# LiquidityCycle

390

LittleQueen

#加密市场观察|Liquidity Dilemma: Can This Rebound Sustain?

🔎 On-Chain + Macro Signals Reveal the True Nature of the Move

The current crypto rebound appears less like a genuine market recovery and more like a macro-driven reaction. Weak on-chain participation combined with improving global risk sentiment suggests this is a fragile rebound, not a structural trend reversal.

🌍 Macro Layer: Risk Appetite Is Steering Price

The short-term upside has been fueled primarily by global risk-on sentiment. Recent geopolitical and trade-related comments from U.S. leadership, alongside improving NATO coordination

🔎 On-Chain + Macro Signals Reveal the True Nature of the Move

The current crypto rebound appears less like a genuine market recovery and more like a macro-driven reaction. Weak on-chain participation combined with improving global risk sentiment suggests this is a fragile rebound, not a structural trend reversal.

🌍 Macro Layer: Risk Appetite Is Steering Price

The short-term upside has been fueled primarily by global risk-on sentiment. Recent geopolitical and trade-related comments from U.S. leadership, alongside improving NATO coordination

- Reward

- 1

- 2

- Repost

- Share

CryptoVortex :

:

2026 GOGOGO 👊View More

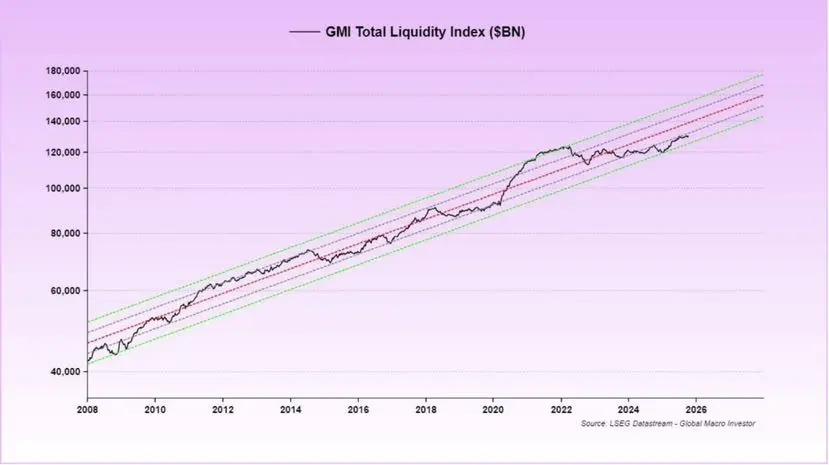

Markets look stressed, but the bigger picture is shifting in silence. The shutdown has locked up liquidity and the Treasury’s cash pile keeps rising, starving risk assets of fresh flow.

Crypto feels the pressure first, yet this is the classic pain window before a major turn.

When the shutdown ends, the Treasury will push hundreds of billions back into the system, QT will slow, and dollar liquidity will expand. Rate cuts are lined up, global easing is building, and fiscal spending ahead of 2026 keeps growth alive.

This squeeze won’t last. When liquidity returns, it will hit fast and lift eve

Crypto feels the pressure first, yet this is the classic pain window before a major turn.

When the shutdown ends, the Treasury will push hundreds of billions back into the system, QT will slow, and dollar liquidity will expand. Rate cuts are lined up, global easing is building, and fiscal spending ahead of 2026 keeps growth alive.

This squeeze won’t last. When liquidity returns, it will hit fast and lift eve

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

54.05K Popularity

35.06K Popularity

19.95K Popularity

65.14K Popularity

346.46K Popularity

11.79K Popularity

10.4K Popularity

19.32K Popularity

108.86K Popularity

25.64K Popularity

217.81K Popularity

20.48K Popularity

6.93K Popularity

16.43K Popularity

172.56K Popularity

News

View MoreNasdaq 100 futures pre-market gains expand to 1%

1 m

Sentient opens SENT token airdrop claim

7 m

Analysis: The number of initial unemployment claims in the United States shows little change, and the scale of layoffs may be limited.

8 m

Data: A total of 13,690,300 TON transferred from Kiln to TON, valued at approximately $212 million.

10 m

Cultural Industry RWA Project LOVEVoyage Launches on RWAX, Reaching a Market Cap of $3 Million in 10 Minutes

11 m

Pin