#比特币下一步怎么走? Who is selling Bitcoin? Will it go up or down next? On-chain data + long and short battle, the answer is hidden here

Bitcoin has been a bit “troublesome” lately — fluctuating around key levels, sometimes breaking psychological thresholds, sometimes bouncing back slightly, leaving investors anxious: even though ETFs are still attracting capital, why are there always sellers? Where is this selling pressure coming from? Will it rebound or continue to fall?

First, identify the “main sellers”

Many believe that Bitcoin’s decline is due to retail “cutting losses and fleeing,” but on-chain data shows that the real main sellers are “long-term holders” and early whales — those “veterans” who entered the market when Bitcoin was worth a few dollars or hundreds. Now, they are systematically “cashing out.”

Fidelity Digital Assets expert Chris Kuiper said this isn’t “panic selling,” but more like “slow bleeding”: veteran holders are calmly transferring their chips little by little.

Glassnode’s data supports this: “Bitcoin held for over a year without movement” used to plummet during previous bull markets, indicating concentrated selling by long-term holders; but this time, the decline is very gradual, meaning they are “selling in batches” and not trying to crash the market all at once.

A prime example is early whale Owen Gunden, whose related wallets recently transferred over $1 billion worth of Bitcoin to exchanges — that’s no small amount, equivalent to pouring cold water directly on the market.

Who is taking these sell orders?

Mainly new institutional entrants and ETF buyers. On one side, veteran holders are “buying low and selling high” to cash out; on the other, institutions are “buying at high prices” to position themselves, creating a “big turnover”: previously, Bitcoin was concentrated in a few low-cost whales, but now it’s gradually shifting to higher-cost institutions and retail investors.

This “turnover” might make the market more mature in the long run, but in the short term, it’s risky — new buyers with higher costs may be more eager to sell if prices fall again, potentially triggering new sell-offs.

3 reasons Bitcoin still might fall

Many institutions and analysts are pessimistic about the short-term outlook, even suggesting Bitcoin could enter a “mini bear market,” mainly due to three concerns.

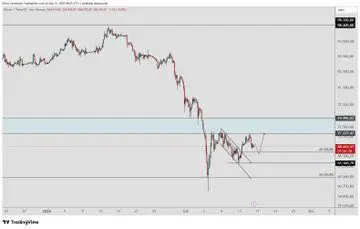

Technical indicators flashing red, “surrender-style selling” risk high

Analysis from 10x Research shows Bitcoin has broken below the “21-week exponential moving average (EMA)” — a key indicator that historically signals a short-term downtrend once breached.

More troubling is that recent investors (short-term holders) bought at an average price higher than the current market price, meaning they are “trapped in losses.” If these investors can’t hold out, they might “collectively cut losses,” leading to what’s called “surrender selling,” which could drive prices down even further.

The bears have set a “life-and-death line”: as long as Bitcoin stays below $113,000, it faces significant downside risk; if it falls below miners’ “cost basis” of $94,000 (estimated by JPMorgan, mainly covering electricity and operational costs), then a bottom might be reached — after all, miners losing money tend to reduce selling, providing support.

Macro and political headwinds. As a risk asset, Bitcoin fears “liquidity tightening” and “regulatory crackdowns.” Both risks are present now.

First, the Federal Reserve’s policy remains uncertain. Markets hoped for a rate cut in December, but recent hawkish comments from Fed officials suggest “inflation isn’t under control yet, so no easing.” Without a rate cut, market liquidity will shrink, making it hard for assets like Bitcoin to rise.

Second, political winds in the U.S. have shifted. Democrats won local elections, raising concerns they might implement stricter crypto regulations — the SEC has historically targeted crypto platforms; if policies tighten further, institutions might withdraw investments temporarily, further suppressing prices.

The “bull market dual engines” have stalled. Previously, Bitcoin’s bull run relied on the “halving cycle” (reducing supply every four years) and “global liquidity easing” (central banks printing money and flowing into risk assets). But now, both engines have “fired out.”

Renowned analyst Willy Woo said, “The halving cycle” and “liquidity cycle” are no longer synchronized, and Bitcoin has lost its “natural accelerator.” More critically, Bitcoin has never experienced a severe recession like 2008 — if a recession hits, everyone will lack funds, and who will buy Bitcoin? Its ability to withstand such shocks remains uncertain.

3 sources of confidence

Despite the clouds in the short term, the bullish camp isn’t panicking; they see this as “darkness before dawn,” with three main reasons.

Liquidity will “flood in”

Raoul Pal, CEO of Real Vision, believes the current market’s cash shortage is temporary. After the government shutdown ends, the U.S. Treasury will start “massive spending,” injecting hundreds of billions of dollars into the market.

Arthur Hayes, founder of Bit, is more direct: the U.S. government will issue a lot of bonds, which will ultimately require the Fed to “print money to buy bonds,” essentially “hidden quantitative easing” — when liquidity increases, Bitcoin is likely to rise along with it.

