MrAsifAli

No content yet

MrAsifAli

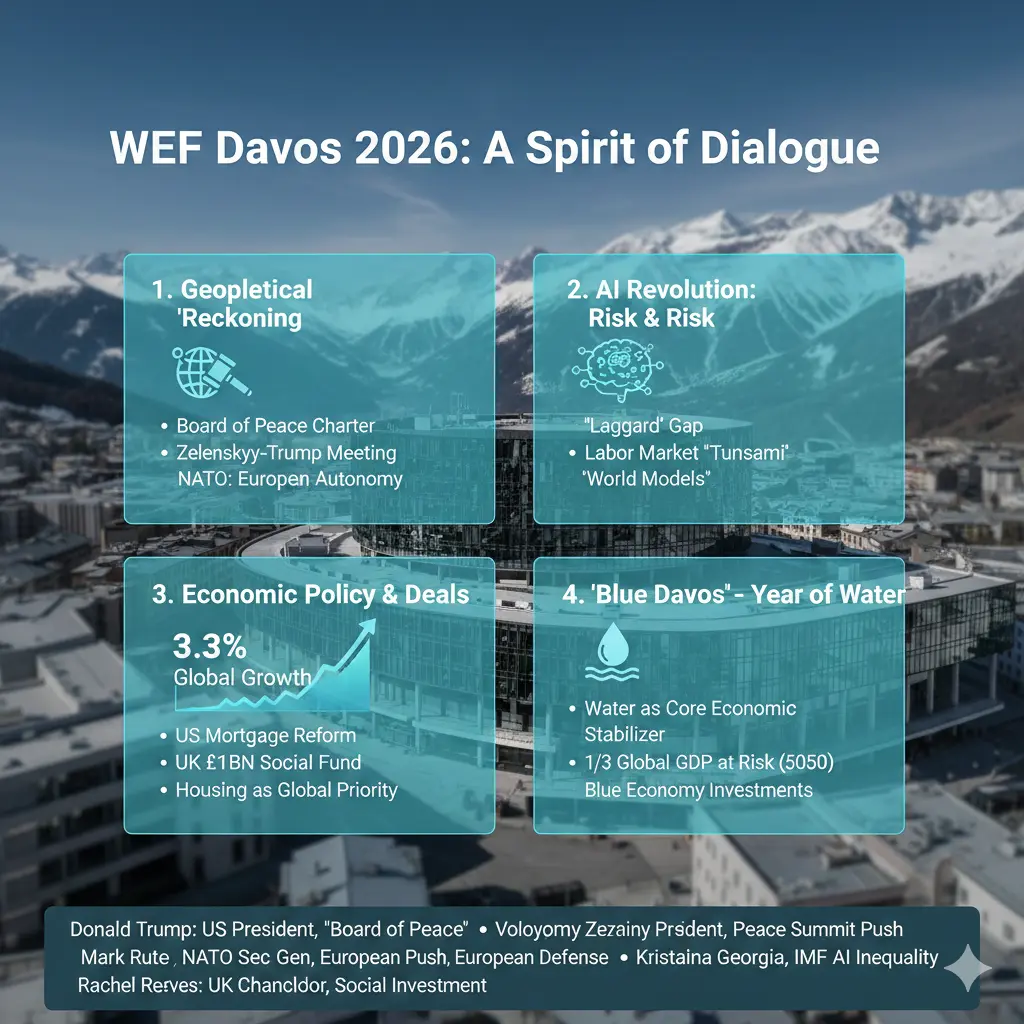

Friday, January 23, 2026, marks the finale of Davos 2026. The day centers on the "Global Economic Outlook" and the closing address by WEF President Børge Brende.

Key sessions include "Internet up for Grabs," debating the future of a fragmented digital world, and high-level panels on "Global Risks 2026." Expect final declarations from the newly formed Board of Peace and a wrap-up of the FIFA World Cup 2026 kick-off initiative. The meeting concludes at 11:15 CET, shifting focus to actionable 12-month goals for AI and climate.

The closing press conference of Davos 2026 is expected to focus on the

Key sessions include "Internet up for Grabs," debating the future of a fragmented digital world, and high-level panels on "Global Risks 2026." Expect final declarations from the newly formed Board of Peace and a wrap-up of the FIFA World Cup 2026 kick-off initiative. The meeting concludes at 11:15 CET, shifting focus to actionable 12-month goals for AI and climate.

The closing press conference of Davos 2026 is expected to focus on the

BTC-1.07%

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

The nomination of a new Fed Chair significantly impacts market liquidity and risk appetite. Here is how it affects the Crypto and Forex markets:

Impact on Forex (US Dollar)

USD Strength: The Dollar Index (DXY) recently recovered as the likelihood of a "dovish" (rate-cutting) nominee like Kevin Hassett decreased. A more hawkish Chair supports a stronger USD by keeping U.S. bond yields attractive to global investors.

Independence Risk: The biggest threat to the Forex market is the "independence discount." If the market believes the Fed is losing its independence to the White House, the USD could

Impact on Forex (US Dollar)

USD Strength: The Dollar Index (DXY) recently recovered as the likelihood of a "dovish" (rate-cutting) nominee like Kevin Hassett decreased. A more hawkish Chair supports a stronger USD by keeping U.S. bond yields attractive to global investors.

Independence Risk: The biggest threat to the Forex market is the "independence discount." If the market believes the Fed is losing its independence to the White House, the USD could

- Reward

- 2

- 3

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

The nomination of a new Fed Chair significantly impacts market liquidity and risk appetite. Here is how it affects the Crypto and Forex markets:

1. Impact on Crypto (Bitcoin & Altcoins)

The "Warsh Effect" (Neutral/Hawkish): As Kevin Warsh became the frontrunner, Bitcoin faced slight downward pressure (dipping toward $95,000). Warsh is viewed as more "hawkish" (favoring higher rates/tighter liquidity) than previous favorites, which typically reduces the appeal of high-risk assets like crypto.

Liquidity Sensitivity: Crypto prices thrive on cheap money. If the new Chair is perceived as a "puppet"

1. Impact on Crypto (Bitcoin & Altcoins)

The "Warsh Effect" (Neutral/Hawkish): As Kevin Warsh became the frontrunner, Bitcoin faced slight downward pressure (dipping toward $95,000). Warsh is viewed as more "hawkish" (favoring higher rates/tighter liquidity) than previous favorites, which typically reduces the appeal of high-risk assets like crypto.

Liquidity Sensitivity: Crypto prices thrive on cheap money. If the new Chair is perceived as a "puppet"

BTC-1.07%

- Reward

- 2

- 4

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

Solana (SOL) is currently trading around $124–$130, facing a "risk-off" market dip.

News: The SKR token airdrop for Seeker phone users is driving on-chain activity, while Spot ETF progress and the Alpenglow upgrade maintain long-term institutional interest.

Next Move: Likely sideways consolidation. A daily close above $135 signals a rally toward $146; losing $120 risks a slide to $110.

Buy Zone (Support): $122 – $126 (Strong demand)

Sell Zone (Resistance): $135 – $142 (Heavy supply)

#solana $SOL

News: The SKR token airdrop for Seeker phone users is driving on-chain activity, while Spot ETF progress and the Alpenglow upgrade maintain long-term institutional interest.

Next Move: Likely sideways consolidation. A daily close above $135 signals a rally toward $146; losing $120 risks a slide to $110.

Buy Zone (Support): $122 – $126 (Strong demand)

Sell Zone (Resistance): $135 – $142 (Heavy supply)

#solana $SOL

SOL-2.21%

- Reward

- 2

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Today, January 22, 2026, Bitcoin (BTC) is exhibiting a cautious recovery, currently trading around $90,000. After a period of "Extreme Fear" (Index at 20), price action has stabilized above the $88,000 support level. Technically, BTC is testing the 50-day moving average as resistance. While the long-term trend remains structurally bullish after reclaiming $90k, the short-term outlook is neutral-to-bearish as it struggles with a falling trend channel. A decisive daily close above $92,000 is needed to confirm a shift in momentum; otherwise, the market may see further consolidation or a sweep of

