置顶

Gate 广场创作者新春激励正式开启,发帖解锁 $60,000 豪华奖池

如何参与:

报名活动表单:https://www.gate.com/questionnaire/7315

使用广场任意发帖小工具,搭配文字发布内容即可

丰厚奖励一览:

发帖即可可瓜分 $25,000 奖池

10 位幸运用户:获得 1 GT + Gate 鸭舌帽

Top 发帖奖励:发帖与互动越多,排名越高,赢取 Gate 新年周边、Gate 双肩包等好礼

新手专属福利:首帖即得 $50 奖励,继续发帖还能瓜分 $10,000 新手奖池

活动时间:2026 年 1 月 8 日 16:00 – 1 月 26 日 24:00(UTC+8)

详情:https://www.gate.com/announcements/article/49112来Gate广场发帖分享你的GateAI 使用感受,赢丰厚奖励!

🎁 精选10 位幸运用户,每人奖励 $10 仓位体验券!

📌 如何参与?

1️⃣ 关注 Gate 广场_Official

2️⃣ 在广场发帖,带上话题 #我的GateAI使用体验,帖文需附上使用GateAI页面的截图

3️⃣ 创作内容表达使用感受、建议等不限

3️⃣ 帖子内容 不少于 30 字,且仅带本活动话题标签

GateAI上线详情:https://www.gate.com/announcements/article/49070

活动截止时间:2026/01/15 18:00(UTC+8)

快来广场分享你的 GateAI 使用感受吧 🚀每天看行情、刷大佬观点,却不发声?你的观点可能比你想的更有价值!

广场新人 & 回归福利进行中!首次发帖或久违回归,直接送你奖励!

每月 $20,000 奖金等你瓜分!

在广场带 #我在广场发首帖 发布首帖或回归帖即可领取 $50 仓位体验券

月度发帖王和互动王还将各获额外 50U 奖励

你的加密观点可能启发无数人,开始创作之旅吧!

👉️ https://www.gate.com/postGate 广场「创作者认证激励计划」优质创作者持续招募中!

立即加入,发布优质内容,参与活动即可瓜分月度 $10,000+ 创作奖励!

认证申请步骤:

1️⃣ 打开 App 首页底部【广场】 → 点击右上角头像进入个人主页

2️⃣ 点击头像右下角【申请认证】,提交申请等待审核

立即报名:https://www.gate.com/questionnaire/7159

豪华代币奖池、Gate 精美周边、流量曝光等超 $10,000 丰厚奖励等你拿!

活动详情:https://www.gate.com/announcements/article/47889Gate 2025 年终盛典|广场 TOP50 榜单正式公布!

冲榜关键期已开启,看直播、发帖即可获得助力值

30 助力值 = 1 票,快来为你喜爱的创作者投票

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max、京东 E 卡、小米手环、Gate 独家周边、仓位体验券等你赢!

内容达人也欢迎积极发帖拉票,冲榜赢取荣誉与奖励!

投票截止:1 月 20 日 10:00(UTC+8)

详情:https://www.gate.com/announcements/article/48693

Billionaire Michael Saylor Explains Why Bitcoin Will Be the 'Apex Commodity' in New Keynote – Here's What You Need to Know

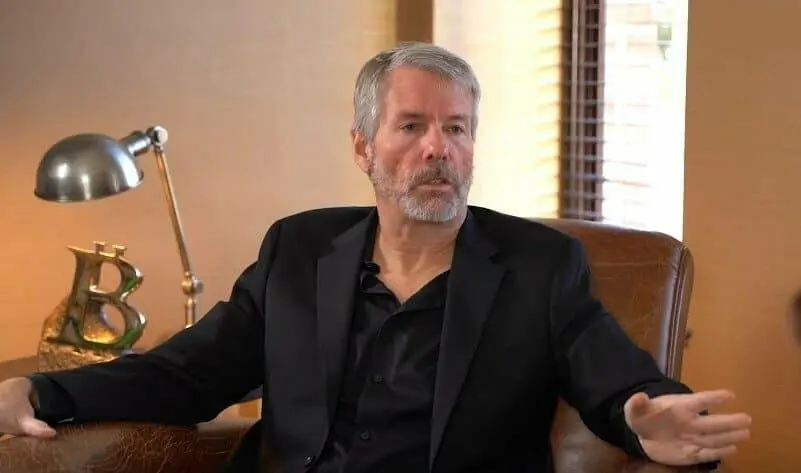

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. By using this website, you agree to our terms and conditions. We may utilise affiliate links within our content, and receive commission. Michael Saylor. Source: a video screenshot, Natalie Brunell / YouTubeMicroStrategy’s utive chairman Michael Saylor believes that Bitcoin (BTC) can still be 1000x from its current price of $41,500 – if given enough time.

Michael Saylor. Source: a video screenshot, Natalie Brunell / YouTubeMicroStrategy’s utive chairman Michael Saylor believes that Bitcoin (BTC) can still be 1000x from its current price of $41,500 – if given enough time.

In a keynote published to X on Monday, the billionaire explained how all major asset classes appreciate against the US dollar in perpetuity, and argued that BTC will appreciate faster than all others in the long run.

“Bitcoin is the world’s leading scarce, desirable, portable, durable, and maintainable asset,” said Saylor, adding that most investment strategies besides HODLing “don’t work.”

On one hand, the average investor earns 2.9% returns per year and outperforms the standard 2% consumer inflation rate. On the other, almost no major asset class is capable of outperforming the “real” monetary inflation rate – or rate of M2 money supply growth, of roughly 7-8% per year in the United States.

The S&P index, for example, has done little more than remain on par with the monetary inflation rate since 2001. Bitcoin, by comparison, lacks the former’s risk of asset duation due to companies issuing new shares, thus making it the “apex ETF” of the future.

Bitcoin’s fixed supply of 21 million coins also makes it the “apex commodity,” according to Saylor, since competitors like wheat, lumber, and oil can be produced by humans. Gold, Bitcoin’s largest competitor in that arena, still suffers from high transportation costs and fierce difficulty to audit.

As a form of property, real estate also suffers major disadvantages next to Bitcoin. Those include maintenance costs, zoning risks, immobility, and illiquidity, among other things.

Bitcoin may even capture the appeal of tech investors who would otherwise choose to buy top-performing stocks like Apple, Amazon, and Tesla. “Getting rid of all of the liability risk that comes with corporations is a big upgrade for Bitcoin,” Saylor said.

How Fast Can Bitcoin Go?

In Saylor’s view, while stocks continue to garner a 7% return year over year, Bitcoin will likely return 14% annually once it becomes a mature asset. He explained:

“Bitcoin not only does not have the risks and liabilities of company… but also Bitcoin has all the virtues of a pure crypto decentralized network.”

Over the next 20 years, however, the billionaire expects Bitcoin to grow at a much faster 21%+ per year, as people reallocate their wealth into BTC from alternative asset classes.

Based on Saylor’s calculations, he expects $1 million worth of Bitcoin today to reach $1 billion in real terms by the year 2123.

Saylor’s company MicroStrategy is famous for going all-in on BTC, having accumulated over 174,000 coins since 2020. Last month, the company bought $600 million worth of the digital currency using money raised through issuing new stock.

As of Monday, the company’s investment is up 37%, amounting to $2 billion in profit. MicroStrategy’s stock, MSTR, is up 288% year to date.

Saylor personally bought over 17,732 BTC in 2020 which, assuming he hasn’t sold, is now up 320%.