#Gate广场创作者新春激励 The Three Major Changes in the Crypto Market and New Trends in 2026

Recent market anomalies behind the deep trends:

Trend 1: Fundamental shift in market structure - the end of the speculative retail-led cycle and the arrival of the institutional era:

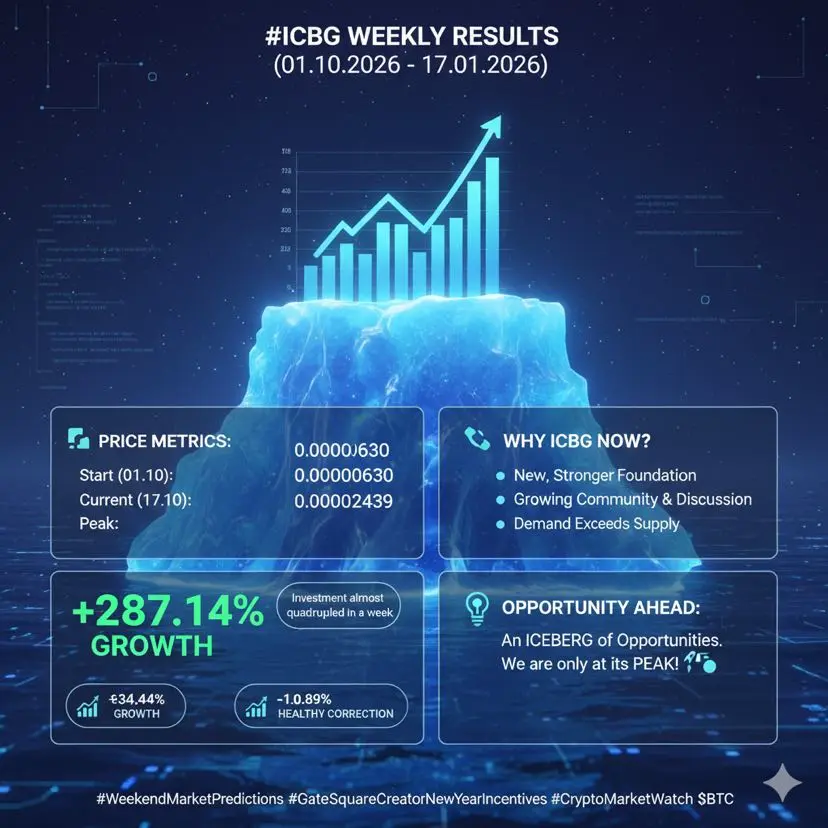

• Net inflow of BTC on exchanges drops to a three-year low, indicating short-term speculators are exiting.

• Continuous outflow of Bitcoin from exchanges, with a single-day net outflow of 14,484 BTC.

• The market is transitioning from a retail-dominated cycle to institutional liquidity distribution.

Market narrative transformation:

• From simple store of value to a multi-functional application platform.

• Functional assets (like ETH) are beginning to show long-term potential beyond BTC.

• The ETH/BTC exchange rate is showing signs of recovery, with structural advantages emerging.

Trend 2: Regulatory storm hits in full force - compliance becomes the survival bottom as global regulatory frameworks are rapidly implemented:

• The US CLARITY Act legislation process accelerates, clarifying legal boundaries.

• CRS and CARF collaborative regulatory systems are launched, bringing crypto assets under “financial account” regulation.

• China’s central bank will implement a “three-tier filtering” mechanism in 2026: licensing access, compliance review, and law enforcement coordination.

Regulatory red lines continue to tighten:

• OTC trading, Ponzi schemes, and airdrops involving recruitment are classified as criminal offenses.

• The risk coefficient for individuals participating in virtual currency trading rises to over 90%.

• Italy’s withholding tax increases from 26% to 33%, and the €2000 tax exemption threshold is canceled.

Trend 3: Liquidity expansion driven - macro environment shifts to easing, signaling a turning point in global liquidity:

• Federal Reserve’s balance sheet expansion, increased bank lending, and falling mortgage rates.

• The probability of Fed rate cuts in 2026 rises to a relatively high level.

• China’s central bank continues its “moderate easing” stance, flexibly using reserve requirement ratio cuts and interest rate reductions.

Institutional funds re-enter the market:

• Bitcoin ETF has recently rebounded, rising about 8% over the past week.

• Large companies like Bitmine Immersion continue to increase ETH holdings.

• Visa’s stablecoin settlement volume has an annualized rate of $4.5 billion, with demand growing month by month.

