#What’sNextforBitcoin?

CPI Market Outlook

With the U.S. Core CPI hitting a four-year low, markets are adjusting their expectations for interest rates and economic growth. Here’s what it could mean for Bitcoin:

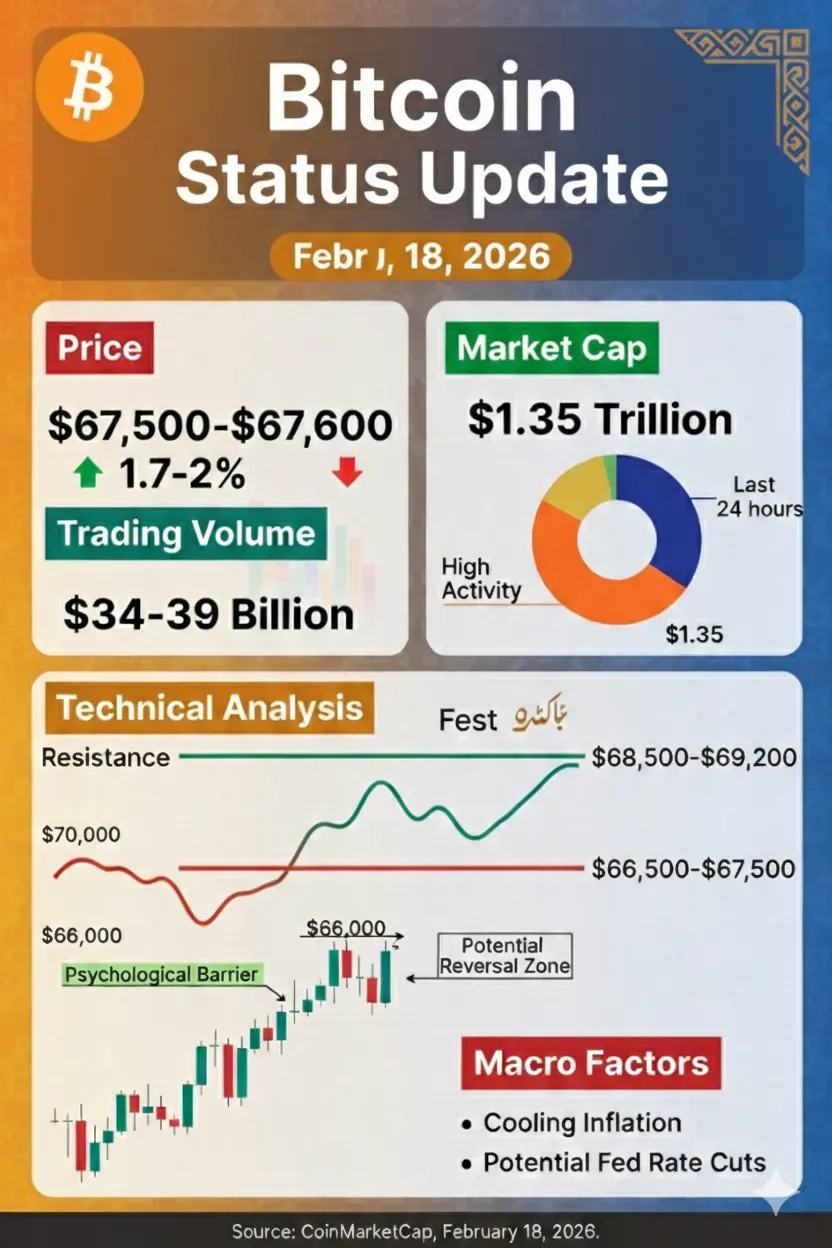

1️⃣ Short-Term Volatility Ahead

Disinflation signals potential easing of monetary policy, which often fuels risk-on assets like BTC.

Expect heightened volatility as traders react to CPI, jobs data, and Fed statements.

2️⃣ Bullish Sentiment Drivers

Lower inflation reduces pressure on rates → lower opportunity cost of holding BTC.

Investors may rotate from cash and bonds into crypto for yield and growth exposure.

