Bitcoin (BTC) News Today

Latest crypto news and price forecasts for BTC: Gate News brings together the latest updates, market analysis, and in-depth insights.

BlackRock Clients Sell $114.7M in Bitcoin in Fresh Outflow Move

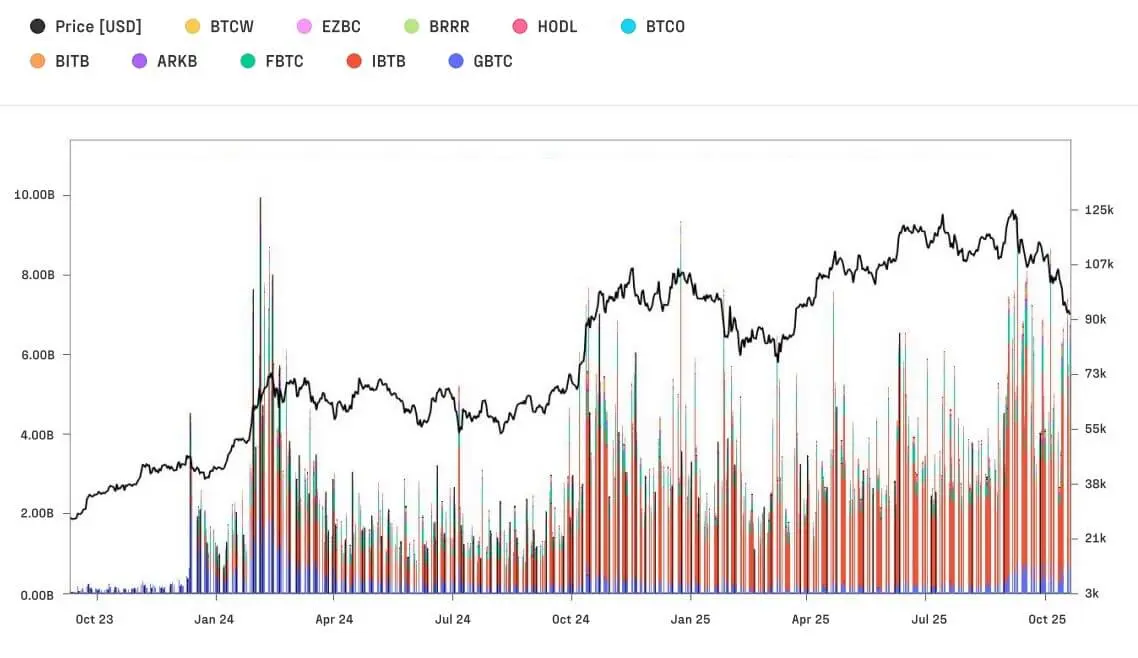

BlackRock clients pulled $114.73 million worth of Bitcoin from the firm’s iShares Bitcoin Trust (IBIT). The move marked the largest single-day ETF outflow of the week. It also pushed total net outflows across all U.S. spot Bitcoin ETFs to roughly $194.64 million for the day.

This sell-off added to

BTC-1.49%

Coinfomania·5m ago

Larry Fink Confirms Sovereign Funds Are Buying the Bitcoin Dip

Sovereign funds are increasing Bitcoin investments, seeing it as a hedge against currency devaluation and macroeconomic instability. BlackRock's CEO notes this trend highlights growing institutional adoption and suggests a shift toward regulated digital assets.

BTC-1.49%

CryptoBreaking·13m ago

21Shares Founder Predicts Bitcoin Won’t Hit New High in January

Market analysts are skeptical about Bitcoin's potential for a significant rally amidst ongoing volatility, citing macroeconomic uncertainties. While recent price drops raise caution, optimism remains for long-term growth driven by institutional interest and regulatory clarity.

