【Understanding Bitcoin in One Article: Short-term Trading Logic + Mid-term Risks + Long-term Opportunities】

Bitcoin's recent decline has been rapid and fierce. Our initial strong support at 69,000 was briefly tested and then broken after slight resistance. The price continued to break through the second support at 63,000, dropping straight down to 60,000 before bouncing back and stabilizing, signaling a halt to the decline.

The 69,000 level is what we define as a shallow bear position, once held with high hopes. But facing such fragile reality, we need to update our outlook on the upcoming market. The trend is set; the shallow bear is unlikely, and a deep bear market has become a reality!

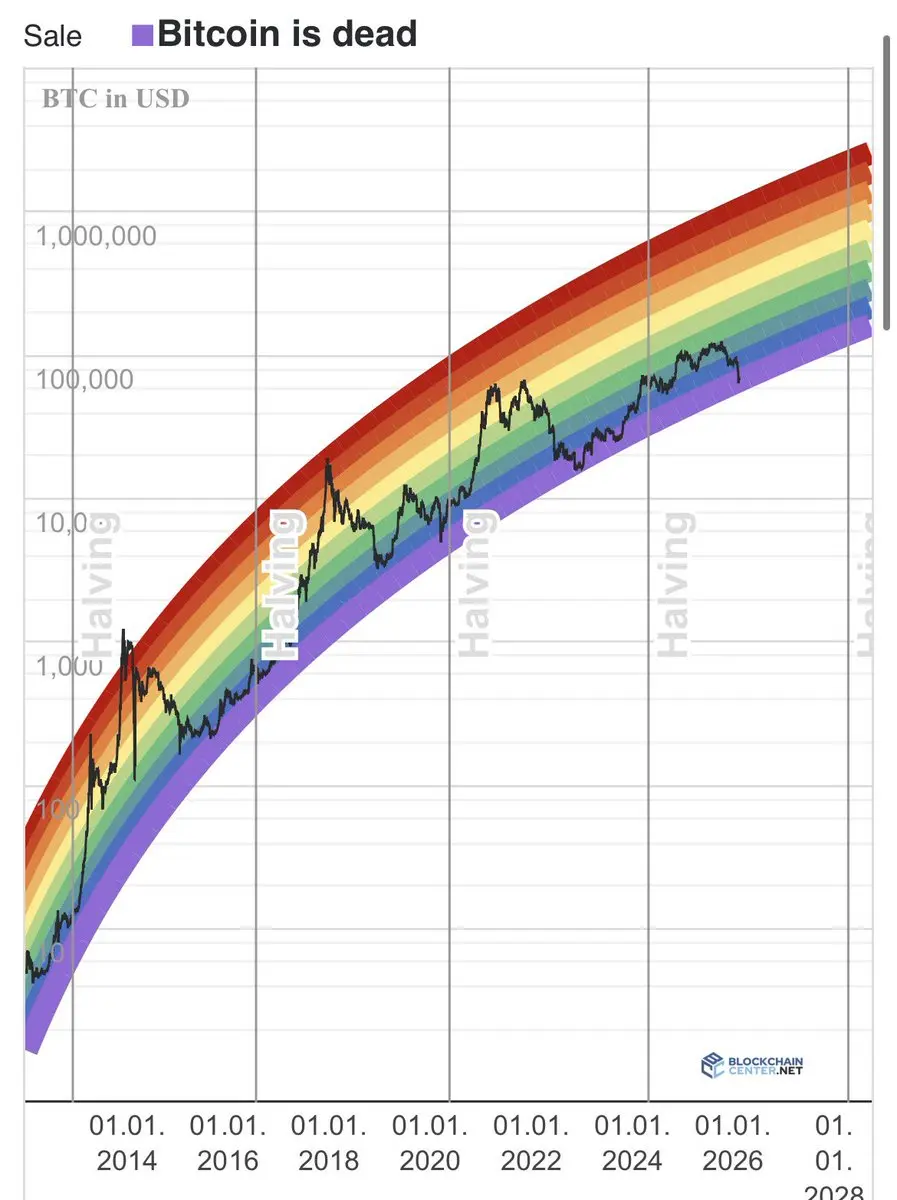

Looking back to 2025, the most frequently heard phrase is that the four-year cycle of Bitcoin has failed. However, the recent months' market behavior has given us a loud slap in the face, confirming that while the cycle may weaken, it will not fail!

From a macro perspective, Bitcoin has consecutively broken two major support levels in a short period, indicating that 60,000 is not the bottom. We still need to look lower.

The principle is simple: quick and ruthless. This wave of decline is a large C-wave downward, based on structure. According to market rules, such a C-wave typically develops into a five-wave pattern, with five waves being longer than three. Therefore, after a rebound, new lows are highly probable!

⸻

Externally, Powell's term ends on May 15, 2026. Optimistically, if Trump's nominee is confirmed, the new chair will be dovish, advocating easing policies. But historically, market reactions to such appointments usually take 2 to 3 months, so the new cycle might start around August...

Moreover, there are uncertainties in the nomination process. Opponents are active. If the new chair isn't confirmed promptly, the Fed may need Vice Chair Philip Jefferson to serve as acting chair. He's hawkish and concerned about inflation, not friendly to easing. So, the external environment remains complex. It's not as simple as replacing someone in May and easing in June!

In summary, with internal and external troubles, the bottom hasn't arrived yet. Everyone should prepare mentally for at least half a year of long-term resistance!

⸻

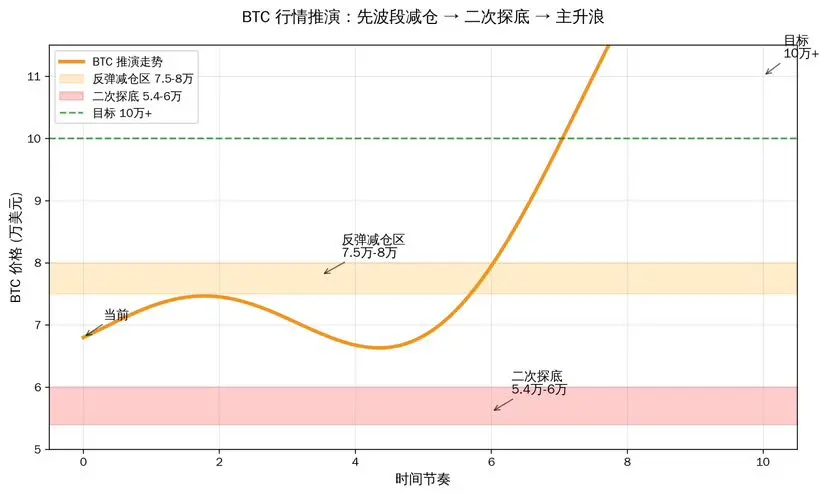

Back to the chart, where might the bottom be? Let's do a rough projection.

Based on our previous views, there are a few key levels downward. From a yearly chart perspective, the lows of the last two bear markets were near the 7-month moving average (MA7). Currently, MA7 is around 54,638, which is worth watching.

Let's also look at the Fibonacci retracement of the bullish candle in 2024. The 0.236 level is at 54,388, closely aligning with MA7, providing strong support.

Next, on the weekly chart, the important MA233 is at about 56,654, also close. This means the 54,000 to 57,000 range consolidates several major supports. Considering the extreme volatility caused by chain reactions of liquidations, the bottom is likely between 51,000 and 57,000!

⸻

Strategically, entering in stages below 60,000 is definitely safe. If a black swan event drives the price down to the 40,000s, don't hesitate—go all in! Note that this discussion only applies to spot trading; futures trading is a different story—trade at your own risk!

Finally, regarding the short- to medium-term daily cycle: the current rebound is the main theme. Finding long opportunities is much safer than shorting. The short-term resistance at 71,000 has been touched today, and the rebound is expected to continue. The next resistance levels are around 74,000 to 75,000. Beyond that, the major pressure is at 80,000.

CME has a large downward gap, which after a gap-up, accelerated the decline. This is currently considered a breakout gap downward, with a low chance of being filled. The lower boundary or halfway of the gap will be a huge resistance, likely marking the end of this rebound. We need to be aware of this.

Reviewing all our views since August, the overall trend predictions have been accurate. The upcoming market remains risky, so caution is advised. Cherish every opportunity!

