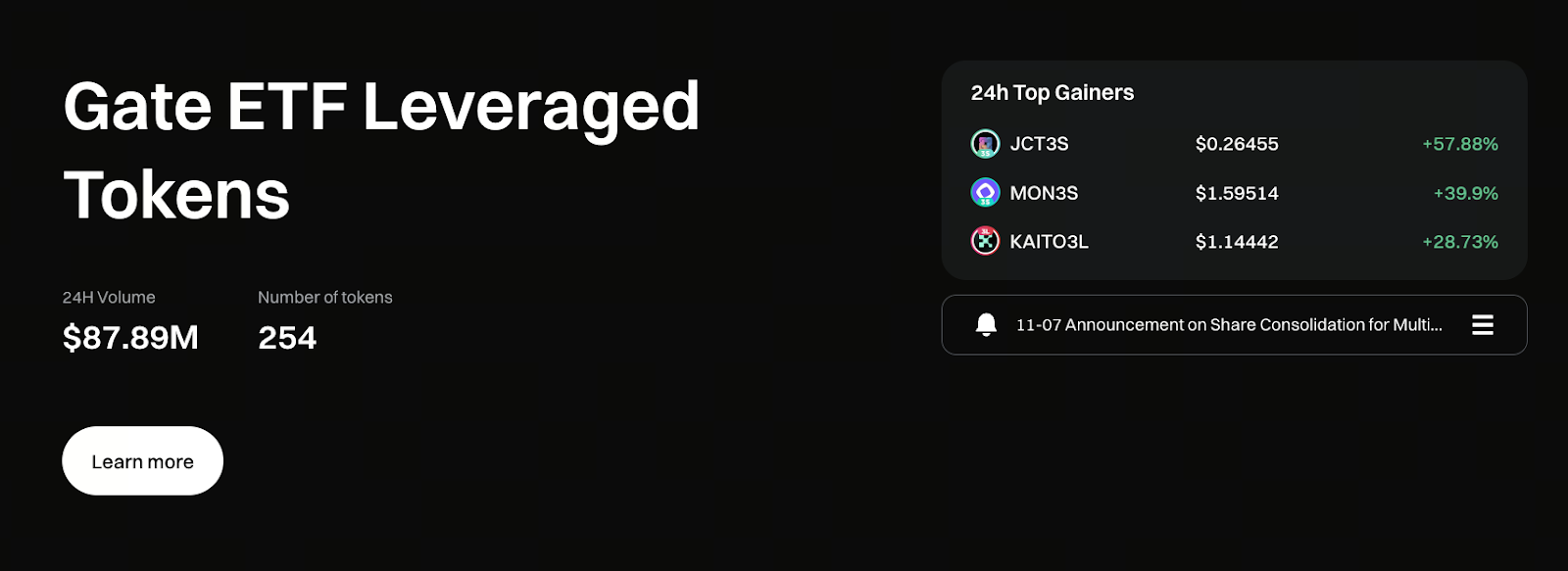

Gate ETF Leveraged Tokens: New Tools to Amplify Returns

Crypto ETFs: The Key Gateway for Traditional Capital Entering the Crypto Market

ETFs (Exchange Traded Funds) have been a staple in traditional investing. With the introduction of crypto ETFs, both institutions and individual investors can now access digital assets like Bitcoin and Ethereum through familiar channels. These channels are also regulated, making participation easier.

Since 2025, crypto ETFs have gained even more prominence. Institutions such as Bank of America announced that starting in early 2026, wealth management clients will be able to invest in crypto-related ETFs and ETPs. This shift signals that digital assets are moving from being considered “alternative investments” to becoming “mainstream portfolio assets.”

Key advantages of crypto ETFs include:

- No need for personal custody of cryptocurrencies

- Regulated access to digital asset markets

- Lower investment barriers

- Suitable for long-term investing or portfolio diversification

The expansion of these products is boosting market stability and drawing more traditional capital into the digital asset ecosystem.

Tightening Regulation: High-Leverage Crypto ETFs Remain in a Sensitive Phase

While crypto ETFs are advancing quickly, regulators have paused applications for 3× and 5× leveraged crypto ETFs. Several major fund companies have withdrawn their submissions.

The main reasons are:

- Extreme volatility in crypto assets

- Leveraged ETFs can magnify systemic risk

- Regulators worry that investors cannot withstand high risk

Regulators will continue to impose policy restrictions on leveraged crypto products within traditional finance for now.

Investors continue to demand these products. In trending markets, many users still seek tools that increase returns—without having to manage leverage themselves.

Gate ETF Leveraged Tokens: Amplifying Returns in Trending Markets

Image: https://www.gate.com/leveraged-etf

Unlike restricted “crypto leveraged ETFs,” ETF leveraged tokens on crypto trading platforms have become established investment tools. They are widely used for leveraged trading. Gate’s ETF leveraged tokens stand out for their simple operation, no risk of forced liquidation, and suitability for short-term trend trading—attracting significant trader interest.

1. Simple Operation: Use Leverage Just Like Trading Standard Tokens

Users simply search in the trading interface, for example:

- BTC3L (3x long Bitcoin)

- BTC3S (3x short Bitcoin)

This lets users access leverage with no margin requirements. There’s no need to open positions, add margin, or worry about liquidation—a key advantage of ETF leveraged tokens.

2. Automatic Rebalancing: Maintains Target Leverage Ratio

Gate’s ETF leveraged tokens rebalance automatically to maintain fixed leverage ratios, such as 2× or 3×. Users do not need to manually increase or decrease positions as with contracts, which significantly lowers the barrier to entry.

3. No Forced Liquidation, But Identifying Market Trends Remains Crucial

Although there is no forced liquidation, automatic rebalancing in volatile markets can cause value decay due to volatility in net asset value. These tokens are most effective in:

- Clear upward trends (where gains are compounded)

- Clear downward trends (where losses can be amplified)

- Ranging markets (where rebalancing may impact returns)

- Short-term trend trading (where active management is advantageous)

When market trends are clear, the compounding effect of ETF leveraged tokens is especially pronounced.

Why Focus on ETF Leveraged Tokens in the Current Market?

As institutions expand their crypto investment products, crypto ETFs are gaining market influence. Meanwhile, most regulators continue to restrict “high-leverage crypto ETFs,” fueling demand for non-contract leveraged tools.

In this environment, Gate’s ETF leveraged tokens offer distinct advantages:

1. Amplified Returns in Trending Markets

For example, if Bitcoin rises 10%, BTC3L could rise by nearly 30%. This is ideal for short-term trend traders.

2. Lower Barriers to Entry, Accessible for Everyday Users

There is no need to learn about contracts, funding rates, or liquidation processes.

3. As Crypto ETF Popularity Climbs, Leveraged Tokens Offer Flexible Alternatives

Crypto ETFs suit long-term portfolio allocation, while ETF leveraged tokens act as active, high-volatility return instruments.

These products complement each other:

- For long-term stability: choose spot or crypto ETFs

- For short-term return amplification: choose Gate’s ETF leveraged tokens

Future Outlook: Dual-Track Growth for ETFs and Leveraged Tokens

As institutions enter the market, crypto ETFs will keep growing and drive greater transparency and maturity. Leveraged tokens offered by trading platforms, with their flexibility, convenience, and potential for high returns, will remain popular among traders.

The future crypto investment landscape will likely feature:

- Regulated markets offering primarily crypto ETFs

- Crypto trading platforms providing leveraged tokens, perpetual contracts, and other high-efficiency tools

Investors can freely switch between stable allocation and amplified trend returns.

Conclusion

Whether it’s the rise of crypto ETFs or the widespread adoption of Gate’s ETF leveraged tokens, both signal the rapid normalization and diversification of digital assets. In trending markets, ETF leveraged tokens serve as powerful return tools. For long-term investing, crypto ETFs offer a more stable approach.

Related Articles

The Compounding Powerhouse in Trending Markets: How ETF Leveraged Tokens Amplify Your Gains

Altcoin ETFs Explode, Covering Bitcoin’s Ten-Year Path in Six Months: A Structural Shift Is Underway in Crypto