#BlackRockToBuyUNI

BlackRock's Bold Step into DeFi: Acquiring UNI and Bringing BUIDL to Uniswap – What It Means for the Market

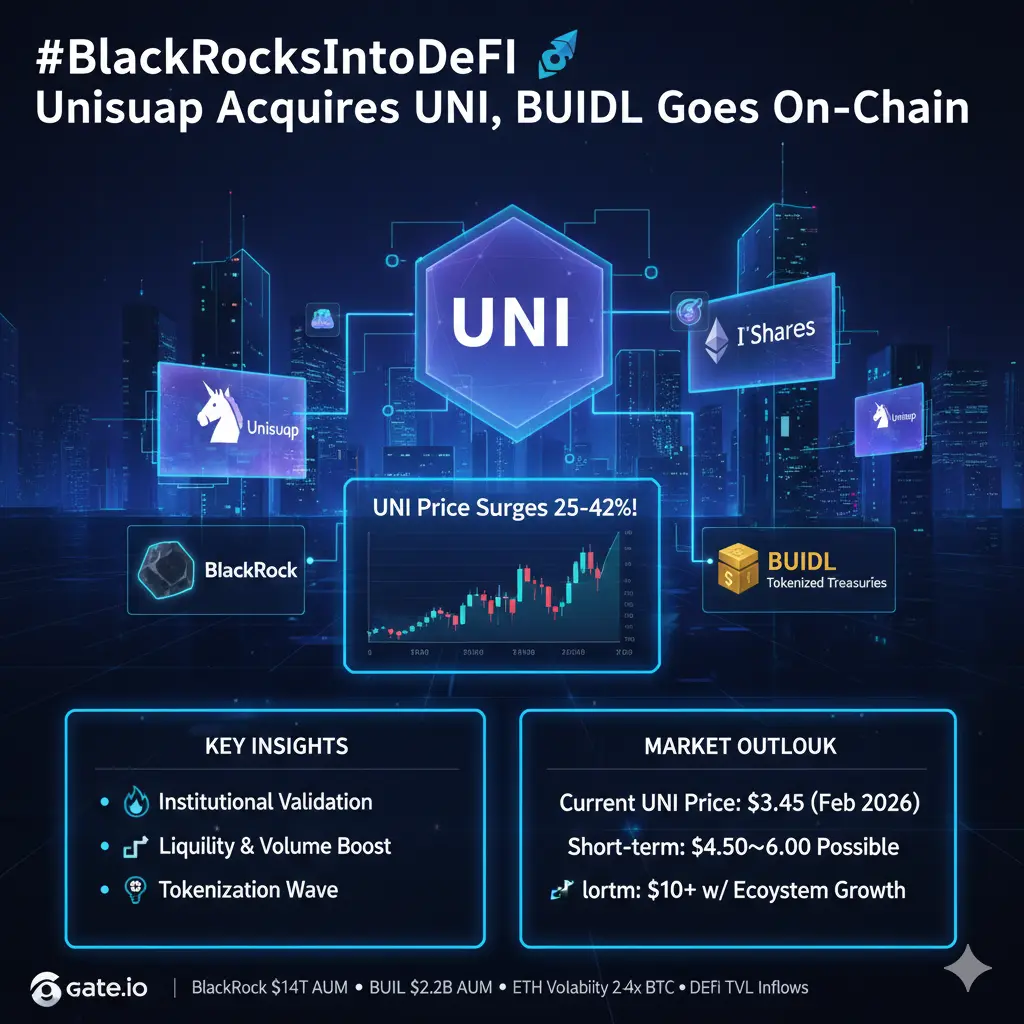

In a landmark move that bridges traditional finance (TradFi) and decentralized finance (DeFi), BlackRock — the world's largest asset manager with over $14 trillion in AUM — has officially entered the Uniswap ecosystem.

Recent announcements confirm that BlackRock is not only making its tokenized U.S. Treasury fund (BUIDL, currently managing ~$2.2 billion in assets) tradable on UniswapX, but has also purchased an undisclosed amount of UNI, the native governance token of Uniswap.

While the exact size of BlackRock's UNI holdings remains undisclosed, this marks the first time a financial giant of this scale has directly held a pure DeFi governance token on its balance sheet. The news triggered immediate market excitement: UNI surged as much as 25–42% intraday before partial retracements, underscoring how powerful institutional narratives can be in crypto.

At the time of this writing (mid-February 2026), UNI is trading around $3.25–$3.50 (after volatility from the spike), with a market cap hovering near $2.1 billion. Like most DeFi tokens, UNI remains extremely sensitive to institutional flows, regulatory signals, and broader crypto sentiment.

