# JapanBondMarketSell-Off

2.13K

Japan’s bond market saw a sharp sell-off, with 30Y and 40Y yields jumping over 25 bps after plans to end fiscal tightening and boost spending. Will this impact global rates and risk assets?

MissCrypto

#JapanBondMarketSell-Off

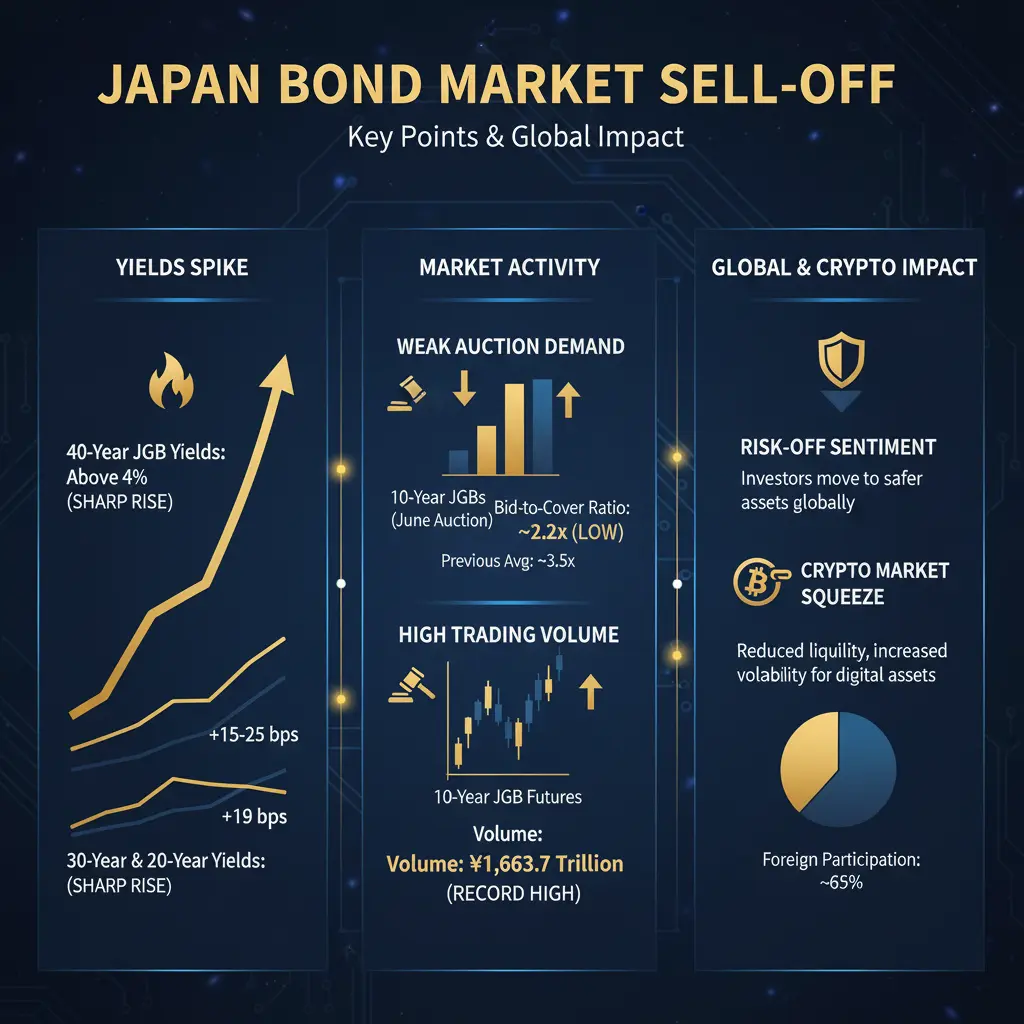

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

- Reward

- 2

- 6

- Repost

- Share

CryptoChampion :

:

HODL Tight 💪View More

#JapanBondMarketSell-Off

a much deeper breakdown of the Japan Bond Market Sell-Off — why it’s happening, what it means domestically, and how it’s already shaking global markets

Buyers flee Japanese debt as Takaichi hits the ground spending

Instant View: Japan bond yields soar as election promises stir fiscal fears

1. The Immediate Catalyst: Politics + Fiscal Fear

• Snap election and fiscal promises: Prime Minister Sanae Takaichi’s announcement of a early election with aggressive fiscal pledges — especially a two-year suspension of the food consumption tax worth about ¥5 trillion (US$32 billio

a much deeper breakdown of the Japan Bond Market Sell-Off — why it’s happening, what it means domestically, and how it’s already shaking global markets

Buyers flee Japanese debt as Takaichi hits the ground spending

Instant View: Japan bond yields soar as election promises stir fiscal fears

1. The Immediate Catalyst: Politics + Fiscal Fear

• Snap election and fiscal promises: Prime Minister Sanae Takaichi’s announcement of a early election with aggressive fiscal pledges — especially a two-year suspension of the food consumption tax worth about ¥5 trillion (US$32 billio

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

Japan’s government bond market has recently experienced a significant sell-off, sending shockwaves through both domestic and global financial markets. Prices of Japanese Government Bonds (JGBs) have declined sharply, causing yields to rise across the board. While JGBs are traditionally viewed as safe, low-risk assets, recent events highlight how even the most stable markets can experience volatility when macroeconomic and global pressures converge.

1. Current Yields and Percentage Moves

40-year JGB yields surged above 4.0%, hitting record highs — a major breakout in l