To summarize our trading approach: currently fully long, waiting for Bitcoin to rebound to 75,000–80,000 to consider swing trading. If it retraces, buy back spot. For mid- to long-term reversal, Bitcoin must stabilize above 82,000 USD on the daily chart to initiate an upward trend. For now, focus on swing trading—buy low, sell high. We will adjust our judgment based on the current market conditions, making our strategy more rational.

Bitcoin's recent decline has been rapid and fierce. Our initial strong support at 69,000 was briefly tested and then broken after slight resistance. The price continued to break through the second support at 63,000, dropping straight down to 60,000 before bouncing back and stabilizing, signaling a halt to the decline.

The 69,000 level is what we define as a shallow bear position, once held with high hopes. But facing such fragile reality, we need to update our outlook on the upcoming market. The trend is set; the shallow bear is unlikely, and a deep bear market has become a reality!

Looking back to 2025, the most frequently heard phrase is that the four-year cycle of Bitcoin has failed. However, the recent months' market behavior has given us a loud slap in the face, confirming that while the cycle may weaken, it will not fail!

From a macro perspective, Bitcoin has consecutively broken two major support levels in a short period, indicating that 60,000 is not the bottom. We still need to look lower.

The principle is simple: quick and ruthless. This wave of decline is a large C-wave downward, based on structure. According to market rules, such a C-wave typically develops into a five-wave pattern, with five waves being longer than three. Therefore, after a rebound, new lows are highly probable!

⸻

Externally, Powell's term ends on May 15, 2026. Optimistically, if Trump's nominee is confirmed, the new chair will be dovish, advocating easing policies. But historically, market reactions to such appointments usually take 2 to 3 months, so the new cycle might start around August...

Moreover, there are uncertainties in the nomination process. Opponents are active. If the new chair isn't confirmed promptly, the Fed may need Vice Chair Philip Jefferson to serve as acting chair. He's hawkish and concerned about inflation, not friendly to easing. So, the external environment remains complex. It's not as simple as replacing someone in May and easing in June!

In summary, with internal and external troubles, the bottom hasn't arrived yet. Everyone should prepare mentally for at least half a year of long-term resistance!

⸻

Back to the chart, where might the bottom be? Let's do a rough projection.

Based on our previous views, there are a few key levels downward. From a yearly chart perspective, the lows of the last two bear markets were near the 7-month moving average (MA7). Currently, MA7 is around 54,638, which is worth watching.

Let's also look at the Fibonacci retracement of the bullish candle in 2024. The 0.236 level is at 54,388, closely aligning with MA7, providing strong support.

Next, on the weekly chart, the important MA233 is at about 56,654, also close. This means the 54,000 to 57,000 range consolidates several major supports. Considering the extreme volatility caused by chain reactions of liquidations, the bottom is likely between 51,000 and 57,000!

⸻

Strategically, entering in stages below 60,000 is definitely safe. If a black swan event drives the price down to the 40,000s, don't hesitate—go all in! Note that this discussion only applies to spot trading; futures trading is a different story—trade at your own risk!

Finally, regarding the short- to medium-term daily cycle: the current rebound is the main theme. Finding long opportunities is much safer than shorting. The short-term resistance at 71,000 has been touched today, and the rebound is expected to continue. The next resistance levels are around 74,000 to 75,000. Beyond that, the major pressure is at 80,000.

CME has a large downward gap, which after a gap-up, accelerated the decline. This is currently considered a breakout gap downward, with a low chance of being filled. The lower boundary or halfway of the gap will be a huge resistance, likely marking the end of this rebound. We need to be aware of this.

Reviewing all our views since August, the overall trend predictions have been accurate. The upcoming market remains risky, so caution is advised. Cherish every opportunity!

To summarize our trading approach: currently fully long, waiting for Bitcoin to rebound to 75,000–80,000 to consider swing trading. If it retraces, buy back spot. For mid- to long-term reversal, Bitcoin must stabilize above 82,000 USD on the daily chart to initiate an upward trend. For now, focus on swing trading—buy low, sell high. We will adjust our judgment based on the current market conditions, making our strategy more rational.