#WarshNominationBullorBear? The nomination of Warsh to a leadership role at the Federal Reserve represents a major macroeconomic event with wide-reaching implications for global markets. Fed leadership changes are never symbolic; they reshape expectations around policy direction, communication style, and institutional priorities. Investors immediately begin recalibrating their outlook for interest rates, liquidity conditions, and economic stability. These shifts influence not only U.S. markets but also global capital flows, emerging markets, and digital assets, making this nomination a key variable in the current financial landscape.

Warsh’s reputation for balancing inflation control with economic growth places him at the center of a complex policy debate. Markets are now focused on whether his approach will lean toward strict inflation containment or flexible economic management. His stance on data dependency, employment resilience, and financial stability will determine how aggressively the Fed responds to economic signals. Even before concrete policy actions occur, perceptions of his philosophy can move markets, as traders and institutions price in future expectations ahead of official decisions.

For equity markets, Warsh’s messaging will be critical in shaping near-term direction. If he emphasizes the need for continued restrictive policy to combat inflation, growth-oriented sectors such as technology, clean energy, and emerging industries may face renewed pressure. Higher expected borrowing costs can compress valuations and dampen expansion plans. On the other hand, if he signals openness to policy moderation in response to slowing growth, equities may benefit from improved sentiment and renewed institutional participation in risk assets.

Bond markets will also react strongly to shifting expectations around Warsh’s policy framework. Treasury yields, yield curve dynamics, and term premiums will adjust as investors reassess long-term rate trajectories. A perceived commitment to sustained tightening could push yields higher and increase funding costs across the economy. Conversely, a data-driven and flexible stance could stabilize bond markets, reduce volatility, and improve overall liquidity conditions, indirectly supporting broader financial stability.

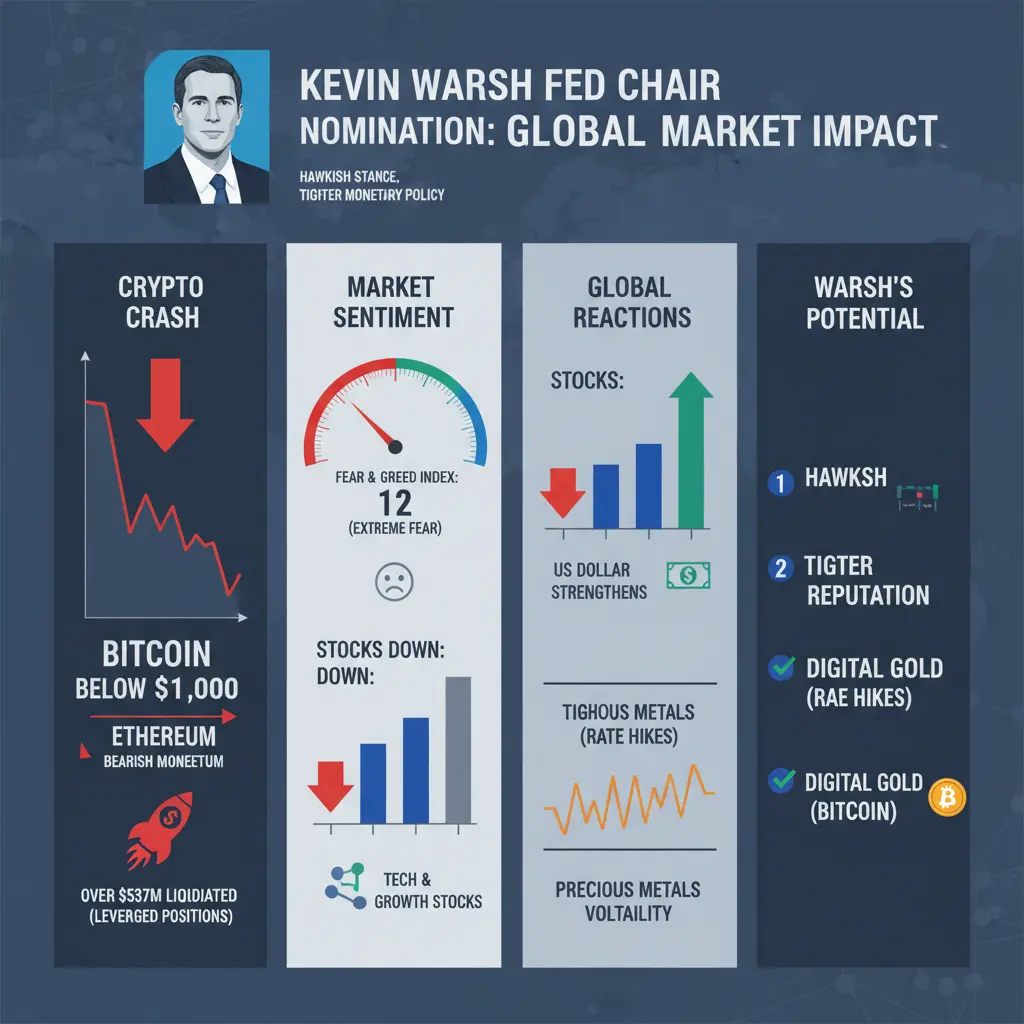

Cryptocurrency markets are particularly sensitive to these developments because digital assets depend heavily on global liquidity and risk appetite. Hawkish policy expectations typically raise the opportunity cost of holding non-yielding assets such as Bitcoin and Ethereum, creating downward pressure. In contrast, signs of monetary flexibility tend to support speculative capital flows into crypto. Layer 2 ecosystems, DeFi platforms, and high-beta altcoins are especially affected, as capital rotation accelerates during periods of shifting macro narratives.

Historical patterns show that Fed leadership transitions often produce an initial surge in volatility followed by gradual normalization. Markets tend to overreact in the early stages, pricing in extreme scenarios before clearer guidance emerges. Over time, actual voting behavior, policy decisions, and macro data become more influential than headlines. This reinforces the importance of distinguishing between short-term emotional reactions and longer-term structural trends.

From a strategic standpoint, Warsh’s nomination should be viewed as a period of heightened observation rather than immediate action. Key indicators to monitor include his public statements, FOMC voting patterns, inflation trajectories, labor market strength, and financial conditions indexes. The interaction between these variables provides a more accurate picture of policy direction than any single announcement. Investors who focus on these signals are better positioned to anticipate meaningful shifts.

Risk management becomes especially important in such transitional periods. Short-term traders may find opportunities in increased volatility but should rely on strict position sizing and hedging strategies. Long-term investors are better served by maintaining diversified exposure and avoiding overcommitment based on speculative narratives. Liquidity preservation remains a priority, as flexibility allows investors to adapt when clearer policy confirmation emerges.

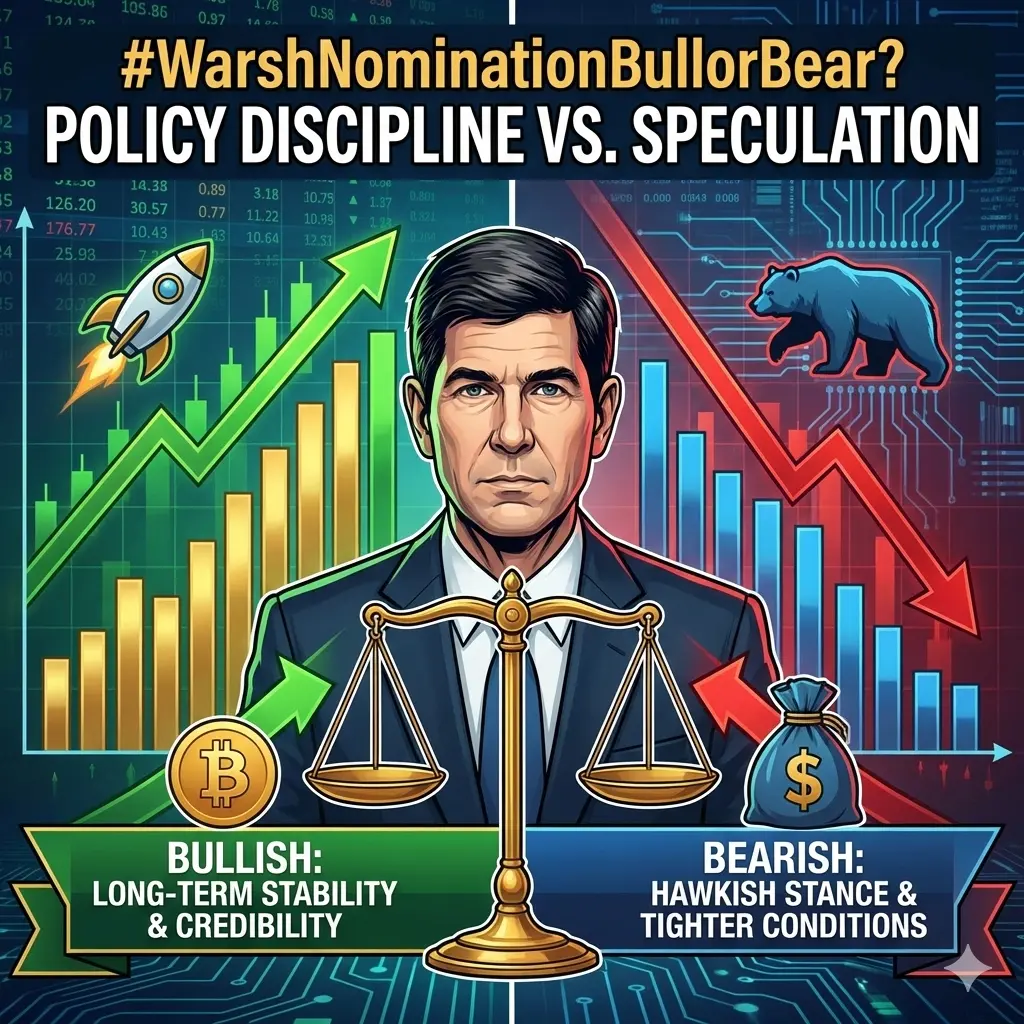

Several scenarios can unfold as Warsh’s influence becomes clearer. In a bullish scenario, markets interpret him as pragmatic and responsive to economic conditions, leading to stabilizing yields, improving liquidity, and renewed confidence in risk assets. Equities and crypto benefit as capital re-enters higher-growth sectors. In a bearish scenario, markets perceive him as firmly hawkish, prioritizing inflation control regardless of economic slowdown, resulting in sustained pressure on valuations and speculative assets. In a neutral scenario, mixed signals produce extended consolidation and choppy trading conditions across asset classes.

Ultimately, Warsh’s nomination does not determine market direction on its own. It reshapes probability distributions and introduces a phase of uncertainty that requires disciplined navigation. The true impact will depend on how his views translate into policy actions and how economic data evolves in response. Investors who remain patient, data-focused, and strategically flexible will be best equipped to manage this transition. Rather than signaling an immediate bull or bear outcome, the nomination marks the beginning of a process that rewards careful analysis, risk control, and long-term perspective.

Warsh’s reputation for balancing inflation control with economic growth places him at the center of a complex policy debate. Markets are now focused on whether his approach will lean toward strict inflation containment or flexible economic management. His stance on data dependency, employment resilience, and financial stability will determine how aggressively the Fed responds to economic signals. Even before concrete policy actions occur, perceptions of his philosophy can move markets, as traders and institutions price in future expectations ahead of official decisions.

For equity markets, Warsh’s messaging will be critical in shaping near-term direction. If he emphasizes the need for continued restrictive policy to combat inflation, growth-oriented sectors such as technology, clean energy, and emerging industries may face renewed pressure. Higher expected borrowing costs can compress valuations and dampen expansion plans. On the other hand, if he signals openness to policy moderation in response to slowing growth, equities may benefit from improved sentiment and renewed institutional participation in risk assets.

