2025 BNB Price Prediction: Expert Analysis and Market Forecast for Binance Coin's Growth Potential

Introduction: BNB's Market Position and Investment Value

Binance Coin (BNB), as a leading cryptocurrency in the global market, has achieved significant milestones since its inception in 2017. As of 2025, BNB's market capitalization has reached $122,680,985,061, with a circulating supply of approximately 137,735,472 coins, and a price hovering around $890.7. This asset, often referred to as the "Exchange Token Pioneer," is playing an increasingly crucial role in decentralized finance (DeFi) and blockchain ecosystems.

This article will comprehensively analyze BNB's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. BNB Price History Review and Current Market Status

BNB Historical Price Evolution

- 2017: Initial launch, price started at $0.15

- 2021: Bull market peak, price reached all-time high of $1,369.99

- 2022: Market downturn, price declined significantly from peak

BNB Current Market Situation

As of December 15, 2025, BNB is trading at $890.7, ranking 4th in the global cryptocurrency market. The 24-hour trading volume stands at $5,576,340.44, with a market capitalization of $122,680,985,061.82. BNB has experienced a slight decrease of 0.17% in the past 24 hours, while showing a 24.51% increase over the past year. The current price is 35% below its all-time high of $1,369.99 recorded on October 13, 2025. With a circulating supply of 137,735,472.17 BNB, the token maintains a market dominance of 3.76%.

Click to view the current BNB market price

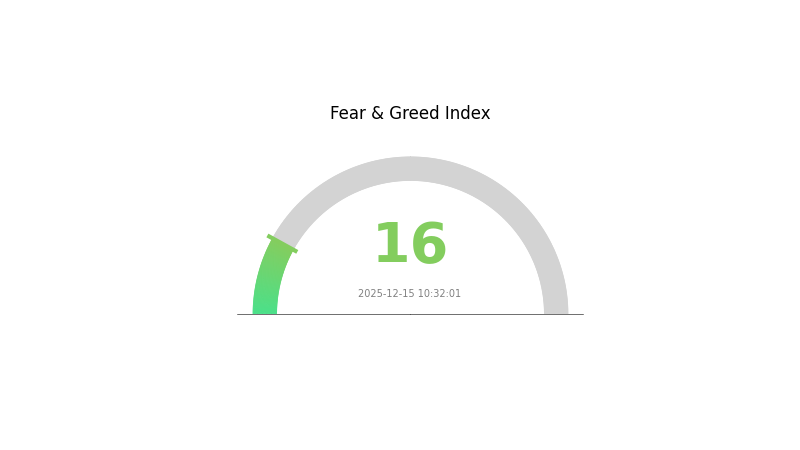

BNB Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the Fear and Greed Index plummeting to 16. This low reading suggests that investors are highly cautious and hesitant to enter the market. Such extreme fear often precedes potential buying opportunities, as assets may be undervalued. However, traders should remain vigilant and conduct thorough research before making any investment decisions. Keep an eye on market trends and fundamental factors that could influence BNB's price movement in the coming days.

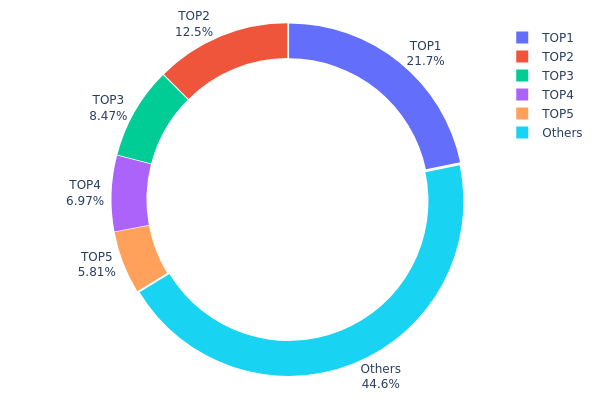

BNB Holdings Distribution

The address holdings distribution data reveals a significant concentration of BNB tokens among a few top addresses. The top address holds 21.69% of the total supply, while the top five addresses collectively control 55.41% of all BNB tokens. This high level of concentration raises concerns about the decentralization and potential market manipulation risks associated with BNB.

Such a concentrated distribution could lead to increased volatility in the BNB market, as large holders have the potential to significantly impact prices through their trading activities. Moreover, this concentration may undermine the network's resilience and governance structure, as a small number of entities could exert disproportionate influence over the ecosystem.

Despite these concerns, it's worth noting that 44.59% of BNB tokens are distributed among other addresses, indicating some level of broader participation. However, the current distribution pattern suggests that BNB's on-chain structure and market dynamics are heavily influenced by a small group of major stakeholders, potentially compromising its decentralization goals.