BTC-1.07%

- Reward

- 1

- 3

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

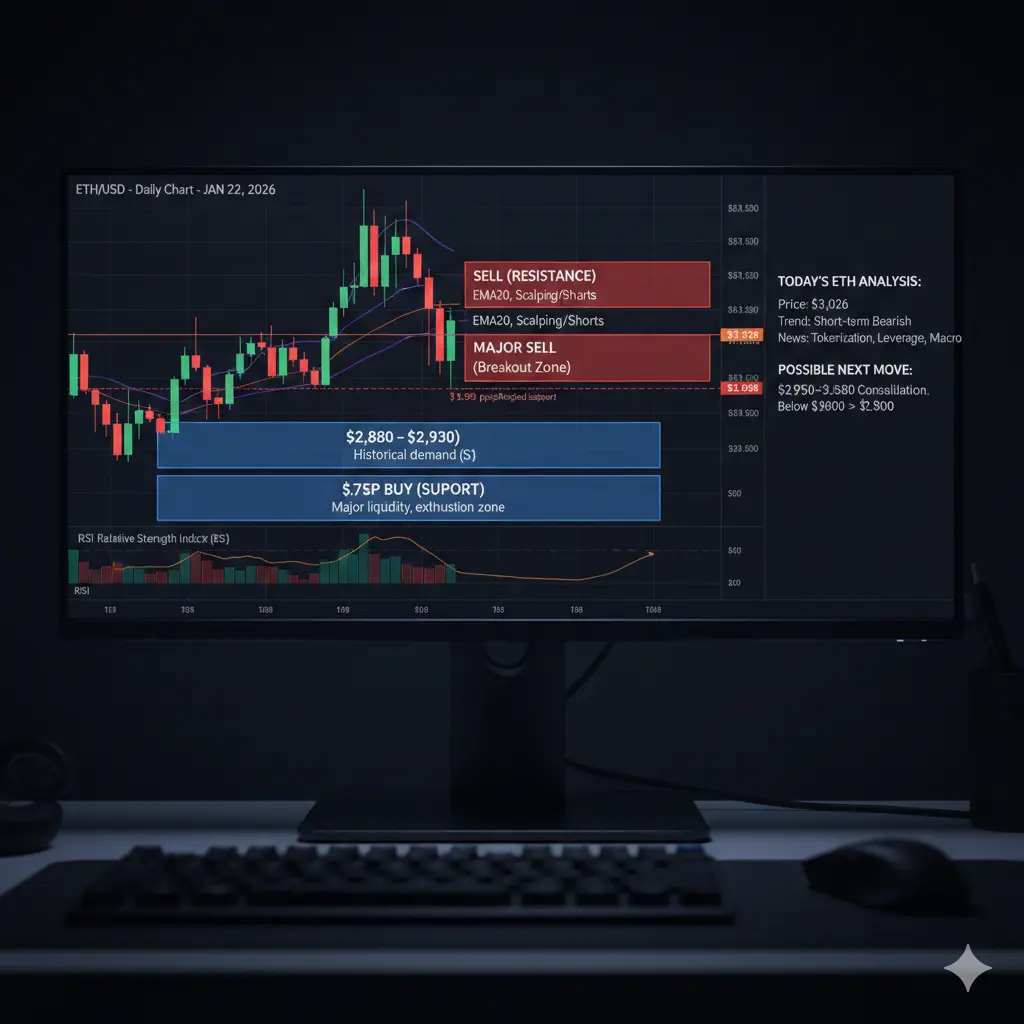

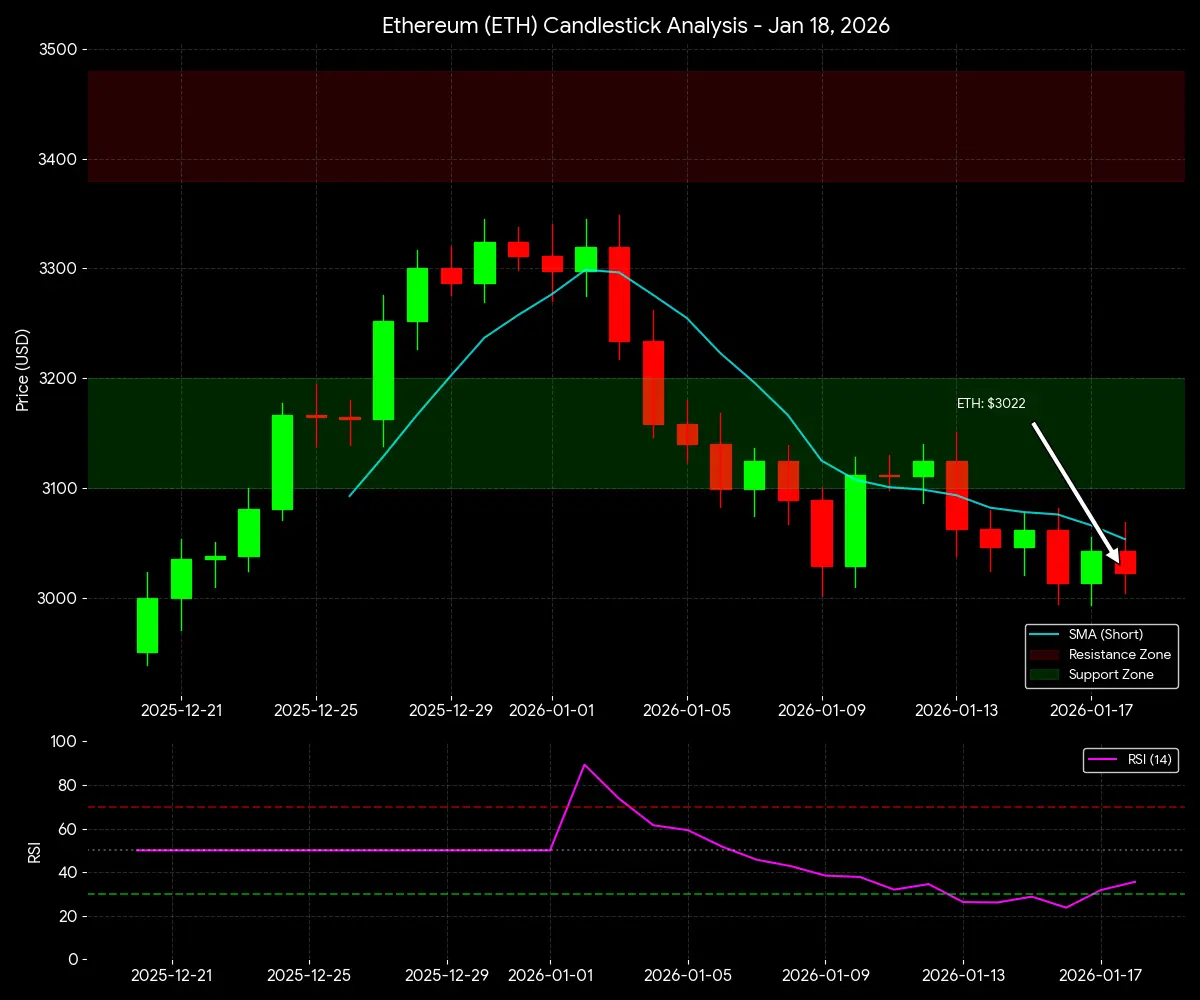

Today, January 22, 2026, Ethereum (ETH) is navigating a high-stakes moment. After breaking below the critical $3,000 psychological support yesterday, the coin is currently trading around $3,026, attempting a fragile recovery. The market structure is leaning bearish in the short term as ETH remains below its 50-day and 200-day moving averages. Traders are closely watching for a decisive daily close above $3,100 to invalidate the current breakdown. Failure to reclaim this level could lead to a deeper liquidity sweep toward December lows, though an oversold RSI on lower timeframes suggests a reli

ETH-2.75%

- Reward

- 1

- 2

- Repost

- Share

GateUser-678935d2 :

:

1000x Vibes 🤑View More

Digital Asset Evolution: The CLARITY Act & Crypto Reform

President Trump’s recent moves signal a shift toward aggressive economic populism and high-stakes diplomacy. By restricting corporations from buying houses, he aims to lower domestic living costs, though it risks cooling the real estate investment sector. His push for a comprehensive Crypto Bill seeks to cement the U.S. as a digital asset hub, despite friction with industry leaders like Coinbase over regulatory specifics. Meanwhile, the tariff threats against Switzerland and European allies (linked to the Greenland dispute) highlight a r

President Trump’s recent moves signal a shift toward aggressive economic populism and high-stakes diplomacy. By restricting corporations from buying houses, he aims to lower domestic living costs, though it risks cooling the real estate investment sector. His push for a comprehensive Crypto Bill seeks to cement the U.S. as a digital asset hub, despite friction with industry leaders like Coinbase over regulatory specifics. Meanwhile, the tariff threats against Switzerland and European allies (linked to the Greenland dispute) highlight a r

BTC-1.07%

- Reward

- like

- Comment

- Repost

- Share

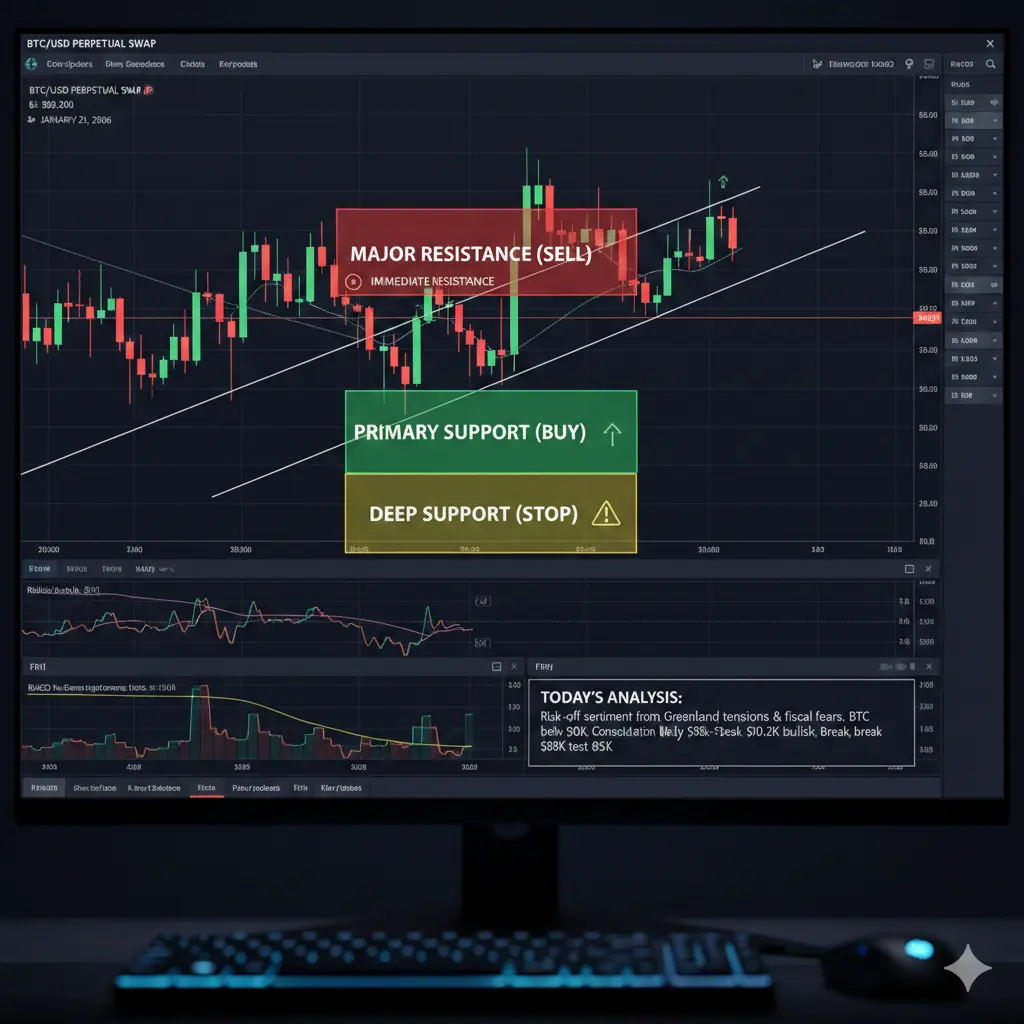

Today, January 21, 2026, Bitcoin (BTC) is experiencing significant selling pressure, currently trading around $89,200. The market is reacting to a "risk-off" sentiment triggered by renewed geopolitical tensions in Greenland and fiscal concerns following a recent government shutdown recovery. BTC has slipped below the psychological $90,000 level, marking its sixth consecutive day of losses—the longest streak since 2024. While long-term institutional support remains through entities like Strategy Inc. (MSTR), the short-term outlook is cautious as traders wait for stability. If $88,000 fails to h

BTC-1.07%

- Reward

- like

- Comment

- Repost

- Share

Today, Ethereum (ETH) is facing significant bearish pressure, dropping roughly 5-7% to trade near $2,910 – $2,936. This sharp decline marks a breakdown from the $3,000 psychological level, largely triggered by a broader "risk-off" sentiment in global markets and rising US Treasury yields. On-chain data reveals massive leveraged liquidations and nearly $713 million in outflows from Bitcoin and Ethereum ETFs, signaling a cooling of institutional appetite. Technically, ETH is showing a "Death Cross" (50-day moving average crossing below the 200-day), suggesting that sellers are currently in contr

ETH-2.75%

- Reward

- like

- Comment

- Repost

- Share

Today, January 19, 2026, Ethereum (ETH) is navigating a period of high volatility, currently trading around $3,212. Despite a recent 3% pullback, the underlying structure remains cautiously bullish. The network is seeing record-breaking activity, with daily transactions hitting all-time highs and massive institutional inflows ($12.9B cumulative net inflows into ETFs). However, this growth is currently clashing with broader macro-uncertainty, causing a "risk-off" sentiment across the crypto market. Traders are watching for a consolidation phase before a potential push toward the $3,400 resistan