Immediate Price Impact & Potential Catalysts

Institutional accumulation — especially from a name like BlackRock — often acts as rocket fuel for altcoins:

Demand surge + supply squeeze: Large buys reduce available float on exchanges while signaling long-term confidence, frequently sparking 10–50%+ short-term rallies in high-beta assets like UNI.

Historical parallels: Think of similar events (e.g., Grayscale/ETF inflows or major partnerships) — altcoins often see explosive intraday moves followed by consolidation or profit-taking.

Current technical setup: UNI had been range-bound in the $2.50–$4.00 zone for months. A confirmed large institutional position could propel it toward previous resistance levels (~$5–$7) if momentum sustains.

Realistic short-term scenarios:

Bullish case — Strong confirmation + follow-on volume: +20–40% rally possible within days/weeks, targeting $4.50–$6.00.

Neutral case — Hype fades quickly: Initial pump followed by 10–20% pullback and sideways action.

Bearish case — Broader market weakness or whale selling (as seen with recent dormant whale transfers): Retrace toward $2.80–$3.00 support.

Volatility & Beta Dynamics

UNI is a classic high-beta play — it amplifies Bitcoin's moves by 2–4x in either direction. Institutional entry adds another layer:

Increased volatility in both directions (sharp upside on news, equally sharp downside on fades).

Potential for short squeezes if leveraged positions build up during rallies.

Long-term holders may benefit from reduced downside beta as more "sticky" capital enters.

Liquidity & Market Depth Improvements

One of the most underrated benefits of institutional participation:

Tighter spreads — Larger players and market makers step in, narrowing bid-ask gaps.

Deeper order books — Reduced slippage for mid-to-large trades.

Stronger liquidity pools — More efficient price discovery on Uniswap itself.

Potential supply lock-up — If BlackRock (or others) holds UNI long-term, circulating exchange supply shrinks → upward price pressure over months/years.

However, if tokens are custodied off-exchange or locked, short-term liquidity could temporarily thin on CEXs.

Trading Volume Explosion

News like this reliably drives massive volume spikes:

Short-term — 5–10x average daily volume common during confirmation windows.

Signals to watch — Sustained elevated volume = genuine positioning (not just FOMO).

Other effects — Forced liquidations (longs & shorts), momentum algos kicking in, whale repositioning.

High, consistent volume post-news would confirm this as more than a fleeting rumor.

Broader Market & Narrative Implications

This isn't just about one token — it's a watershed moment for DeFi:

Validation of governance tokens — UNI as a proxy for Uniswap's protocol value gains credibility.

Gateway for TradFi — BlackRock's move could encourage other asset managers (Fidelity, Vanguard, etc.) to explore DeFi rails for tokenized RWAs.

Tokenization acceleration — BUIDL on UniswapX proves regulated, on-chain trading of real-world assets is viable and scalable.

Ecosystem flywheel — Stronger Uniswap usage → more fees → potential UNI value accrual (especially if fee-switch proposals advance).

If more institutions follow suit, DeFi could see trillions in inflows over the coming years — starting with stable, low-risk products like tokenized Treasuries.

Final Takeaway

BlackRock's strategic investment in UNI and integration of BUIDL onto Uniswap isn't just hype — it's a concrete step toward mainstream adoption of decentralized infrastructure. Short-term price action will likely be volatile and news-driven, but the long-term implications are profound: improved liquidity, tighter integration with TradFi, and renewed confidence in DeFi's staying power.

Institutional interest is often the ultimate catalyst — but true sustainability requires continued inflows, positive macro conditions, and protocol upgrades.

Bonus: Price Projection Scenarios (hypothetical, not financial advice)

Short-term (1–4 weeks): $3.80–$5.50 on sustained momentum; $2.80–$3.20 if hype fades.

Mid-term (3–6 months): $6–$9 if DeFi TVL rises and more RWAs arrive; $4–$5 consolidation otherwise.

Long-term (12+ months): $10+ if Uniswap captures significant tokenized asset volume and governance value accrues.

BlackRock's Bold Step into DeFi: Acquiring UNI and Bringing BUIDL to Uniswap – What It Means for the Market

In a landmark move that bridges traditional finance (TradFi) and decentralized finance (DeFi), BlackRock — the world's largest asset manager with over $14 trillion in AUM — has officially entered the Uniswap ecosystem.

Recent announcements confirm that BlackRock is not only making its tokenized U.S. Treasury fund (BUIDL, currently managing ~$2.2 billion in assets) tradable on UniswapX, but has also purchased an undisclosed amount of UNI, the native governance token of Uniswap.