- Reward

- 8

- 10

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

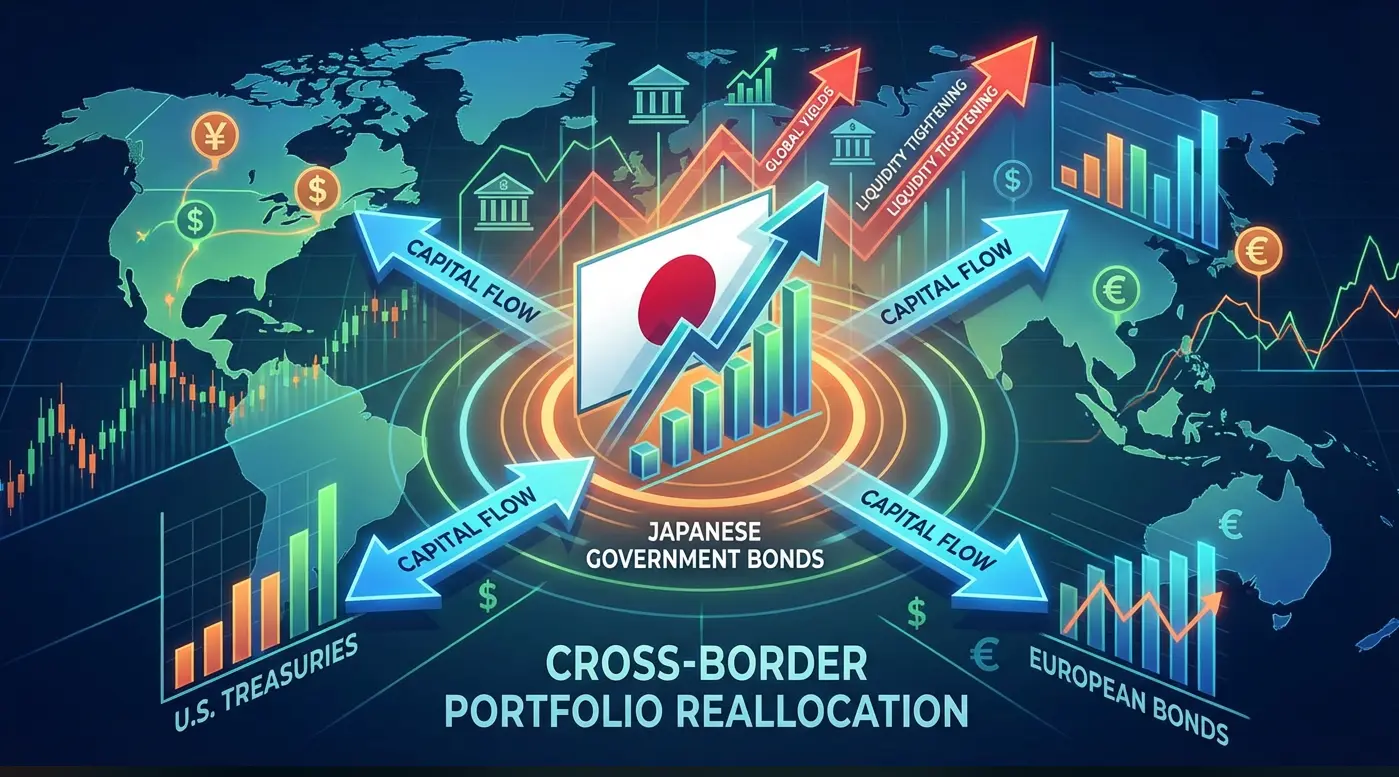

Japan Bond Market Sell-Off: A Warning Signal the Global Market Can’t Ignore

A Rare Shock from One of the World’s Most Stable Markets:

The Japan bond market sell-off has caught global investors by surprise. For decades, Japanese government bonds (JGBs) were considered among the most stable and predictable assets in the world. Japan’s ultra-loose monetary policy and yield control framework created a sense of calm and reliability. A sudden sell-off in this market is not just a local event it’s a macro signal with global implications.

Why the Japan Bond Market Matters Glo

Japan Bond Market Sell-Off: A Warning Signal the Global Market Can’t Ignore

A Rare Shock from One of the World’s Most Stable Markets:

The Japan bond market sell-off has caught global investors by surprise. For decades, Japanese government bonds (JGBs) were considered among the most stable and predictable assets in the world. Japan’s ultra-loose monetary policy and yield control framework created a sense of calm and reliability. A sudden sell-off in this market is not just a local event it’s a macro signal with global implications.

Why the Japan Bond Market Matters Glo

- Reward

- 2

- 3

- Repost

- Share

Luna_Star :

:

DYOR 🤓View More

#JapanBondMarketSell-Off

Japan Bond Sell-Off: Global Rates & Risk Assets in Focus

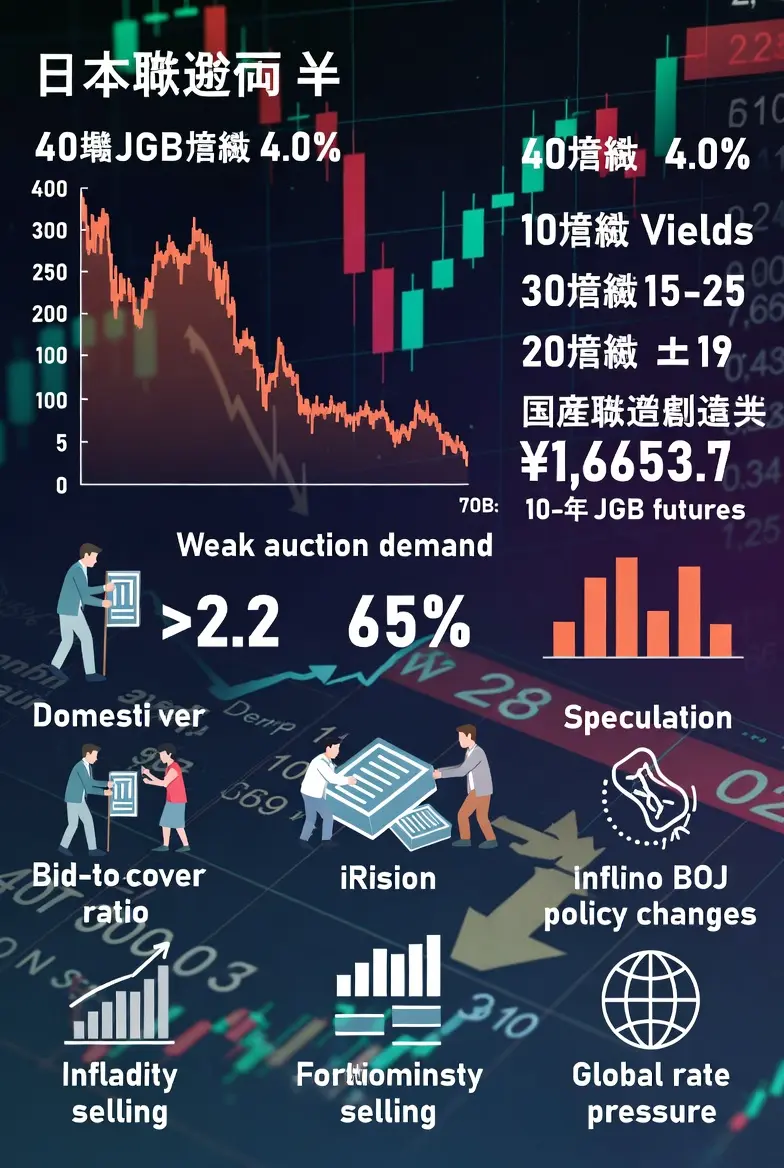

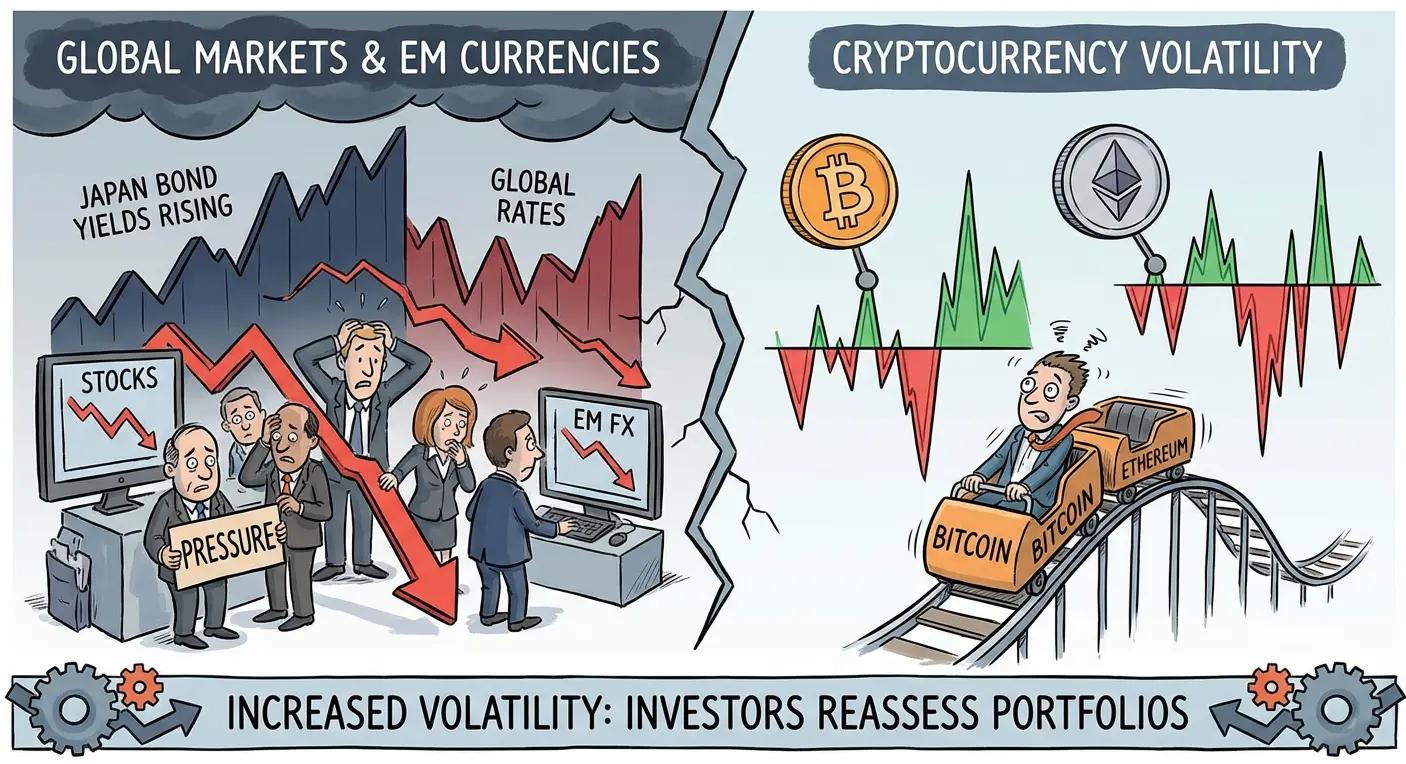

Japan’s bond market experienced a sharp sell-off after the government signaled an end to fiscal tightening and plans to boost spending. Yields on 30-year and 40-year JGBs surged over 25 bps, marking the largest move in years.

Why This Matters

Japan’s Long-Term Yields Jump

The 30Y and 40Y bonds breaking higher signals inflation expectations rising.

This also reflects a shift in monetary/fiscal balance, as investors price in more government borrowing.

Impact on Global Rates

Japan is a major holder of global capita

Japan Bond Sell-Off: Global Rates & Risk Assets in Focus

Japan’s bond market experienced a sharp sell-off after the government signaled an end to fiscal tightening and plans to boost spending. Yields on 30-year and 40-year JGBs surged over 25 bps, marking the largest move in years.

Why This Matters

Japan’s Long-Term Yields Jump

The 30Y and 40Y bonds breaking higher signals inflation expectations rising.

This also reflects a shift in monetary/fiscal balance, as investors price in more government borrowing.

