# NonfarmPayrollsComing

271.25K

The first U.S. nonfarm payroll report of 2026 is out tonight, with 60K jobs expected. It could shape Fed rate-cut expectations and short-term BTC moves, as BTC consolidates near $90.5K. Will this data decide BTC’s next direction?

CryptoSeth

Buenos días, familia ☘️

Las nóminas no agrícolas y la tasa de desempleo en 4h aumentarán la volatilidad. Se espera que la tasa de desempleo suba al 4.5% desde el 4.4%.

Ver originalesLas nóminas no agrícolas y la tasa de desempleo en 4h aumentarán la volatilidad. Se espera que la tasa de desempleo suba al 4.5% desde el 4.4%.

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

#NonfarmPayrollsComing #NonfarmPayrollsComing

#NonfarmPayrollsComing #NonfarmPayrollsComing

El informe de Nóminas No Agrícolas (NFP) es un indicador económico crucial en EE. UU., que detalla el número de empleos añadidos o perdidos, excluyendo sectores como trabajadores agrícolas y empleados gubernamentales. Este informe influye significativamente en el dólar estadounidense, las expectativas de tasas de interés y los mercados financieros globales.

Importancia del NFP:

Un crecimiento fuerte del empleo indica una economía robusta, lo que suele fortalecer el dólar estadounidense y probablemente

#NonfarmPayrollsComing #NonfarmPayrollsComing

El informe de Nóminas No Agrícolas (NFP) es un indicador económico crucial en EE. UU., que detalla el número de empleos añadidos o perdidos, excluyendo sectores como trabajadores agrícolas y empleados gubernamentales. Este informe influye significativamente en el dólar estadounidense, las expectativas de tasas de interés y los mercados financieros globales.

Importancia del NFP:

Un crecimiento fuerte del empleo indica una economía robusta, lo que suele fortalecer el dólar estadounidense y probablemente

BTC-2,19%

- Recompensa

- 3

- 3

- Republicar

- Compartir

Discovery :

:

Observando de cerca 🔍️Ver más

#NonfarmPayrollsComing #NonfarmPayrollsComing

#NonfarmPayrollsComing #NoFarmPayrollsPróximamente

El informe de Nóminas No Agrícolas (NFP) es un indicador económico crucial en EE. UU., que detalla el número de empleos añadidos o perdidos, excluyendo sectores como trabajadores agrícolas y empleados gubernamentales. Este informe influye significativamente en el dólar estadounidense, las expectativas de tasas de interés y los mercados financieros globales.

Importancia del NFP:

Un crecimiento fuerte del empleo indica una economía robusta, lo que suele fortalecer el dólar estadounidense y probablem

#NonfarmPayrollsComing #NoFarmPayrollsPróximamente

El informe de Nóminas No Agrícolas (NFP) es un indicador económico crucial en EE. UU., que detalla el número de empleos añadidos o perdidos, excluyendo sectores como trabajadores agrícolas y empleados gubernamentales. Este informe influye significativamente en el dólar estadounidense, las expectativas de tasas de interés y los mercados financieros globales.

Importancia del NFP:

Un crecimiento fuerte del empleo indica una economía robusta, lo que suele fortalecer el dólar estadounidense y probablem

BTC-2,19%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

#NonfarmPayrollsComing El informe de (NFP) de Nóminas No Agrícolas es uno de los indicadores económicos más observados en EE. UU. Mide el número de empleos añadidos o perdidos en la economía, excluyendo trabajadores agrícolas, empleados gubernamentales y algunos otros sectores. Los datos de NFP tienen un impacto importante en el dólar estadounidense, las expectativas de tasas de interés y los mercados globales, incluyendo las criptomonedas.

Por qué importa el NFP

Un crecimiento fuerte en el empleo indica una economía saludable. Esto suele fortalecer el dólar y aumentar las expectativas de tasa

Por qué importa el NFP

Un crecimiento fuerte en el empleo indica una economía saludable. Esto suele fortalecer el dólar y aumentar las expectativas de tasa

BTC-2,19%

- Recompensa

- 9

- 6

- Republicar

- Compartir

StylishKuri :

:

GOGOGO 2026 👊Ver más

#NonfarmPayrollsComing #Crypto2026Vision 🌐💹

Resiliencia en Ingeniería en la Era de Mercados Intencionales

El mercado de criptomonedas de 2026 ya no es un campo de juego para la especulación reflexiva o la búsqueda de hype. La velocidad y el espectáculo están pasados de moda. Lo que importa ahora es la estructura, la visión y la resistencia. Los mercados recompensan la comprensión de los sistemas, no solo reaccionar a ellos.

1️⃣ Convicción Analítica Sobre Respuesta Emocional

• Los impulsos especulativos—rotaciones apalancadas, narrativas falsas—se filtran sistemáticamente.

• El éxito favore

Ver originalesResiliencia en Ingeniería en la Era de Mercados Intencionales

El mercado de criptomonedas de 2026 ya no es un campo de juego para la especulación reflexiva o la búsqueda de hype. La velocidad y el espectáculo están pasados de moda. Lo que importa ahora es la estructura, la visión y la resistencia. Los mercados recompensan la comprensión de los sistemas, no solo reaccionar a ellos.

1️⃣ Convicción Analítica Sobre Respuesta Emocional

• Los impulsos especulativos—rotaciones apalancadas, narrativas falsas—se filtran sistemáticamente.

• El éxito favore

- Recompensa

- 8

- Comentar

- Republicar

- Compartir

#非农就业数据 | Nóminas no Agrícolas (NFP) Impacto en el Mercado

Los datos de Nóminas no Agrícolas de EE. UU. de hoy son un factor clave para la volatilidad del mercado. El NFP influye directamente en las expectativas sobre las tasas de interés, la fortaleza del USD y el sentimiento general de riesgo, lo que lo hace muy importante para los traders de criptomonedas.

NFP mejor de lo esperado:

Señala un mercado laboral fuerte → expectativas de tasas más altas → presión sobre activos de riesgo como las criptomonedas.

NFP peor de lo esperado:

Aumenta las esperanzas de recortes de tasas → el USD se suaviz

Ver originalesLos datos de Nóminas no Agrícolas de EE. UU. de hoy son un factor clave para la volatilidad del mercado. El NFP influye directamente en las expectativas sobre las tasas de interés, la fortaleza del USD y el sentimiento general de riesgo, lo que lo hace muy importante para los traders de criptomonedas.

NFP mejor de lo esperado:

Señala un mercado laboral fuerte → expectativas de tasas más altas → presión sobre activos de riesgo como las criptomonedas.

NFP peor de lo esperado:

Aumenta las esperanzas de recortes de tasas → el USD se suaviz

- Recompensa

- 9

- 5

- Republicar

- Compartir

EagleEye :

:

¡Feliz Año Nuevo! 🤑Ver más

🔥Nonfarm Payrolls Coming: What to Expect and How It Could Impact Markets 🔥

Esta noche marca un momento importante para inversores y traders en todo el mundo, ya que está programado el lanzamiento del primer informe de nóminas no agrícolas de EE. UU. de 2026. Con una expectativa de 60,000 nuevos empleos añadidos, este informe es más que una simple actualización mensual del empleo; es un indicador clave que podría influir en las decisiones de política de la Reserva Federal y en el sentimiento del mercado a corto plazo. Los datos de empleo que se publiquen esta noche probablemente moldearán la

Esta noche marca un momento importante para inversores y traders en todo el mundo, ya que está programado el lanzamiento del primer informe de nóminas no agrícolas de EE. UU. de 2026. Con una expectativa de 60,000 nuevos empleos añadidos, este informe es más que una simple actualización mensual del empleo; es un indicador clave que podría influir en las decisiones de política de la Reserva Federal y en el sentimiento del mercado a corto plazo. Los datos de empleo que se publiquen esta noche probablemente moldearán la

BTC-2,19%

- Recompensa

- 8

- 6

- Republicar

- Compartir

SoominStar :

:

GOGOGO 2026 👊Ver más

#NonfarmPayrollsComing El informe de (NFP) de Nóminas No Agrícolas es uno de los indicadores económicos más observados en EE. UU. Mide el número de empleos añadidos o perdidos en la economía, excluyendo trabajadores agrícolas, empleados gubernamentales y algunos otros sectores. Los datos de NFP tienen un impacto importante en el dólar estadounidense, las expectativas de tasas de interés y los mercados globales, incluyendo las criptomonedas.

Por qué importa el NFP

Un crecimiento fuerte en el empleo indica una economía saludable. Esto suele fortalecer el dólar y aumentar las expectativas de tasa

Por qué importa el NFP

Un crecimiento fuerte en el empleo indica una economía saludable. Esto suele fortalecer el dólar y aumentar las expectativas de tasa

BTC-2,19%

- Recompensa

- 1

- 2

- Republicar

- Compartir

Discovery :

:

GOGOGO 2026 👊Ver más

#NonfarmPayrollsComing

El informe de Nóminas No Agrícolas (NFP) de EE. UU. (NFP) sigue siendo uno de los indicadores económicos más influyentes en los mercados globales. A medida que se acerca el NFP de enero de 2026, su importancia va mucho más allá de los números de empleo. El informe de diciembre de 2025 reveló que la economía de EE. UU. añadió aproximadamente 50,000 empleos, por debajo de las expectativas, marcando una desaceleración en la actividad de contratación. Al mismo tiempo, la tasa de desempleo mejoró ligeramente hasta el 4.4%, mientras que el crecimiento salarial se mantuvo esta

Ver originalesEl informe de Nóminas No Agrícolas (NFP) de EE. UU. (NFP) sigue siendo uno de los indicadores económicos más influyentes en los mercados globales. A medida que se acerca el NFP de enero de 2026, su importancia va mucho más allá de los números de empleo. El informe de diciembre de 2025 reveló que la economía de EE. UU. añadió aproximadamente 50,000 empleos, por debajo de las expectativas, marcando una desaceleración en la actividad de contratación. Al mismo tiempo, la tasa de desempleo mejoró ligeramente hasta el 4.4%, mientras que el crecimiento salarial se mantuvo esta

- Recompensa

- 16

- 17

- Republicar

- Compartir

EagleEye :

:

Comprar para ganar 💎Ver más

#NonfarmPayrollsComing

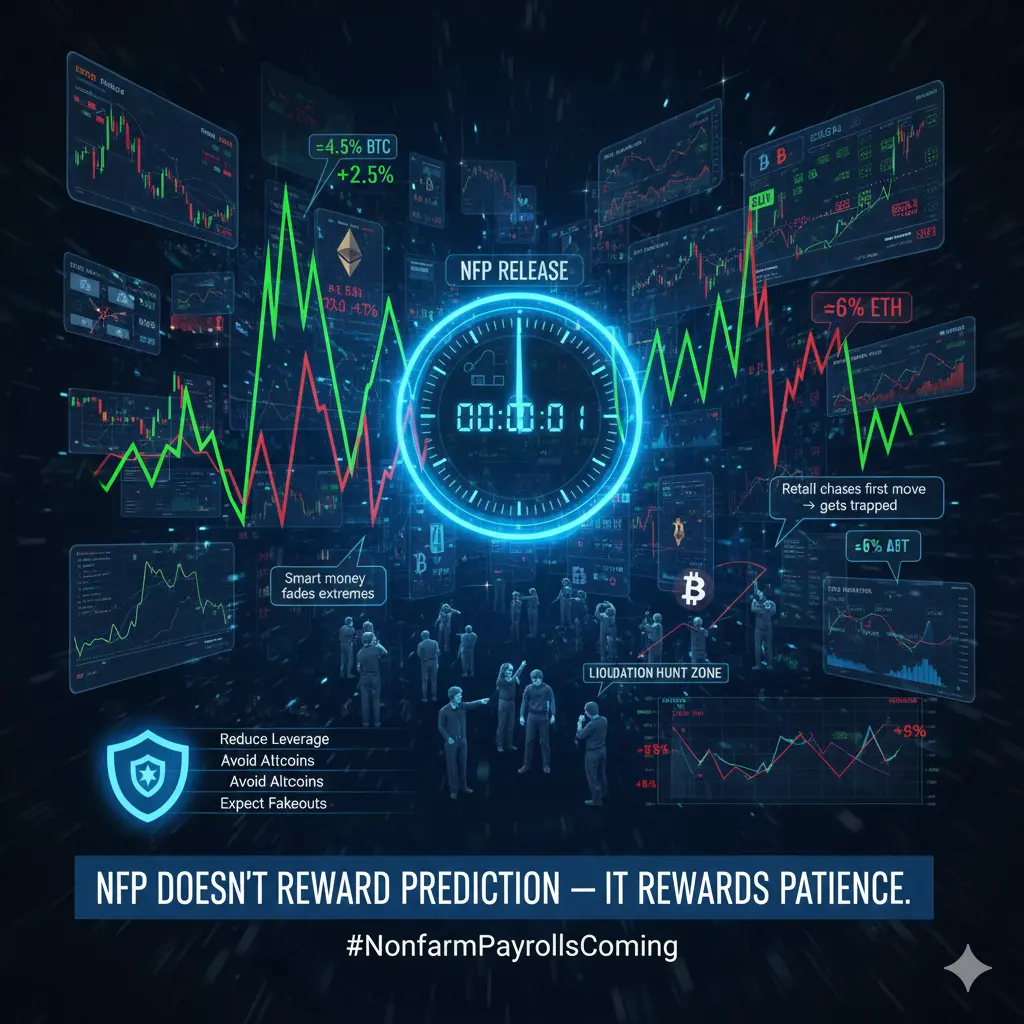

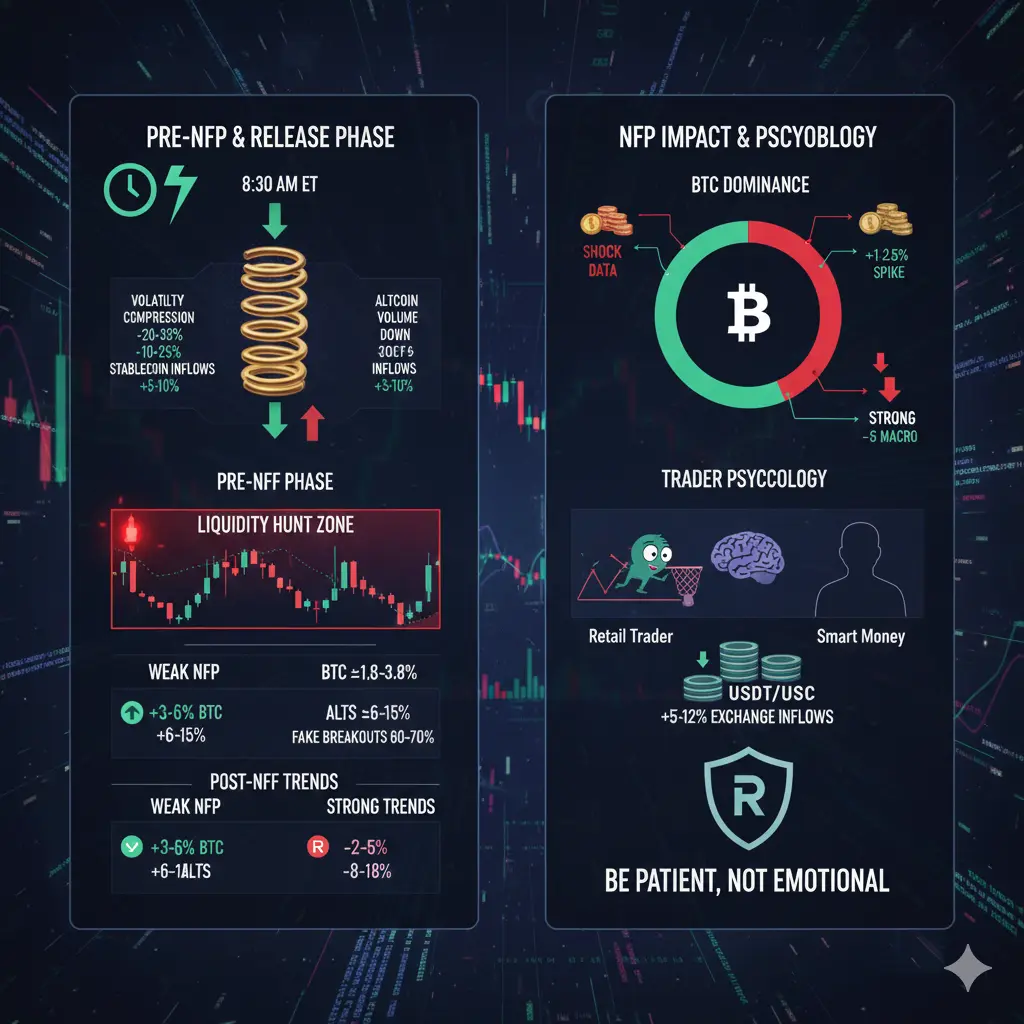

A medida que se acerca el informe de Nóminas No Agrícolas (NFP), el mercado de criptomonedas entra en una de sus fases macroeconómicas más sensibles. Esto no es solo un evento de noticias — es un multiplicador de volatilidad que puede mover miles de millones en liquidez a través de Bitcoin, altcoins y stablecoins en minutos.

El NFP define las expectativas en torno a las tasas de interés, la fortaleza del dólar y el apetito por el riesgo, que influyen directamente en la acción del precio de las criptomonedas.

⏳ Fase previa al NFP: Posicionamiento y compresión

Normalmente

Ver originalesA medida que se acerca el informe de Nóminas No Agrícolas (NFP), el mercado de criptomonedas entra en una de sus fases macroeconómicas más sensibles. Esto no es solo un evento de noticias — es un multiplicador de volatilidad que puede mover miles de millones en liquidez a través de Bitcoin, altcoins y stablecoins en minutos.

El NFP define las expectativas en torno a las tasas de interés, la fortaleza del dólar y el apetito por el riesgo, que influyen directamente en la acción del precio de las criptomonedas.