While the exact size of BlackRock's UNI holdings remains undisclosed, this marks the first time a financial giant of this scale has directly held a pure DeFi governance token on its balance sheet. The news triggered immediate market excitement: UNI surged as much as 25–42% intraday before partial retracements, underscoring how powerful institutional narratives can be in crypto.

At the time of this writing (mid-February 2026), UNI is trading around $3.25–$3.50 (after volatility from the spike), with a market cap hovering near $2.1 billion. Like most DeFi tokens, UNI remains extremely sensitive to institutional flows, regulatory signals, and broader crypto sentiment.

Immediate Price Impact & Potential Catalysts

Institutional accumulation — especially from a name like BlackRock — often acts as rocket fuel for altcoins:

Demand surge + supply squeeze: Large buys reduce available float on exchanges while signaling long-term confidence, frequently sparking 10–50%+ short-term rallies in high-beta assets like UNI.

Historical parallels: Think of similar events (e.g., Grayscale/ETF inflows or major partnerships) — altcoins often see explosive intraday moves followed by consolidation or profit-taking.

Current technical setup: UNI had been range-bound in the $2.50–$4.00 zone for months. A confirmed large institutional position could propel it toward previous resistance levels (~$5–$7) if momentum sustains.

Realistic short-term scenarios:

Bullish case — Strong confirmation + follow-on volume: +20–40% rally possible within days/weeks, targeting $4.50–$6.00.

Neutral case — Hype fades quickly: Initial pump followed by 10–20% pullback and sideways action.

Bearish case — Broader market weakness or whale selling (as seen with recent dormant whale transfers): Retrace toward $2.80–$3.00 support.

Volatility & Beta Dynamics

UNI is a classic high-beta play — it amplifies Bitcoin's moves by 2–4x in either direction. Institutional entry adds another layer:

Increased volatility in both directions (sharp upside on news, equally sharp downside on fades).

Potential for short squeezes if leveraged positions build up during rallies.

Long-term holders may benefit from reduced downside beta as more "sticky" capital enters.

Liquidity & Market Depth Improvements

One of the most underrated benefits of institutional participation:

Tighter spreads — Larger players and market makers step in, narrowing bid-ask gaps.

Deeper order books — Reduced slippage for mid-to-large trades.

Stronger liquidity pools — More efficient price discovery on Uniswap itself.

Potential supply lock-up — If BlackRock (or others) holds UNI long-term, circulating exchange supply shrinks → upward price pressure over months/years.

However, if tokens are custodied off-exchange or locked, short-term liquidity could temporarily thin on CEXs.

Trading Volume Explosion

News like this reliably drives massive volume spikes:

Short-term — 5–10x average daily volume common during confirmation windows.

Signals to watch — Sustained elevated volume = genuine positioning (not just FOMO).

Other effects — Forced liquidations (longs & shorts), momentum algos kicking in, whale repositioning.

High, consistent volume post-news would confirm this as more than a fleeting rumor.

Broader Market & Narrative Implications

This isn't just about one token — it's a watershed moment for DeFi:

Validation of governance tokens — UNI as a proxy for Uniswap's protocol value gains credibility.

Gateway for TradFi — BlackRock's move could encourage other asset managers (Fidelity, Vanguard, etc.) to explore DeFi rails for tokenized RWAs.

Tokenization acceleration — BUIDL on UniswapX proves regulated, on-chain trading of real-world assets is viable and scalable.

Ecosystem flywheel — Stronger Uniswap usage → more fees → potential UNI value accrual (especially if fee-switch proposals advance).

If more institutions follow suit, DeFi could see trillions in inflows over the coming years — starting with stable, low-risk products like tokenized Treasuries.

Final Takeaway

BlackRock's strategic investment in UNI and integration of BUIDL onto Uniswap isn't just hype — it's a concrete step toward mainstream adoption of decentralized infrastructure. Short-term price action will likely be volatile and news-driven, but the long-term implications are profound: improved liquidity, tighter integration with TradFi, and renewed confidence in DeFi's staying power.

Institutional interest is often the ultimate catalyst — but true sustainability requires continued inflows, positive macro conditions, and protocol upgrades.

Bonus: Price Projection Scenarios (hypothetical, not financial advice)

Short-term (1–4 weeks): $3.80–$5.50 on sustained momentum; $2.80–$3.20 if hype fades.

Mid-term (3–6 months): $6–$9 if DeFi TVL rises and more RWAs arrive; $4–$5 consolidation otherwise.

Long-term (12+ months): $10+ if Uniswap captures significant tokenized asset volume and governance value accrues.