Bond markets will also react strongly to shifting expectations around Warsh’s policy framework. Treasury yields, yield curve dynamics, and term premiums will adjust as investors reassess long-term rate trajectories. A perceived commitment to sustained tightening could push yields higher and increase funding costs across the economy. Conversely, a data-driven and flexible stance could stabilize bond markets, reduce volatility, and improve overall liquidity conditions, indirectly supporting broader financial stability.

Cryptocurrency markets are particularly sensitive to these developments because digital assets depend heavily on global liquidity and risk appetite. Hawkish policy expectations typically raise the opportunity cost of holding non-yielding assets such as Bitcoin and Ethereum, creating downward pressure. In contrast, signs of monetary flexibility tend to support speculative capital flows into crypto. Layer 2 ecosystems, DeFi platforms, and high-beta altcoins are especially affected, as capital rotation accelerates during periods of shifting macro narratives.

Historical patterns show that Fed leadership transitions often produce an initial surge in volatility followed by gradual normalization. Markets tend to overreact in the early stages, pricing in extreme scenarios before clearer guidance emerges. Over time, actual voting behavior, policy decisions, and macro data become more influential than headlines. This reinforces the importance of distinguishing between short-term emotional reactions and longer-term structural trends.

From a strategic standpoint, Warsh’s nomination should be viewed as a period of heightened observation rather than immediate action. Key indicators to monitor include his public statements, FOMC voting patterns, inflation trajectories, labor market strength, and financial conditions indexes. The interaction between these variables provides a more accurate picture of policy direction than any single announcement. Investors who focus on these signals are better positioned to anticipate meaningful shifts.

Risk management becomes especially important in such transitional periods. Short-term traders may find opportunities in increased volatility but should rely on strict position sizing and hedging strategies. Long-term investors are better served by maintaining diversified exposure and avoiding overcommitment based on speculative narratives. Liquidity preservation remains a priority, as flexibility allows investors to adapt when clearer policy confirmation emerges.

Several scenarios can unfold as Warsh’s influence becomes clearer. In a bullish scenario, markets interpret him as pragmatic and responsive to economic conditions, leading to stabilizing yields, improving liquidity, and renewed confidence in risk assets. Equities and crypto benefit as capital re-enters higher-growth sectors. In a bearish scenario, markets perceive him as firmly hawkish, prioritizing inflation control regardless of economic slowdown, resulting in sustained pressure on valuations and speculative assets. In a neutral scenario, mixed signals produce extended consolidation and choppy trading conditions across asset classes.

Ultimately, Warsh’s nomination does not determine market direction on its own. It reshapes probability distributions and introduces a phase of uncertainty that requires disciplined navigation. The true impact will depend on how his views translate into policy actions and how economic data evolves in response. Investors who remain patient, data-focused, and strategically flexible will be best equipped to manage this transition. Rather than signaling an immediate bull or bear outcome, the nomination marks the beginning of a process that rewards careful analysis, risk control, and long-term perspective.