Click to view the current BNB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xff3f...8ac4d3 | 29888.00K | 21.69% |

| 2 | 0xbe0e...4d33e8 | 17195.73K | 12.48% |

| 3 | 0xd37c...aa07ca | 11666.89K | 8.47% |

| 4 | 0xf977...41acec | 9606.63K | 6.97% |

| 5 | 0x771f...a9a23e | 8000.56K | 5.80% |

| - | Others | 61377.69K | 44.59% |

2. Core Factors Affecting BNB's Future Price

Supply Mechanism

- Burn Mechanism: BNB implements a token burn mechanism to reduce supply over time

- Historical Pattern: Past burns have generally had a positive impact on price due to reduced supply

- Current Impact: Ongoing burns are expected to continue supporting price by creating scarcity

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions have been increasing their BNB holdings, indicating growing confidence

- Corporate Adoption: Several prominent companies have started using BNB for various purposes, expanding its utility

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those of the Federal Reserve, are expected to influence crypto markets including BNB

- Inflation Hedging Properties: BNB has shown some potential as an inflation hedge, attracting investors during periods of high inflation

Technical Development and Ecosystem Building

- Gas Expansion: Upgrades to increase gas capacity are expected to boost ecosystem growth potential

- Cross-chain Capabilities: Development of cross-chain functionalities to enhance interoperability with other blockchains

- Ecosystem Applications: Key DApps and projects in the ecosystem include PancakeSwap, Aster (a cross-chain perpetual trading protocol), and Lista DAO (providing liquid staking derivatives)

III. BNB Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $821.56 - $893

- Neutral prediction: $893 - $973.37

- Optimistic prediction: $973.37 - $1053.74 (requires continued growth in DeFi and NFT sectors)

2027-2028 Outlook

- Market stage expectation: Potential consolidation followed by gradual growth

- Price range forecast:

- 2027: $528.78 - $1167.31

- 2028: $714.46 - $1526.34

- Key catalysts: Increased adoption of BNB Chain, expansion of BNB ecosystem

2030 Long-term Outlook

- Base scenario: $1331.69 - $1604.44 (assuming steady market growth)

- Optimistic scenario: $1604.44 - $2214.13 (assuming strong ecosystem expansion)

- Transformative scenario: Above $2214.13 (extreme favorable conditions like mass adoption)

- 2030-12-31: BNB $1604.44 (potential peak based on average prediction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1053.74 | 893 | 821.56 | 0 |

| 2026 | 1022.04 | 973.37 | 574.29 | 9 |

| 2027 | 1167.31 | 997.7 | 528.78 | 12 |

| 2028 | 1526.34 | 1082.51 | 714.46 | 21 |

| 2029 | 1904.46 | 1304.42 | 900.05 | 46 |

| 2030 | 2214.13 | 1604.44 | 1331.69 | 80 |

IV. Professional BNB Investment Strategies and Risk Management

BNB Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking steady growth

- Operation suggestions:

- Accumulate BNB during market dips

- Set long-term price targets and review periodically

- Store BNB in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversals

- RSI (Relative Strength Index): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor BNB's correlation with overall market trends

- Set strict stop-loss and take-profit levels

BNB Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BNB

BNB Market Risks

- Volatility: Significant price fluctuations common in crypto markets

- Competition: Emerging blockchain platforms may challenge BNB's market position

- Liquidity: Large sell-offs could impact price stability

BNB Regulatory Risks

- Regulatory uncertainty: Changing government policies may affect BNB's operations

- Compliance challenges: Adapting to evolving global cryptocurrency regulations

- Legal status: Potential classification as a security in some jurisdictions

BNB Technical Risks

- Network congestion: High transaction volumes may lead to slower processing times

- Smart contract vulnerabilities: Potential exploits in DeFi applications on BNB Chain

- Centralization concerns: Reliance on a limited number of validator nodes

VI. Conclusion and Action Recommendations

BNB Investment Value Assessment

BNB presents strong long-term potential due to its ecosystem growth and burn mechanism. However, short-term volatility and regulatory uncertainties pose significant risks.

BNB Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider a balanced approach of holding and active trading ✅ Institutional investors: Explore BNB as part of a diversified crypto portfolio

BNB Trading Participation Methods

- Spot trading: Direct purchase and sale of BNB on Gate.com

- Staking: Participate in BNB staking programs for passive income

- DeFi: Explore decentralized finance opportunities within the BNB ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will be the price of BNB in 2025?

Based on current projections, BNB's price in 2025 could range from $581 to $1000, with an average forecast of $790.

Will BNB reach $10,000?

While unlikely in the near term, BNB could potentially reach $10,000 by 2050 if market conditions are extremely favorable and adoption continues to grow significantly.

What will BNB be worth in 2030?

By 2030, BNB is projected to reach $1,424, with potential to approach $2,000 depending on market conditions and adoption rates.

Can BNB reach $5000?

Yes, BNB could potentially reach $5000 by 2025, driven by Binance's ecosystem growth and favorable market conditions. However, this depends on continued adoption and positive regulatory developments.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

How Does Crypto Community and Ecosystem Activity Impact ASP Token Price and Long-Term Project Success

How to analyze on-chain data: DOGE active addresses, transaction volume, whale distribution and fees explained

How Do Crypto Derivatives Market Signals Impact Trading Strategy: Analyzing Futures Open Interest, Funding Rates, and Liquidation Data

What is Melania Meme (MELANIA) price and market cap in 2025?

How to Use On-Chain Data Analysis to Track Whale Movements and Active Addresses