ETH-2.75%

- Reward

- like

- Comment

- Repost

- Share

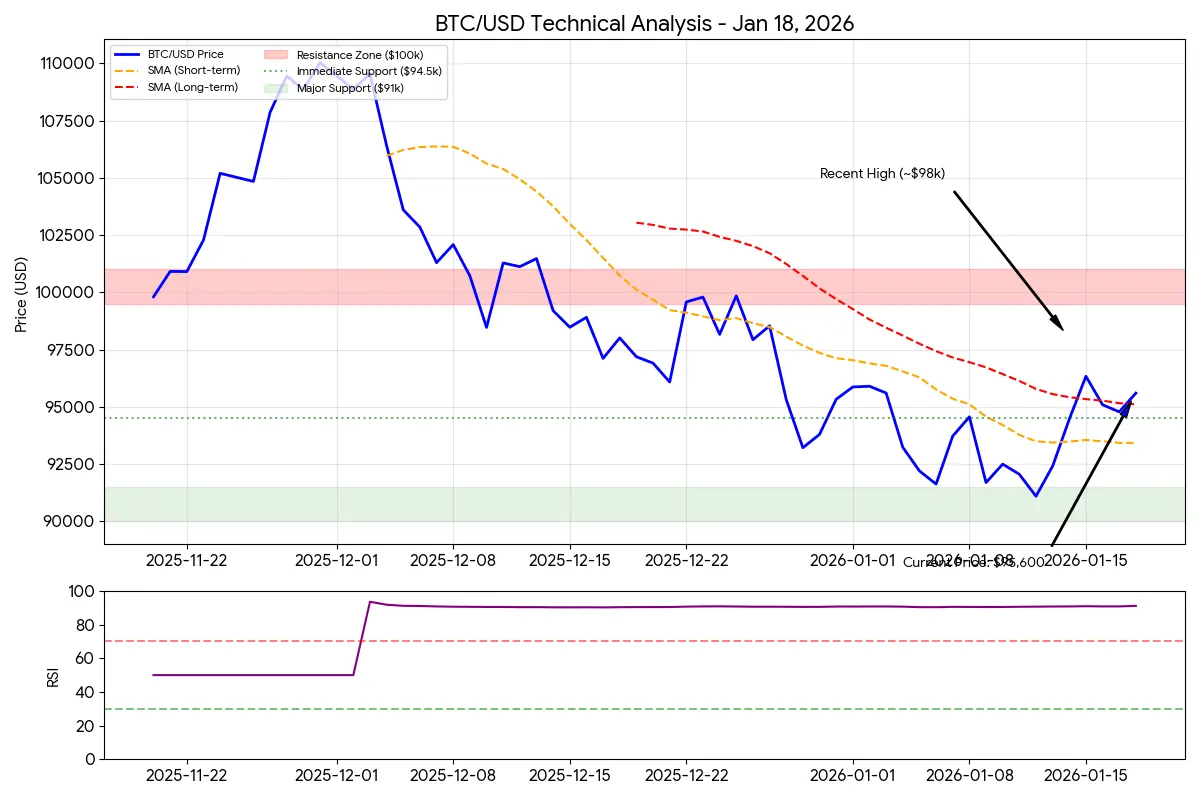

Today, January 19, 2026, Bitcoin (BTC) is experiencing a sharp pullback, trading around $92,500 after dropping nearly 3% in 24 hours. This follows a high of $95,467 earlier today. Market sentiment has turned "risk-off" as over $870 million in long positions were liquidated in just four hours. While some analysts maintain a bullish outlook toward $100,000, others warn that a break below the 50-week moving average could trigger a slide toward the $67,000–$74,000 range. The current phase is defined by high volatility and institutional caution amid shifting global trade dynamics.

Today’s Key News

Today’s Key News

BTC-1.07%

- Reward

- like

- Comment

- 1

- Share

Today, January 18, 2026, Solana (SOL) is trading between $142 and $144, experiencing a slight intraday dip of around 1.1%. Despite this minor cooling, the token maintains a bullish weekly posture, having gained nearly 4% recently. Technical indicators show SOL battling a "glass ceiling" resistance at $145.81. While the RSI remains neutral, suggesting room for growth, a bearish MACD signal indicates that short-term momentum is currently flat. The market is largely consolidating as traders wait for a decisive breakout above the $150 level to confirm a new uptrend.

