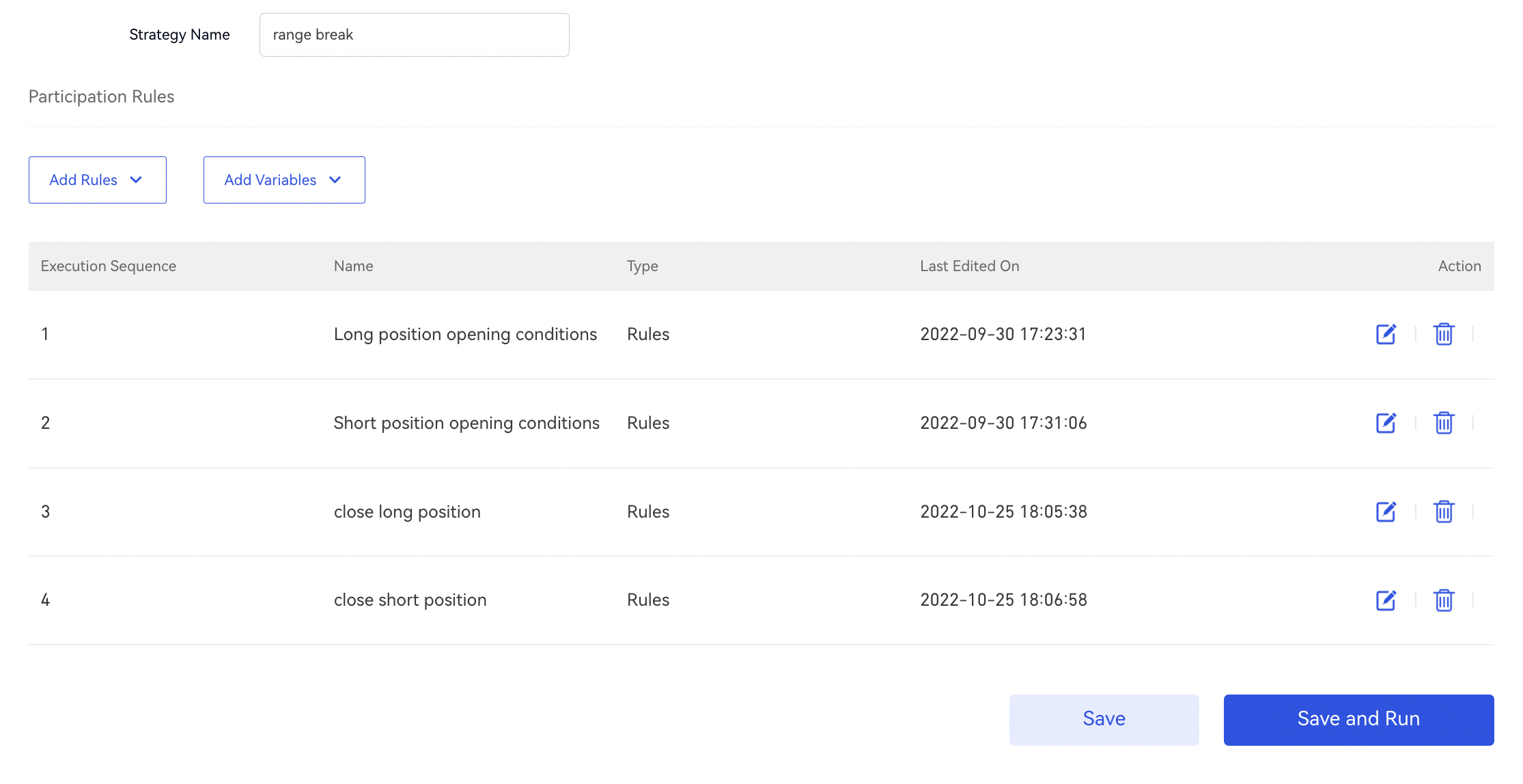

1. Range-breaking Strategy

This example highlights how to create a strategy by adopting custom rules

Open position

Long Position: Break above the last 60-minute peak

Short Position: Break below the last 60-minute trough

Close position

Close long Position: Break below the 10-minute peak

Close short Position: Break above the 10-minute trough

1.1 Rules on new creating

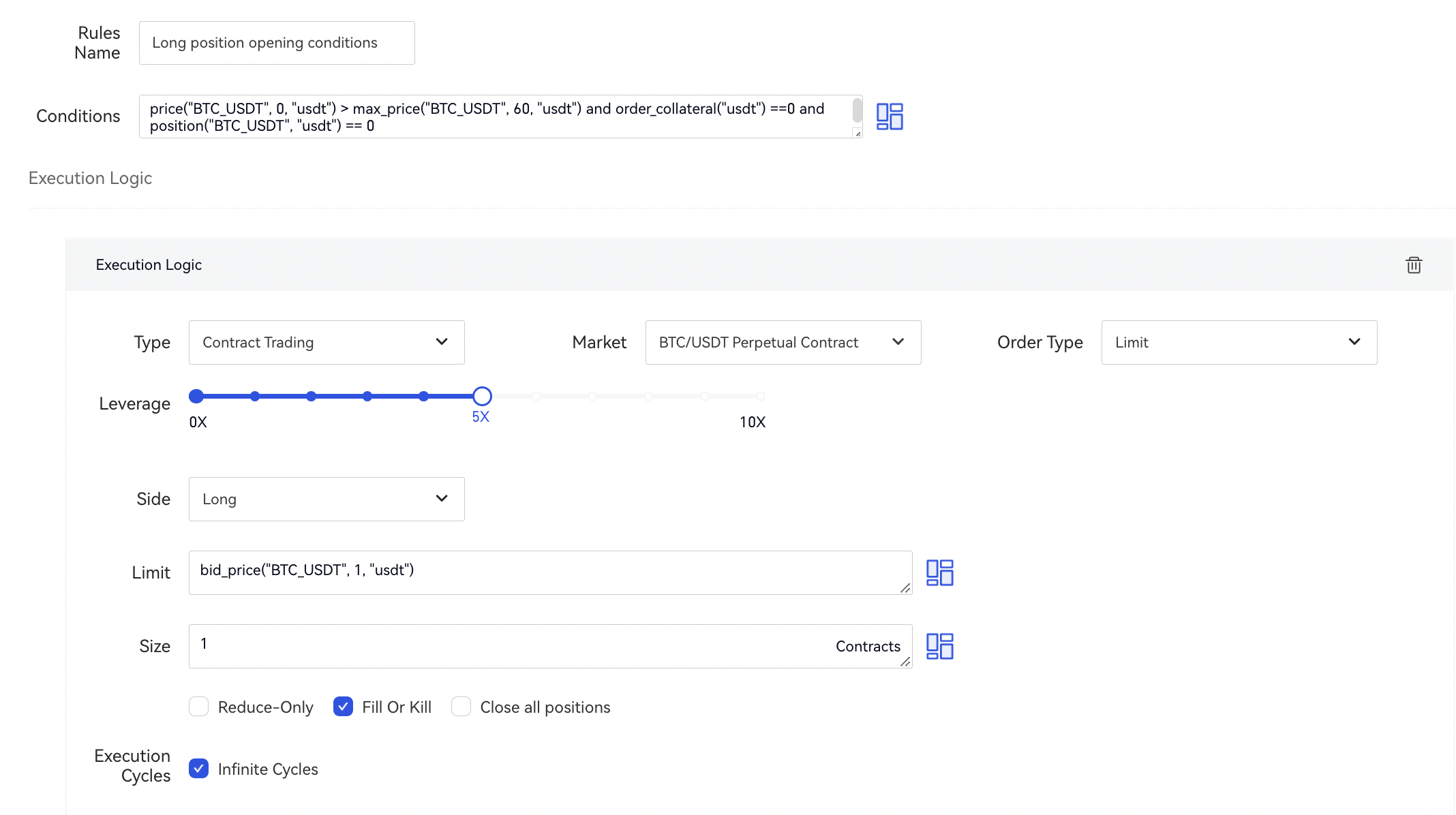

1. Long position opening

Conditions

price("BTC_USDT", 0, "usdt") > max_price("BTC_USDT", 60, "usdt") and order_collateral("usdt") ==0 and position("BTC_USDT", "usdt") == 0

(1)price("BTC_USDT", 0, "usdt") > max_price("BTC_USDT", 60, "usdt")

This condition means that the current BTC perpetual contract price is greater than the highest price in the last 60 minutes.

(2)and order_collateral("usdt") ==0

This condition means that there are no pending orders for the current strategy; order_collateral is a predefined function, which obtains the margin of the unfilled orders. If the return value of this function is 0, it means that there are no pending orders for the current strategy.

(3)and position("BTC_USDT", "usdt") == 0

This condition means that the current position size of the strategy is 0, and position is a predefined function. It indicates the position in specified market for the current strategy.

Execution logic

Type: Contract Trading; Market: BTC/USDT Perpetual Contract; Order Type: Limit; Leverage: 5X; Side: Long; Limit price: bid_price("BTC_USDT", 1, "usdt"); Size: 1.

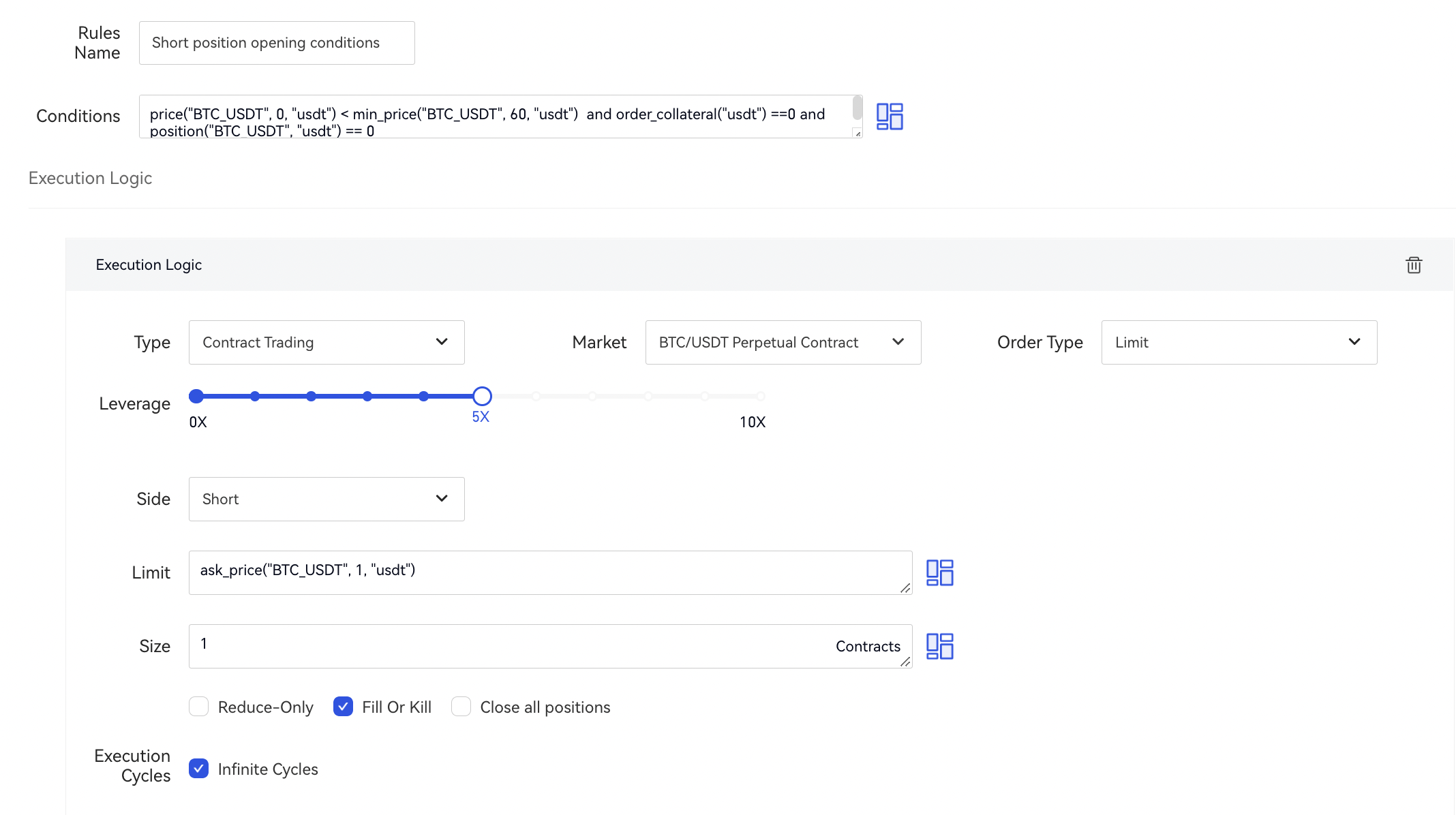

2. Short position opening-short position opening conditions

Conditions

price("BTC_USDT", 0, "usdt") < min_price("BTC_USDT", 60, "usdt") and order_collateral("usdt") ==0 and position("BTC_USDT", "usdt") == 0

(1)price("BTC_USDT", 0, "usdt") < min_price("BTC_USDT", 60, "usdt")

This condition means that the current BTC perpetual contract price is lower than the lowest price in the last 60 minutes.

(2)and order_collateral("usdt") ==0

This condition means that there are no pending orders for the current strategy.

(3)and position("BTC_USDT", "usdt") == 0

This condition means that the current position size for the strategy is 0.

Execution strategy

Type: Contract Trading; Market: BTC/USDT Perpetual Contract; Order Type: Limit; Leverage: 5x; Dide: Short; Limit price: ask_price("BTC_USDT", 1, "usdt"); Size: 1.

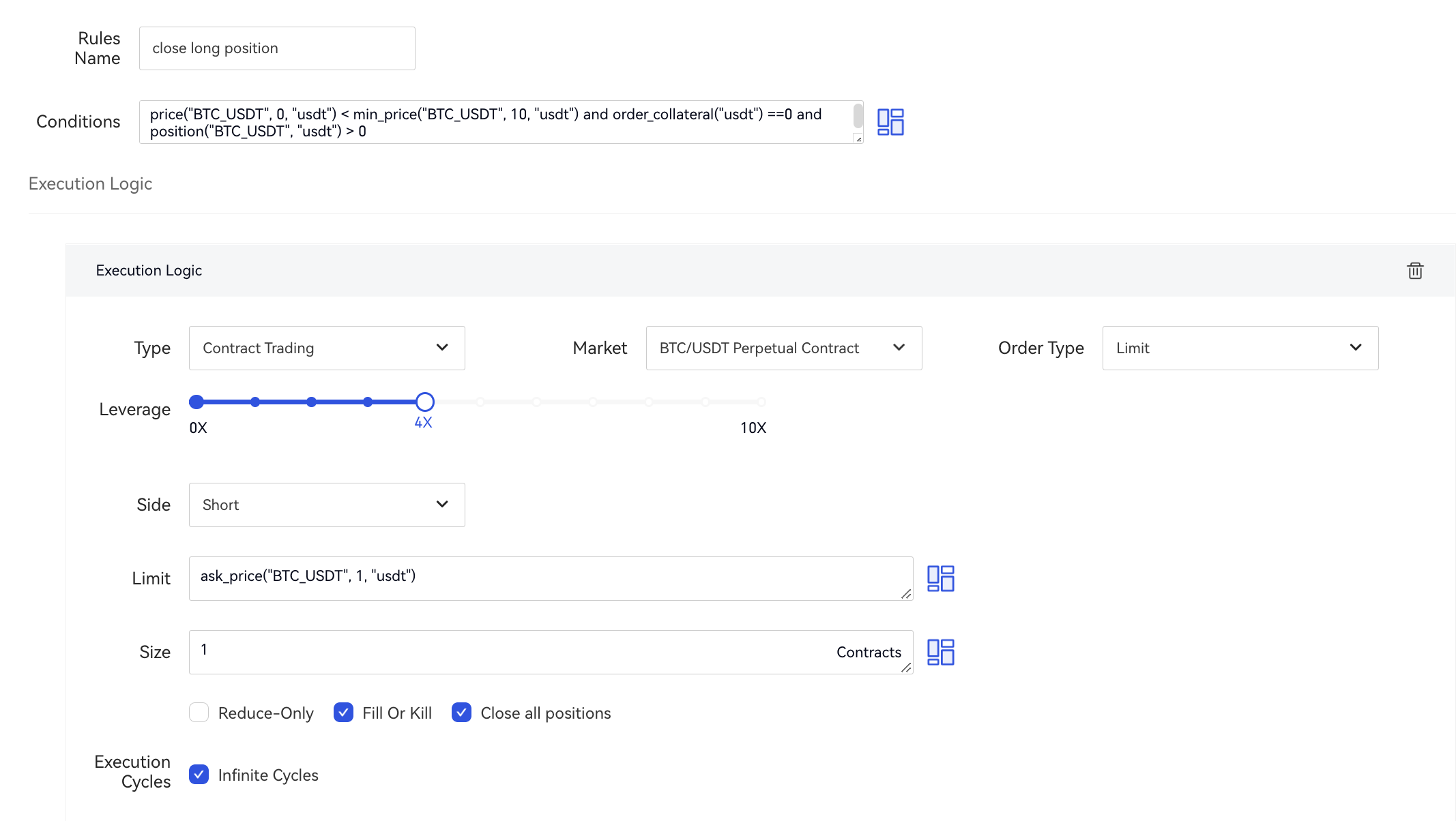

3. Closing long conditions -close long position

Conditions

price("BTC_USDT", 0, "usdt") < min_price("BTC_USDT", 10, "usdt") and order_collateral("usdt") ==0 and position("BTC_USDT", "usdt") > 0

(1)price("BTC_USDT", 0, "usdt") < min_price("BTC_USDT", 10, "usdt")

This condition means that the current BTC perpetual contract price is lower than the lowest price in the last 10 minutes.

(2)and order_collateral("usdt") ==0

This condition indicates that there are no pending orders for the current strategy.

(3)and position("BTC_USDT", "usdt") > 0

This condition implies that the strategy has already set up positions, based on which the positions will be closed.

Execution logic

Type: Contract Trading; Market: BTC/USDT Perpetual Contract; Order Type: Limit; Leverage: 5x; Side: Short; Limit price: ask_price("BTC_USDT", 1, "usdt"); Size: 1.