⏳ Fase previa al NFP: Posicionamiento y compresión

Normalmente

- Recompensa

- 30

- 19

- Republicar

- Compartir

Vortex_King :

:

GOGOGO 2026 👊Ver más

Cargar más

Únete a 40M usuarios en nuestra comunidad en crecimiento.

⚡️ Únete a 40M usuarios en el debate sobre la fiebre cripto

💬 Interactúa con tus creadores favoritos

👍 Explora lo que te interesa

Temas de actualidad

42.47M Popularidad

166.3K Popularidad

143.07K Popularidad

1.67M Popularidad

529.7K Popularidad

15.85K Popularidad

14.87K Popularidad

28.23K Popularidad

10.21K Popularidad

371.57K Popularidad

51.09K Popularidad

196.51K Popularidad

21.36K Popularidad

76.31K Popularidad

14.89K Popularidad

Noticias

Ver másETH cae por debajo de 1950 USDT

1 h

Datos: Si BTC supera los 69,628 dólares, la intensidad total de liquidación de posiciones cortas en los principales CEX alcanzará los 12.57 mil millones de dólares

2 h

Datos: Si ETH cae por debajo de 1,882 dólares, la intensidad total de liquidación de posiciones largas en los principales CEX alcanzará los 6.98 mil millones de dólares

2 h

El gobernador del BCE, Nagel: La posición de refugio del dólar está siendo cuestionada, la debilidad del tipo de cambio continuará

2 h

BTC cae por debajo de 66,000 USDT

4 h

Anclado