# NFPBeatsExpectations

12.96K

HighAmbition

#NFPBeatsExpectations

On Feb 11, 2026, the U.S. Non-Farm Payroll (NFP) report came in much stronger than expected — and it shook both macro and crypto markets.

📊 The Key Jobs Data (January 2026)

✅ Jobs Added: +130,000

(Expected: ~55K–70K)

✅ Unemployment: 4.3%

(Expected: 4.4%)

🔁 December 2025 jobs were revised sharply lower to +48K

Big annual revisions show 2025 job growth much weaker than first reported.

So January looked strong on the surface, but the underlying trend was softer than markets thought.

This created a “strong headline, softer reality” vibe in markets — which mattered for cryp

On Feb 11, 2026, the U.S. Non-Farm Payroll (NFP) report came in much stronger than expected — and it shook both macro and crypto markets.

📊 The Key Jobs Data (January 2026)

✅ Jobs Added: +130,000

(Expected: ~55K–70K)

✅ Unemployment: 4.3%

(Expected: 4.4%)

🔁 December 2025 jobs were revised sharply lower to +48K

Big annual revisions show 2025 job growth much weaker than first reported.

So January looked strong on the surface, but the underlying trend was softer than markets thought.

This created a “strong headline, softer reality” vibe in markets — which mattered for cryp

BTC-1,34%

- Reward

- 8

- 9

- Repost

- Share

AylaShinex :

:

To The Moon 🌕View More

#NFPBeatsExpectations 📊 A Signal of Economic Strength and Market Shifts

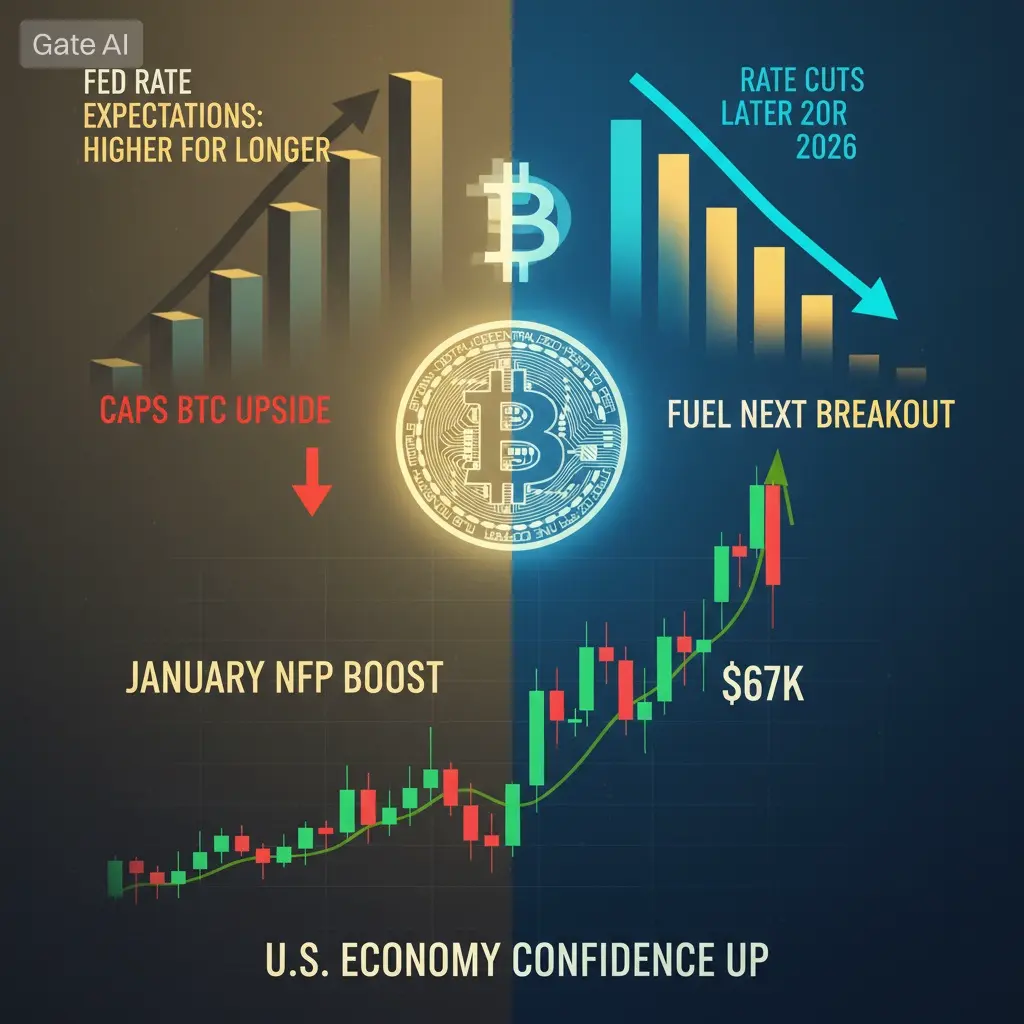

When Non-Farm Payroll (NFP) data surpasses forecasts, it signals that the labor market in the world’s largest economy remains resilient. This strength extends beyond job creation, reflecting rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise temporarily eases recession concerns and fuels optimism across markets.

Federal Reserve Response and Interest Rate Outlook

The most significant implication of strong NFP data is its influence on Federal Reserve policy. Rapid employmen

When Non-Farm Payroll (NFP) data surpasses forecasts, it signals that the labor market in the world’s largest economy remains resilient. This strength extends beyond job creation, reflecting rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise temporarily eases recession concerns and fuels optimism across markets.

Federal Reserve Response and Interest Rate Outlook

The most significant implication of strong NFP data is its influence on Federal Reserve policy. Rapid employmen

BTC-1,34%

- Reward

- 1

- 2

- Repost

- Share

MrFlower_ :

:

LFG 🔥View More

#NFPBeatsExpectations

A Signal of Economic Strength and Market Shifts

When Non-Farm Payroll (NFP) data exceeds forecasts, it sends a powerful message that the labor market in the world’s largest economy remains resilient. This strength goes beyond job creation — it reflects rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise in employment data reinforces optimism and temporarily pushes recession fears into the background.

Federal Reserve Response and Interest Rate Outlook

The most important implication of strong NFP data lies in its impact on

A Signal of Economic Strength and Market Shifts

When Non-Farm Payroll (NFP) data exceeds forecasts, it sends a powerful message that the labor market in the world’s largest economy remains resilient. This strength goes beyond job creation — it reflects rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise in employment data reinforces optimism and temporarily pushes recession fears into the background.

Federal Reserve Response and Interest Rate Outlook

The most important implication of strong NFP data lies in its impact on

BTC-1,34%

- Reward

- 1

- 2

- Repost

- Share

MrFlower_ :

:

LFG 🔥View More

#NFPBeatsExpectations Strong Jobs, Market Implications

The latest U.S. Non-Farm Payroll (NFP) report beat expectations, signaling a resilient labor market and complicating the Federal Reserve’s path toward early rate cuts. Strong employment supports wages and consumer spending, meaning the economy can tolerate tighter financial conditions longer.

Key Market Takeaways:

• Risk Assets: Strong NFP often triggers short-term pullbacks in equities and crypto—liquidity isn’t loosening as fast as markets hoped.

• Interest Rates & Dollar: Higher employment → stronger yields → firmer USD → delayed Fed ea

The latest U.S. Non-Farm Payroll (NFP) report beat expectations, signaling a resilient labor market and complicating the Federal Reserve’s path toward early rate cuts. Strong employment supports wages and consumer spending, meaning the economy can tolerate tighter financial conditions longer.

Key Market Takeaways:

• Risk Assets: Strong NFP often triggers short-term pullbacks in equities and crypto—liquidity isn’t loosening as fast as markets hoped.