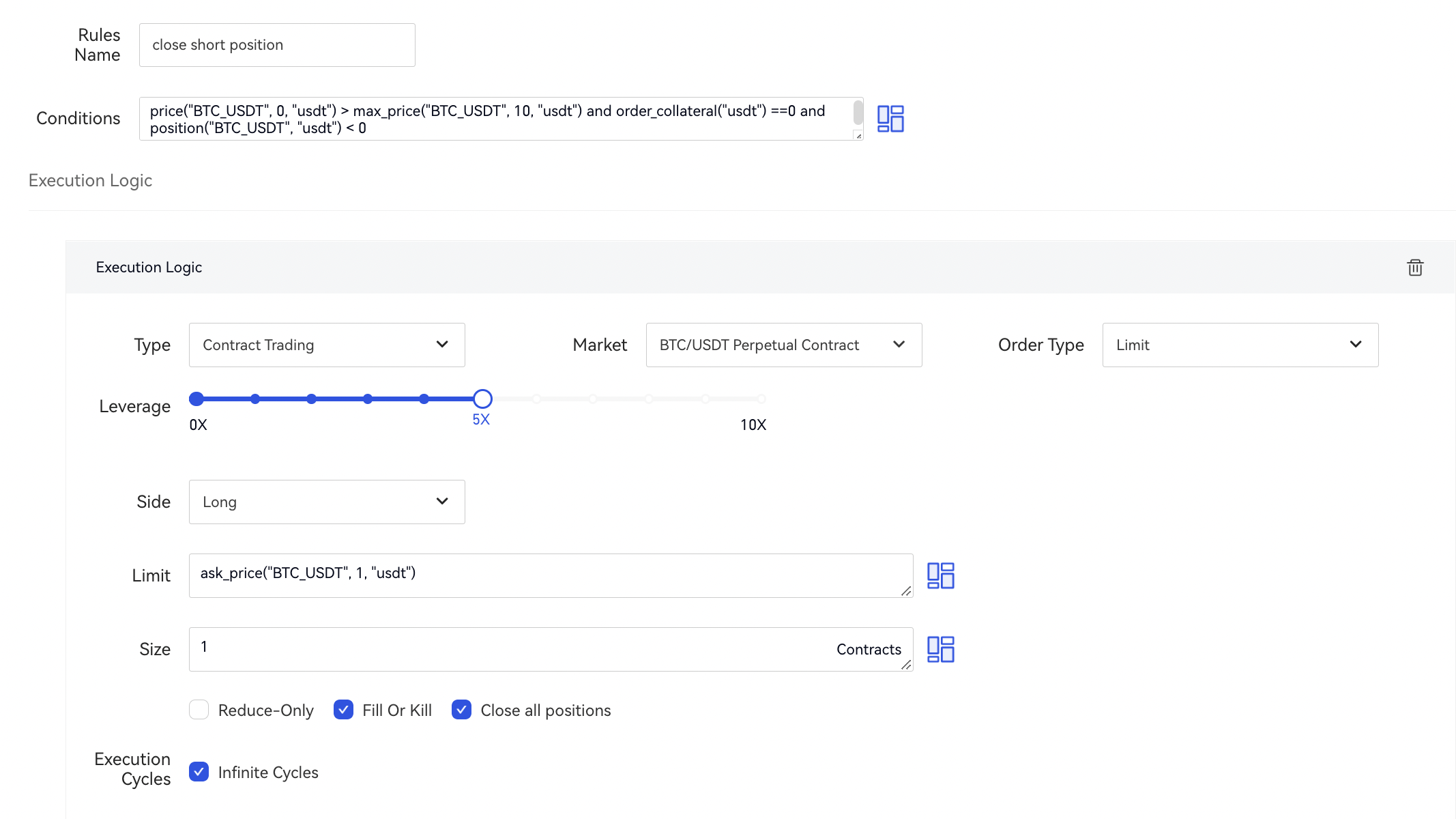

4. Close short conditions

Conditions

price("BTC_USDT", 0, "usdt") > max_price("BTC_USDT", 10, "usdt") and order_collateral("usdt") ==0 and position("BTC_USDT", "usdt") < 0

(1)price("BTC_USDT", 0, "usdt") > max_price("BTC_USDT", 10, "usdt")

This condition means that the current BTC perpetual contract price is higher than the highest price in the last 10 minutes.

(2)and order_collateral("usdt") ==0

This condition indicates that there are no pending orders for the current strategy.

(3)and position("BTC_USDT", "usdt") < 0

This condition implies that the strategy has already set up positions, based on which the positions will be closed.

Execution logic

Type: Contract Trading; Market: BTC/USDT Perpetual Contract; Order Type: Limit; Leverage: 5x; Side: Long; Limit price: ask_price("BTC_USDT", 1, "usdt"); Size: 1.

1.2 Rules on strategy creating

Establish the opening conditions and closing conditions in turn by adding the "long position opening conditions," "short position opening conditions," "close long position conditions" and "close short position conditions" in turn.