BTC-1.49%

CryptoBreaking·15m ago

New Paper by Black Swan Author: Is Not Cutting Losses in Investing Safer? The Hidden Structural Risks Behind It

Nassim Nicholas Taleb, the author of the Black Swan theory, published a new paper pointing out that many people’s sense of security regarding “stop-loss” is actually a misconception. He emphasizes that stop-loss is not a talisman that reduces risk, but rather concentrates the originally dispersed probability of loss at a single price point, creating an insidious yet more dangerous “hidden spike risk.” (Previous context: Has the Bitcoin top-escape indicator failed? How should investors recalibrate?) (Background supplement: How to survive the Bitcoin winter? Investment strategies, tips, and bottom detection) On December 4, Nassim Nicholas Taleb, the author of the Black Swan theory, shared his latest paper “Trading With a” on the X platform.

BTC-1.49%

動區BlockTempo·29m ago

Bitcoin dominance shifts! Crypto exchanges lose ground as ETFs become the new king with $5 billion in daily trading

Glassnode's latest report indicates that U.S. spot ETFs account for over 5% of Bitcoin's cumulative net inflows, making institutional investors a new source of demand. The daily trading volume of Bitcoin ETFs has grown from $1 billion at launch to consistently over $5 billion, and even exceeding $9 billion during periods of heightened volatility. Twelve funds now hold about 1.36 million Bitcoins, which is nearly 7% of the circulating supply.

BTC-1.49%

MarketWhisper·33m ago

Reader Submission: Why Did MSCI Have to Take Action? Strategy Is Shaking the Index System

Morgan Stanley's MSCI index is considering removing MicroStrategy due to a conflict with the nature of the company's underlying assets. This article is a reader submission, authored by Taylor Chan. (Previously: MicroStrategy bitcoin reserves hit the brakes? Unlimited accumulation turns into cash hoarding—should retail investors flee?) (Background: ) MSCI (Morgan Stanley Capital International) is a global "index and classification standard provider" responsible for determining which companies are included in stock indices, thereby influencing the flow of trillions of dollars in global passive fund investments. Approximately $16 trillion in assets worldwide track various MSCI indices, with the vast majority of these funds coming from national pension plans, government sovereign funds, university endowments, and large institutions.

BTC-1.49%

動區BlockTempo·34m ago

Bitcoin Has Broken Its Trendline, and Analysts Say Pepeto Is Now the Leading Crypto to Invest in ...

Bitcoin has recently broken its long-standing trendline, causing a stir in the crypto market. This shift has analysts buzzing about potential implications for investors.

Trendline analysis is a key tool in btc technical analysis. It helps investors predict future price movements and market

CaptainAltcoin·49m ago

Michael Saylor: If I could only leave one last message to the world, it would be: don't be afraid to doubt, don't be scared off by volatility, and think about how to use digital technology to change everything around you!

At the Binance Blockchain Week event, when asked, "What is the one thing you want to tell the world? Why is it always Bitcoin?" Michael Saylor gave a highly representative answer:

"Think about how to leverage digital technology to bring better value to your products, services, company, and investors. Don't be afraid of new things, and don't be scared by volatility—because volatility means it's strong, dynamic, and it's the most useful thing in the entire capital market."

"This may be the most extraordinary force of our lifetime."

BTC-1.49%

PANews·1h ago

Trading Moment: Expectations Rise for RMB to "Break 7", Bitcoin Needs to Break 96,000 to Confirm Trend Reversal

Daily Market Key Data Review and Trend Analysis, produced by PANews.

1. Market Observation

The U.S. labor market has recently shown conflicting signals. Last week, initial jobless claims unexpectedly fell to 191,000, the lowest since last September, indicating resilience in the job market; however, continuing claims remain at a high level of 1.94 million, reflecting structural challenges for the unemployed to find new jobs. Against this backdrop, the market's expectation for a Fed rate cut at the December 10 meeting has risen to 87%. National Economic Council Director Kevin Hassett predicts the Fed may cut rates by 25 basis points. In addition, the Federal Reserve's quantitative tightening policy has ended, and the market expects the launch of a "reserve management purchase" plan as early as January next year, buying about $35 billion per month to supplement liquidity. Although officials emphasize that this is not a new round of quantitative easing, investors still see it as a dovish signal. Meanwhile, the U.S. Treasury market regu

PANews·1h ago

Data: Bitcoin spot ETFs had a total net outflow of $195 million yesterday, with none of the twelve ETFs recording a net inflow.

According to Mars Finance, based on SoSoValue data, the total net outflow from Bitcoin spot ETFs yesterday (Eastern US time, December 4) was $195 million. The Bitcoin spot ETF with the highest single-day net outflow yesterday was BlackRock ((Blackrock) ETF IBIT, with a single-day net outflow of $113 million. Currently, IBIT's historical total net inflow has reached $62.55 billion. Next is Fidelity ((Fidelity) ETF FBTC, with a single-day net outflow of $54.2048 million. Currently, FBTC's historical total net inflow has reached $12.063 billion. As of press time, the total net asset value of Bitcoin spot ETFs is $120.682 billion, and the ETF net asset ratio (market value as a percentage of Bitcoin's total market value) has reached 6.54%. The historical cumulative net inflow

BTC-1.49%

MarsBitNews·1h ago

Peter Schiff’s “Bitcoin Only Redistributes Wealth” Claim Falls Apart Under Scrutiny

During a heated December 2025 debate with Changpeng Zhao (CZ), gold advocate Peter Schiff repeated his long-standing argument that Bitcoin creates no real wealth and merely redistributes existing wealth from late buyers to early sellers, like a giant zero-sum game or Ponzi scheme.

BTC-1.49%

CryptoPulseElite·2h ago

Over $4 Billion in BTC and ETH Options Expire Worthless: Traders Are Quietly Betting on a Massive 2026 Comeback

December 5, 2025, saw one of the quietest yet most revealing options expiry events of the year: more than $4 billion in notional value across Bitcoin and Ethereum contracts rolled off the board worthless as traders refused to chase short-term upside and instead rotated aggressively into mid-2026 calls.

CryptoPulseElite·2h ago

November Profit Crisis Forces 70% of Top Bitcoin Miners into $20B AI Pivot

November 2025 delivered one of the harshest profitability squeezes in Bitcoin mining history, with hashprice collapsing below $35 per petahash and all-in sustaining costs for many operators now exceeding $80,000 per BTC.

BTC-1.49%

CryptoPulseElite·2h ago

MicroStrategy’s $1.4 Billion Reserves Brace for Bear Market! CryptoQuant: Bitcoin Could Drop to $55,000 Next Year

MicroStrategy announced the establishment of a $1.44 billion reserve fund to pay for preferred stock dividends and debt interest over the next 12 to 24 months, drawing widespread market attention and bearish expectations. On-chain analytics firm CryptoQuant noted that this move shows MicroStrategy is preparing in advance to cope with a potential Bitcoin bear market. If the bearish trend continues, Bitcoin prices may fluctuate between $55,000 and $70,000 next year.

MarketWhisper·2h ago

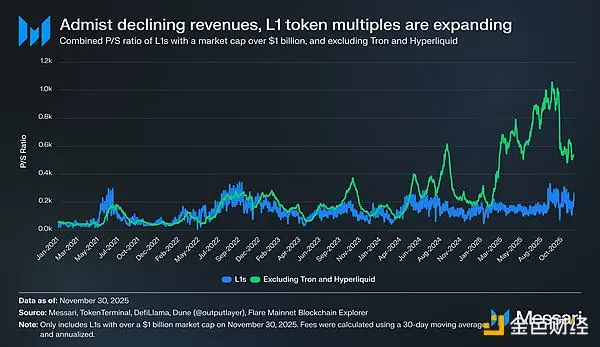

Can L1 tokens compete with Bitcoin in the cryptocurrency space?

