Introducing sPENDLE

Key Takeaways

- vePENDLE to be replaced by sPENDLE, a liquid staking token that removes multi-year locks in favor of a 14-day withdrawal period

- Protocol revenue is used for PENDLE buybacks, distributed to eligible sPENDLE holders

- The manual voting system will be upgraded to an algorithmic emission model, cutting PENDLE emissions by ~30% while delivering significantly better allocation efficiency

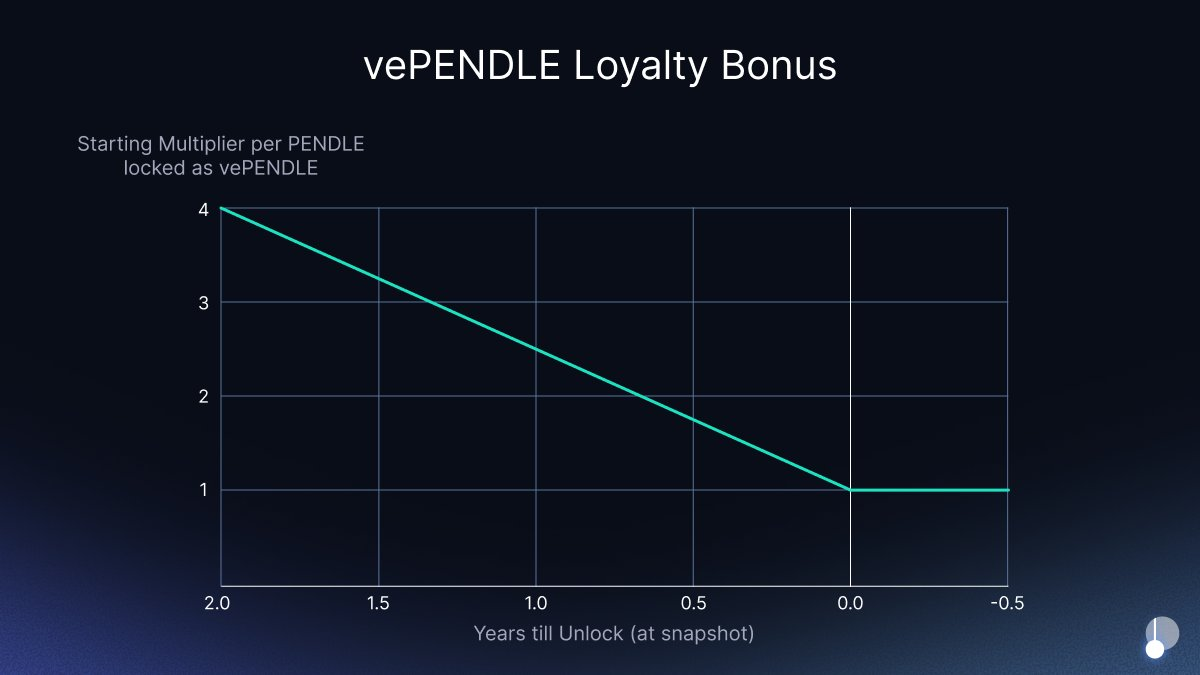

- Existing vePENDLE holders will receive an exclusive boosted sPENDLE of up to 4x (based on remaining lock duration)

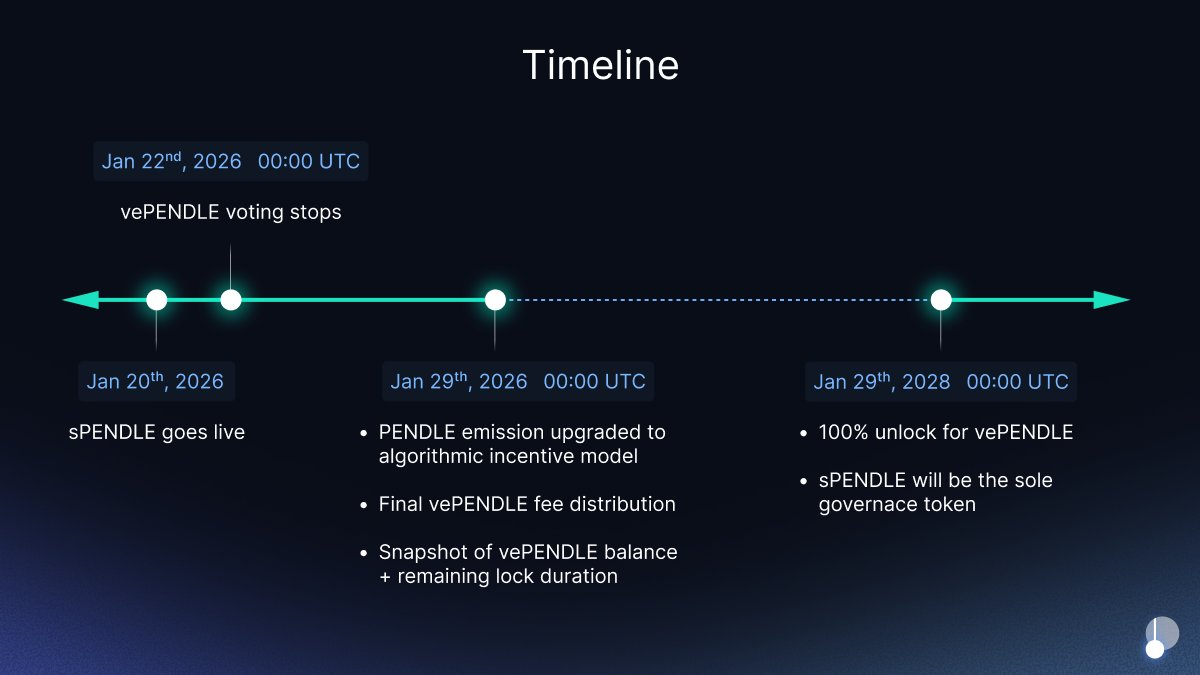

Timeline

January 20th

- sPENDLE staking goes live

January 29th, 00:00 UTC

- vePENDLE locks paused

- Snapshot of vePENDLE balance and lock duration (for virtual sPENDLE calculation)

- New PENDLE incentive structure commences

Introduction

We’re excited to introduce sPENDLE, the next evolution of Pendle tokenomics.

This upgrade is designed to address critical limitations of the vePENDLE system, while unlocking new opportunities for PENDLE holders and the protocol.

sPENDLE is a liquid fee and governance token with a 14-day withdrawal period that replaces vePENDLE as the protocol’s primary governance and reward token. Protocol revenue flows to sPENDLE holders in the form of PENDLE buybacks and reward distributions (e.g. airdrops collected from fees).

During this transition, new vePENDLE locks will be paused on January 29th. Existing vePENDLE will be treated as boosted sPENDLE, with a special boost (up to 4x) applied throughout their unlock period.

The vePENDLE Challenge

Despite a 60x revenue growth over the past 2 years, our analysis of vePENDLE revealed significant barriers that limited its effectiveness and broader adoption.

Poor Capital Efficiency

vePENDLE’s lock requirement was a significant factor, which was intended to allow for strong signalling on commitment. An early hypothesis was that this coupled with competition amongst pools and voters would lead to an efficient market and ecosystem - this hasn’t materialized over the years.

Its non-transferrability also precluded access to DeFi’s most powerful use case: composability, robbing holders of opportunities to stack more rewards.

Complex Weekly Commitment

The weekly vote-to-earn system required a deep understanding of DeFi and market dynamics to optimize rewards.

Despite generating over $37M in 2025, the complex voting mechanics meant that rewards concentrated among vePENDLE holders with enough expertise to navigate the system effectively - a tiny fraction of users.

This concentrated distribution model failed to benefit the large majority, and discouraged casual users and newcomers from participating meaningfully.

