PlayNameGENTLEMAN

Gold and silver prices decline, with silver technical patterns causing panic among bulls

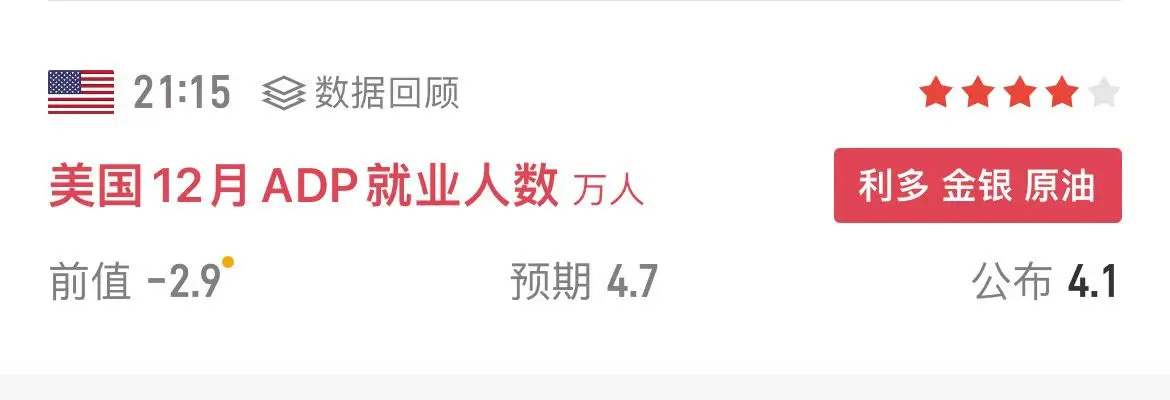

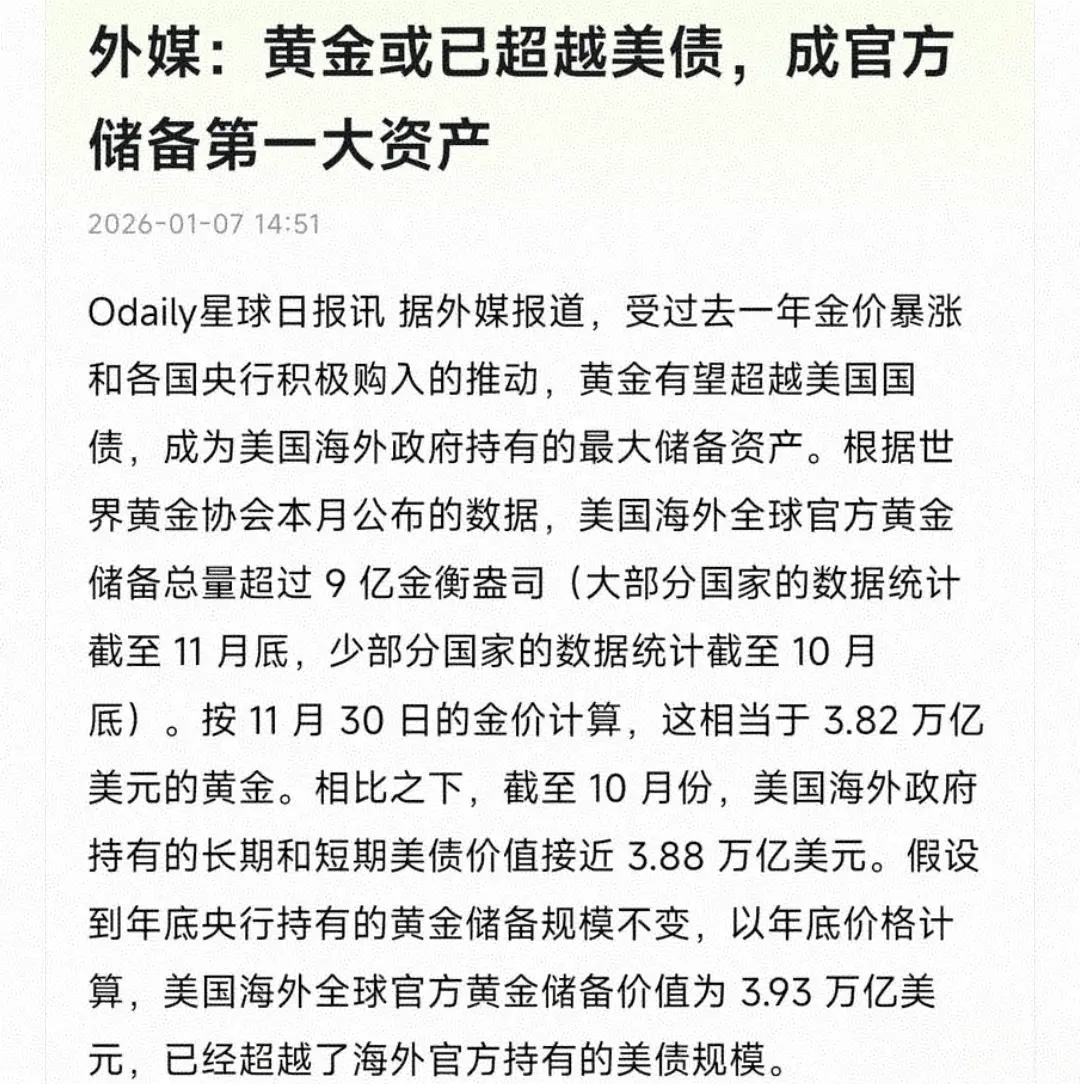

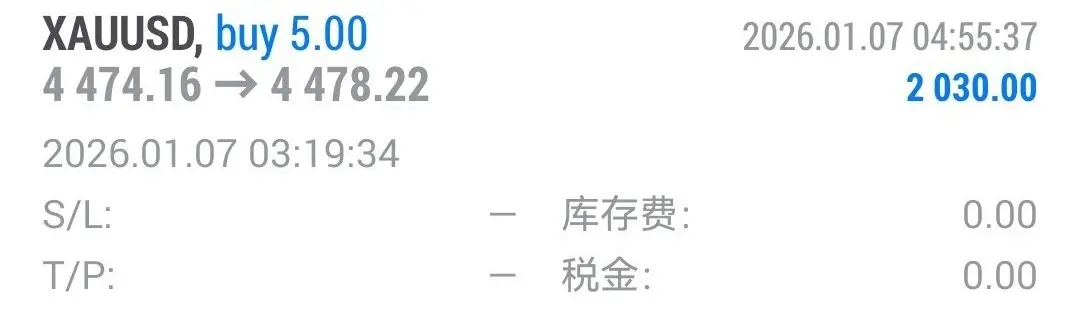

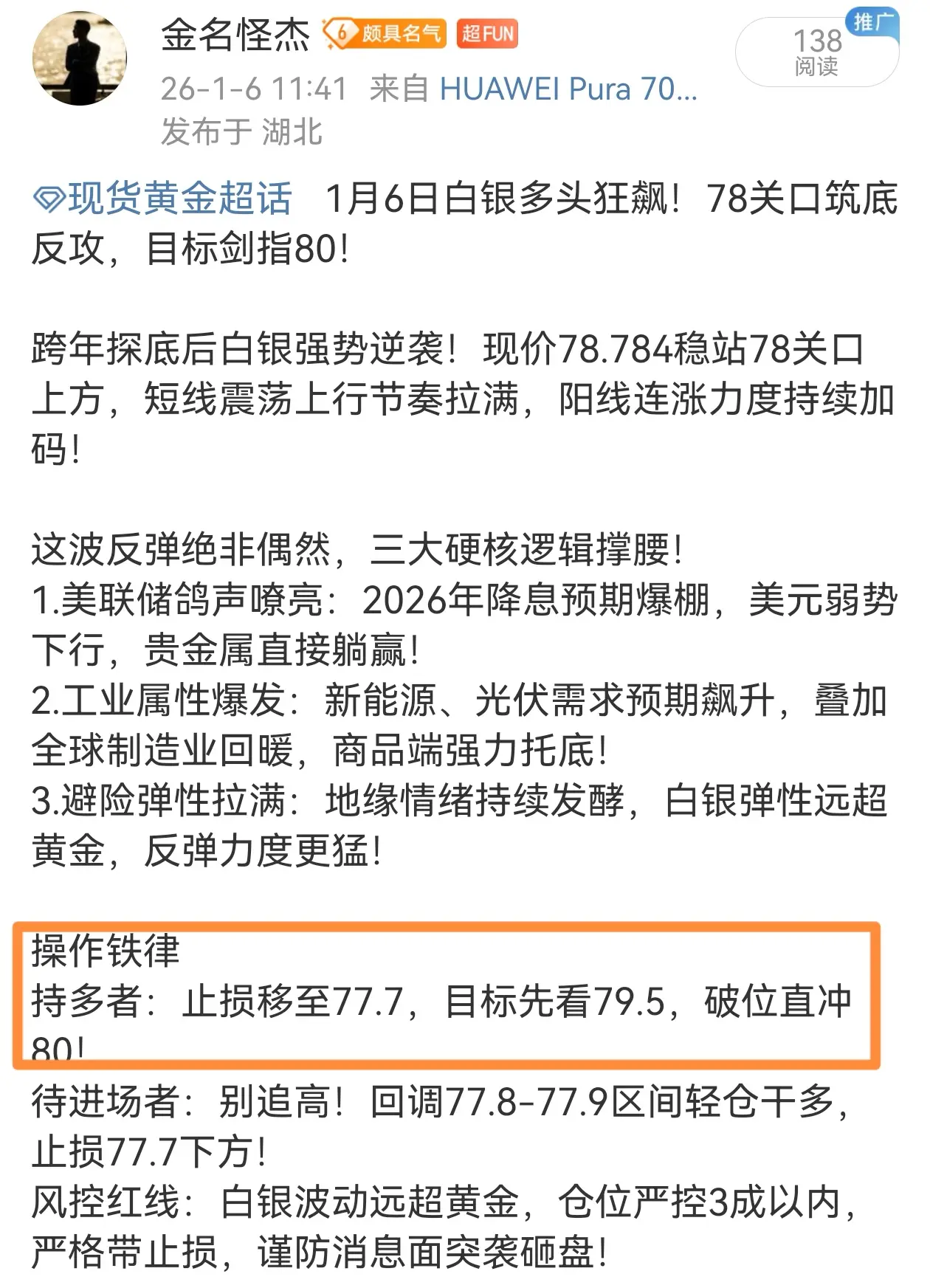

Around midday on January 7th during the US trading session, gold and silver prices fell mainly due to short-term futures traders taking profits. The strong technical resistance just above the record high levels also caused gold and silver bulls to remain cautious during the midweek period. The March delivery gold futures are reported at 4467.2, down 28.9; the March delivery silver futures are at 78.22, down 2.819.

From a technical perspective, the next upward target for February gold futures is a closing p

View OriginalAround midday on January 7th during the US trading session, gold and silver prices fell mainly due to short-term futures traders taking profits. The strong technical resistance just above the record high levels also caused gold and silver bulls to remain cautious during the midweek period. The March delivery gold futures are reported at 4467.2, down 28.9; the March delivery silver futures are at 78.22, down 2.819.

From a technical perspective, the next upward target for February gold futures is a closing p