Author: AJC, Research Manager at Messari; Source: X, @AvgJoesCrypto; Translated by: Shaw, Jinse Finance

Cryptocurrency Drives Industry Development

Refocusing on cryptocurrency is crucial because it remains the ultimate target where most of the industry’s capital is trying to invest. The total market capitalization of cryptocurrencies has reached $3.26 trillion. Of this, Bitcoin accounts for $1.80 trillion, or 55%. Of the remaining $1.45 trillion, about $0.83 trillion is concentrated in other Layer-1 protocol (L1) tokens. In total, approximately $2.63 trillion (about 81% of all crypto capital) is allocated to assets that the market already considers money or believes may acquire a monetary premium.

Given this, whether you are a trader, investor, capital allocator, or developer, it is critical to understand how the market allocates and withdraws monetary premiums. In the cryptocurrency sector,

金色财经_·2h ago

XRP Price Prediction: XRP ETF Attracts Nearly $1 Billion, So Why Has the Token Price Fallen Into the "Fear Zone"?

Within less than a month of its launch, the US spot XRP ETF has rapidly approached $1 billion in assets under management (AUM), with cumulative net inflows reaching $881.25 million and no single-day outflows recorded, making it one of the fastest-growing crypto investment products. However, in stark contrast to the robust institutional inflows, the market price of XRP continues to face downward pressure, currently trading near $2.09, down approximately 31% over the past two months. According to market analytics platform Santiment, social sentiment surrounding XRP has sharply turned negative, entering the "fear zone." This is similar to the scenario at the end of November when sentiment hit bottom and then rebounded by 22%, suggesting the market may be approaching a sentiment-driven turning point.

MarketWhisper·3h ago

YouTube King MrBeast Targets Finance: Cryptocurrency Exchanges May Become the Next Prey in His Business Empire

MrBeast (real name Jimmy Donaldson), the world's most-subscribed YouTube superstar, is expanding his vast business empire into the heart of fintech. The CEO of his holding company, Beast Industries, recently confirmed the launch of a financial services platform called "MrBeast Financial" and a mobile phone company called Beast Mobile. According to trademark application documents that have surfaced, the financial platform's scope of business clearly includes "cryptocurrency exchange" services. With revenues exceeding $400 million last year, Beast Industries is no longer satisfied with just content and consumer products, and is now seeking to leverage its massive influence over Gen Z to become a gateway to next-generation financial and digital asset services.

BTC-1.49%

MarketWhisper·3h ago

Central Banks' Gold Hoarding Trend Spreads: Is Bitcoin Becoming the Next National Strategic Reserve Asset?

Central banks around the world are stockpiling gold at an unprecedented pace, with net purchases reaching 53 tons in October 2025 alone—a new annual high. Poland, Brazil, and other countries are the main buyers. Meanwhile, Bitcoin is transitioning from a fringe asset to the national reserve stage: the United States, under executive order, has designated approximately 200,000 Bitcoins (worth about $17 billion) as a strategic national reserve asset; Texas has taken the lead by purchasing $10 million worth of Bitcoin as part of its state treasury reserves. This trend of reserve diversification, extending from traditional gold to digital gold, may be reshaping the global financial power structure for the coming decades.

BTC-1.49%

MarketWhisper·3h ago

The UK Registers Digital Assets: Why Is This Step So Significant?

While major economies around the world are still debating how to regulate cryptocurrencies, the UK has quietly made a key institutional move.

On December 3 local time, John McFall, Speaker of the House of Lords, officially announced that the “Property (Digital Assets, etc.) Act” had been approved. This means that, with the assent of King Charles, the bill has officially become law. From now on, under the legal framework of England and Wales, cryptocurrencies, stablecoins, and other digital assets are clearly recognized as a form of property.

A Key Leap from “Case Law Recognition” to “Codification”

This legislation is not created out of thin air, but is a confirmation and elevation of existing judicial practice. Previously, UK case law had already established the principle that digital assets constitute property through several court rulings. However, such case-by-case recognition has always lacked the clarity and stability of written law.

The core of this act is to incorporate the recommendations of the UK Law Commission in 2

BTC-1.49%

PANews·3h ago

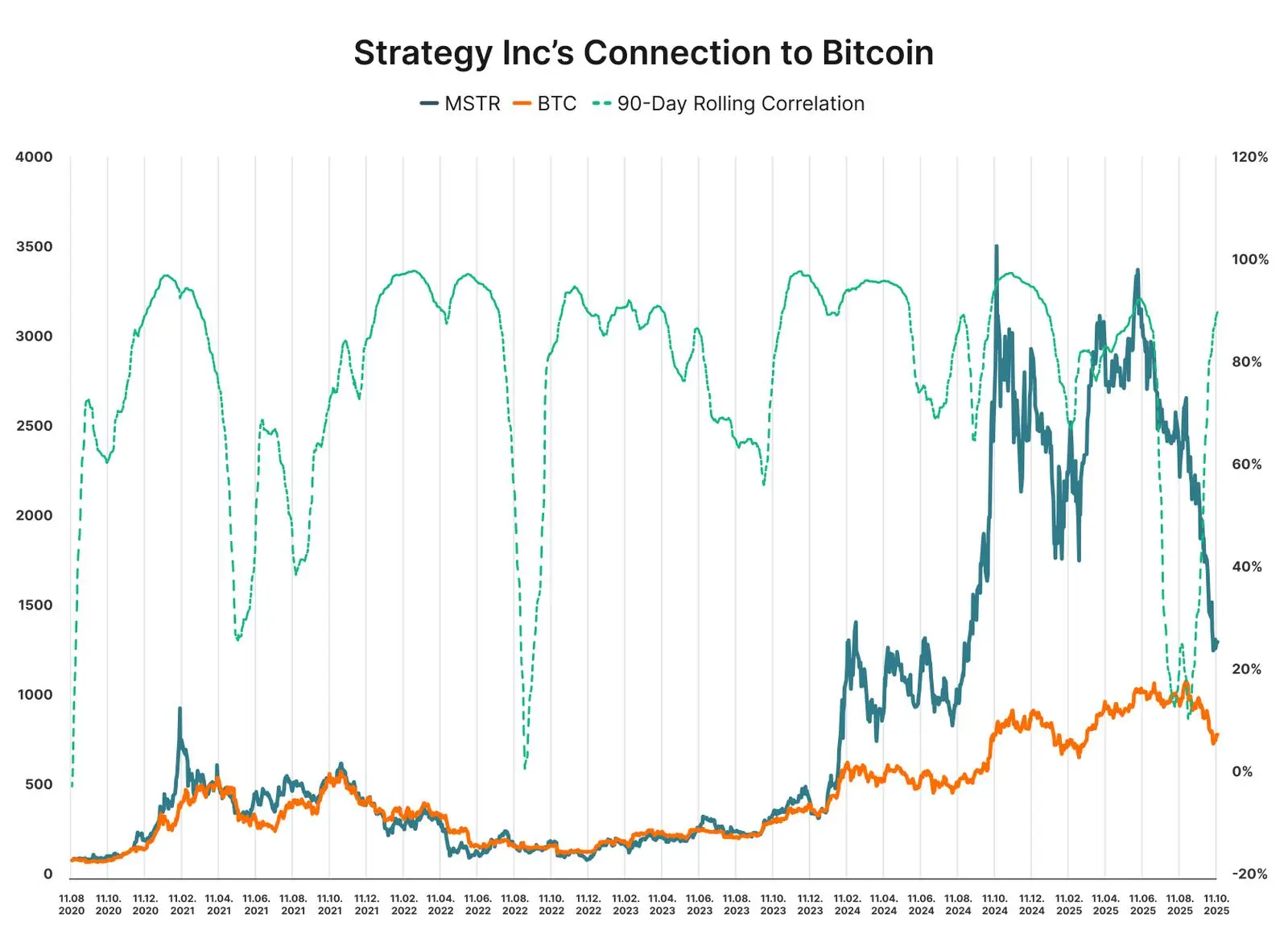

Who are the members of Strategy's "mysterious group of shareholders"?

Despite the significant decline in Strategy's stock price, its shareholder structure still reflects support from long-term capital, including many well-known institutional investors. The proportion of institutional holdings continues to grow, with the number of institutions increasing their positions being twice that of those reducing, indicating that market confidence remains and a rebound is expected in the future.

BTC-1.49%

MarsBitNews·4h ago

Life-and-Death Transformation in Bitcoin Mining: 70% of Leading Mining Companies Shift from "Mining Coins" to "Mining Computing Power," Hundreds of Billions in Capital Flow into AI

In November 2025, the Bitcoin mining industry faced a historic profitability crisis. The network-wide hashprice fell below $35 per petahash, while production costs rose to $44.8, resulting in an average miner payback period exceeding 1,200 days. In this life-or-death moment, the industry underwent dramatic changes: 70% of leading publicly listed mining companies began generating revenue from artificial intelligence infrastructure, raising over $6.6 billion in funding and signing GPU procurement contracts worth $15.5 billion. Meanwhile, miners led by Marathon Digital (MARA) were accumulating Bitcoin against the trend, with holdings valued at $5.6 billion. This signals Bitcoin mining’s transformation from a single-purpose energy consumer into a comprehensive high-performance computing service provider.

MarketWhisper·5h ago

CZ and Peter Schiff Debate Kicks Off: Who Will Lead the Future, Bitcoin or Gold?

On the main stage of Binance Blockchain Week 2025, a long-anticipated clash of ideas unfolded as scheduled. CZ and renowned economist and gold bull Peter Schiff engaged in a direct debate on the topic: “Bitcoin vs. Tokenized Gold—which is the better sound money?” CZ defended Bitcoin from the angles of verifiability, digital native utility, and provable scarcity, while Schiff argued that gold’s physical value and historical trust are irreplaceable, with tokenization merely representing its evolutionary form. This debate went far beyond a mere exchange of personal views; it profoundly revealed the core contradiction between traditional stores of value and digital native assets as they vie for influence over the future of finance, and provided investors with a clear framework to understand the fundamental differences between the two asset classes.

BTC-1.49%

MarketWhisper·5h ago

XRP News Today: $2 Psychological Support in Jeopardy—Can ETF Inflows Turn the Tide?

On December 4, XRP pulled back more than 4.5% after failing to break through the $2.20 resistance, closing at $2.097 and falling below the key 50-day and 200-day moving averages. However, there are positive signals from the fundamentals: the US spot XRP ETF has seen net inflows for 13 consecutive trading days, with the cumulative total approaching $900 million. Market analysis platform Santiment pointed out that current FUD (fear, uncertainty, doubt) sentiment around XRP has reached its highest level since October, similar to the situation after November 21, when a 22% rebound followed. Although the short-term technical outlook is weak, strong ETF demand and the potential “decoupling from Bitcoin” narrative are laying a bullish foundation for XRP in the mid to long term.

MarketWhisper·5h ago

Bitunix Analyst: Market Tightens Before PCE Release, BTC 90K Zone Becomes the Battleground for Bulls and Bears

On December 5, the US will release September PCE inflation data, with the core PCE annual growth rate expected to be around 2.8%. If the data comes in below expectations, it will be favorable for the US dollar and risk assets; if it exceeds expectations, it may increase pressure for a rate cut. Market sentiment remains cautious, and the crypto market continues to fluctuate, with BTC hovering around $92,000. Before the data release, market volatility has decreased, with BTC mainly fluctuating between the $91,000 to $95,000 range.

BTC-1.49%

MarsBitNews·5h ago

The strategy is more important than miners for Bitcoin's price: JPMorgan

According to JPMorgan analysts, the "resilience" of Strategy plays a key role in Bitcoin's short-term price movements, even more important than the increased selling pressure from miners — even though Strategy, the world's largest bitcoin holder, has yet to sell any coins.

In a Wednesday report, the analysis team...

BTC-1.49%

TapChiBitcoin·5h ago

ChatGPT 2025 Prediction: XRP Aims for $15, Bitcoin to Challenge $230,000 by Year-End?

The latest version of ChatGPT has released data-driven price predictions for XRP, Bitcoin, and Solana through the end of 2025, warning that the market may experience significant volatility in the coming month. The AI outlines sharply contrasting dual-track scenarios for these three major assets: in an optimistic case, XRP could soar to $15, Bitcoin might aim for $230,000, and Solana’s bullish target could reach as high as $1,200. These forecasts are based on current market data, technical indicators, and the macroeconomic context. However, analysts caution that AI models cannot fully capture black swan events related to market sentiment, so investors should view these as scenarios for bullish and bearish speculation rather than definitive guides.

MarketWhisper·5h ago

JPMorgan: MicroStrategy's Bitcoin holding ratio is "safe," concept stocks more resilient than miners

A report issued by the JPMorgan analyst team led by Nikolaos Panigirtzoglou pointed out that the balance sheet resilience of MicroStrategy (MSTR), a leading Bitcoin concept stock, has a greater influence on Bitcoin's recent price trends than selling pressure from miners. The ratio of MicroStrategy's enterprise value to its Bitcoin holdings is currently 1.13, still above the safety threshold of 1.0, indicating that the company is unlikely to face pressure to sell Bitcoin to pay dividends or interest.

MarketWhisper·5h ago

Larry Fink Softens Crypto Stance: BlackRock CEO Admits Evolution on Bitcoin as IBIT Hits $70 Billion Milestone

In a candid admission at the New York Times DealBook Summit on December 3, 2025, BlackRock CEO Larry Fink declared that his views on cryptocurrencies have significantly evolved, marking a stark departure from his earlier skepticism.

BTC-1.49%

CryptoPulseElite·5h ago

Regulatory Breakthrough in the US: CFTC Approves Spot Crypto Trading on Futures Exchanges, Marking a Historic Moment and Opening a Legitimate Main Battlefield

The U.S. Commodity Futures Trading Commission (CFTC) announced on Thursday that it will allow spot cryptocurrency products to be listed and traded on futures exchanges registered with the agency. CFTC Acting Chair Caroline Pham called this a "historic moment," as it means spot crypto assets can be traded for the first time on "gold standard" exchanges with nearly a century of history, bringing U.S. investors the customer protections and market integrity they deserve. This move, driven by the Trump administration, is the latest development in regulators using their existing powers to delineate jurisdiction over the crypto sector. It marks a new stage in the mainstream U.S. financial system's acceptance of crypto assets and could reshape the global crypto trading landscape by guiding compliant capital back into the market.

MarketWhisper·6h ago

Charles Schwab to Launch Spot Bitcoin & Ethereum Trading in 2026: $12 Trillion Giant Enters Crypto

Charles Schwab, the largest U.S. brokerage with $12.1 trillion in client assets and 38 million active accounts, confirmed on December 3, 2025, that it will roll out direct spot Bitcoin (BTC) and Ethereum (ETH) trading directly inside its existing platform in the first half of 2026.

CryptoPulseElite·6h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Meetup

Helium will host the Helium House networking event on December 10 in Abu Dhabi, positioned as a prelude to the Solana Breakpoint conference scheduled for December 11–13. The one-day gathering will focus on professional networking, idea exchange and community discussions within the Helium ecosystem.

2025-12-09

Hayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27