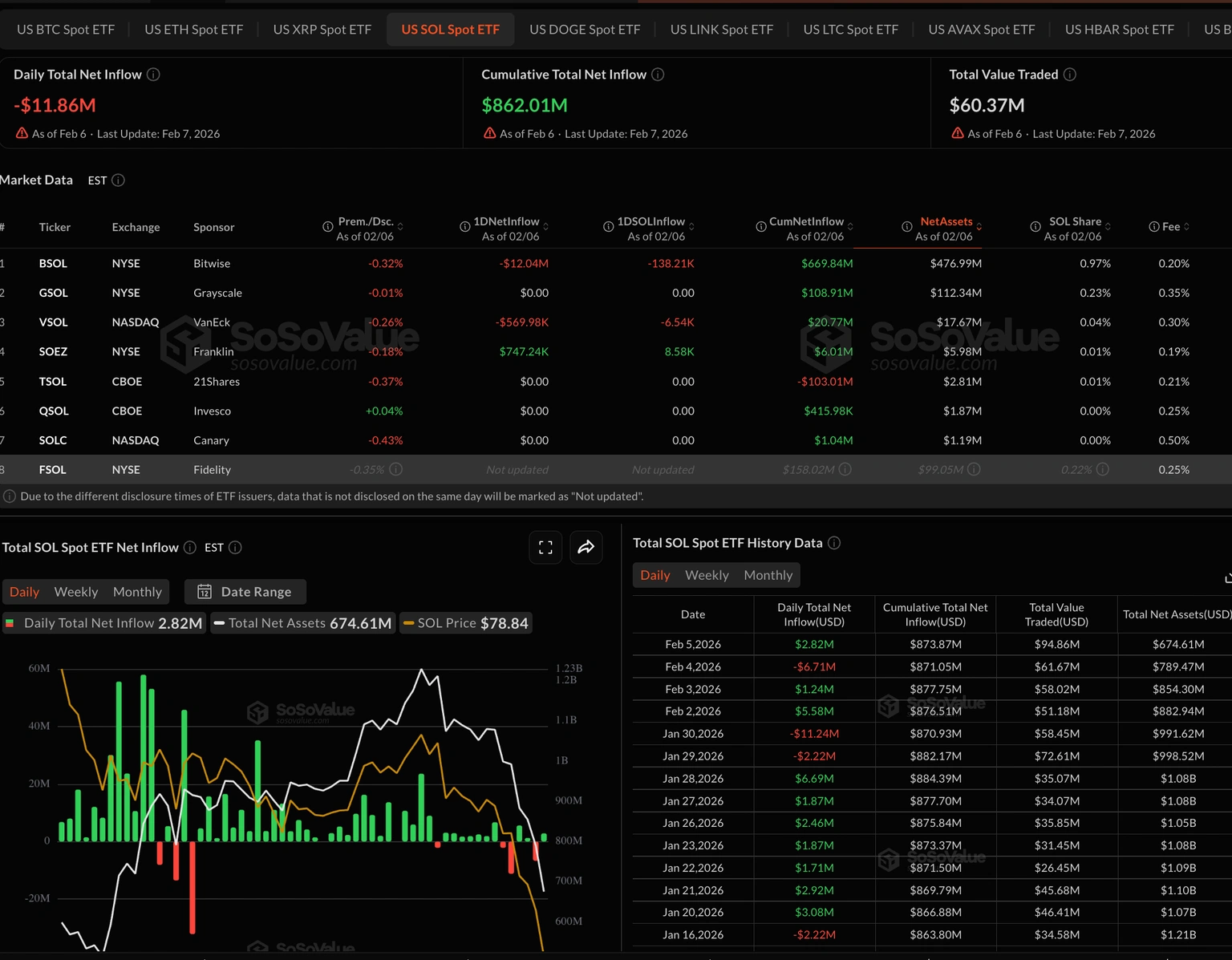

Yesterday, the US Bitcoin ETF saw a net inflow of 417 BTC, and the Ethereum ETF experienced a net inflow of 10,536 ETH.

Odaily Planet Daily reports that, according to Lookonchain monitoring, yesterday the US Bitcoin ETF had a net inflow of 417 BTC, with a 7-day net outflow of 11,607 BTC; Ethereum ETF had a net inflow of 10,536 ETH, with a 7-day net outflow of 78,345 ETH; Solana ETF had a net inflow of 10,471 ETH.

GateNewsBot·1h ago