Impact on Global Rates

Japan is a major holder of global capita

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#JapanBondMarketSell-Off

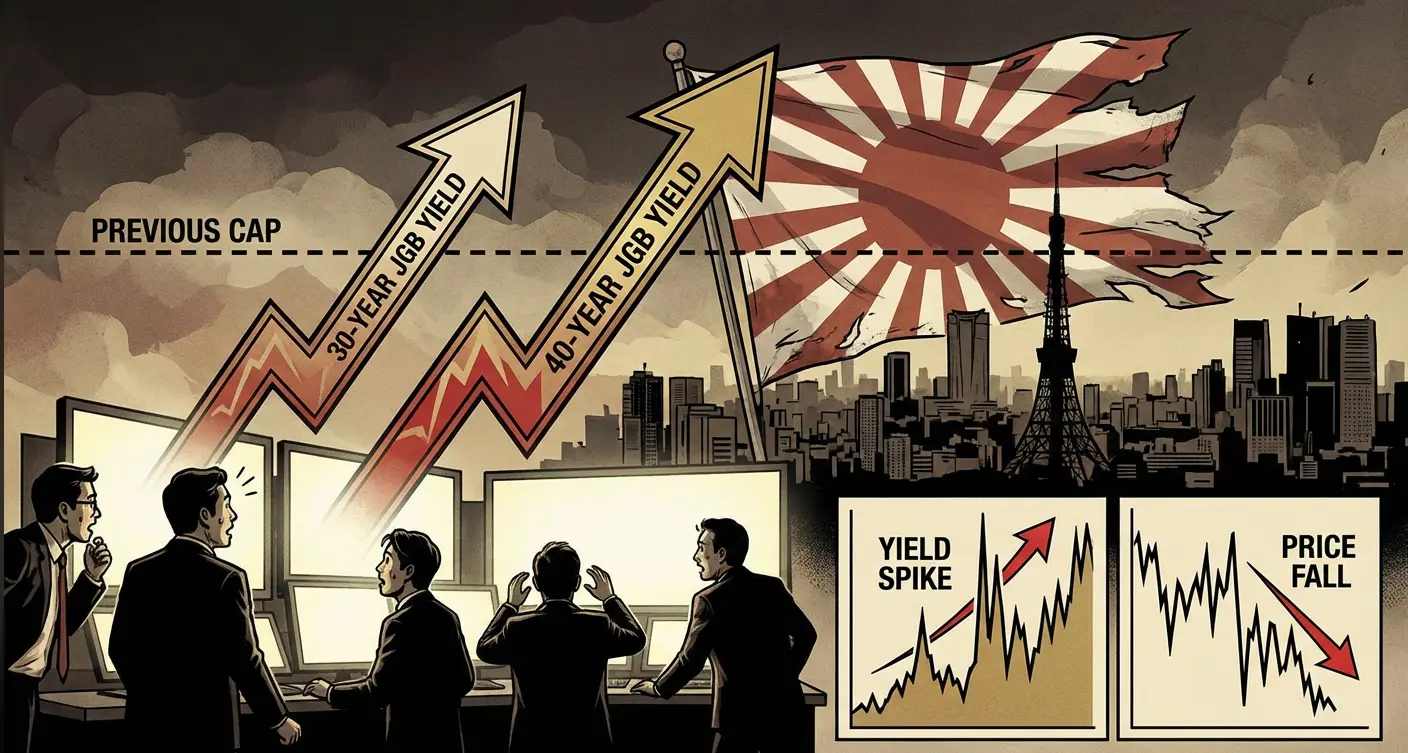

Japan’s bond market is under unprecedented stress, sending shockwaves across global finance. The recent sell-off in Japanese Government Bonds (JGBs) is more than routine volatility — it reflects a structural reassessment of long-term risk, fiscal sustainability, and monetary policy in the world’s third-largest economy.

Ultra-Long Bonds Under Pressure

Yields on 30- and 40-year bonds have surged to record levels. Investors are demanding higher returns for holding long-term debt, signaling declining confidence in Japan’s ability to manage growing obligations without stoki

Japan’s bond market is under unprecedented stress, sending shockwaves across global finance. The recent sell-off in Japanese Government Bonds (JGBs) is more than routine volatility — it reflects a structural reassessment of long-term risk, fiscal sustainability, and monetary policy in the world’s third-largest economy.

Ultra-Long Bonds Under Pressure

Yields on 30- and 40-year bonds have surged to record levels. Investors are demanding higher returns for holding long-term debt, signaling declining confidence in Japan’s ability to manage growing obligations without stoki

- Reward

- 2

- 3

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

Japan Bond Market Sell-Off: A Warning Signal the Global Market Can’t Ignore

A Rare Shock from One of the World’s Most Stable Markets:

The Japan bond market sell-off has caught global investors by surprise. For decades, Japanese government bonds (JGBs) were considered among the most stable and predictable assets in the world. Japan’s ultra-loose monetary policy and yield control framework created a sense of calm and reliability. A sudden sell-off in this market is not just a local event it’s a macro signal with global implications.

Why the Japan Bond Market Matters Glo

Japan Bond Market Sell-Off: A Warning Signal the Global Market Can’t Ignore

A Rare Shock from One of the World’s Most Stable Markets:

The Japan bond market sell-off has caught global investors by surprise. For decades, Japanese government bonds (JGBs) were considered among the most stable and predictable assets in the world. Japan’s ultra-loose monetary policy and yield control framework created a sense of calm and reliability. A sudden sell-off in this market is not just a local event it’s a macro signal with global implications.

