Amarylliss_14

No content yet

- Reward

- 2

- 3

- Repost

- Share

dragon_fly2 :

:

2026 GOGOGO 👊View More

- Reward

- 1

- 1

- Repost

- Share

Cryptobuzzz :

:

Good information- Reward

- like

- Comment

- Repost

- Share

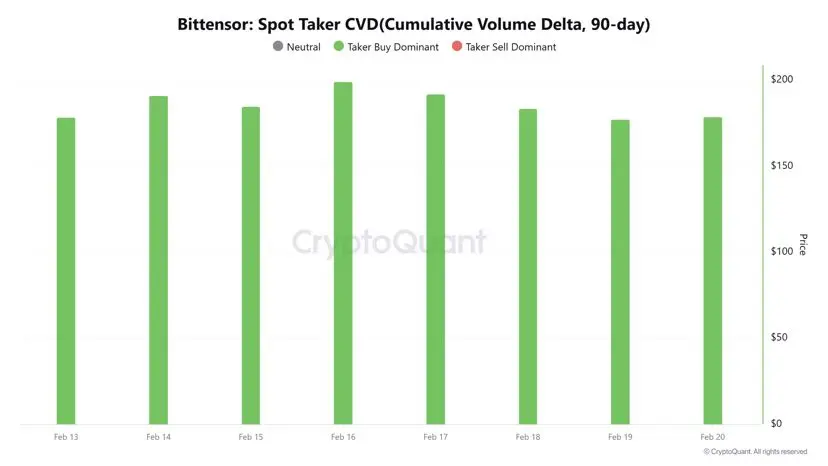

$TAO keeps holding below the key level, continuation remains the base case.

A breakdown opens the door for another -18% toward the $144 liquidity pocket.

Reversal only becomes valid if bulls reclaim that level with strength.

ADX at 33.62 (>25) confirms strong directional momentum trend is active, not ranging.

Derivatives show mixed sentiment:

• $170.8 downside liquidity

• $181.3 upside liquidity

• $2.65M shorts vs $1.89M longs → slight bearish bias

But spot tells a different story.

90D Spot Taker CVD shows consistent buyer absorption despite chop between $170–$195.

Leverage leaning short.

Sp

A breakdown opens the door for another -18% toward the $144 liquidity pocket.

Reversal only becomes valid if bulls reclaim that level with strength.

ADX at 33.62 (>25) confirms strong directional momentum trend is active, not ranging.

Derivatives show mixed sentiment:

• $170.8 downside liquidity

• $181.3 upside liquidity

• $2.65M shorts vs $1.89M longs → slight bearish bias

But spot tells a different story.

90D Spot Taker CVD shows consistent buyer absorption despite chop between $170–$195.

Leverage leaning short.

Sp

TAO2,91%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

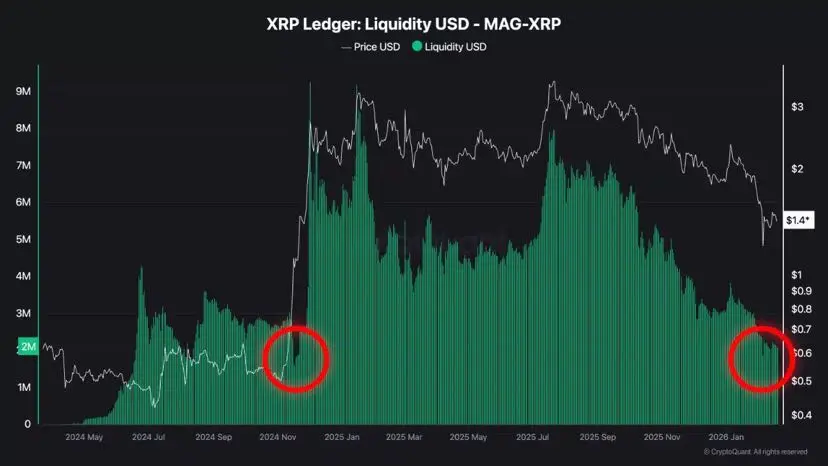

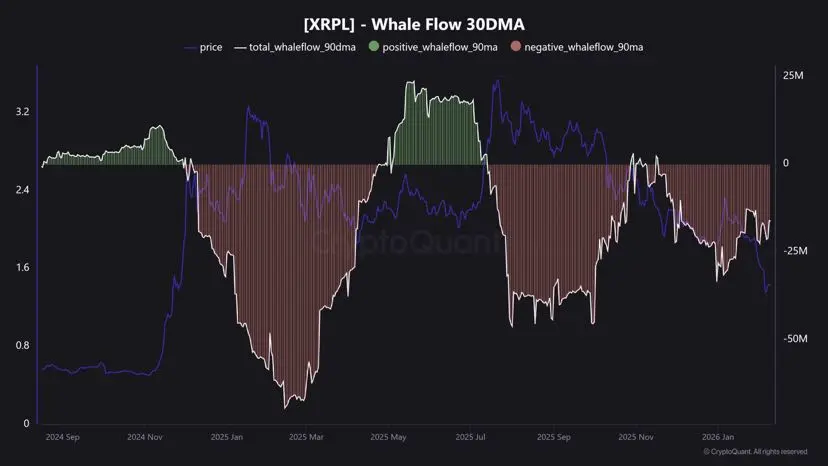

$XRP rallied 30% in February, fueled by easing whale selling and a positive MACD after a golden cross.

Bulls could target $1.6 and $1.8 if momentum holds, but RSI is still below average.

Options data shows traders are cautious, pricing <6% chance of $2 this month a potential ‘dead cat bounce.’

Bulls could target $1.6 and $1.8 if momentum holds, but RSI is still below average.

Options data shows traders are cautious, pricing <6% chance of $2 this month a potential ‘dead cat bounce.’

XRP1,61%

- Reward

- like

- Comment

- Repost

- Share

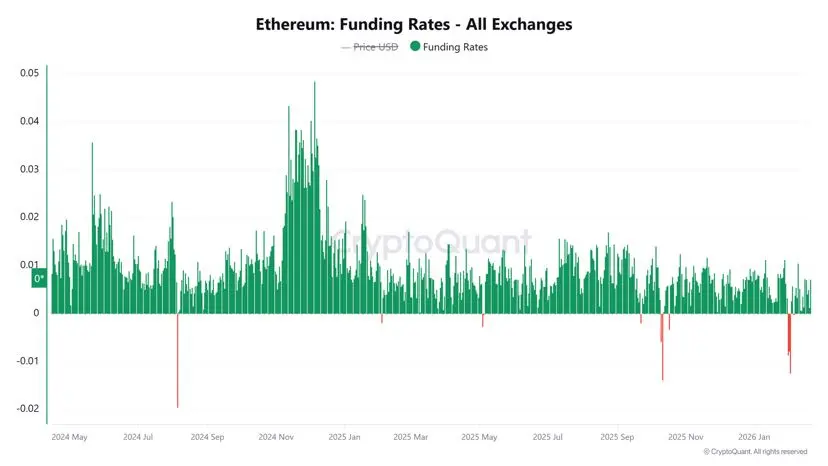

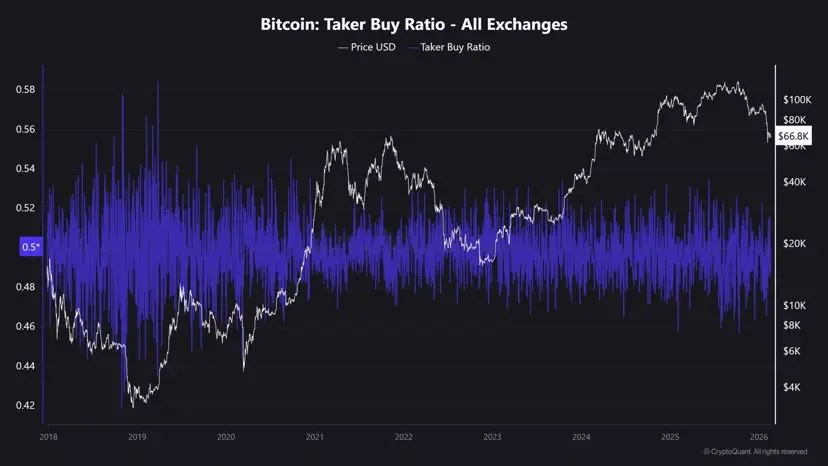

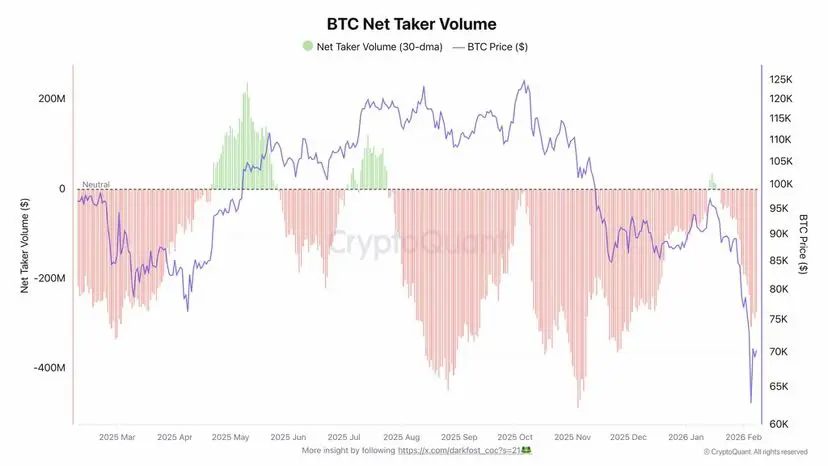

$BTC derivatives flow has flipped.

