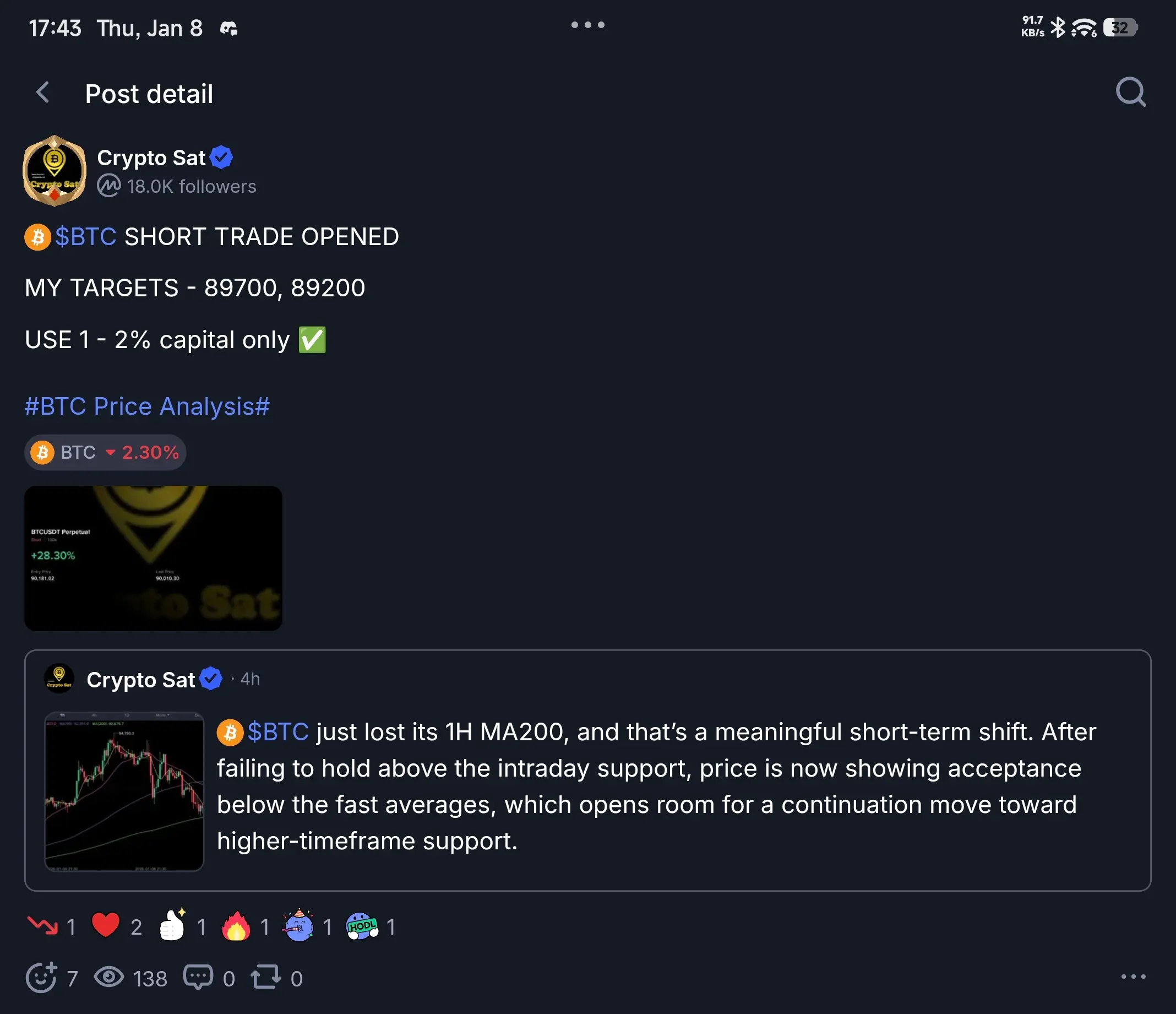

$BTC just lost its 1H MA200, and that’s a meaningful short-term shift. After failing to hold above the intraday support, price is now showing acceptance below the fast averages, which opens room for a continuation move toward higher-timeframe support.

What’s happening right now

1H MA200 lost → short-term trend weakness confirmed

Price rolling down with lower highs on 1H

Market now gravitating toward the 4H MA zone (MA99 + MA200) — a key reaction area

This zone often acts as a magnet during corrections.