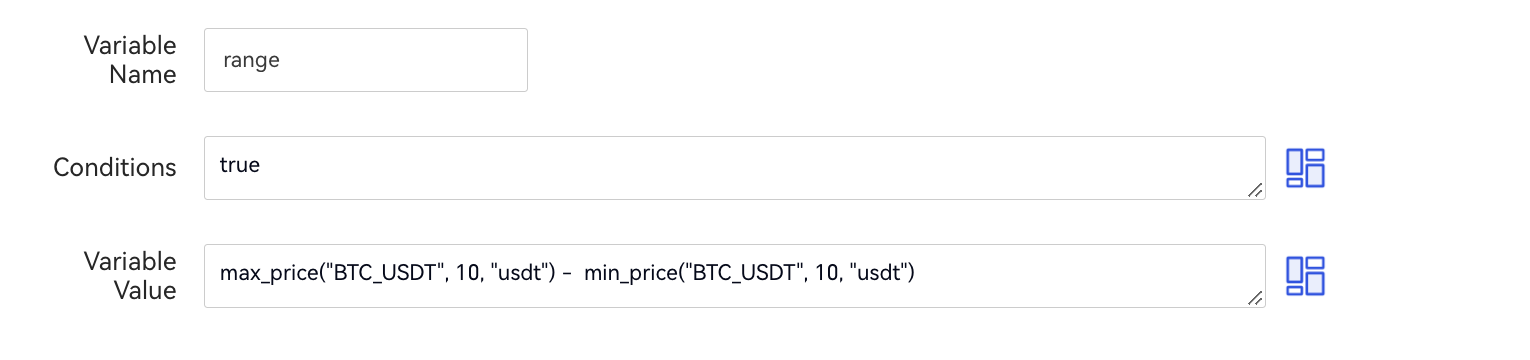

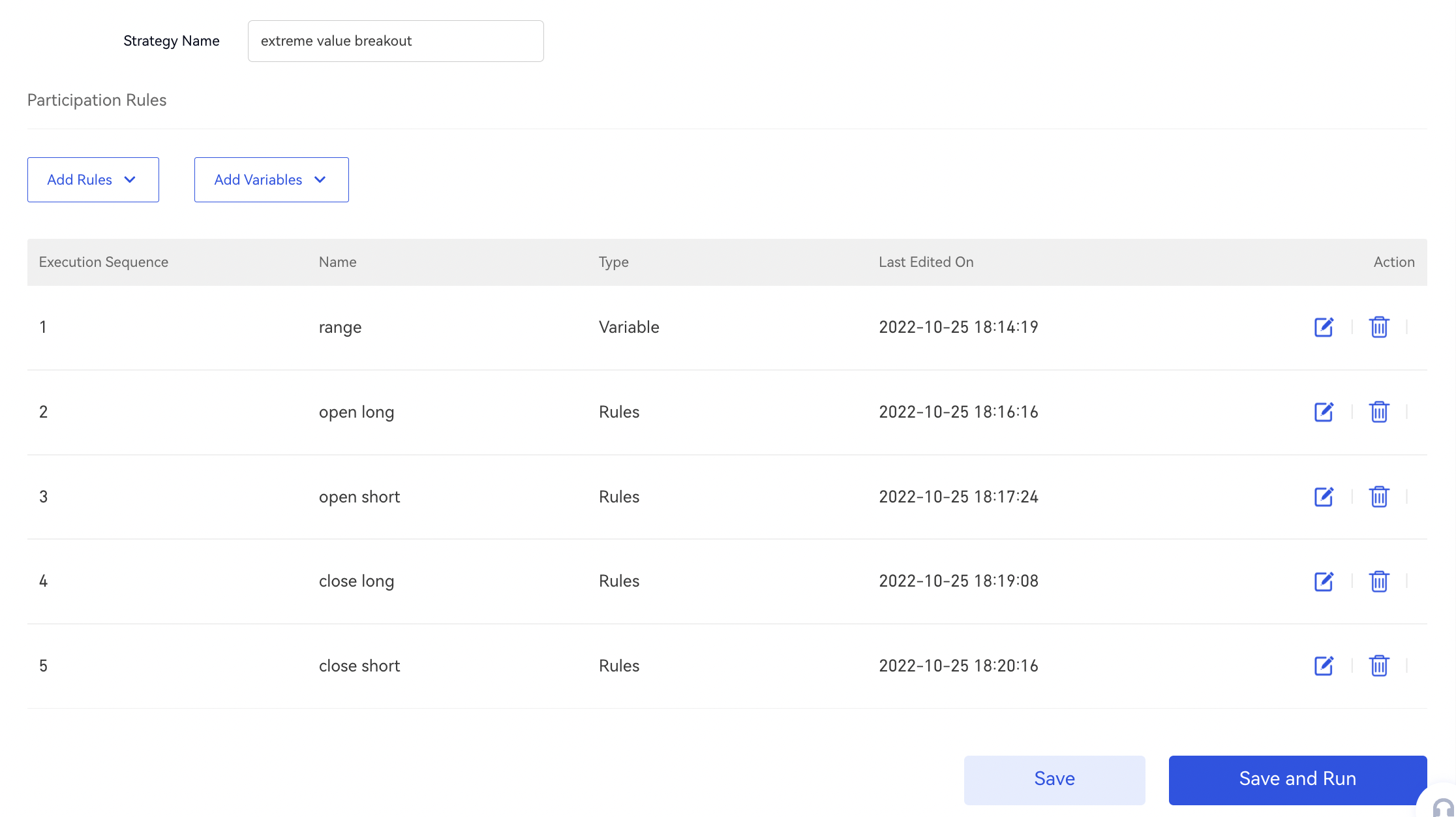

2. Extremum Breakout Strategy

This example highlights how to create a strategy by using custom variable(s)