3️⃣ Key Levels to Watch

Support: Around $65,000 – the recent consolidation zone.

Resistance: $72,000 – psychological and prior high.

Breaks above/below these levels could trigger significant moves.

4️⃣ Longer-Term Outlook

If inflation continues cooling, BTC could benefit from a sustained bull cycle.

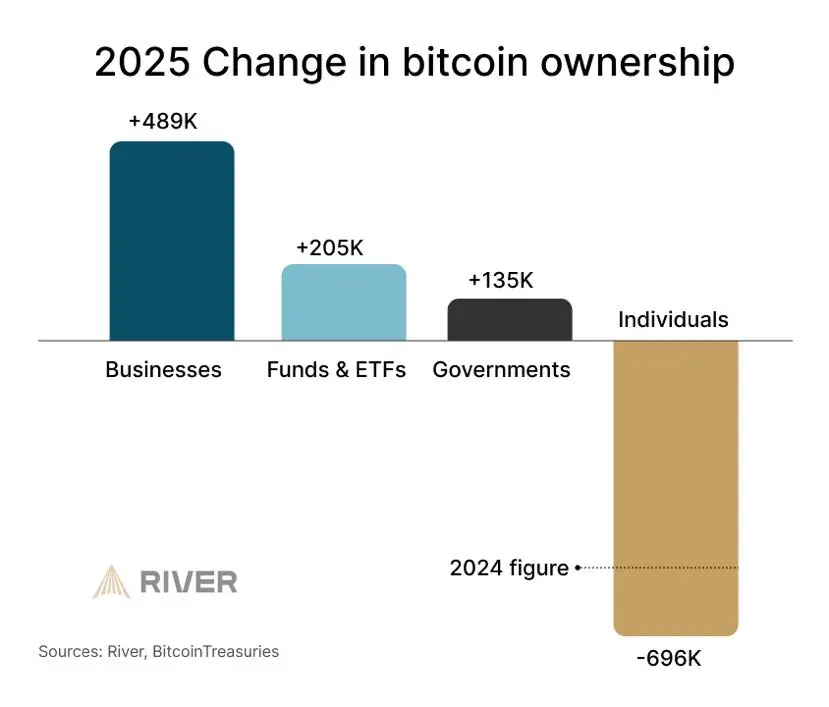

Macro fundamentals remain strong: adoption, institutional inflows, and halving cycle momentum.

5️⃣ Risk Factors

Unexpected hawkish Fed moves.

Geopolitical tensions or regulatory news affecting liquidity.

Market overleveraging on speculation could cause sharp corrections.

📊 Summary:

Bitcoin is at a critical juncture — CPI data favors bullish conditions, but risk management is key. Traders should watch support/resistance closely, and stay ready for volatility spikes.

CPI Market Outlook

With the U.S. Core CPI hitting a four-year low, markets are adjusting their expectations for interest rates and economic growth. Here’s what it could mean for Bitcoin:

1️⃣ Short-Term Volatility Ahead

Disinflation signals potential easing of monetary policy, which often fuels risk-on assets like BTC.

Expect heightened volatility as traders react to CPI, jobs data, and Fed statements.

2️⃣ Bullish Sentiment Drivers

Lower inflation reduces pressure on rates → lower opportunity cost of holding BTC.

Investors may rotate from cash and bonds into crypto for yield and growth exposure.

3️⃣ Key Levels to Watch

Support: Around $65,000 – the recent consolidation zone.

Resistance: $72,000 – psychological and prior high.

Breaks above/below these levels could trigger significant moves.

4️⃣ Longer-Term Outlook

If inflation continues cooling, BTC could benefit from a sustained bull cycle.

Macro fundamentals remain strong: adoption, institutional inflows, and halving cycle momentum.

5️⃣ Risk Factors

Unexpected hawkish Fed moves.

Geopolitical tensions or regulatory news affecting liquidity.

Market overleveraging on speculation could cause sharp corrections.

📊 Summary:

Bitcoin is at a critical juncture — CPI data favors bullish conditions, but risk management is key. Traders should watch support/resistance closely, and stay ready for volatility spikes.