Post content & earn content mining yield

placeholder

GateUser-30a25b37

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLVAUG9XAQ

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

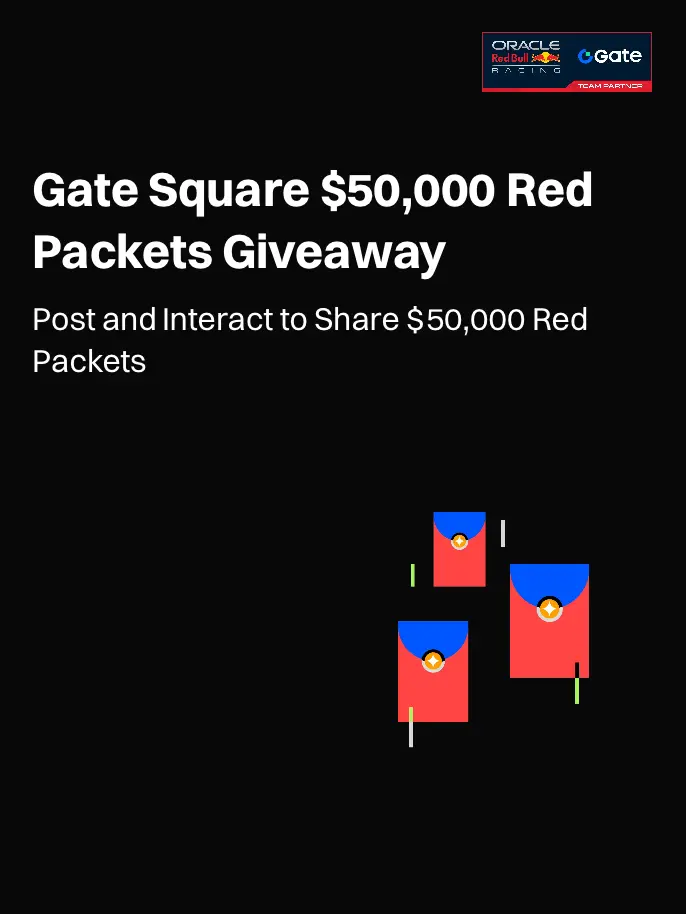

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/campaigns/4044?ref=VLNFU1LCUW&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

p小将

p小将

Created By@DreamJourney

Listing Progress

100.00%

MC:

$1.76K

More Tokens

🔥 Gate Live Trading Champions Contest is live

Streamers are already earning USDT commissions via token component trading

📊 Real trades, weekly settlement

📺 Watch live · Trade with token components

🏆 Streamer & User tracks

Join any live room using Token Tags / Token Components

🎁 $500 USDT + official merch on the leaderboard

⏰ Feb 5–22 (UTC+8)

👉 https://www.gate.com/campaigns/4023

Watch & trade on Gate Live

Streamers are already earning USDT commissions via token component trading

📊 Real trades, weekly settlement

📺 Watch live · Trade with token components

🏆 Streamer & User tracks

Join any live room using Token Tags / Token Components

🎁 $500 USDT + official merch on the leaderboard

⏰ Feb 5–22 (UTC+8)

👉 https://www.gate.com/campaigns/4023

Watch & trade on Gate Live

TOKEN-4,94%

- Reward

- 2

- 2

- Repost

- Share

GateUser-2015b649 :

:

👍🙏🏼View More

Sustaining Momentum in Gate Live Valentine's Giveaway: The Gentle Flow of Shared Resonance

As the festival energy softens into moments of connection and shared warmth, the rhythm shifts from market surges to collective interaction — where a simple comment can spark lasting ties.

Everyone can tune in to a live — but those who contribute thoughtfully create subtle, resonant advantage.

In this new-year phase on Gate Square, momentum often blooms in live spaces: events that reward genuine participation over passive viewing.

The deeper value emerges when collective celebration invites deliberate en

As the festival energy softens into moments of connection and shared warmth, the rhythm shifts from market surges to collective interaction — where a simple comment can spark lasting ties.

Everyone can tune in to a live — but those who contribute thoughtfully create subtle, resonant advantage.

In this new-year phase on Gate Square, momentum often blooms in live spaces: events that reward genuine participation over passive viewing.

The deeper value emerges when collective celebration invites deliberate en

- Reward

- 5

- 5

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

BTC Intraday Structure & Momentum Analysis

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

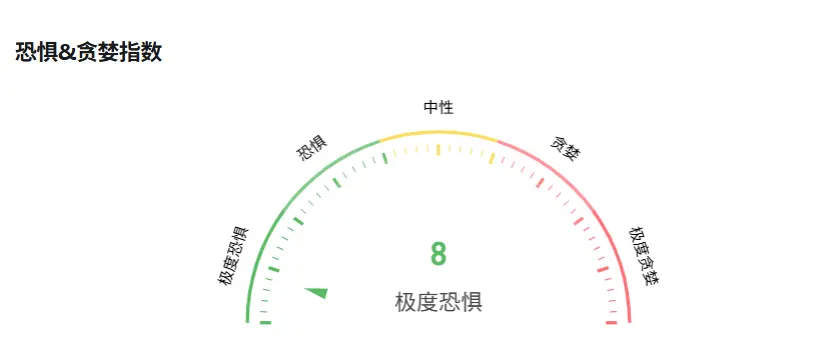

Buy when no one is paying attention, sell when everyone is bustling.

Others are fearful, I am greedy; others are greedy, I am fearful.

The crypto market is now in a state of neglect and extreme fear. Brothers, don't be afraid, go all-in bravely.

Brother Yin won't buy, just here to encourage and cheer you on!

View OriginalOthers are fearful, I am greedy; others are greedy, I am fearful.

The crypto market is now in a state of neglect and extreme fear. Brothers, don't be afraid, go all-in bravely.

Brother Yin won't buy, just here to encourage and cheer you on!

- Reward

- like

- Comment

- Repost

- Share

I now understand why people rug and scam.

Gm

Gm

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: U.S. judge has confirmed that Donald Trump’s $10BILLION defamation lawsuit against the BBC will proceed to trial in Florida on February 15, 2027. The suit alleges the BBC defamed Trump by editing his Jan. 6 speech to falsely suggest he incited the Capitol riot. #crypto

- Reward

- like

- Comment

- Repost

- Share

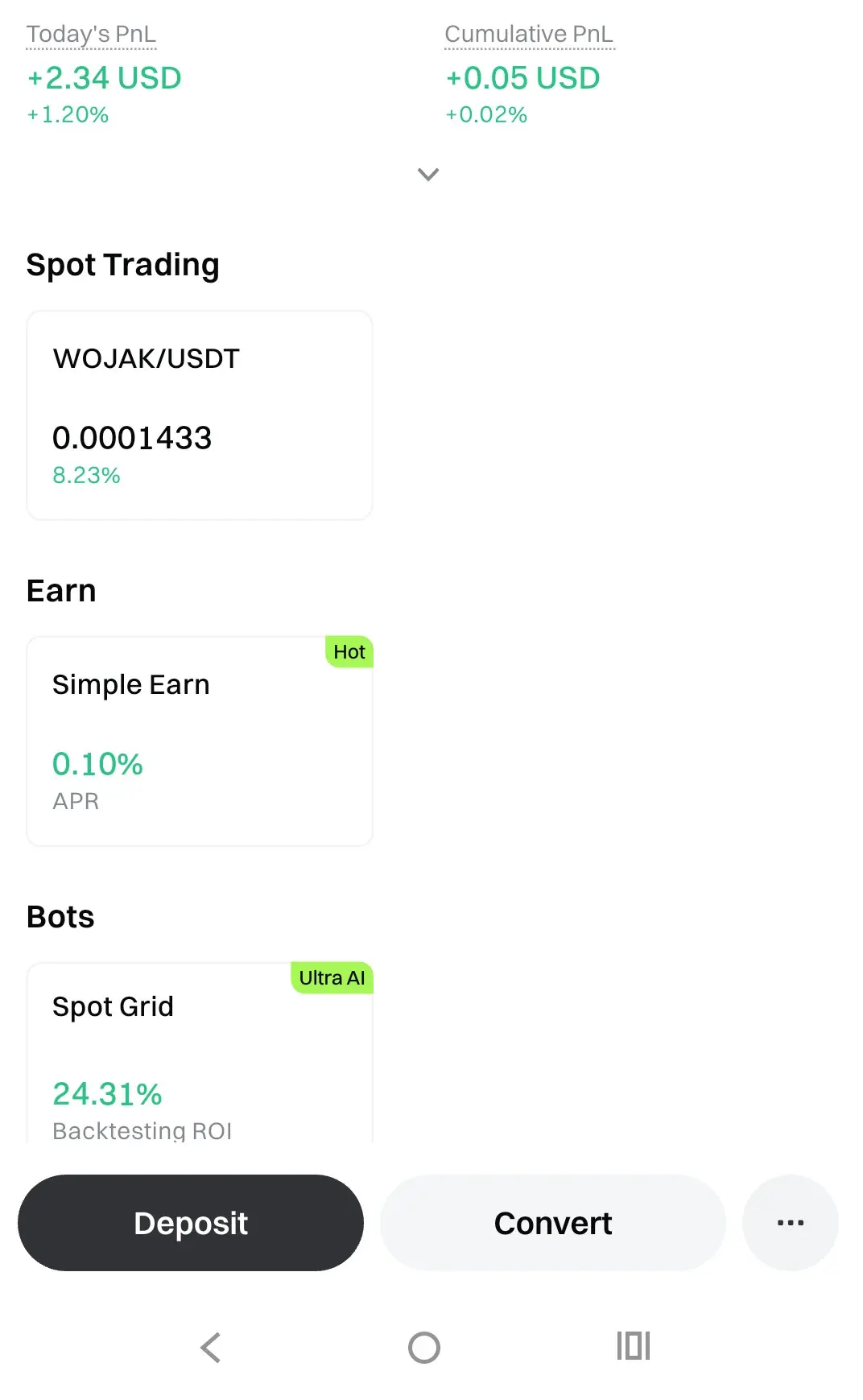

Honestly, I didn't participate this time with the mindset of winning the competition. I thought, "Since I have to trade anyway, I might as well earn some rewards."

I already do spot trading on Gate, so I decided to concentrate my volume on Superform, complete some tasks, and get bonus pool multipliers. The thresholds of $200 and $1,000 aren't high—just a couple of trades and you're there. When you hit UP, it's like earning an extra bonus.

As for the leaderboard, I think it's more about testing your own skills. Those with higher volume naturally push forward, while those with less firepower

I already do spot trading on Gate, so I decided to concentrate my volume on Superform, complete some tasks, and get bonus pool multipliers. The thresholds of $200 and $1,000 aren't high—just a couple of trades and you're there. When you hit UP, it's like earning an extra bonus.

As for the leaderboard, I think it's more about testing your own skills. Those with higher volume naturally push forward, while those with less firepower

UP1,37%

- Reward

- 1

- Comment

- Repost

- Share

msyq

马上有钱

Created By@DiamondHandOfficial

Subscription Progress

0.00%

MC:

$0

More Tokens

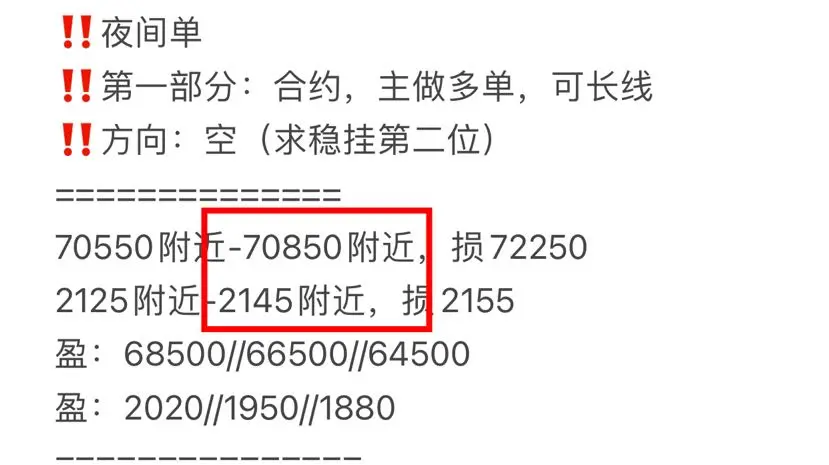

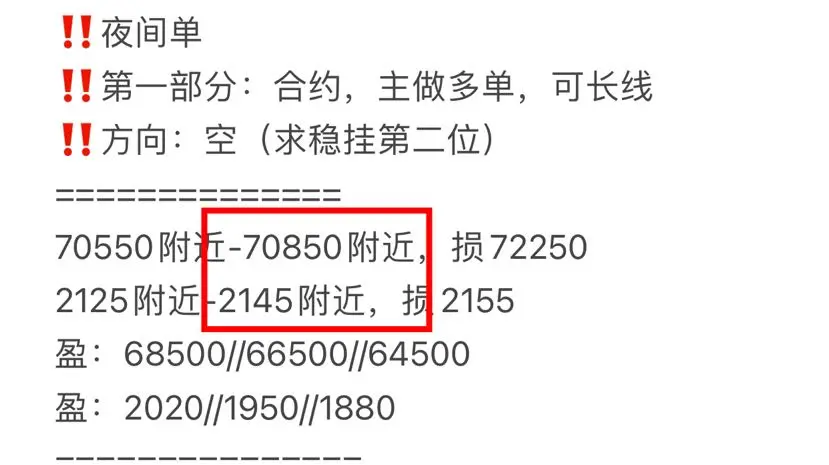

‼️ Guan He Ping Wheel Old Iron Brothers, give me a thumbs up‼️ Contract on the 13th / Spot orders have been updated 👇 Only follow the right people in the crypto world. Thank you all for your support. The New Year 4GT half-price promotion has exceeded 280 people. Tonight, it will resume at 8GT‼️ Apple click 👇

https://www.gate.com/zh/profile/ Chanlun Master

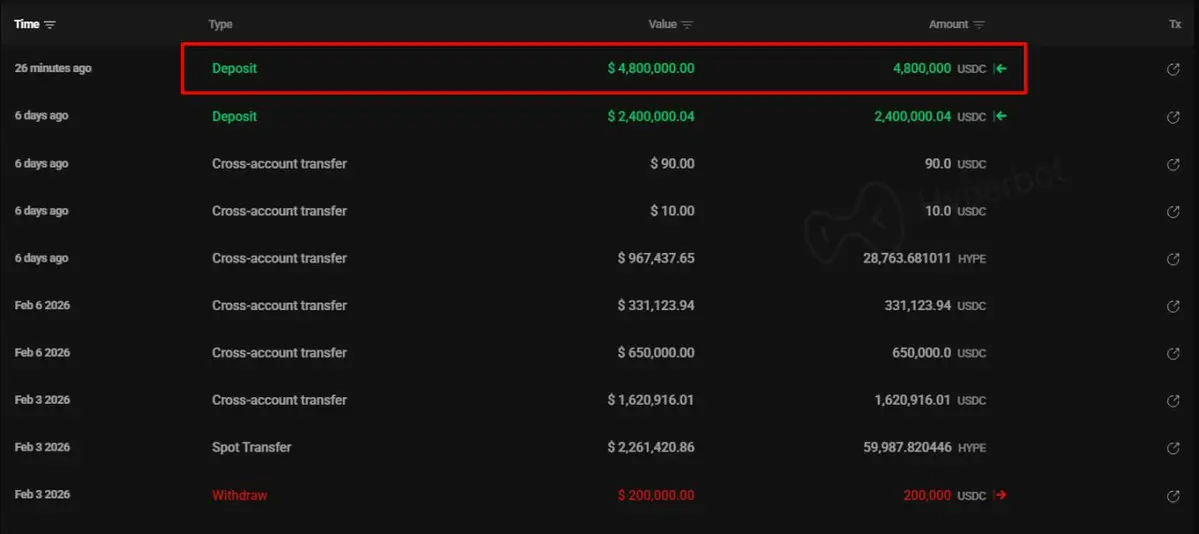

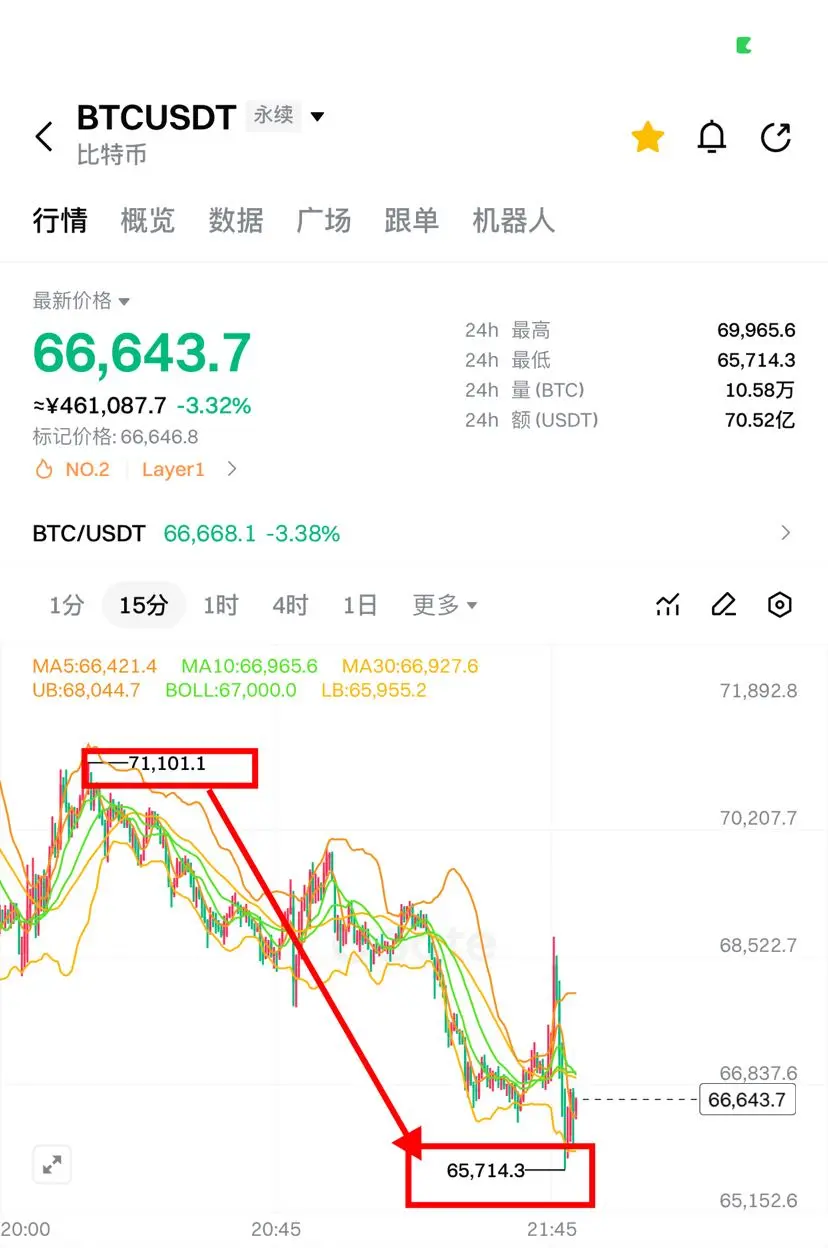

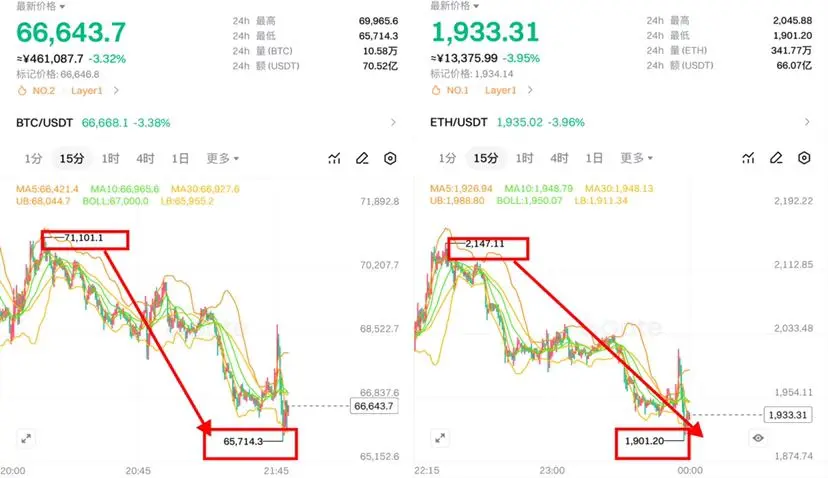

🔥 Recently ate over 2 million U‼️ Last week 3045/90400 short 1740/59900 ate big meat over 1 million 📉

Tuesday 2145/71000 short, now 1890/65700, eating more meat 📉#Gate广场发帖领五万美金红包

View Originalhttps://www.gate.com/zh/profile/ Chanlun Master

🔥 Recently ate over 2 million U‼️ Last week 3045/90400 short 1740/59900 ate big meat over 1 million 📉

Tuesday 2145/71000 short, now 1890/65700, eating more meat 📉#Gate广场发帖领五万美金红包

- Reward

- 10

- 10

- Repost

- Share

BigBigBigBigBigBubbleGum :

:

Good luck and prosperity 🧧View More

‼️ Guan He Ping Wheel Old Iron Brothers Give U‼️ Contract on the 13th / Spot order has been updated 👇 In the crypto world, only follow the right people. Thank you all for your support. The New Year 4gt half-price promotion has exceeded 280 people. Tonight, it will resume at 8gt‼️ Apple click 👇 https://www.gate.com/zh/profile/ Little Ghost Daily Contract

🔥 Recently ate over 2 million U in a row‼️ Last week 3045/90400 short 1740/59900, ate big meat over 1 million W 📉 Tuesday 2145/71000 short, now 1890/65700, eating more meat 📉#Gate广场发帖领五万美金红包

View Original🔥 Recently ate over 2 million U in a row‼️ Last week 3045/90400 short 1740/59900, ate big meat over 1 million W 📉 Tuesday 2145/71000 short, now 1890/65700, eating more meat 📉#Gate广场发帖领五万美金红包

- Reward

- 10

- 10

- Repost

- Share

BigBigBigBigBigBubbleGum :

:

Good luck and prosperity 🧧View More

Start the Year of the Horse with a win! Gate Square is giving away a $50,000 red envelope rain. Post to join and smash https://www.gate.com/campaigns/4044?ref=VLRBBFWLCQ&ref_type=132

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQRGBFPWAW

View Original

- Reward

- like

- Comment

- Repost

- Share

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/campaigns/4044?ref_type=132

- Reward

- like

- Comment

- Repost

- Share

Must be empty

#我在Gate广场过新年 The darkest hour before dawn—Bitcoin’s $66,000 support line is under threat, and the market is waiting in panic for the final “clearance”