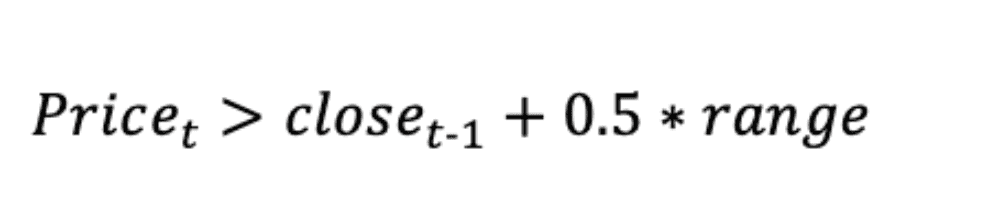

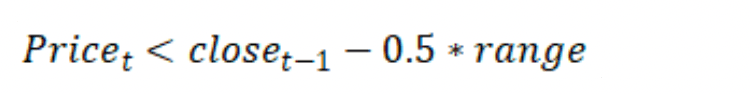

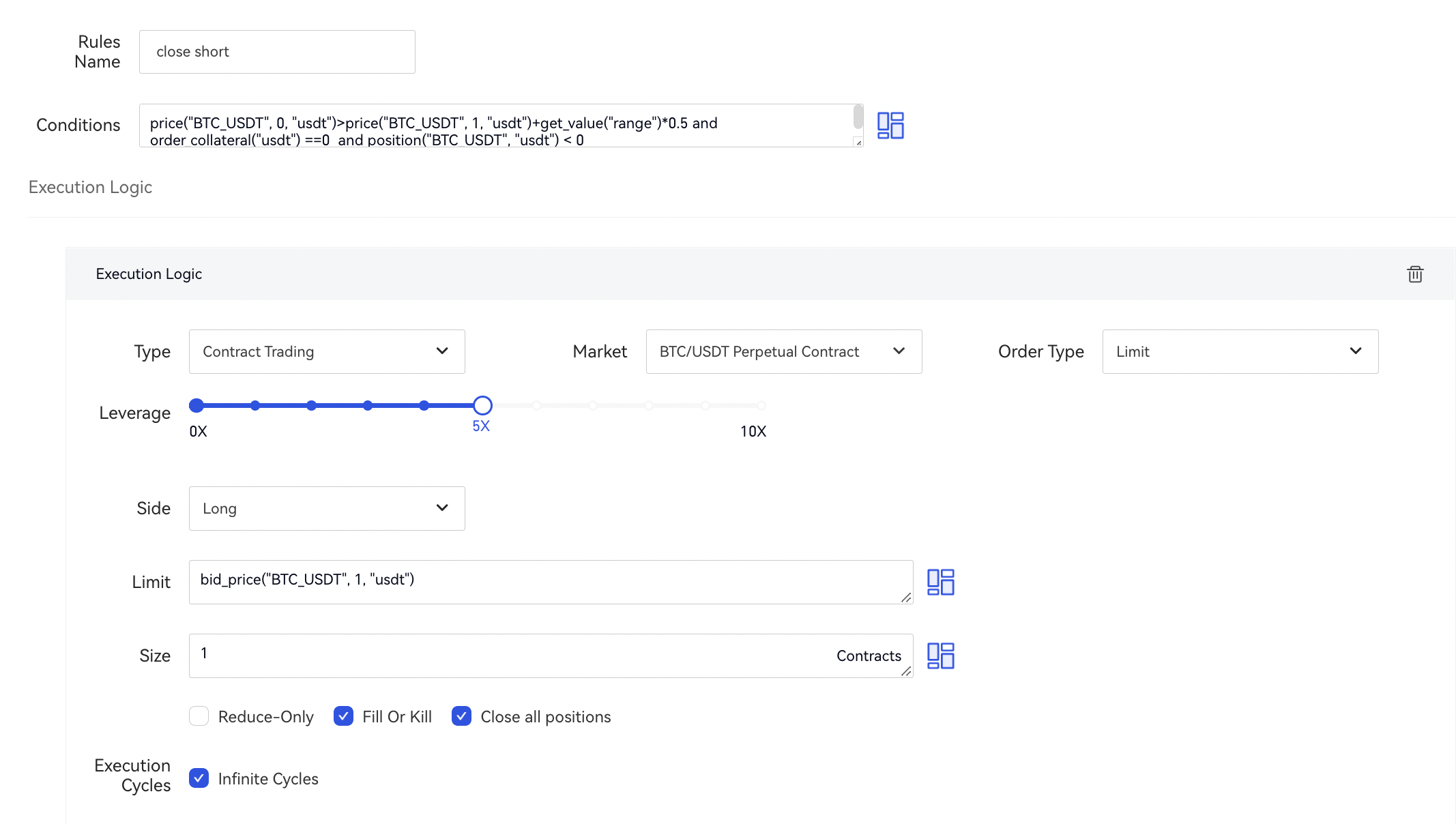

Open Long/Close Short

Where: pricet represents the last price at the current moment

closet-1 represents the closing price at the previous moment

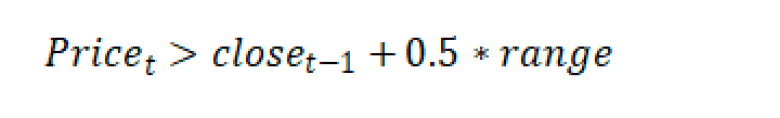

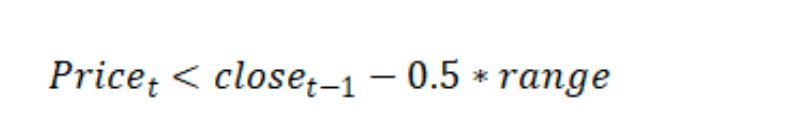

Open Short/Close Long

2.1New variable

Variable name: range

Condition

true

Variable value

max_price("BTC_USDT", 10, "usdt") - min_price("BTC_USDT", 10, "usdt")