Possible Next Move

Bullish Case

Possible Next Move

Bullish Case

SOL-2.21%

- Reward

- like

- Comment

- Repost

- Share

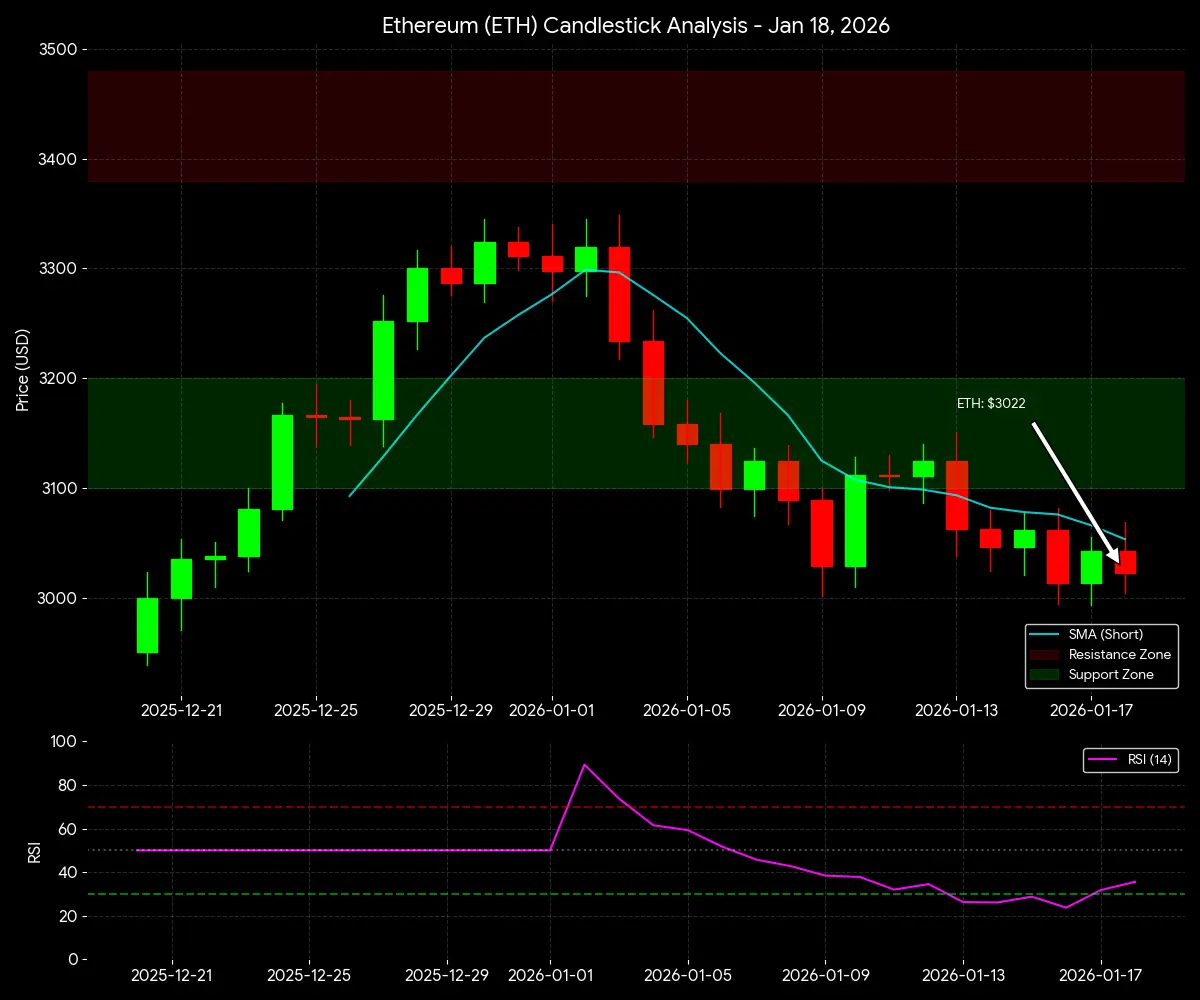

As of January 18, 2026, Ethereum (ETH) is exhibiting a steady consolidation pattern with a slight bullish bias, trading near the $3,320 range ($928,305 PKR). Over the last 24 hours, the price has fluctuated within a narrow 0.6% band, indicating that bulls are successfully defending immediate support levels. Trading volume remains moderate, suggesting a period of "calm before the storm" as the market awaits a clear breakout signal. Technically, ETH is holding above its 50-day moving average, which currently acts as a psychological floor for short-term traders.

The Next Possible Move

Bullish Sce

The Next Possible Move

Bullish Sce

ETH-2.75%

- Reward

- like

- Comment

- Repost

- Share

As of January 18, 2026, Bitcoin is exhibiting a cautiously bullish recovery, currently trading around $95,600. After a sluggish 2025, BTC recently hit a three-month high of nearly $98,000, supported by massive spot ETF inflows (notably $351M into Fidelity's FBTC in a single day) and lower-than-expected US inflation data. Technically, it is forming a "higher high" structure, though it faces stiff psychological resistance at the $100,000 mark. Market sentiment has stabilized into "Neutral" territory with a Fear & Greed Index score of 50, reflecting a maturing balance between institutional demand

BTC-1.07%

- Reward

- 1

- Comment

- Repost

- Share

Smooth Love Potion (SLP) is showing signs of a potential recovery, trading around $0.0010 with a recent 20% surge in volume. While it remains down significantly from its all-time high, decreasing exchange supply suggests holders are moving tokens to private wallets, reducing immediate selling pressure.

