Brothers, here comes the follow-up trading plan. Read the chart carefully. Like and follow if you're making money by copying my trades.

13:10 - Reviewing the current market based on yesterday’s ideas and strategies, I can say it was pretty much perfect, and it also validated the three scenarios I mentioned the day before. You can look back at the strategies from yesterday and the day before; overall, there wasn’t much difference, mainly because the direction was correct.

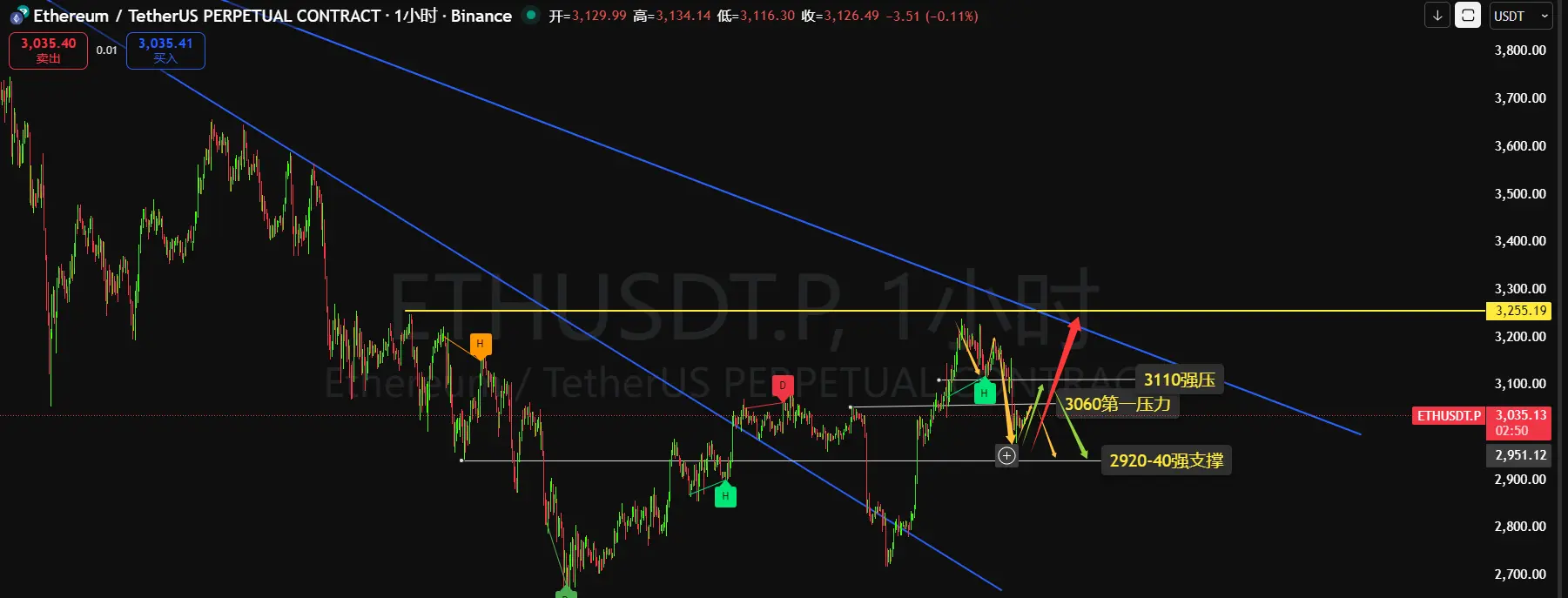

Now, looking at the current market as shown in the chart, here’s my personal opinion:

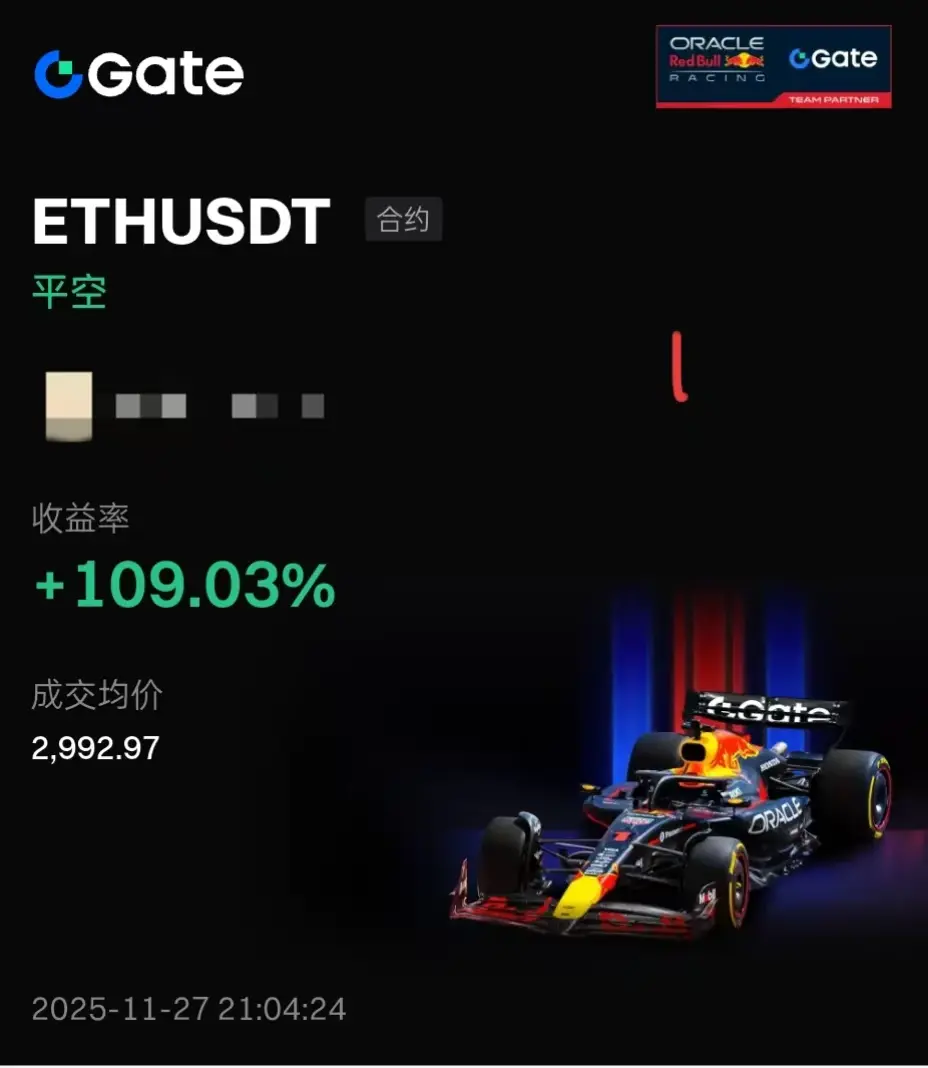

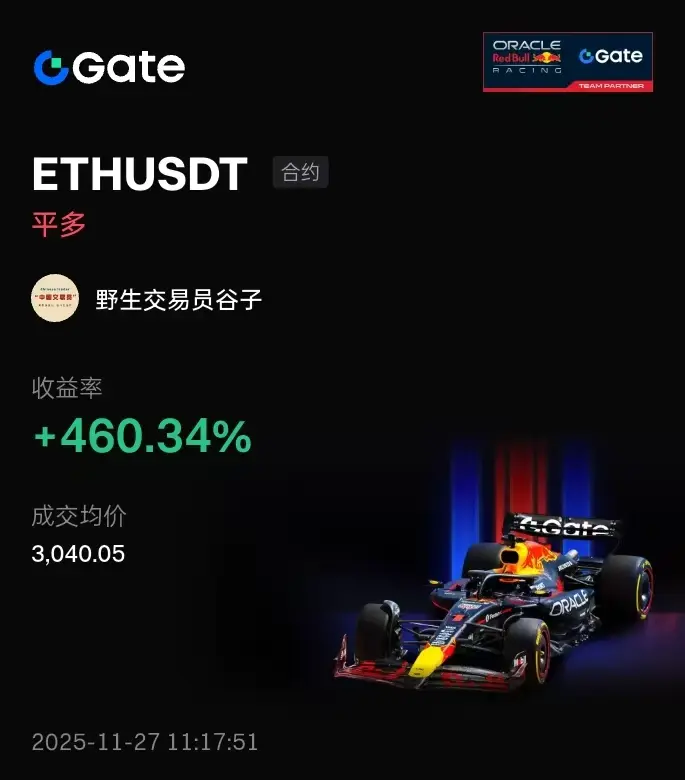

After yesterday's sharp drop, due to news, we got a second opportunity to short and both hit take profit perfectly—no need to catch the very bottom. I've closed all positions in BTC and ETH and am currently holding no positions. Here’s my current analysis and strategy: there are still three possible scenarios for the current move, and since it's the weekend, the market is more likely to move sideways within a broad range.

First scenario: Wide range consolidation, i.e., around 3060-2980.

Second scenario: The green arrow path—pushing up towards the strong resistance at 3110, failing to break through, and then falling back to 2990-2940.

Third scenario: Around 3060-80, not focusing on exact points, mainly direction; if 3090 can’t hold, a continued bearish move down to 2920-40.

Personally, I lean toward the third scenario. But in all cases, around 2990 is a must-reduce position point, which controls risk since you already have profit to lock in.

Of course, all of this is based on technical analysis and predictions—the actual moves depend on the market’s flexibility.

There’s also a fourth possibility, which is the chart I shared the day before yesterday: pushing up to retest the 3250 previous high and breaking through to 3360 or above. Based on the current market, this seems unlikely, but it’s possible if we break and hold 3110. That’s just my personal take.

With this, the trading plan is clear: focus on the scenario with the highest probability—mainly shorting at the top. The strategy is to watch if 3060-80 becomes effective resistance to enter shorts, possibly in batches. Add another position around 3110, set stop loss 10 points above 3110, and as for take profit, everyone knows—reduce positions around 2990-3000, then aim for 2920-40, or close the swing trade, depending on personal preference and market changes.

If 3110 is broken, look for long opportunities. The past couple of days, as you can see, I’ve only taken big moves, no frequent trading, so ultra-short-term trades aren’t in my consideration. I’m just providing you with a big picture and direction for reference. If you make money with ultra-short-term trades, that’s fine—just don’t lose money.

For BTC, the first resistance above is at 90500, strong resistance at 91200, and there’s a chance to retest around 87800 again. I’m still leaning toward shorting at the top, but will be cautious with entries. If 91200 is broken, the probability increases for a move up to 94000-96000.

Mainly, let’s see if the weekend brings a big wide-range consolidation. A strong single directional move is unlikely; markets don’t just keep going up or down endlessly.

13:10 - Reviewing the current market based on yesterday’s ideas and strategies, I can say it was pretty much perfect, and it also validated the three scenarios I mentioned the day before. You can look back at the strategies from yesterday and the day before; overall, there wasn’t much difference, mainly because the direction was correct.

Now, looking at the current market as shown in the chart, here’s my personal opinion:

After yesterday's sharp drop, due to news, we got a second opportunity to short and both hit take profit perfectly—no need to catch the very bottom. I've closed all positions in BTC and ETH and am currently holding no positions. Here’s my current analysis and strategy: there are still three possible scenarios for the current move, and since it's the weekend, the market is more likely to move sideways within a broad range.

First scenario: Wide range consolidation, i.e., around 3060-2980.

Second scenario: The green arrow path—pushing up towards the strong resistance at 3110, failing to break through, and then falling back to 2990-2940.

Third scenario: Around 3060-80, not focusing on exact points, mainly direction; if 3090 can’t hold, a continued bearish move down to 2920-40.

Personally, I lean toward the third scenario. But in all cases, around 2990 is a must-reduce position point, which controls risk since you already have profit to lock in.

Of course, all of this is based on technical analysis and predictions—the actual moves depend on the market’s flexibility.

There’s also a fourth possibility, which is the chart I shared the day before yesterday: pushing up to retest the 3250 previous high and breaking through to 3360 or above. Based on the current market, this seems unlikely, but it’s possible if we break and hold 3110. That’s just my personal take.

With this, the trading plan is clear: focus on the scenario with the highest probability—mainly shorting at the top. The strategy is to watch if 3060-80 becomes effective resistance to enter shorts, possibly in batches. Add another position around 3110, set stop loss 10 points above 3110, and as for take profit, everyone knows—reduce positions around 2990-3000, then aim for 2920-40, or close the swing trade, depending on personal preference and market changes.

If 3110 is broken, look for long opportunities. The past couple of days, as you can see, I’ve only taken big moves, no frequent trading, so ultra-short-term trades aren’t in my consideration. I’m just providing you with a big picture and direction for reference. If you make money with ultra-short-term trades, that’s fine—just don’t lose money.

For BTC, the first resistance above is at 90500, strong resistance at 91200, and there’s a chance to retest around 87800 again. I’m still leaning toward shorting at the top, but will be cautious with entries. If 91200 is broken, the probability increases for a move up to 94000-96000.

Mainly, let’s see if the weekend brings a big wide-range consolidation. A strong single directional move is unlikely; markets don’t just keep going up or down endlessly.