Limited Participation

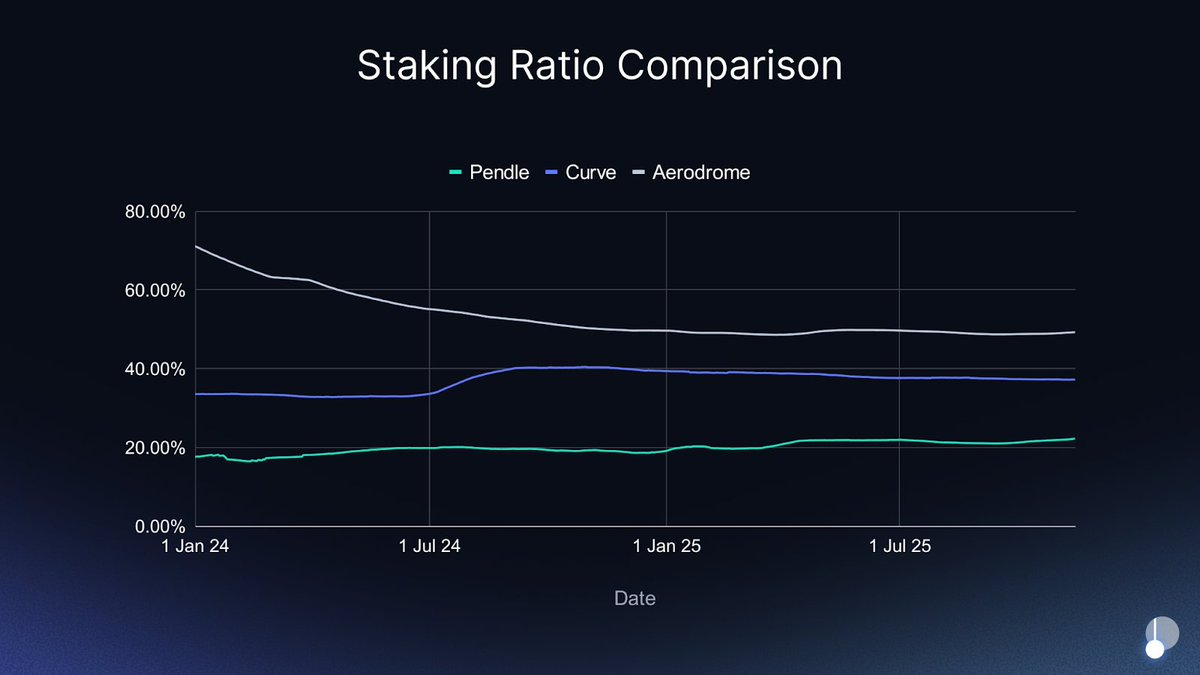

The above factors have contributed to low participation rates, with only 20% of supply engaged with vePENDLE. As the lowest amongst veToken models, this indicated a critical area for improvement.

Suboptimal Emissions Allocation

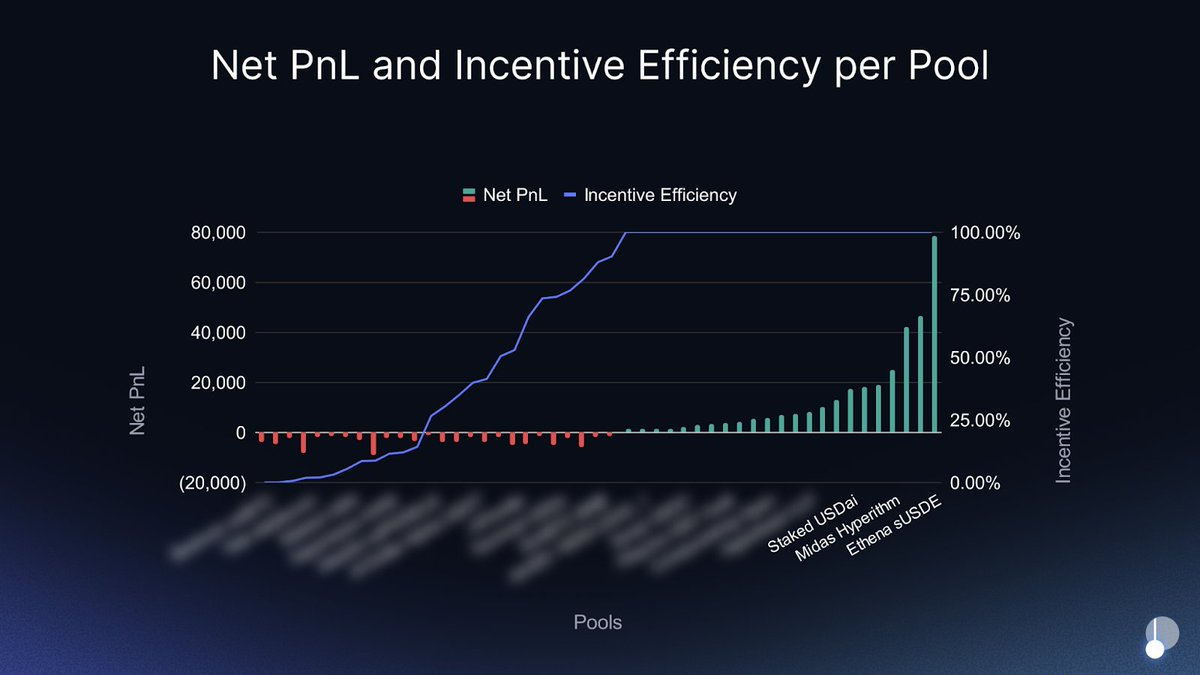

While Pendle’s overall fee efficiency historically exceeds 1 (i.e. revenue > emissions), this does not capture the actual performance of individual pools.

A per pool breakdown indicates that over 60% of pools are unprofitable. Subsequently, our positive overall fee efficiency is attributable to disproportionately high performance in a minority of pools.

