GertVanLagen

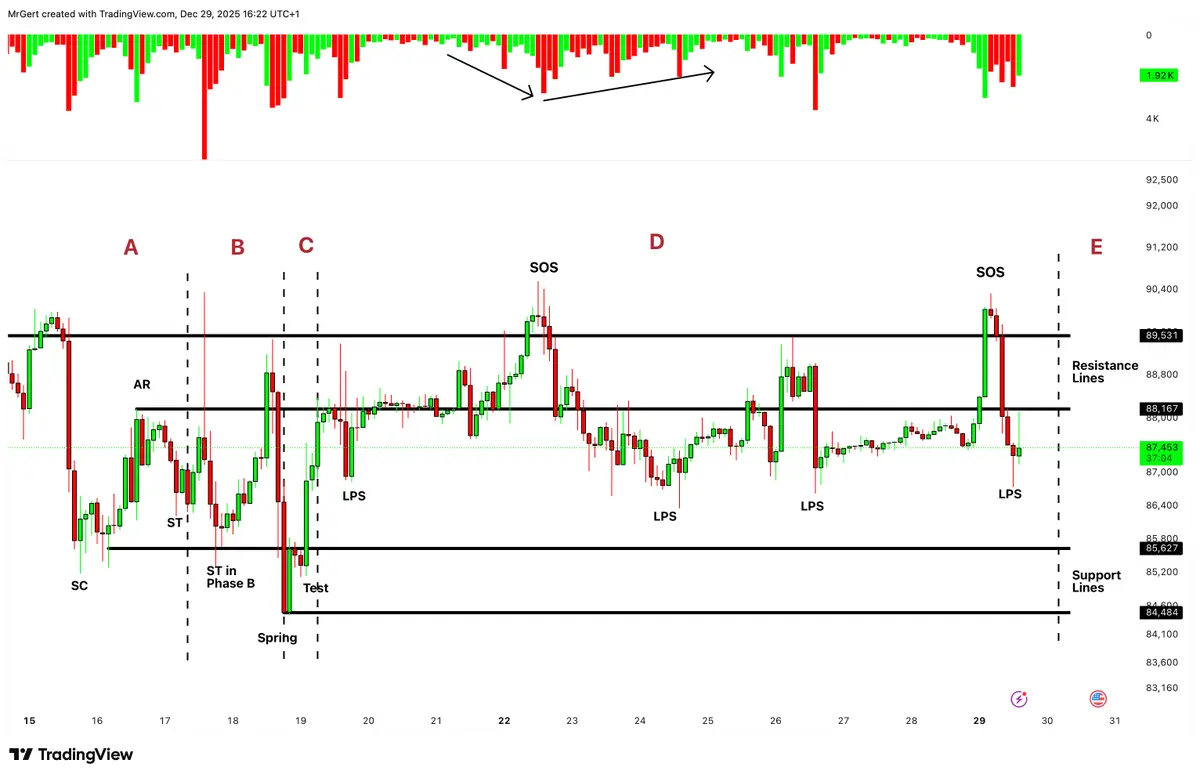

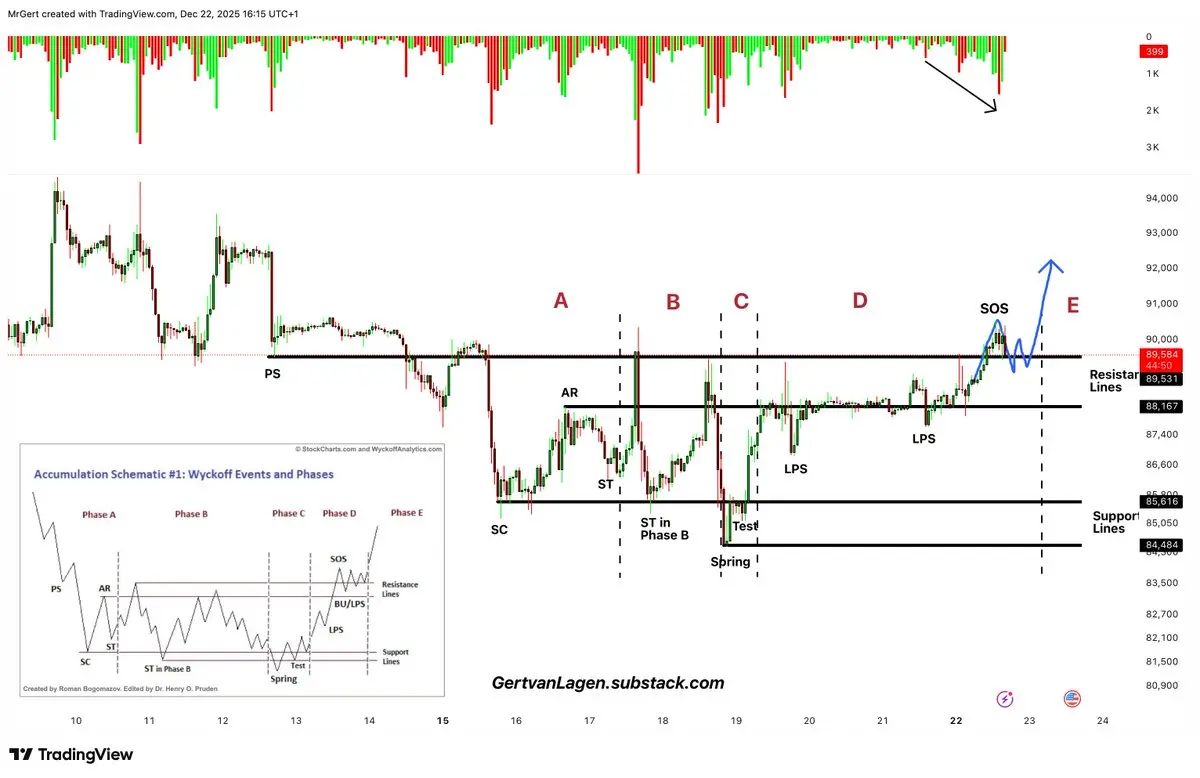

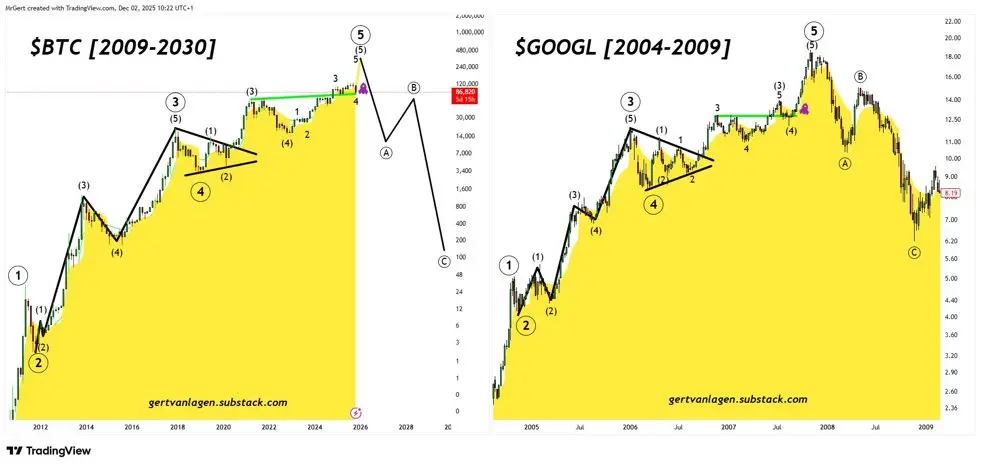

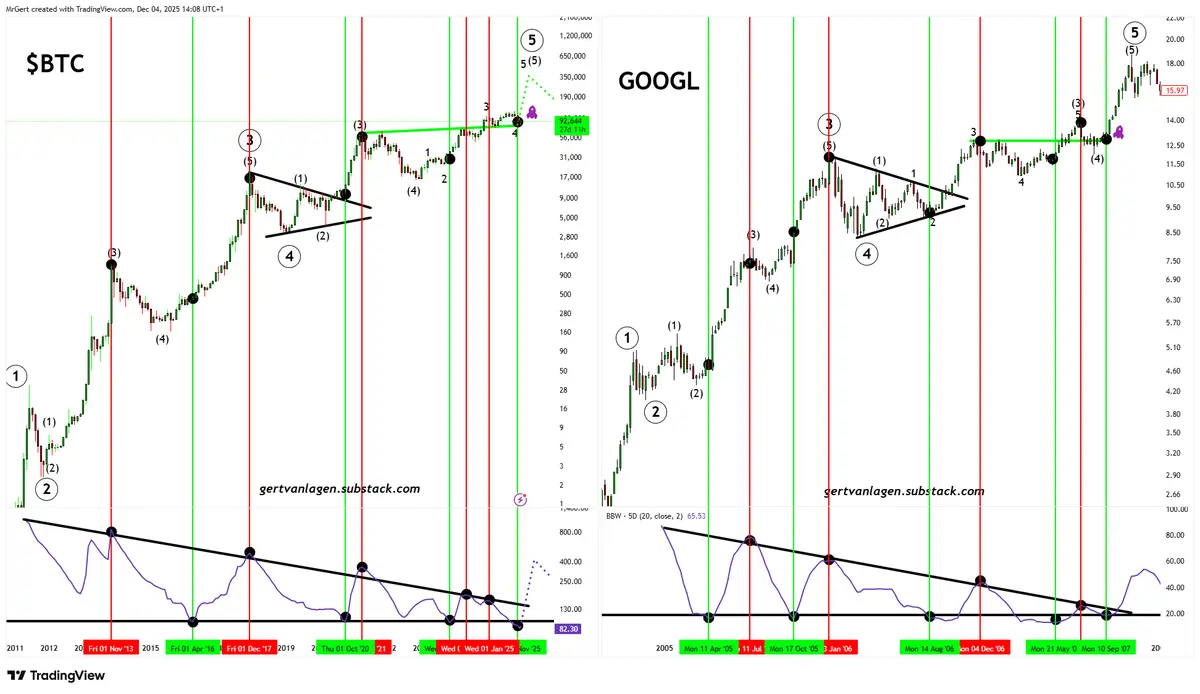

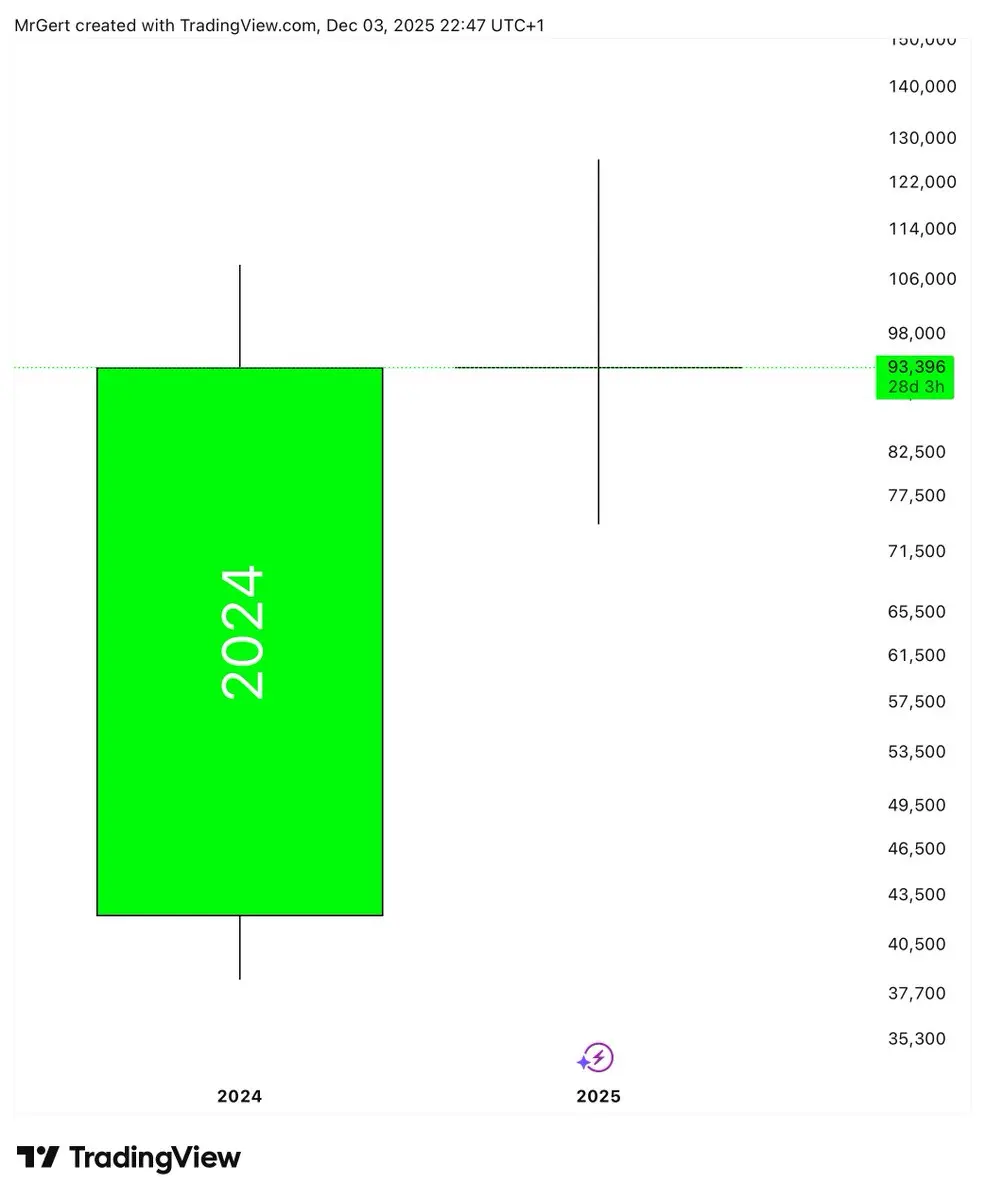

#Wyckoff Accumulation update - BTC breaks above SOS line with expanding volume✅

Before mark-up phase E expect:

⌛️Successful low-volume retest(s) of SOS line

Before mark-up phase E expect:

⌛️Successful low-volume retest(s) of SOS line

BTC0,27%