Why the Japan Bond Market Matters Glo

- Reward

- 1

- 1

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊#JapanBondMarketSell-Off Japan’s bond market is undergoing one of the most critical stress events seen in decades, sending powerful signals across global financial systems. The recent sell-off in Japanese Government Bonds (JGBs) is not a routine market fluctuation — it represents a structural shift in how investors are reassessing long-term risk, fiscal sustainability, and monetary direction in the world’s third-largest economy.

The pressure has been most visible in ultra-long-dated bonds. Yields on 30-year and 40-year Japanese bonds have surged to record levels, reflecting growing concern abo

The pressure has been most visible in ultra-long-dated bonds. Yields on 30-year and 40-year Japanese bonds have surged to record levels, reflecting growing concern abo

- Reward

- 4

- 2

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#日本国债突现抛售风暴

On January 21, the Japanese government bond market experienced a rare and intense fluctuation, with 30-year and 40-year ultra-long-term bond yields soaring by over 25 basis points in a single day, marking an extreme event rarely seen in recent years. The immediate trigger was the Japanese government's clear signal—"end fiscal austerity"—shifting towards tax cuts and expansionary spending. This statement quickly altered market expectations regarding Japan's long-term fiscal discipline and the supply-demand structure of government bonds.

In the short term, this appears to be a conce

View OriginalOn January 21, the Japanese government bond market experienced a rare and intense fluctuation, with 30-year and 40-year ultra-long-term bond yields soaring by over 25 basis points in a single day, marking an extreme event rarely seen in recent years. The immediate trigger was the Japanese government's clear signal—"end fiscal austerity"—shifting towards tax cuts and expansionary spending. This statement quickly altered market expectations regarding Japan's long-term fiscal discipline and the supply-demand structure of government bonds.

In the short term, this appears to be a conce

- Reward

- 1

- Comment

- Repost

- Share

Daily Global Foreign Exchange Market Highlights (2026-01-21)

Dollar:

1. The U.S. Supreme Court tariff ruling continues to "break promises."

2. U.S. Secretary of Commerce Raimondo: We believe this quarter's GDP growth rate will exceed 5%.

3. U.S. Treasury Secretary Yellen: The earliest possible announcement of the Federal Reserve Chair candidate could be next week. Powell attending the Supreme Court's Cook hearing was a mistake.

4. Danish pension fund Akademiker Pension will exit the U.S. bond market, holding about $100 million in U.S. Treasuries as of the end of December.

5. ADP Weekly Employm

View OriginalDollar:

1. The U.S. Supreme Court tariff ruling continues to "break promises."

2. U.S. Secretary of Commerce Raimondo: We believe this quarter's GDP growth rate will exceed 5%.

3. U.S. Treasury Secretary Yellen: The earliest possible announcement of the Federal Reserve Chair candidate could be next week. Powell attending the Supreme Court's Cook hearing was a mistake.

4. Danish pension fund Akademiker Pension will exit the U.S. bond market, holding about $100 million in U.S. Treasuries as of the end of December.

5. ADP Weekly Employm

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

23.87K Popularity

6.27K Popularity

57.7K Popularity

49.55K Popularity

340.69K Popularity

2.13K Popularity

2.39K Popularity

12.55K Popularity

106.87K Popularity

18.19K Popularity

195.95K Popularity

15.69K Popularity

6.71K Popularity

11.55K Popularity

168.31K Popularity

News

View More"On-chain gold's largest long position" closes Oracle token long position, losing $199,000

1 m

XRP Price Prediction 2026: Can it Return to $3 or Even Break $4 Within Four Months?

1 m

Vitalik Buterin Returns to Decentralized Social Media, Ethereum Founder Criticizes "corposlop" Platform

5 m

Ethereum falls below the key level of $3000, does the outflow of $238 million from ETH ETF indicate a deeper correction?

8 m

Elon Musk questions ChatGPT safety, Altman counters Tesla autonomous driving risk escalation, AI and autonomous vehicle controversy fermenting simultaneously

12 m

Pin