2.2 Rules on new creating

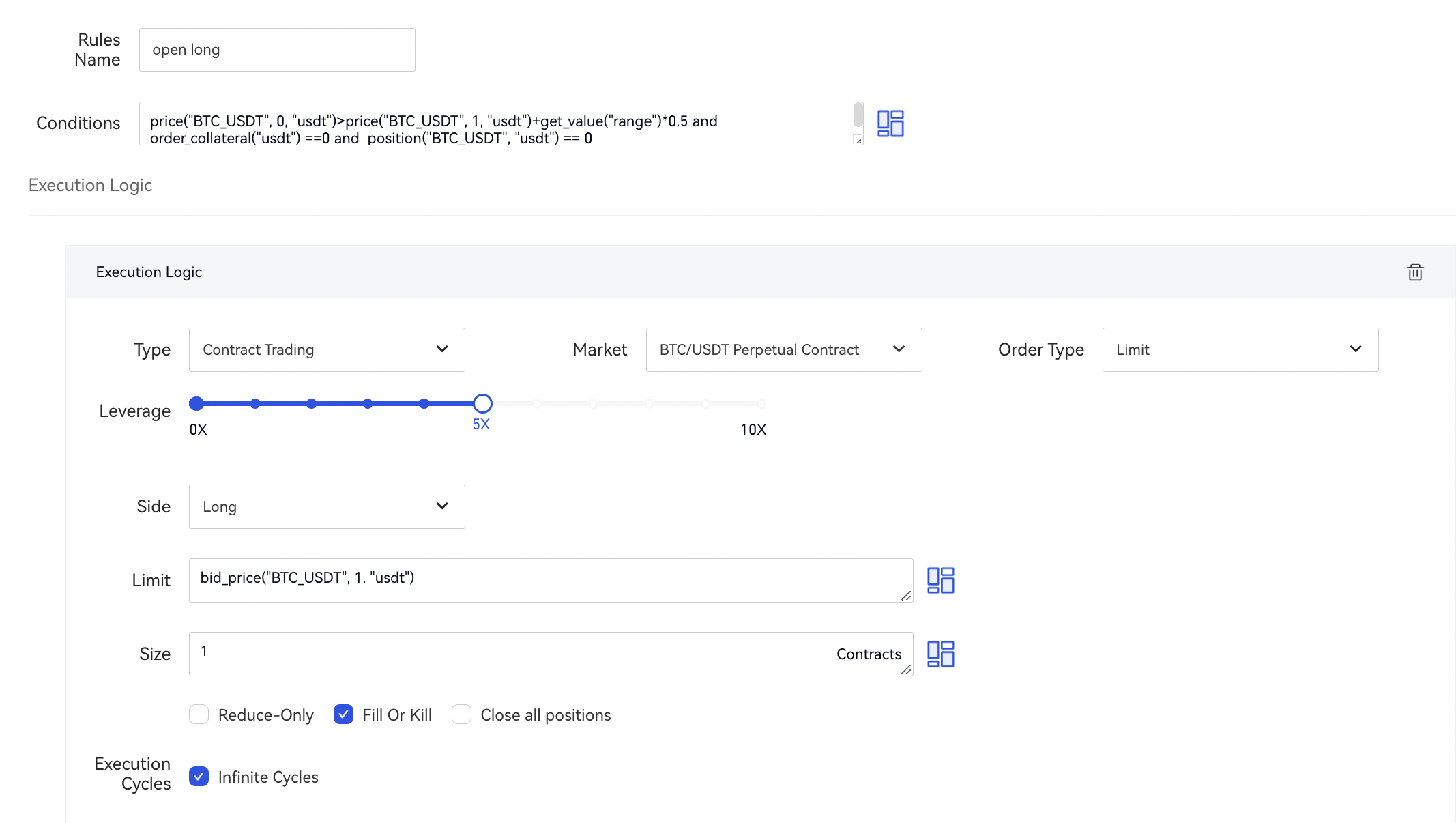

1. Open long conditions

Conditions

price("BTC_USDT", 0, "usdt")>price("BTC_USDT", 1, "usdt")+get_value("range")*0.5 and order_collateral("usdt") ==0 and position("BTC_USDT", "usdt") == 0

(1)price("BTC_USDT", 0, "usdt")>price("BTC_USDT", 1, "usdt")+get_value("range")*0.5

This condition indicates open long positions as the following rule:

Get the value of "range" variable by "get_value" predefined fuction

(2)and order_collateral("usdt") ==0

This condition indicates that there are no pending orders for the current strategy.

(3)and position("BTC_USDT", "usdt") == 0

This condition means that there are opening positions for the strategy.

Execution logic

Type: Contract Trading; Market: BTC/USDT Perpetual Contract; Order Type: Limit; Leverage: 5x; Side: Long; Limit price: bid_price("BTC_USDT", 1, "usdt"); Size: 1.

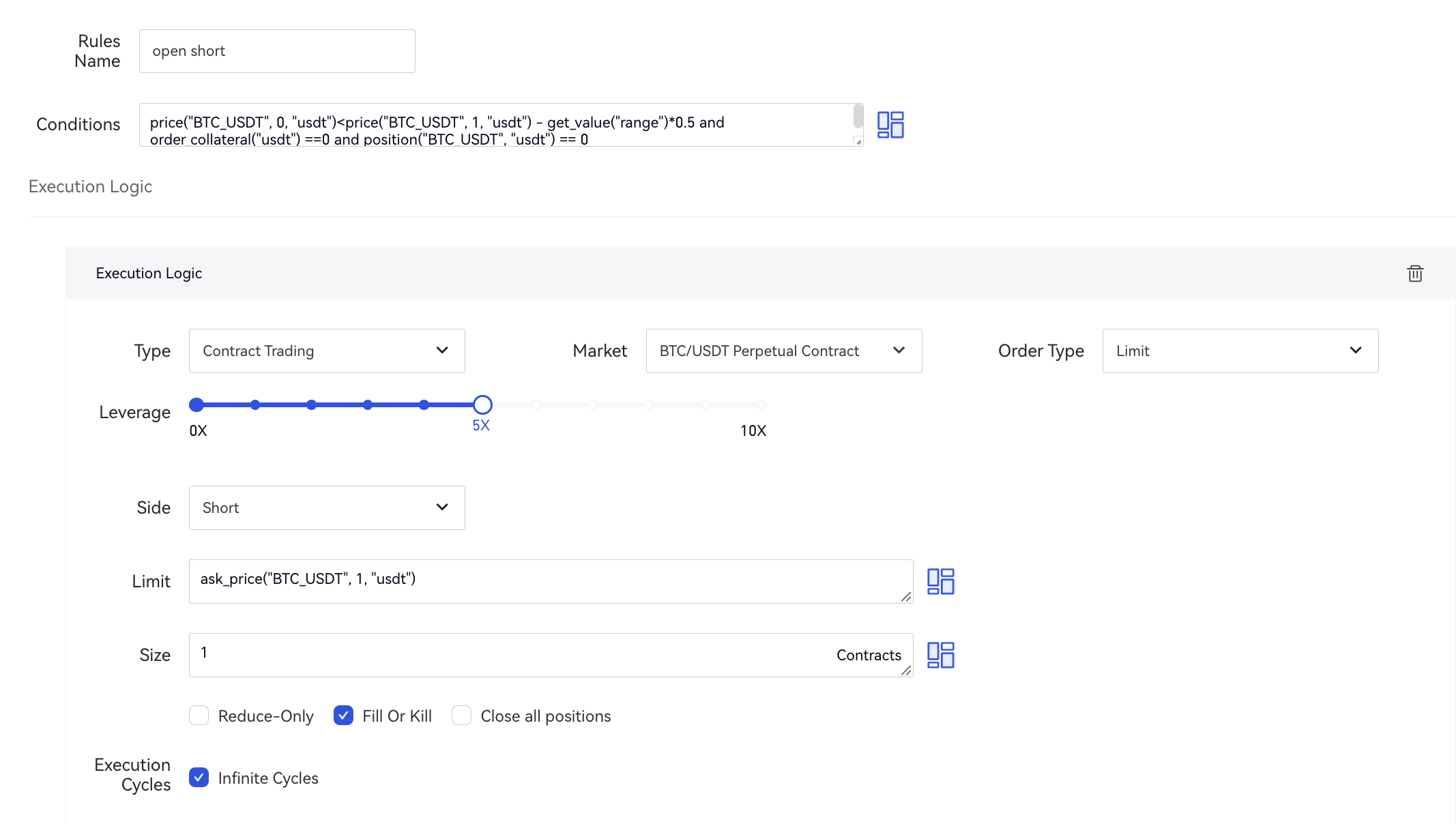

2. Open short conditions

Conditions

price("BTC_USDT", 0, "usdt")<price("BTC_USDT", 1, "usdt") - get_value("range")0.5 and order_collateral("usdt") ==0 and position("BTC_USDT", "usdt") == 0

(1)price("BTC_USDT", 0, "usdt")<price("BTC_USDT", 1, "usdt") - get_value("range")0.5

This condition indicates open short positions as the following rule:

Get the value of "range" variable by "get_value" predefined fuction.

(2)and order_collateral("usdt") ==0

This condition indicates that there are no pending orders for the current strategy.

(3)and position("BTC_USDT", "usdt") == 0

This condition means that there are no opening positions for the strategy.

Execution logic

Type: Contract Trading; Market: BTC/USDT Perpetual Contract; Order Type: Limit; Leverage: 5x; Side: Short; Limit price: ask_price("BTC_USDT", 1, "usdt"); Size: 1.

