XRP Price Prediction ETF Approval Near Yet Price Struggles With Potential 600 Percent Long Term Upside

21Shares Spot XRP ETF Receives Listing Approval

(Source: 21Shares)

The Cboe BZX Exchange has officially approved the listing and registration of the 21Shares Spot XRP ETF. On December 10, 2025, the exchange submitted the necessary documents to the U.S. Securities and Exchange Commission (SEC). Once the SEC issues its final notice, the ETF will be eligible for official listing, with trading potentially beginning as soon as the next day.

This development further expands the lineup of spot XRP ETFs. Current applicants include Rex Osprey, Canary Capital, Franklin Templeton, Bitwise, Grayscale, and futures-based providers such as Volatility Shares and ProShares.

XRP Price Remains Range-Bound Under Pressure

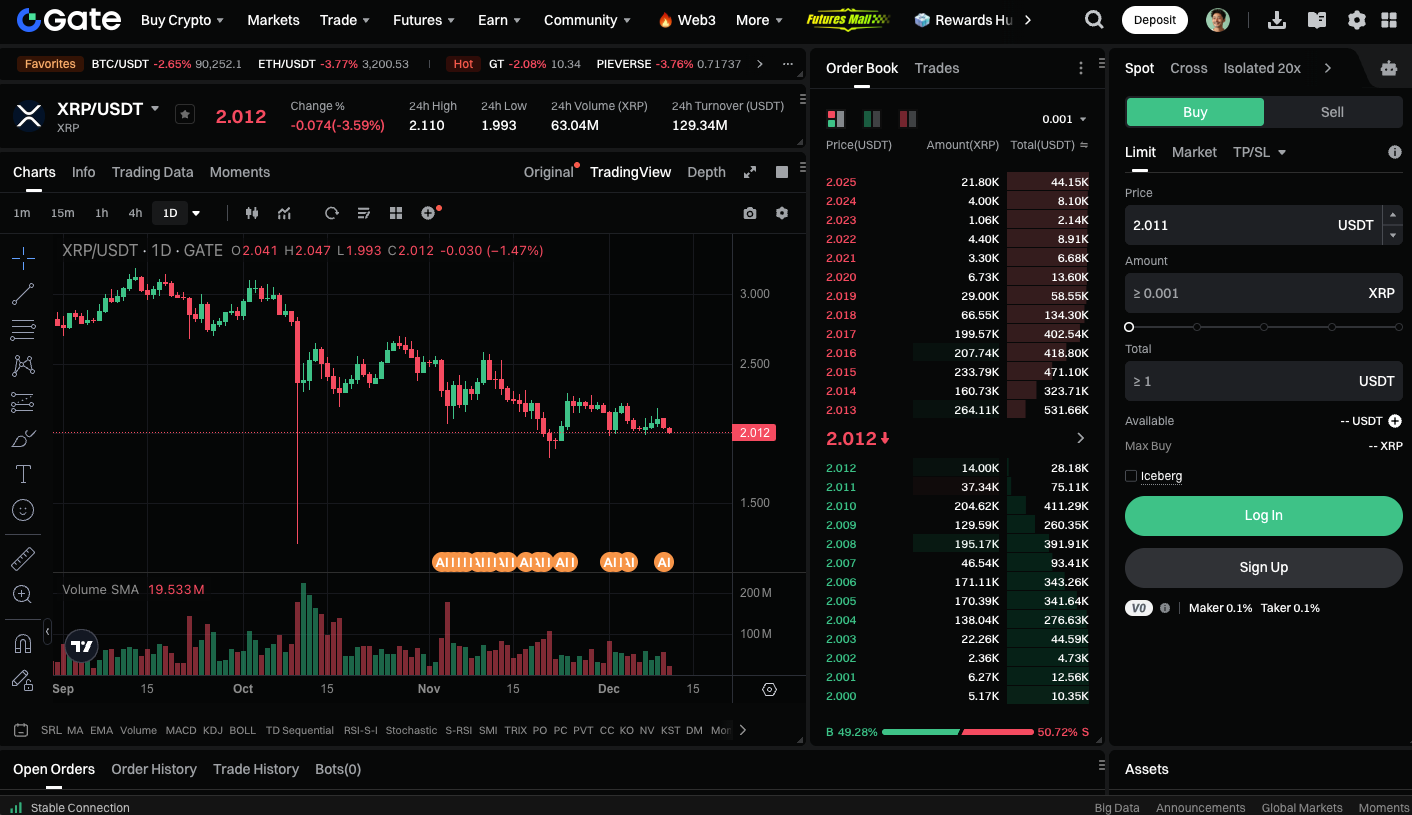

Despite growing momentum around the ETF narrative, XRP continues to trade near the $2 mark and has not yet reversed its multi-week downtrend. Short-term volatility persists, but a bullish divergence on the daily chart has allowed the price to consolidate sideways rather than suffer another sharp decline.

Currently, XRP is seeking support in the $2.00 to $2.25 range. A break below this zone could see further support at $1.90 and $1.80, while the main resistance remains at $2.20.

Analysts See Strong Long-Term Breakout Potential

Crypto analyst Javon Marks highlighted XRP’s strong outperformance versus Bitcoin in prior bull markets. He noted that XRP once delivered over 240% excess returns relative to BTC during a major rally, with its price surging more than 570%. Based on historical trends, Marks projects that XRP could once again outperform BTC in the future, potentially by more than 600%, and has set a long-term price target above $14.

Start trading XRP spot now: https://www.gate.com/trade/XRP_USDT

Summary

The weekly chart continues to show a pronounced bearish divergence, which has kept XRP under significant downward pressure in recent months. However, a bullish divergence on the daily chart is providing some support, resulting in sideways consolidation instead of a steep decline. Most analysts agree that XRP’s short-term price action will remain closely tied to Bitcoin’s trajectory. As long as BTC consolidates near its resistance zone, XRP is likely to stay in a range, awaiting a new market catalyst. A break above $2.20 could open up short-term upside, while a drop below $2.00 could lead to a test of lower support levels.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution