Japan has become the world\'s first country to successfully generate electricity in space and beam it back to Earth! 🚀

- Reward

- like

- Comment

- Repost

- Share

BREAKING: President Zelensky states the United States is pushing for the war in Ukraine to conclude by June. 🚨

- Reward

- like

- 1

- Repost

- Share

Lock_433 :

:

Buy To Earn 💎BULLISH: El Salvador makes history as the world\'s first country to introduce Bitcoin education to all students aged 7 and older! 🇸🇻🚀

BTC2,7%

- Reward

- like

- 1

- Repost

- Share

NiuniuBit :

:

2b- Reward

- like

- 1

- Repost

- Share

Lock_433 :

:

2026 GOGOGO 👊BREAKING: Trump forecasts the U.S. stock market will double by the end of his presidency. 🚨

- Reward

- 1

- 3

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

Gm Crypto Fam!Can i get Gm back?

- Reward

- like

- Comment

- Repost

- Share

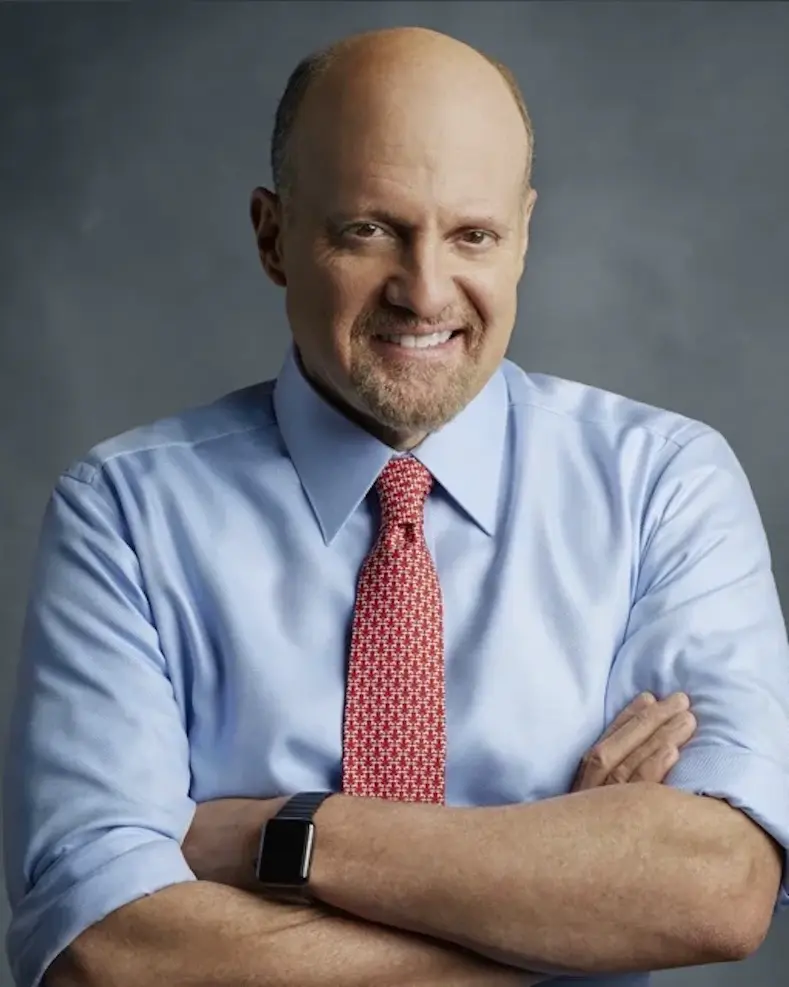

BREAKING: Jim Cramer warns: “Tomorrow’s looking pretty ugly…”CONFIRMED: Classic Cramer reverse indicator → weekend pump incoming!! 🚀

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Gm CT!Can i get Gm?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

BREAKING: Tether announces a $100 million investment in Anchorage Digital! 🚀

- Reward

- like

- Comment

- Repost

- Share

BREAKING: Argentina and the United States have finalized a major agreement on critical minerals, according to Argentina\'s Foreign Ministry. 🚨

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

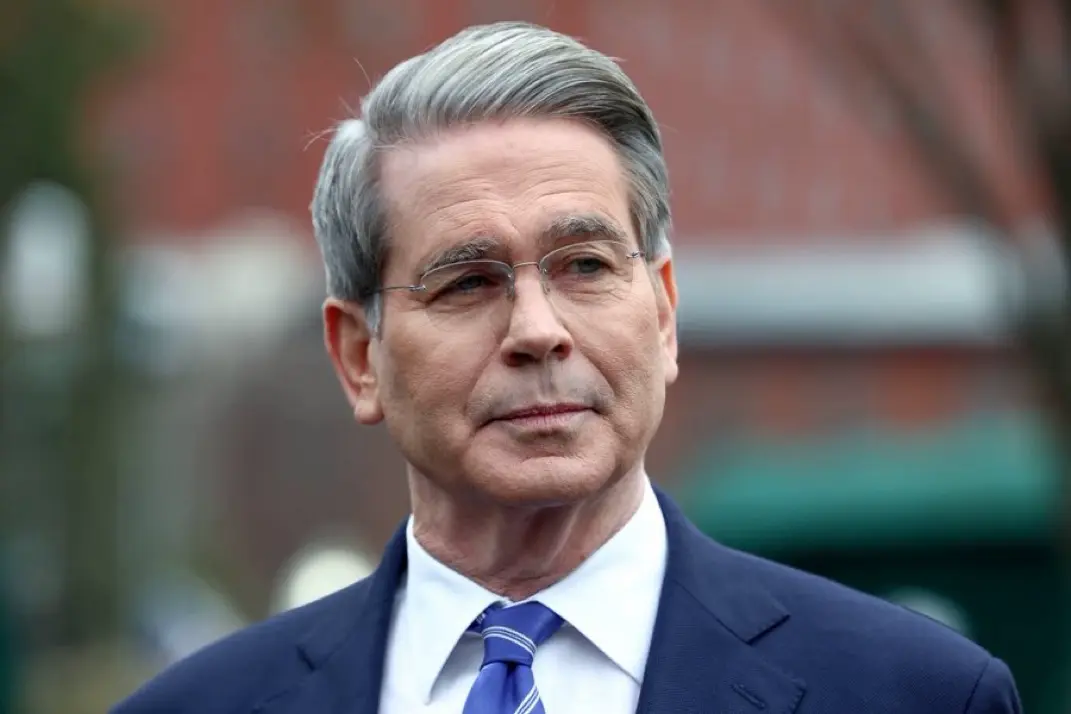

SCOTT BESSENT: “The United States is committed to holding Bitcoin—no matter what happens.” 🚨

BTC2,7%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More173.45K Popularity

698 Popularity

166 Popularity

11.3K Popularity

3.76K Popularity

Pin