Possible Next Move

Technical indicators show a bullish divergence on the daily chart, suggesting a price reversal might be starting. If SLP can hold above the $0.00085 support level, it may attempt to break resistance at $0.0012. However, a failure to sustain this momentum could lead to further

Possible Next Move

Technical indicators show a bullish divergence on the daily chart, suggesting a price reversal might be starting. If SLP can hold above the $0.00085 support level, it may attempt to break resistance at $0.0012. However, a failure to sustain this momentum could lead to further

SLP-3.41%

- Reward

- 1

- Comment

- Repost

- Share

Today, January 17, 2026, Solana (SOL) is showing resilient performance despite a slightly volatile weekend environment. It is currently acting as a leader among major Layer 1 (L1) assets, outperforming both Bitcoin and Ethereum in monthly gains.

Short Analysis & Current Status

Current Price: Approximately $144.20 – $144.80 (hovering near a 0.3% to 1% daily gain).

Market Position: Ranked #6 by market cap (~$81.5B).

Trend: The short-to-medium term trend is bullish. After months of trading in a descending channel, SOL has broken out and is now establishing a pattern of higher lows.

Key Levels: *

Short Analysis & Current Status

Current Price: Approximately $144.20 – $144.80 (hovering near a 0.3% to 1% daily gain).

Market Position: Ranked #6 by market cap (~$81.5B).

Trend: The short-to-medium term trend is bullish. After months of trading in a descending channel, SOL has broken out and is now establishing a pattern of higher lows.

Key Levels: *

- Reward

- like

- Comment

- Repost

- Share

As of January 17, 2026, Bitcoin (BTC) is exhibiting a cautious consolidation phase, trading at approximately $95,520. After a modest weekly recovery of over 5%, the price is currently holding above the immediate support level of $95,000. While market sentiment remains "Neutral" (Fear & Greed Index at 50), Bitcoin continues to dominate the crypto space with a 57.5% market share. Investors are currently watching a tight range, with high institutional holding providing a price floor despite minor daily dips.

Possible Next Move

The short-term technical outlook suggests sideways movement between $9

Possible Next Move

The short-term technical outlook suggests sideways movement between $9

BTC-1.07%

- Reward

- like

- Comment

- Repost

- Share

Today, January 16, 2026, DUSK is trading around $0.065–$0.071, holding onto a massive +47% monthly gain despite a recent 17% "shakeout" correction.

Next Move: The price is currently consolidating above the 200 EMA. A decisive breakout above $0.072 targets $0.085–$0.10. Conversely, failing to hold $0.063 could lead to a retest of the $0.058 support.

Key News:

Mainnet Launch: Q1 2026 activation of the DuskEVM is the primary bullish driver.

RWA Expansion: Progress on the €300M NPEX securities tokenization project validates its utility.

Regulatory Edge: Growing institutional interest (projected 70

Next Move: The price is currently consolidating above the 200 EMA. A decisive breakout above $0.072 targets $0.085–$0.10. Conversely, failing to hold $0.063 could lead to a retest of the $0.058 support.

Key News:

Mainnet Launch: Q1 2026 activation of the DuskEVM is the primary bullish driver.

RWA Expansion: Progress on the €300M NPEX securities tokenization project validates its utility.

Regulatory Edge: Growing institutional interest (projected 70

DUSK-20.31%

- Reward

- like

- Comment

- Repost

- Share

KBC Group is set to become Belgium’s first bank to offer retail crypto trading, launching Bitcoin and Ethereum services via its Bolero platform in mid-February 2026. Operating under the EU's MiCA framework, the bank utilizes a secure "closed-loop" model, preventing external transfers to mitigate fraud. This move marks a major milestone in integrating digital assets into mainstream European banking.

Bitcoin (BTC) and Ethereum (ETH) are the primary coins affected, as KBC is officially launching trading for these two.

Broadly, the news impacts the European market for major altcoins and regulated

Bitcoin (BTC) and Ethereum (ETH) are the primary coins affected, as KBC is officially launching trading for these two.

Broadly, the news impacts the European market for major altcoins and regulated

BTC-1.07%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More23.49K Popularity

6.01K Popularity

2.14K Popularity

1.52K Popularity

1.9K Popularity

Pin

Gate ELSA Futures Trading Challenge is Now Live!

Share a 200,000 USDT Prize Pool

💰 Get 20 USDT for your first futures trade

🏆 Trade to share 160,000 USDT!

join now: https://www.gate.com/campaigns/3911

Announcement link: https://www.gate.com/announcements/article/49432

#ELSA #FuturesTrading #GateStrike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889