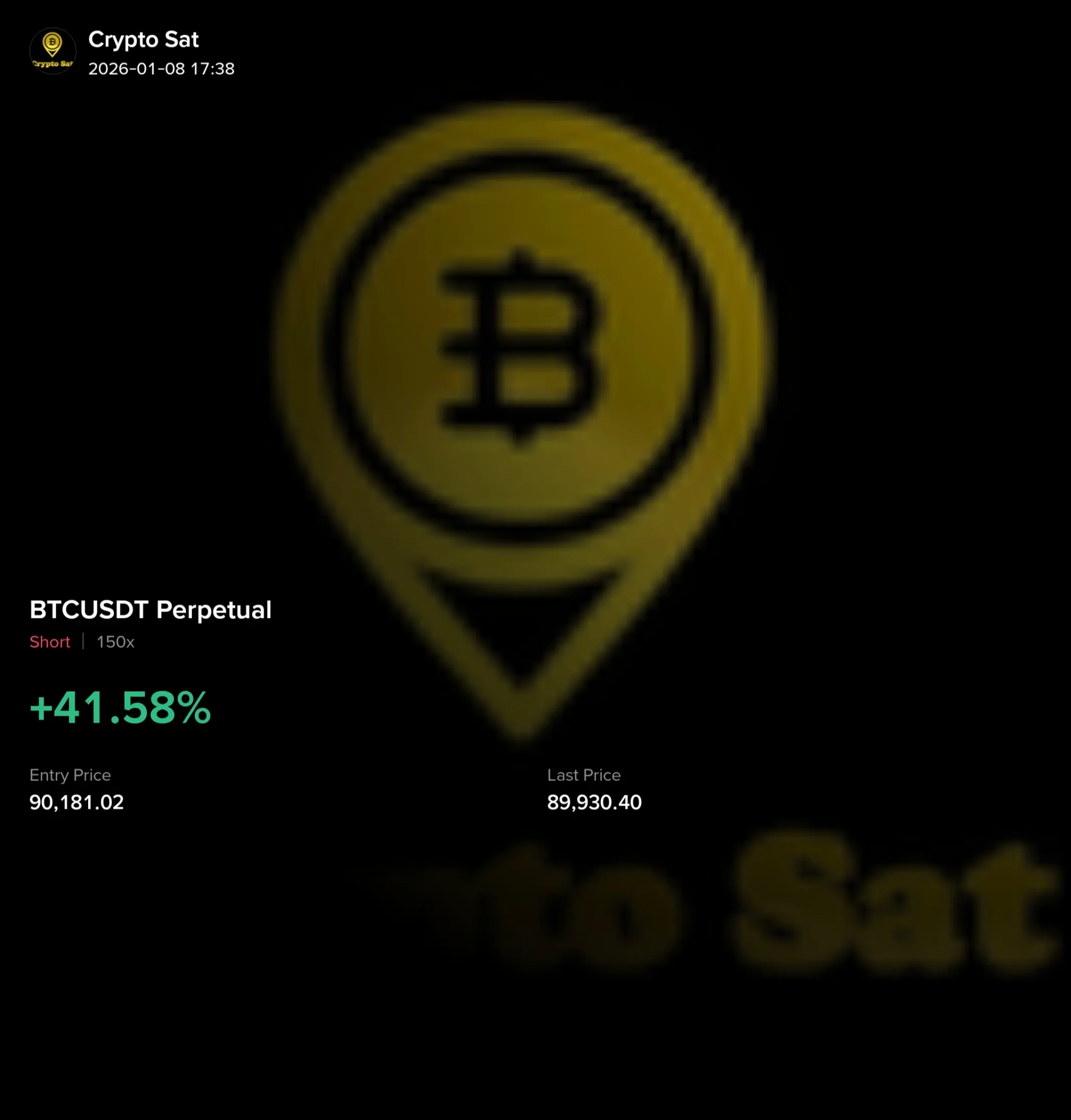

🔽 Short scalp continuation

As long as

$BTC stays below the 1H MA200:

Downside pressure remains active

Expect a move into the 4H MA99 / MA200 cluster

Momentum favors shorts on lower-timeframe pullbacks

This is a scalping environment, not a swing chase.

Quick reactions, tight risk, no emotions.