Net taker volume just turned negative for the first time in months, with roughly $270M leaning toward sellers.

Binance data backs it up. Despite over $20B in volume, the taker buy/sell ratio is sitting below 1, showing aggressive selling is dominating.

Market control is slowly moving back to the sell side.

Net taker volume just turned negative for the first time in months, with roughly $270M leaning toward sellers.

Binance data backs it up. Despite over $20B in volume, the taker buy/sell ratio is sitting below 1, showing aggressive selling is dominating.

Market control is slowly moving back to the sell side.

BTC1,45%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊$BTC

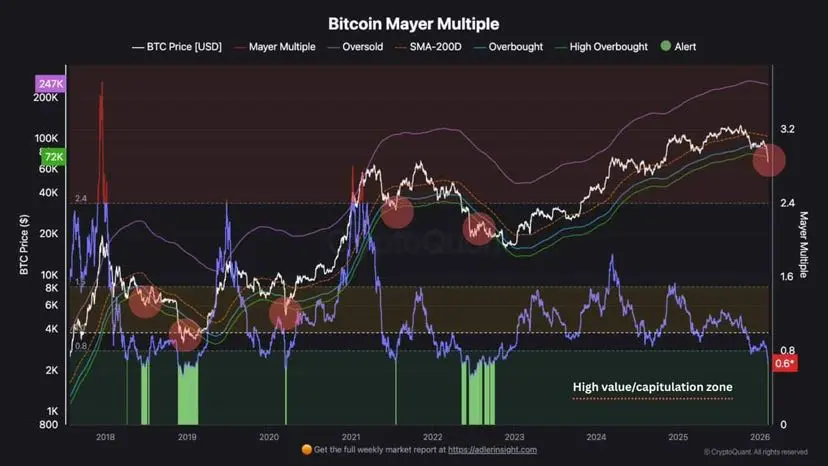

$60K wasn’t just another bounce.

That level absorbed panic, forced sellers out, and flipped momentum when the market least expected it. Same zone that kick-started the 2025 run is still doing its job.

Momentum isn’t clean yet — hesitation remains — but value buyers are clearly stepping in while fear is loud.

Bitcoin doesn’t bottom when confidence is high. It bottoms when selling stops working

$60K wasn’t just another bounce.

That level absorbed panic, forced sellers out, and flipped momentum when the market least expected it. Same zone that kick-started the 2025 run is still doing its job.

Momentum isn’t clean yet — hesitation remains — but value buyers are clearly stepping in while fear is loud.

Bitcoin doesn’t bottom when confidence is high. It bottoms when selling stops working

BTC1,45%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$XRP $XRP keeps printing lower highs, sliding from $3.50 toward $1.50 — yet Open Interest is up ~12%.

That’s a classic divergence.

Rising OI into a falling price usually isn’t accumulation.

It’s leverage building:

• shorts leaning into weakness

• late longs chasing dip entries

ETF desk activity and hedging flows point to positioning, not spot demand.

As leverage thickens and price compresses, fragility increases.

These setups tend to lead to volatility expansion, not a clean reversal.

Watch positioning. Not narratives.

That’s a classic divergence.

Rising OI into a falling price usually isn’t accumulation.

It’s leverage building:

• shorts leaning into weakness

• late longs chasing dip entries

ETF desk activity and hedging flows point to positioning, not spot demand.

As leverage thickens and price compresses, fragility increases.

These setups tend to lead to volatility expansion, not a clean reversal.

Watch positioning. Not narratives.

XRP1,61%

- Reward

- 1

- Comment

- Repost

- Share

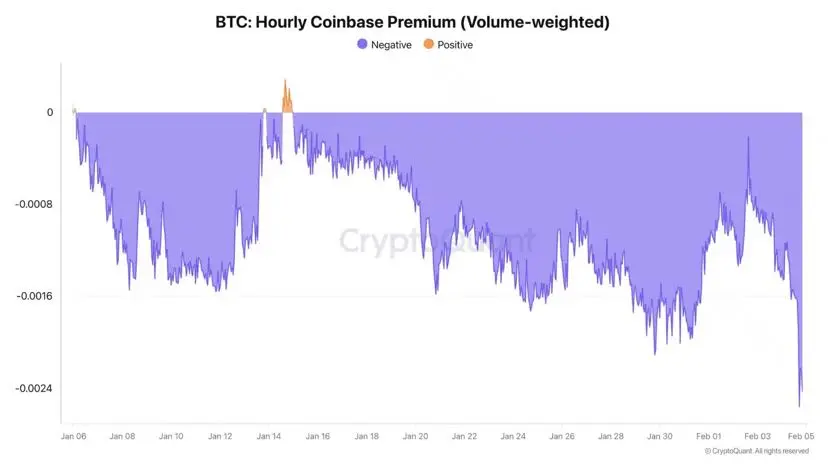

Bitcoin is flashing stress signals.