This morning, the price did not show the anticipated “pre-CPI data rebound,” but instead slowly tested the bottom amid decreasing volume. According to real-time data at 09:40 AM, the market is undergoing a “boiling frog” confidence test: after a brief rebound above $68,000 yesterday, Bitcoin quickly retreated and is now trading around $66,456, having remained below the $67,000 level for three consecutive days. Ethereum’s situation

View Original#我在Gate广场过新年 The darkest hour before dawn—Bitcoin’s $66,000 support line is under threat, and the market is waiting in panic for the final “clearance”

This morning, the price did not show the anticipated “pre-CPI data rebound,” but instead slowly tested the bottom amid decreasing volume. According to real-time data at 09:40 AM, the market is undergoing a “boiling frog” confidence test: after a brief rebound above $68,000 yesterday, Bitcoin quickly retreated and is now trading around $66,456, having remained below the $67,000 level for three consecutive days. Ethereum’s situation

- Reward

- like

- Comment

- Repost

- Share

【$BTC Signal】Hold off on trading — Downtrend continuation, waiting for key support confirmation

$BTC After breaking below EMA20, the market entered a weak consolidation phase, showing a downtrend continuation pattern on the 4H timeframe. The price fluctuates within the 66,100-66,700 range with weak rebounds, and bulls have failed to reclaim the key moving averages.

🎯Direction: No Position (NoPosition)

Market analysis: The price has broken below EMA20 (67391) and continues to trade below it, which is a clear signal of a short-term trend weakening. The 4H candlestick chart shows that each rebou

View Original$BTC After breaking below EMA20, the market entered a weak consolidation phase, showing a downtrend continuation pattern on the 4H timeframe. The price fluctuates within the 66,100-66,700 range with weak rebounds, and bulls have failed to reclaim the key moving averages.

🎯Direction: No Position (NoPosition)

Market analysis: The price has broken below EMA20 (67391) and continues to trade below it, which is a clear signal of a short-term trend weakening. The 4H candlestick chart shows that each rebou

- Reward

- like

- Comment

- Repost

- Share

🚨 Bears overcrowded on $BTC — squeeze risk rising

Data from Santiment shows heavily negative funding rates across exchanges — meaning traders are piling into shorts and paying to stay bearish.

Historically, when shorts get this crowded and Bitcoin $BTC stops falling, the unwind can be violent:

forced buybacks → liquidations → sharp rallies.

This doesn’t guarantee a pump, but it creates mechanical upside risk.

The “easy short” gets dangerous when everyone’s on the same side.

If price starts reclaiming levels with funding still negative, a fast squeeze could follow.

Stay cautious — but don’t ge

Data from Santiment shows heavily negative funding rates across exchanges — meaning traders are piling into shorts and paying to stay bearish.

Historically, when shorts get this crowded and Bitcoin $BTC stops falling, the unwind can be violent:

forced buybacks → liquidations → sharp rallies.

This doesn’t guarantee a pump, but it creates mechanical upside risk.

The “easy short” gets dangerous when everyone’s on the same side.

If price starts reclaiming levels with funding still negative, a fast squeeze could follow.

Stay cautious — but don’t ge

BTC-0,82%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More33.82K Popularity

42.29K Popularity

15.2K Popularity

41.43K Popularity

250.59K Popularity

News

View MoreAn investor in Shanghai, China, invested 1.05 million yuan in virtual currency. After encountering platform withdrawal issues, they sued the court for compensation, but the court dismissed their claim.

3 m

Traditional Finance Alert: XAGUSD rises over 4%

5 m

Spot silver surges 5.00% intraday, currently at $79.11 per ounce

8 m

South Korean police lose Bitcoin seized and stored in cold wallets since 2021

12 m

Polymarket extends fees to sports markets; starting February 18, fees will be charged for NCAA and Serie A events.

13 m

Pin