Trend 4: Accelerated technological innovation - Ethereum’s moat continues to widen, highlighting its technological advantages:

• Mainnet scaling plans will increase throughput tenfold, supporting a target price of $4,000.

• Dominance in stablecoins, RWA tokenization, and DeFi remains unshaken.

• Long-term bullish outlook to $40,000, with broad recognition of ETH’s potential to surpass BTC.

Digital Renminbi ecosystem upgrade:

• From “Digital Cash 1.0” to fully entering “Deposit Currency 2.0.”

• Bank wallet balances accrue interest at the current deposit rate and are included in deposit insurance.

• Transaction volume is expected to surpass 50 trillion yuan in 2026.

Investment insights and risk warnings

Three certain tracks:

1. Compliance survival - regulatory red lines continue to tighten, compliance is the survival line.

2. Pragmatism rising - revaluation of functional assets’ value.

3. Institutionalization trend - long-term holders strengthen control over supply.

Core risk warnings:

• Significant increase in tax reporting complexity and compliance costs.

• Reduced cost-effectiveness for small investments, higher market entry barriers.

• Cross-border tax evasion routes are thoroughly blocked, with no regulatory blind spots.

Recent market anomalies behind the deep trends:

Trend 1: Fundamental shift in market structure - the end of the speculative retail-led cycle and the arrival of the institutional era:

• Net inflow of BTC on exchanges drops to a three-year low, indicating short-term speculators are exiting.

• Continuous outflow of Bitcoin from exchanges, with a single-day net outflow of 14,484 BTC.

• The market is transitioning from a retail-dominated cycle to institutional liquidity distribution.

Market narrative transformation:

• From simple store of value to a multi-functional application platform.

• Functional assets (like ETH) are beginning to show long-term potential beyond BTC.

• The ETH/BTC exchange rate is showing signs of recovery, with structural advantages emerging.

Trend 2: Regulatory storm hits in full force - compliance becomes the survival bottom as global regulatory frameworks are rapidly implemented:

• The US CLARITY Act legislation process accelerates, clarifying legal boundaries.

• CRS and CARF collaborative regulatory systems are launched, bringing crypto assets under “financial account” regulation.

• China’s central bank will implement a “three-tier filtering” mechanism in 2026: licensing access, compliance review, and law enforcement coordination.

Regulatory red lines continue to tighten:

• OTC trading, Ponzi schemes, and airdrops involving recruitment are classified as criminal offenses.

• The risk coefficient for individuals participating in virtual currency trading rises to over 90%.

• Italy’s withholding tax increases from 26% to 33%, and the €2000 tax exemption threshold is canceled.

Trend 3: Liquidity expansion driven - macro environment shifts to easing, signaling a turning point in global liquidity:

• Federal Reserve’s balance sheet expansion, increased bank lending, and falling mortgage rates.

• The probability of Fed rate cuts in 2026 rises to a relatively high level.

• China’s central bank continues its “moderate easing” stance, flexibly using reserve requirement ratio cuts and interest rate reductions.

Institutional funds re-enter the market:

• Bitcoin ETF has recently rebounded, rising about 8% over the past week.

• Large companies like Bitmine Immersion continue to increase ETH holdings.

• Visa’s stablecoin settlement volume has an annualized rate of $4.5 billion, with demand growing month by month.

Trend 4: Accelerated technological innovation - Ethereum’s moat continues to widen, highlighting its technological advantages:

• Mainnet scaling plans will increase throughput tenfold, supporting a target price of $4,000.

• Dominance in stablecoins, RWA tokenization, and DeFi remains unshaken.

• Long-term bullish outlook to $40,000, with broad recognition of ETH’s potential to surpass BTC.

Digital Renminbi ecosystem upgrade:

• From “Digital Cash 1.0” to fully entering “Deposit Currency 2.0.”

• Bank wallet balances accrue interest at the current deposit rate and are included in deposit insurance.

• Transaction volume is expected to surpass 50 trillion yuan in 2026.

Investment insights and risk warnings

Three certain tracks:

1. Compliance survival - regulatory red lines continue to tighten, compliance is the survival line.

2. Pragmatism rising - revaluation of functional assets’ value.

3. Institutionalization trend - long-term holders strengthen control over supply.

Core risk warnings:

• Significant increase in tax reporting complexity and compliance costs.

• Reduced cost-effectiveness for small investments, higher market entry barriers.

• Cross-border tax evasion routes are thoroughly blocked, with no regulatory blind spots.