• Interest Rates & Dollar: Higher employment → stronger yields → firmer USD → delayed Fed ea

BTC-1,34%

- Reward

- 3

- 2

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

#NFPBeatsExpectations

The latest NFP data beating expectations has once again shifted the market’s tone, reminding investors that the U.S. economy remains far more resilient than many narratives suggested. At a time when markets were getting comfortable with the idea of early and aggressive rate cuts, strong job creation challenges that optimism and forces a reassessment of liquidity expectations. Employment strength signals that demand in the economy is still alive, wages remain supported, and consumer spending has not rolled over yet, all of which complicate the Federal Reserve’s path towar

The latest NFP data beating expectations has once again shifted the market’s tone, reminding investors that the U.S. economy remains far more resilient than many narratives suggested. At a time when markets were getting comfortable with the idea of early and aggressive rate cuts, strong job creation challenges that optimism and forces a reassessment of liquidity expectations. Employment strength signals that demand in the economy is still alive, wages remain supported, and consumer spending has not rolled over yet, all of which complicate the Federal Reserve’s path towar

BTC-1,34%

- Reward

- 2

- 2

- Repost

- Share

Yunna :

:

2026 GOGOGOView More

📈💼 #NFPBeatsExpectations

The latest Non-Farm Payroll (NFP) report has beat expectations, showing stronger-than-anticipated job growth in the U.S. economy.

🔎 Market Implications:

• Strong employment → potential for higher interest rates

• Risk assets like crypto and stocks may face short-term pressure

• USD strength could increase, impacting BTC and altcoin liquidity

📊 Key Levels to Watch:

• BTC Support: $67K – $68K

• BTC Resistance: $70K – $71K

• Altcoins: Watch for correlated volatility

💡 Trading Tip:

NFP surprises often trigger sharp price swings. Keep positions sized properly and watch

The latest Non-Farm Payroll (NFP) report has beat expectations, showing stronger-than-anticipated job growth in the U.S. economy.

🔎 Market Implications:

• Strong employment → potential for higher interest rates

• Risk assets like crypto and stocks may face short-term pressure

• USD strength could increase, impacting BTC and altcoin liquidity

📊 Key Levels to Watch:

• BTC Support: $67K – $68K

• BTC Resistance: $70K – $71K

• Altcoins: Watch for correlated volatility

💡 Trading Tip:

NFP surprises often trigger sharp price swings. Keep positions sized properly and watch

BTC-1,34%

- Reward

- 3

- 4

- Repost

- Share

HighAmbition :

:

thank you for information about cryptoView More

🚀 TAKE/USDT +68.92% — Massive Breakout Alert!

TAKE is on fire today, currently trading at $0.03294 after a huge +68% surge. Strong momentum, high volatility, and clear breakout structure — but this is where smart traders stay disciplined.

After a move like this, chasing can be dangerous. The key now is reaction at support and breakout levels.

📌 Bullish Setup (Continuation Play):

If price holds above $0.030 zone:

Entry: $0.030 – $0.0315

Targets: $0.035 / $0.038

SL: Below $0.0285

📌 Bearish Setup (Rejection Play):

If price loses $0.031 with volume:

Short target: $0.027 – $0.025

SL: Above $0.03

TAKE is on fire today, currently trading at $0.03294 after a huge +68% surge. Strong momentum, high volatility, and clear breakout structure — but this is where smart traders stay disciplined.

After a move like this, chasing can be dangerous. The key now is reaction at support and breakout levels.

📌 Bullish Setup (Continuation Play):

If price holds above $0.030 zone:

Entry: $0.030 – $0.0315

Targets: $0.035 / $0.038

SL: Below $0.0285

📌 Bearish Setup (Rejection Play):

If price loses $0.031 with volume:

Short target: $0.027 – $0.025

SL: Above $0.03

- Reward

- 1

- Comment

- Repost

- Share

#NFPBeatsExpectations

A Reflection of Economic Strength and Vitality

When Non-Farm Payroll (NFP) figures surpass forecasts, it signals that the labor market in the world’s largest economy remains rock-solid. This trend indicates more than just increased employment; it points toward a surge in consumer spending and accelerating GDP growth. Every data point that beats expectations triggers a wave of optimism, effectively pushing recession fears to the sidelines.

Central Banks and the Interest Rate Equation

The most critical takeaway for markets is the influence of this data on the Federal Rese

A Reflection of Economic Strength and Vitality

When Non-Farm Payroll (NFP) figures surpass forecasts, it signals that the labor market in the world’s largest economy remains rock-solid. This trend indicates more than just increased employment; it points toward a surge in consumer spending and accelerating GDP growth. Every data point that beats expectations triggers a wave of optimism, effectively pushing recession fears to the sidelines.

Central Banks and the Interest Rate Equation

The most critical takeaway for markets is the influence of this data on the Federal Rese

BTC-1,34%

- Reward

- 42

- 37

- Repost

- Share

Moonchart :

:

To The Moon 🌕View More

📈💼 #NFPBeatsExpectations

The latest Non-Farm Payroll (NFP) report has beat expectations, showing stronger-than-anticipated job growth in the U.S. economy.

🔎 Market Implications:

• Strong employment → potential for higher interest rates

• Risk assets like crypto and stocks may face short-term pressure

• USD strength could increase, impacting BTC and altcoin liquidity

📊 Key Levels to Watch:

• BTC Support: $67K – $68K

• BTC Resistance: $70K – $71K

• Altcoins: Watch for correlated volatility

💡 Trading Tip:

NFP surprises often trigger sharp price swings. Keep positions sized properly and watch

The latest Non-Farm Payroll (NFP) report has beat expectations, showing stronger-than-anticipated job growth in the U.S. economy.

🔎 Market Implications:

• Strong employment → potential for higher interest rates

• Risk assets like crypto and stocks may face short-term pressure

• USD strength could increase, impacting BTC and altcoin liquidity

📊 Key Levels to Watch:

• BTC Support: $67K – $68K

• BTC Resistance: $70K – $71K

• Altcoins: Watch for correlated volatility

💡 Trading Tip:

NFP surprises often trigger sharp price swings. Keep positions sized properly and watch

BTC-1,34%

- Reward

- 8

- 12

- Repost

- Share

HighAmbition :

:

thank you for information about cryptoView More

#NFPBeatsExpectations — Markets React Big!

U.S. Non-Farm Payrolls (NFP) just beat expectations — signalling a stronger labor market and pushing markets into high-volatility mode today. Strong job growth usually boosts the USD and shakes up crypto, gold & forex. �

LIVE PRICES NOW: Bitcoin (BTC): ~$67,100

Trend: Slight weakness in crypto, testing key support after volatility. �

CoinGecko

Gold (XAU/USD): ~$5,080/oz

Safe haven under pressure from strong jobs data & USD strength. �

EUR/USD: ~1.19

European currency steady as market digests macro data. �

• BTC: ~-1.5% (weakness today)

• Go

U.S. Non-Farm Payrolls (NFP) just beat expectations — signalling a stronger labor market and pushing markets into high-volatility mode today. Strong job growth usually boosts the USD and shakes up crypto, gold & forex. �

LIVE PRICES NOW: Bitcoin (BTC): ~$67,100

Trend: Slight weakness in crypto, testing key support after volatility. �

CoinGecko

Gold (XAU/USD): ~$5,080/oz

Safe haven under pressure from strong jobs data & USD strength. �

EUR/USD: ~1.19

European currency steady as market digests macro data. �

• BTC: ~-1.5% (weakness today)

• Go

BTC-1,34%

- Reward

- 9

- 14

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

26.73K Popularity

12.96K Popularity

6.95K Popularity

39.2K Popularity

249.53K Popularity

172.99K Popularity

7.46K Popularity

6.18K Popularity

4.51K Popularity

6.03K Popularity

122.03K Popularity

26.92K Popularity

23.08K Popularity

20.25K Popularity

4.42K Popularity

News

View MoreHibachi plans to launch a stablecoin settlement forex trading platform on Arc

4 m

Hyperliquid announces that the HIP-3 cross-margin feature has been enabled on the testnet.

8 m

RECALL (Recall) 24-hour increase of 25.03%

22 m

EigenCloud integrates with OGI Open Gas Plan: Ethereum gas-free interactions implemented, AI can verify cloud-accelerated on-chain adoption

23 m

Aave Labs发布「Aave Will Win 框架」温度检查提案

24 m

Pin