GoldMarketBeginner

No content yet

GoldMarketBeginner

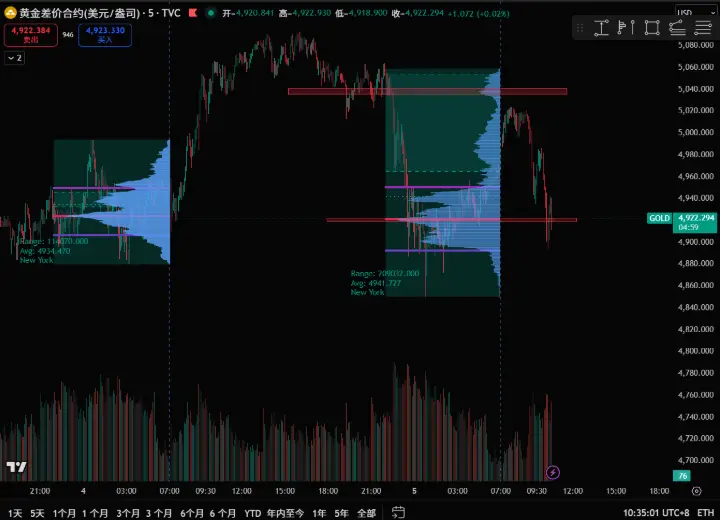

Market Analysis: As the Asian session opens today, spot gold continues its downward trend. After the dollar strengthened, gold investors are taking profits. According to the CME, the margin requirements for gold and silver have been increased. Additionally, the Russia-Ukraine war and tensions in the Middle East have eased, reducing geopolitical tensions. Therefore, gold has been declining for the past three days. Moving forward, attention should still be paid to the US dollar trend and related geopolitical news. Gold prices still face downside risks. Short-term traders should be cautious. From

View Original

- Reward

- like

- Comment

- Repost

- Share

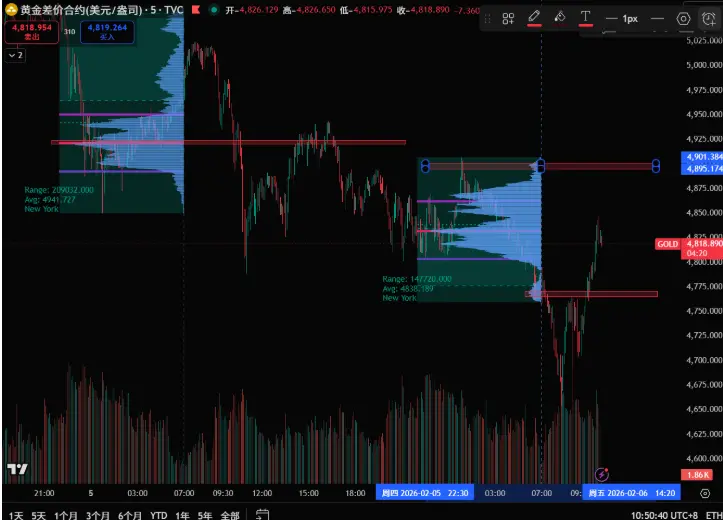

Dahuang🐟4928-31 quickly retreated south, defense at 4950, watch 4900-4885-4850 (personal opinion, for academic exchange only)#当前行情抄底还是观望?

View Original- Reward

- like

- Comment

- Repost

- Share

Today is February 5th, 2026. Gold was around 4851 last night. Currently, the same view remains: as long as it does not break below the range I mentioned yesterday, gold is likely to fluctuate widely, building a bottom for the bulls. The overall bullish factors in the market are the global central banks' gold-buying frenzy and the current war risks. The bearish factors are that tonight's European and American central banks may signal a hawkish stance to strengthen the dollar, which could impact gold prices. Lastly, I want to remind everyone to pay close attention to tonight's European and Ameri

View Original

- Reward

- like

- Comment

- Repost

- Share