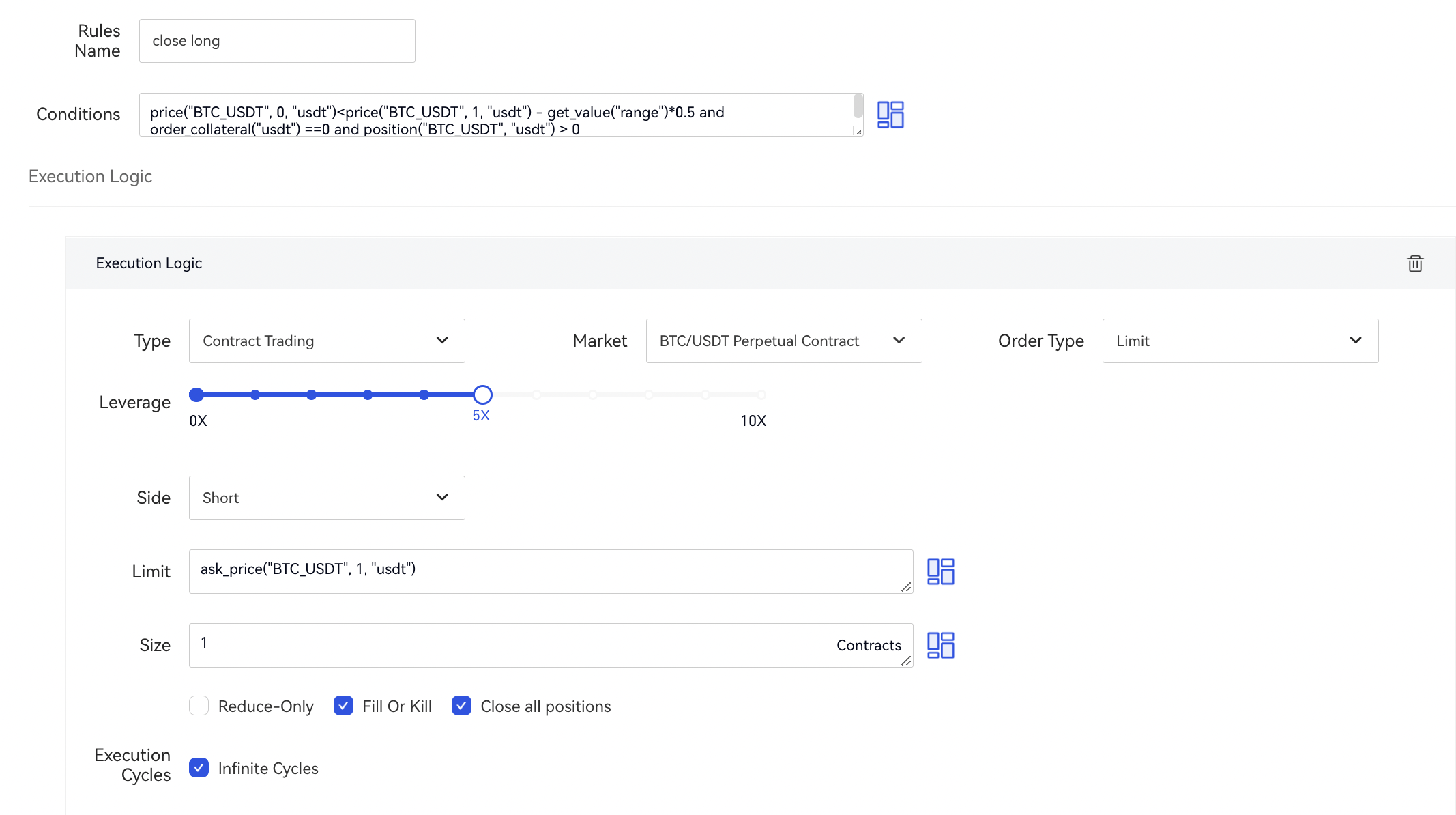

3. Close long conditions

Conditions

price("BTC_USDT", 0, "usdt")<price("BTC_USDT", 1, "usdt") - get_value("range")*0.5 and order_collateral("usdt") ==0 and position("BTC_USDT", "usdt") > 0

(1)price("BTC_USDT", 0, "usdt")<price("BTC_USDT", 1, "usdt") - get_value("range")*0.5

This condition indicates close long positions as the following rule:

Get the value of "range" variable by "get_value" predefined fuction

(2)and order_collateral("usdt") ==0

This condition means that there are no pending orders for the current strategy.

(3)and position("BTC_USDT", "usdt") > 0

This condition implies that the strategy has already set up positions, based on which the positions will be closed.

Execution logic

Type: Contract Trading; Market: BTC/USDT Perpetual Contract; Order Type: Limit; Leverage: 5X; Side: Short; Limit price: ask_price("BTC_USDT", 1, "usdt"); Size: 1.

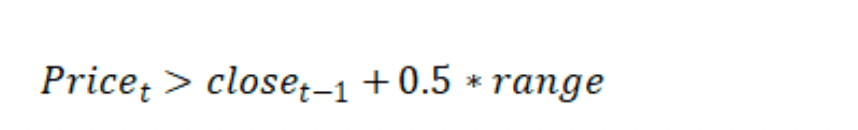

4. Close short conditions

Conditions

price("BTC_USDT", 0, "usdt")>price("BTC_USDT", 1, "usdt")+get_value("range")*0.5 and order_collateral("usdt") ==0 and position("BTC_USDT", "usdt") < 0

(1)price("BTC_USDT", 0, "usdt")>price("BTC_USDT", 1, "usdt")+get_value("range")*0.5

This condition indicates close short positions as the following rule:

Get the value of "range" variable by "get_value" predefined fuction

(2)and order_collateral("usdt") ==0

This condition indicates that there are no pending orders for the current strategy.

(3)and position("BTC_USDT", "usdt") < 0

This condition implies that the strategy has already set up positions, based on which the positions will be closed.

Execution logic

Type: Contract Trading; Market: BTC/USDT Perpetual Contract; Order Type: Limit; Leverage: 5X; Side: Long; Limit price: bid_price("BTC_USDT", 1, "usdt");Size: 1.

2.3 Rules on strategy creating

When using custom variables, the custom variables should be executed before the conditions in the execution sequence. For example, the "range" custom variable should be executed first, followed by the opening and closing conditions in the order 2 to 5.

Gate reserves the final right to interpret the product.