Regulatory clarity is coming. For the crypto market, “uncertain regulation” is scarier than “strict regulation.” The U.S. is now pushing the “CLARITY Act,” which aims to transfer regulatory authority over mainstream digital commodities like Bitcoin to the CFTC (Commodity Futures Trading Commission) instead of the SEC (Securities and Exchange Commission), which has been vague in enforcement.

If this bill passes (supported by both parties and expected to be enacted by late 2025), banks and brokerages will be more confident to enter the Bitcoin space without fear of sudden crackdowns — leading to more capital flowing in and providing a “backstop” for Bitcoin.

Long-term valuation remains low, target price around $170,000. JPMorgan mentioned the $94,000 “cost basis,” but also said Bitcoin’s “theoretical fair value” should be around $170,000 — they compare Bitcoin to gold, and after considering volatility, they believe Bitcoin is still undervalued.

Moreover, the bulls believe that Bitcoin’s previous bull markets followed a “four-year cycle,” but this time, it might extend to five years, with a peak possibly in Q2 2026. The current correction is actually a “buying opportunity,” not the end of the bull run.

Will it go up or down?

Actually, both bulls and bears have valid points. The next move of Bitcoin depends on three key variables.

Short-term: Will liquidity truly be unleashed? If the Fed cuts rates in December or the Treasury “spends money” as scheduled, improving market liquidity, Bitcoin will likely rebound and even break above the “life-and-death line” of $113,000; but if liquidity doesn’t follow or the Fed remains hawkish, a drop below $94,000 is also possible.

Mid-term: Will the “CLARITY Act” be enacted? If it passes smoothly, with clearer regulation, institutions will be more willing to enter, and Bitcoin could start a new rally; but if the bill stalls or regulation tightens further, mid-term prospects will be tough.

Long-term: Will a recession occur? If a severe economic downturn happens, everyone will lack funds, and Bitcoin might fall along with it; but if Bitcoin can withstand the recession or even be seen as a “safe haven” (like gold), its long-term position will be more stable, and prices could rise again.

For ordinary investors, the biggest mistake now is “following the herd” — don’t sell just because you’re bearish, and don’t go all-in when bullish. It’s best to clarify whether you’re “short-term speculating” or “long-term investing”:

Short-term traders should closely watch liquidity and key levels (113,000 and 94,000), while long-term investors can wait for a pullback to support levels and gradually build positions, not investing all their funds at once.

After all, the only “certainty” in the market now is “uncertainty” — only by managing risks well can you stay calm amid Bitcoin’s volatility.

Bitcoin has been a bit “troublesome” lately — fluctuating around key levels, sometimes breaking psychological thresholds, sometimes bouncing back slightly, leaving investors anxious: even though ETFs are still attracting capital, why are there always sellers? Where is this selling pressure coming from? Will it rebound or continue to fall?

First, identify the “main sellers”

Many believe that Bitcoin’s decline is due to retail “cutting losses and fleeing,” but on-chain data shows that the real main sellers are “long-term holders” and early whales — those “veterans” who entered the market when Bitcoin was worth a few dollars or hundreds. Now, they are systematically “cashing out.”

Fidelity Digital Assets expert Chris Kuiper said this isn’t “panic selling,” but more like “slow bleeding”: veteran holders are calmly transferring their chips little by little.

Glassnode’s data supports this: “Bitcoin held for over a year without movement” used to plummet during previous bull markets, indicating concentrated selling by long-term holders; but this time, the decline is very gradual, meaning they are “selling in batches” and not trying to crash the market all at once.

A prime example is early whale Owen Gunden, whose related wallets recently transferred over $1 billion worth of Bitcoin to exchanges — that’s no small amount, equivalent to pouring cold water directly on the market.

Who is taking these sell orders?

Mainly new institutional entrants and ETF buyers. On one side, veteran holders are “buying low and selling high” to cash out; on the other, institutions are “buying at high prices” to position themselves, creating a “big turnover”: previously, Bitcoin was concentrated in a few low-cost whales, but now it’s gradually shifting to higher-cost institutions and retail investors.

This “turnover” might make the market more mature in the long run, but in the short term, it’s risky — new buyers with higher costs may be more eager to sell if prices fall again, potentially triggering new sell-offs.

3 reasons Bitcoin still might fall

Many institutions and analysts are pessimistic about the short-term outlook, even suggesting Bitcoin could enter a “mini bear market,” mainly due to three concerns.

Technical indicators flashing red, “surrender-style selling” risk high

Analysis from 10x Research shows Bitcoin has broken below the “21-week exponential moving average (EMA)” — a key indicator that historically signals a short-term downtrend once breached.

More troubling is that recent investors (short-term holders) bought at an average price higher than the current market price, meaning they are “trapped in losses.” If these investors can’t hold out, they might “collectively cut losses,” leading to what’s called “surrender selling,” which could drive prices down even further.

The bears have set a “life-and-death line”: as long as Bitcoin stays below $113,000, it faces significant downside risk; if it falls below miners’ “cost basis” of $94,000 (estimated by JPMorgan, mainly covering electricity and operational costs), then a bottom might be reached — after all, miners losing money tend to reduce selling, providing support.

Macro and political headwinds. As a risk asset, Bitcoin fears “liquidity tightening” and “regulatory crackdowns.” Both risks are present now.

First, the Federal Reserve’s policy remains uncertain. Markets hoped for a rate cut in December, but recent hawkish comments from Fed officials suggest “inflation isn’t under control yet, so no easing.” Without a rate cut, market liquidity will shrink, making it hard for assets like Bitcoin to rise.

Second, political winds in the U.S. have shifted. Democrats won local elections, raising concerns they might implement stricter crypto regulations — the SEC has historically targeted crypto platforms; if policies tighten further, institutions might withdraw investments temporarily, further suppressing prices.

The “bull market dual engines” have stalled. Previously, Bitcoin’s bull run relied on the “halving cycle” (reducing supply every four years) and “global liquidity easing” (central banks printing money and flowing into risk assets). But now, both engines have “fired out.”

Renowned analyst Willy Woo said, “The halving cycle” and “liquidity cycle” are no longer synchronized, and Bitcoin has lost its “natural accelerator.” More critically, Bitcoin has never experienced a severe recession like 2008 — if a recession hits, everyone will lack funds, and who will buy Bitcoin? Its ability to withstand such shocks remains uncertain.

3 sources of confidence

Despite the clouds in the short term, the bullish camp isn’t panicking; they see this as “darkness before dawn,” with three main reasons.

Liquidity will “flood in”

Raoul Pal, CEO of Real Vision, believes the current market’s cash shortage is temporary. After the government shutdown ends, the U.S. Treasury will start “massive spending,” injecting hundreds of billions of dollars into the market.

Arthur Hayes, founder of Bit, is more direct: the U.S. government will issue a lot of bonds, which will ultimately require the Fed to “print money to buy bonds,” essentially “hidden quantitative easing” — when liquidity increases, Bitcoin is likely to rise along with it.

Regulatory clarity is coming. For the crypto market, “uncertain regulation” is scarier than “strict regulation.” The U.S. is now pushing the “CLARITY Act,” which aims to transfer regulatory authority over mainstream digital commodities like Bitcoin to the CFTC (Commodity Futures Trading Commission) instead of the SEC (Securities and Exchange Commission), which has been vague in enforcement.

If this bill passes (supported by both parties and expected to be enacted by late 2025), banks and brokerages will be more confident to enter the Bitcoin space without fear of sudden crackdowns — leading to more capital flowing in and providing a “backstop” for Bitcoin.

Long-term valuation remains low, target price around $170,000. JPMorgan mentioned the $94,000 “cost basis,” but also said Bitcoin’s “theoretical fair value” should be around $170,000 — they compare Bitcoin to gold, and after considering volatility, they believe Bitcoin is still undervalued.

Moreover, the bulls believe that Bitcoin’s previous bull markets followed a “four-year cycle,” but this time, it might extend to five years, with a peak possibly in Q2 2026. The current correction is actually a “buying opportunity,” not the end of the bull run.

Will it go up or down?

Actually, both bulls and bears have valid points. The next move of Bitcoin depends on three key variables.

Short-term: Will liquidity truly be unleashed? If the Fed cuts rates in December or the Treasury “spends money” as scheduled, improving market liquidity, Bitcoin will likely rebound and even break above the “life-and-death line” of $113,000; but if liquidity doesn’t follow or the Fed remains hawkish, a drop below $94,000 is also possible.

Mid-term: Will the “CLARITY Act” be enacted? If it passes smoothly, with clearer regulation, institutions will be more willing to enter, and Bitcoin could start a new rally; but if the bill stalls or regulation tightens further, mid-term prospects will be tough.

Long-term: Will a recession occur? If a severe economic downturn happens, everyone will lack funds, and Bitcoin might fall along with it; but if Bitcoin can withstand the recession or even be seen as a “safe haven” (like gold), its long-term position will be more stable, and prices could rise again.

For ordinary investors, the biggest mistake now is “following the herd” — don’t sell just because you’re bearish, and don’t go all-in when bullish. It’s best to clarify whether you’re “short-term speculating” or “long-term investing”:

Short-term traders should closely watch liquidity and key levels (113,000 and 94,000), while long-term investors can wait for a pullback to support levels and gradually build positions, not investing all their funds at once.

After all, the only “certainty” in the market now is “uncertainty” — only by managing risks well can you stay calm amid Bitcoin’s volatility.