• $BTC trading well below realized price ($79.1k)

• 14-month low as correlation with U.S. tech tightens

• CLARITY Act delays adding to sell pressure

More concerning:

Coinbase Premium (VWAP) just hit its most negative level of 2026 Darkfost.

That’s heavy selling from large U.S. players.

$74.5k weekly support is gone.

A sweep to $60k now opens the door for a deeper retrace.

High uncertainty. Volatility ahead.

This is not a comfort zone for bulls.

• $BTC trading well below realized price ($79.1k)

• 14-month low as correlation with U.S. tech tightens

• CLARITY Act delays adding to sell pressure

More concerning:

Coinbase Premium (VWAP) just hit its most negative level of 2026 Darkfost.

That’s heavy selling from large U.S. players.

$74.5k weekly support is gone.

A sweep to $60k now opens the door for a deeper retrace.

High uncertainty. Volatility ahead.

This is not a comfort zone for bulls.

BTC1,45%

- Reward

- like

- Comment

- Repost

- Share

Whales are accumulating $ZEC hard big withdrawals, steady exchange outflows, real money moving in.

Yet price keeps sliding and structure stays weak.

Feels like positioning ahead of something, not demand taking control yet.

Share via @coinexcom

#CoinEx #CoinExCreator

Yet price keeps sliding and structure stays weak.

Feels like positioning ahead of something, not demand taking control yet.

Share via @coinexcom

#CoinEx #CoinExCreator

- Reward

- like

- Comment

- Repost

- Share

$MIL is officially live on Solana

Built for the Millionero ecosystem with a clear focus on long-term utility, not short-term hype.

Official CA: 6Tk3uHQpLDtd4Qob5fduLjfhXxAasWgvdo8hYeswxMiL

For more updates @MillioneroEx

Built for the Millionero ecosystem with a clear focus on long-term utility, not short-term hype.

Official CA: 6Tk3uHQpLDtd4Qob5fduLjfhXxAasWgvdo8hYeswxMiL

For more updates @MillioneroEx

SOL2,16%

- Reward

- like

- Comment

- Repost

- Share

$BTC shook out weak hands.

STH unrealized losses peaked near $110B and have now dropped to $65B as price reclaimed $95K–$97K.

Sell-side risk from short-term holders is near cycle lows.

Most panic selling already happened.

With STH stress easing and price reclaiming key EMAs, it won’t take much demand to push BTC toward $99K+.

Market feels lighter here.

Share via @coinexcom

#coinex

STH unrealized losses peaked near $110B and have now dropped to $65B as price reclaimed $95K–$97K.

Sell-side risk from short-term holders is near cycle lows.

Most panic selling already happened.

With STH stress easing and price reclaiming key EMAs, it won’t take much demand to push BTC toward $99K+.

Market feels lighter here.

Share via @coinexcom

#coinex

- Reward

- like

- Comment

- Repost

- Share

Just joined #ChainersParty

Prize pool $5,000+ with $2,000 USDT split across the leaderboard.

Top 250 get rewards, and there’s also a 10,000 CFB raffle for everyone else.

Just doing quests, stacking CP, and letting it play out. Hard to ignore a pool like this tbh.

Prize pool $5,000+ with $2,000 USDT split across the leaderboard.

Top 250 get rewards, and there’s also a 10,000 CFB raffle for everyone else.

Just doing quests, stacking CP, and letting it play out. Hard to ignore a pool like this tbh.

- Reward

- like

- Comment

- Repost

- Share

$BTC is pressing up against a critical inflection zone.

Price is hovering near $97K, just below the Short-Term Holder cost basis at $98.4K a level that often determines whether momentum accelerates or stalls. When recent buyers are underwater, supply tends to lean on price.

Zoom out and the picture looks far healthier $BTC is holding comfortably above long-term benchmarks

Active Investor Mean ($87.8K), True Market Mean ($81.1K), and Realized Price ($56.2K).

That’s not what structural weakness looks like.

This is a tactical fight, not a trend reversal.

A clean reclaim of $98.4K would flip short

Price is hovering near $97K, just below the Short-Term Holder cost basis at $98.4K a level that often determines whether momentum accelerates or stalls. When recent buyers are underwater, supply tends to lean on price.

Zoom out and the picture looks far healthier $BTC is holding comfortably above long-term benchmarks

Active Investor Mean ($87.8K), True Market Mean ($81.1K), and Realized Price ($56.2K).

That’s not what structural weakness looks like.

This is a tactical fight, not a trend reversal.

A clean reclaim of $98.4K would flip short

- Reward

- like

- Comment

- Repost

- Share