📉 ETH Under Pressure — Price vs. Fundamentals

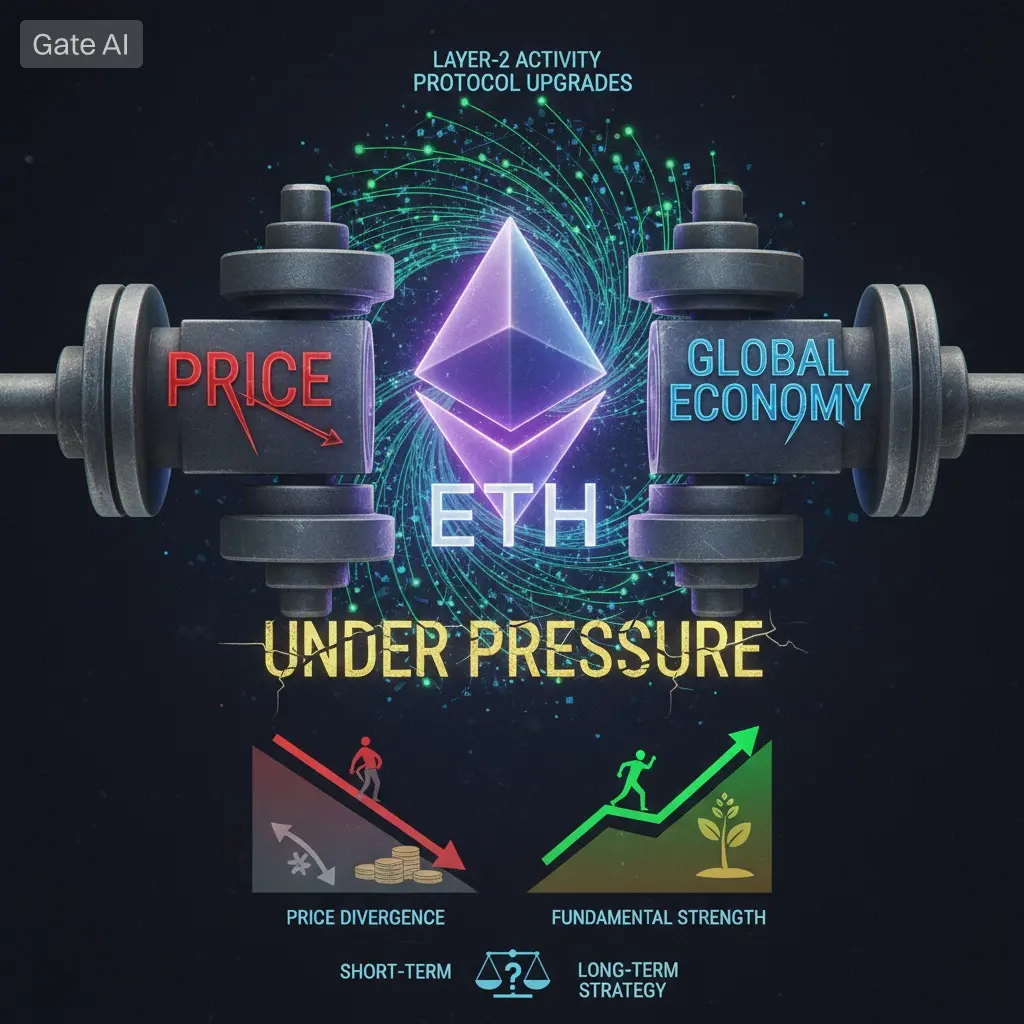

Ethereum is currently facing short-term price pressure, even as network upgrades and Layer-2 adoption continue to advance. This divergence between price action and fundamentals is creating strategic questions for traders and investors.

1️⃣ Price Perspective

ETH recently tested resistance around $2,000–$2,050, with selling pressure keeping it below key levels.

Short-term sentiment is cautious due to macro volatility and broader crypto market pullbacks.

Technical indicators like RSI are hovering near neutral, signaling potential consolidation rather than a full-blown downtrend.

2️⃣ Fundamental Strength

Layer-2 activity continues to grow, with Arbitrum, Optimism, and zk-rollups seeing higher transaction volumes.

Ethereum network upgrades — including EIP improvements and scalability initiatives — are laying the groundwork for future adoption.

DeFi, NFTs, and institutional ETH exposure are increasing steadily, showing underlying demand.

3️⃣ Divergence Insight

Price may react to short-term market swings, but fundamentals suggest long-term strength.

Investors who focus only on price risk missing accumulation opportunities.

Institutional flows and Layer-2 usage metrics indicate sustained network utility, supporting ETH’s structural value.

4️⃣ Key Levels to Watch

Support: $1,950–$1,980 (recent accumulation zone, strong historical volume)

Resistance: $2,050–$2,100 (local highs and liquidity cluster)

Critical breakout: Above $2,150 could reignite bullish momentum.

Dragon Fly Official Strategy

Short-term traders: consider scaling entries on support and monitoring Layer-2 adoption signals.

Long-term holders: fundamentals support accumulation despite price dips, especially with ETH network upgrades ongoing.

Risk management remains crucial — layer trades and position sizing are key during divergence.

#ETHUnderPressure

Ethereum is currently facing short-term price pressure, even as network upgrades and Layer-2 adoption continue to advance. This divergence between price action and fundamentals is creating strategic questions for traders and investors.

1️⃣ Price Perspective

ETH recently tested resistance around $2,000–$2,050, with selling pressure keeping it below key levels.

Short-term sentiment is cautious due to macro volatility and broader crypto market pullbacks.

Technical indicators like RSI are hovering near neutral, signaling potential consolidation rather than a full-blown downtrend.

2️⃣ Fundamental Strength

Layer-2 activity continues to grow, with Arbitrum, Optimism, and zk-rollups seeing higher transaction volumes.

Ethereum network upgrades — including EIP improvements and scalability initiatives — are laying the groundwork for future adoption.

DeFi, NFTs, and institutional ETH exposure are increasing steadily, showing underlying demand.

3️⃣ Divergence Insight

Price may react to short-term market swings, but fundamentals suggest long-term strength.

Investors who focus only on price risk missing accumulation opportunities.

Institutional flows and Layer-2 usage metrics indicate sustained network utility, supporting ETH’s structural value.

4️⃣ Key Levels to Watch

Support: $1,950–$1,980 (recent accumulation zone, strong historical volume)

Resistance: $2,050–$2,100 (local highs and liquidity cluster)

Critical breakout: Above $2,150 could reignite bullish momentum.

Dragon Fly Official Strategy

Short-term traders: consider scaling entries on support and monitoring Layer-2 adoption signals.

Long-term holders: fundamentals support accumulation despite price dips, especially with ETH network upgrades ongoing.

Risk management remains crucial — layer trades and position sizing are key during divergence.

#ETHUnderPressure