In contrast to other verticals, Pendle has minimal reliance on emissions which only serve a peripheral role in bootstrapping and liquidity coordination. In our case, the vote-based emission model precipitated inefficient allocations due to heavy voter concentration and inadequate incentive alignment.

sPENDLE - The Comprehensive Solution

sPENDLE will replace vePENDLE as the governance and reward token.

sPENDLE is a liquid staking token that represents 1 PENDLE deposited in the staking module, which was designed in mind to eliminate the frictions mentioned.

Improved Liquidity & Capital Efficiency

sPENDLE replaces the multi-year lock model with aå simple 14-day withdrawal period (or instant redemption for a 5% fee). This makes sPENDLE a liquid, composable, and fungible token that can be integrated with other dApps while continuing to earn rewards, eliminating the trade-off between participation and liquidity regardless of time horizon.

Streamlined Participation

Up to 80% of protocol revenue will be used for PENDLE token buybacks, and distributed to active sPENDLE holders.

sPENDLE holders are only considered “inactive” if they fail to cast a vote during a period when a Pendle Protocol Proposal (PPP) is available. During periods of no active PPP, all sPENDLE holders remain eligible for sPENDLE yield distributions. sPENDLE deployed in eligible DeFi integrations will be considered “active” at all times.

This approach keeps participation simple and flexible, while ensuring that voting only becomes necessary in moments where critical decisions do arise. In those instances, the community would still maintain governance authority over key protocol directions.

In the event where there is an active PPP and an sPENDLE holder fails to vote, they would forfeit rewards for 14 days.

Please note that sPENDLE queued for withdrawal will not earn rewards or carry voting rights during the unstaking period.

Optimized Algorithmic Emissions

Our upcoming algorithmic emissions model aims to reduce overall emissions by ~30% while significantly improving allocation efficiency across all pools.

This upgrade over the previous manual gauge voting system automatically allocates rewards based on data-driven KPIs, making Pendle more sustainable and capital-efficient in the long run, with emissions directed to markets that truly need them to drive real growth and performance.

Details about the new incentive model will be released next week.

vePENDLE Loyalty Bonus

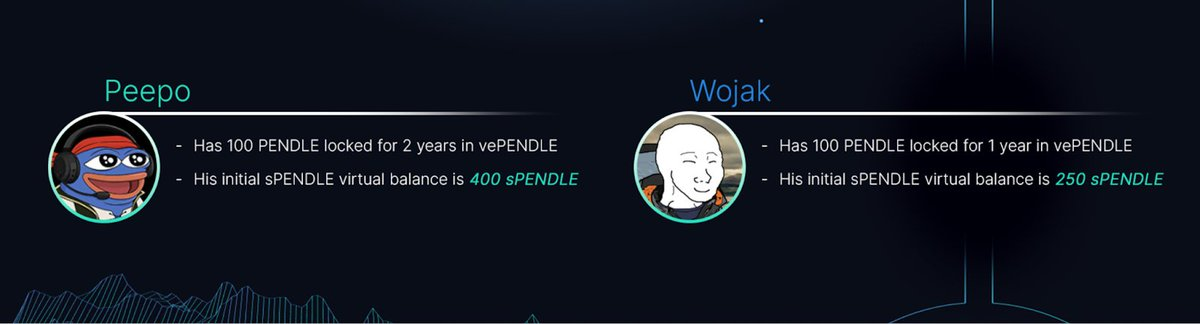

vePENDLE holders will receive an exclusive boosted sPENDLE up to 4x based on their remaining lock duration taken during the snapshot at 00:00 UTC, January 29th. This virtual sPENDLE balance will be determined in this one-off opportunity and will be non-transferable.

The boost multiplier starts at 4x for a max 2-year lock, and decays linearly to 1x by the end of the lock period. As such, each user’s multiplier will be unique, derived from their remaining vePENDLE lock duration.

After 2 years, the special boost and virtual sPENDLE (from existing vePENDLE) will have fully expired, and sPENDLE will be the sole governance token in the Pendle ecosystem.

LP Reward Boosting

Existing pools at time of writing will still be eligible for LP reward boost for LPs with vePENDLE, up until pool maturity.

New pools launched after this announcement will NOT be eligible for LP reward boosting.

Conclusion

The transition to sPENDLE addresses critical inefficiencies in our previous system. While vePENDLE served its purpose during Pendle’s early growth, we believe there are significant areas for improvement, and this upgrade is a step forward to build a more sustainable protocol for the long term.

We are grateful for the feedback and participation that has shaped this and remain dedicated to continuously refining Pendle as new opportunities emerge.

You can learn more about sPENDLE from our docs here.

Disclaimer:

- This article is reprinted from [pendle_fi]. All copyrights belong to the original author [pendle_fi]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?