IMF Warns of Global Stablecoin Gaps and Rising Cross-Border Risks

IMF’s Latest Stablecoin Assessment

The IMF’s recent report, “Understanding Stablecoins,” provides an overview of the regulatory landscape in key economies, including the United States, United Kingdom, European Union, and Japan. The analysis reveals significant disparities in regulatory approaches. Some countries classify stablecoins as securities, others regulate them as payment instruments, and some restrict oversight to tokens issued by banks. In certain cases, comprehensive regulations are still absent. This lack of alignment has resulted in no unified standards for the global market.

(Source: IMFNews)

Cross-Border Circulation Outpaces Regulation

The IMF highlights that stablecoins can easily operate in jurisdictions with lax regulation while serving global markets, which makes it challenging for regulators to monitor the following aspects:

- Reserve assets

- Settlement and redemption processes

- Liquidity management

- Anti-money laundering controls

These regulatory gaps described above expand opportunities for arbitrage and undermine oversight across the global financial system.

Interoperability Between Blockchains Remains Limited

The IMF further notes that, beyond regulatory inconsistencies, stablecoins face technical challenges. The lack of interoperability among public blockchains, exchanges, and cross-chain frameworks leads to the following challenges:

- Higher transaction costs

- Slower market integration

- Reduced global payment efficiency

As regulatory differences persist, this makes cross-border usage and settlement even more complex.

US Dollar Stablecoins Continue to Dominate

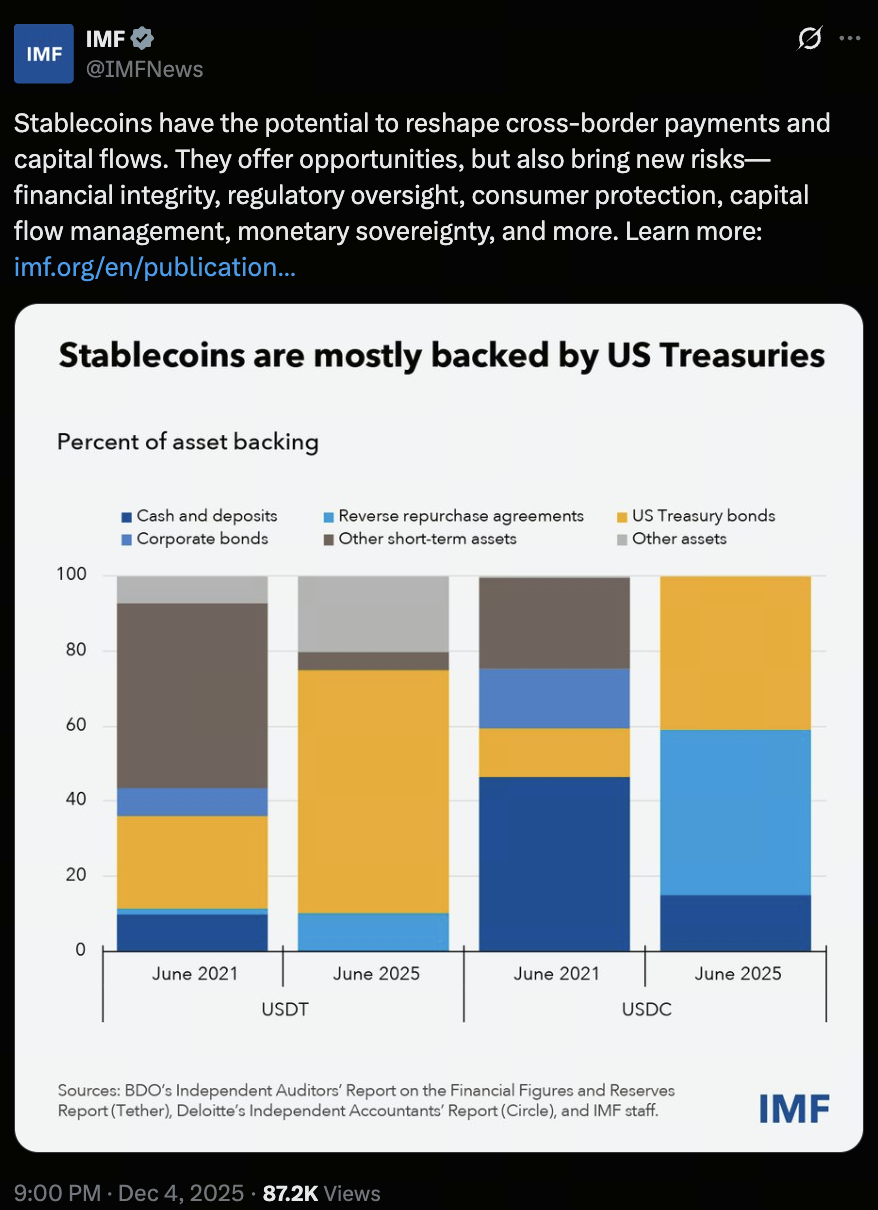

Global stablecoin market capitalization now exceeds $300 billion, with USDT and USDC, both backed by the US dollar, remaining the primary market leaders. The IMF outlines the reserve structures of these stablecoins:

- Approximately 40% of USDC’s reserves are in short-term U.S. Treasuries

- Approximately 75% of USDT’s reserves are in short-term government bonds, with around 5% held in Bitcoin

A closer link between stablecoins and government bond markets increases their potential impact on traditional financial systems.

Stablecoins May Undermine Monetary Sovereignty and Capital Controls

The IMF warns that widespread use of foreign currency-denominated stablecoins could threaten national financial stability, including:

- Decreased demand for domestic currency

- Reduced effectiveness of monetary policy

- Accelerated Digital Dollarization

- Heightened risk of circumventing capital controls (especially via self-custodied wallets and offshore platforms)

If large-scale redemptions occur, issuers may rapidly sell significant quantities of short-term U.S. Treasuries, which could disrupt global short-term funding markets. Stronger ties between stablecoin issuers, banks, custodians, trading platforms, and funds may cause volatility to spill over from the crypto sector into broader financial markets.

Conclusion

The IMF concludes that, without harmonized international regulatory standards, stablecoins could bypass national security mechanisms, increase pressure on fragile economies, and rapidly transmit risk through cross-border transactions.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution