老赵讲趋势

No content yet

老赵讲趋势

Good afternoon, everyone! It's the weekend again in the blink of an eye. Currently, the market is not experiencing much volatility, with no obvious one-sided trend emerging, which is pretty much in line with the normal Saturday and Sunday range, so there’s not much more to say here. As this week is coming to an end, let’s review the overall development trend. This week’s market basically unfolded in a W-shaped pattern, with a decline followed by a rebound in continuous development. From the weekly high of 91,800, there was a strong drop to the 83,760 support line, followed by a shock and upwar

View Original

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and Ethereum trading suggestions and direction for the morning of December 7:

From the current market situation, the 4-hour chart shows that the price is in an upward stretching state. Previously, the price pulled back and went lower but found support at the lower band, without breaking downward. The trading volume is adjusting with a bearish pattern but shrinking, and the moving averages are gradually rising in a converging manner. The mid-term trend is steadily upward, while the long-term range oscillation highlights the strong resistance of the bulls, with limited pullback space. Lo

View OriginalFrom the current market situation, the 4-hour chart shows that the price is in an upward stretching state. Previously, the price pulled back and went lower but found support at the lower band, without breaking downward. The trading volume is adjusting with a bearish pattern but shrinking, and the moving averages are gradually rising in a converging manner. The mid-term trend is steadily upward, while the long-term range oscillation highlights the strong resistance of the bulls, with limited pullback space. Lo

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and Ethereum Trading Suggestions and Direction Sharing for the Night of December 6

From the current market situation, both the daily and 4-hour charts indicate that we are in a rebound recovery phase. The trading volume did not shrink when breaking through the upper resistance, which rules out the possibility of a short-term bull trap. The 1-hour chart shows that as the pullback points are rising, the market displays a strong consolidation characteristic. In the short term, the price is fluctuating above the middle band of the Bollinger Bands, and there has been a substantial breakout

View OriginalFrom the current market situation, both the daily and 4-hour charts indicate that we are in a rebound recovery phase. The trading volume did not shrink when breaking through the upper resistance, which rules out the possibility of a short-term bull trap. The 1-hour chart shows that as the pullback points are rising, the market displays a strong consolidation characteristic. In the short term, the price is fluctuating above the middle band of the Bollinger Bands, and there has been a substantial breakout

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and Ethereum trading suggestions and direction sharing for the evening of December 6

From the current market situation, Bitcoin has been in a narrow range consolidation throughout the day, without much movement. As mentioned in the morning post, due to the weekend, volatility is not expected to be significant, so there was no timely update. Looking at the current market, the 4-hour chart for Bitcoin shows that it is still in a stage of correction after testing the bottom and rebounding. The overall trend of the Bollinger Bands remains downward, with Bitcoin currently fluctuating

View OriginalFrom the current market situation, Bitcoin has been in a narrow range consolidation throughout the day, without much movement. As mentioned in the morning post, due to the weekend, volatility is not expected to be significant, so there was no timely update. Looking at the current market, the 4-hour chart for Bitcoin shows that it is still in a stage of correction after testing the bottom and rebounding. The overall trend of the Bollinger Bands remains downward, with Bitcoin currently fluctuating

- Reward

- like

- Comment

- Repost

- Share

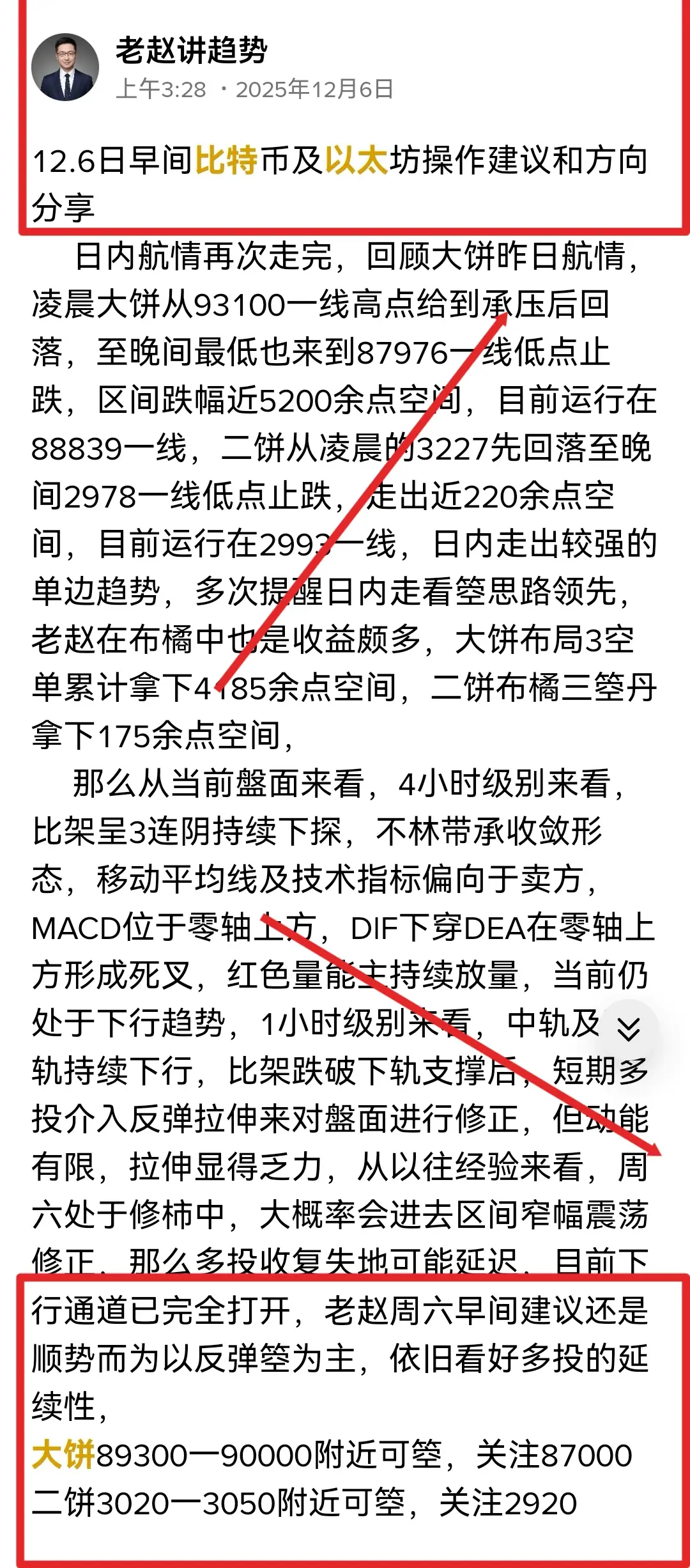

Midday Bitcoin and Ethereum Trading Suggestions and Direction for December 6

From the current market situation, the 1-hour chart shows a volatile downward trend. The Bollinger Bands are opening downward, and the price is running near the lower band. The upper resistance is at the 90,000 level, while the lower band at 87,900 is a key short-term support. If it breaks below, it may test the round number level. During the decline, trading volume has not significantly increased. Although the bearish momentum has paused somewhat, the rebound is even weaker. This rebound is a stage adjustment to the

View OriginalFrom the current market situation, the 1-hour chart shows a volatile downward trend. The Bollinger Bands are opening downward, and the price is running near the lower band. The upper resistance is at the 90,000 level, while the lower band at 87,900 is a key short-term support. If it breaks below, it may test the round number level. During the decline, trading volume has not significantly increased. Although the bearish momentum has paused somewhat, the rebound is even weaker. This rebound is a stage adjustment to the

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and Ethereum Trading Recommendations and Direction Sharing for Midnight, December 5

Our strategies are never blind trial and error; instead, we use data as our rudder and strategy as our sail, identifying every key node in advance. Every step leaves a clear trace, and every decision can withstand scrutiny. Our afternoon and evening approaches were once again validated, with all recommended price levels precisely reached. We set up positions near 91,500 for BTC and synchronized entry for ETH at 3,140. The market moved as expected, and upon a drop, we exited BTC around the 90,200 level a

View OriginalOur strategies are never blind trial and error; instead, we use data as our rudder and strategy as our sail, identifying every key node in advance. Every step leaves a clear trace, and every decision can withstand scrutiny. Our afternoon and evening approaches were once again validated, with all recommended price levels precisely reached. We set up positions near 91,500 for BTC and synchronized entry for ETH at 3,140. The market moved as expected, and upon a drop, we exited BTC around the 90,200 level a

- Reward

- like

- Comment

- Repost

- Share

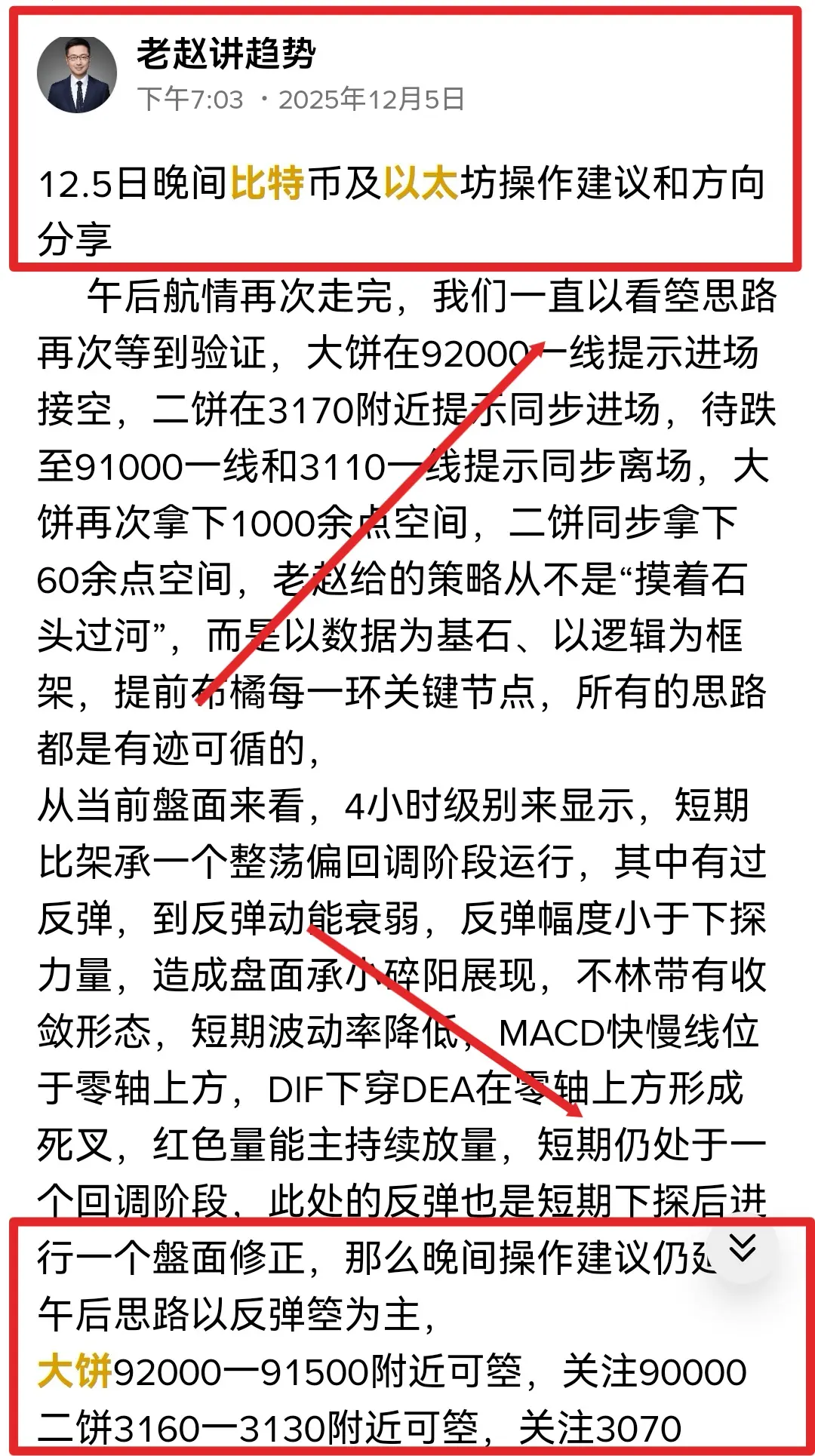

Bitcoin and Ethereum Operation Suggestions and Direction Sharing for the Evening of 12.5

After the market movement in the afternoon, we once again waited for confirmation according to the established short-selling strategy. Bitcoin was suggested to enter short positions around the 92,000 level, and Ethereum was suggested to enter synchronously around 3,170. When the price dropped to around 91,000 for Bitcoin and 3,110 for Ethereum, we suggested exiting synchronously. Bitcoin captured over 1,000 points of movement, and Ethereum captured over 60 points. The strategies provided by Lao Zhao are ne

View OriginalAfter the market movement in the afternoon, we once again waited for confirmation according to the established short-selling strategy. Bitcoin was suggested to enter short positions around the 92,000 level, and Ethereum was suggested to enter synchronously around 3,170. When the price dropped to around 91,000 for Bitcoin and 3,110 for Ethereum, we suggested exiting synchronously. Bitcoin captured over 1,000 points of movement, and Ethereum captured over 60 points. The strategies provided by Lao Zhao are ne

- Reward

- like

- Comment

- Repost

- Share

Afternoon Bitcoin and Ethereum Trading Suggestions and Direction Sharing for December 5

Looking at the previous market trend, the 1-hour chart shows that BTC is currently in a volatile downtrend, with the Bollinger Bands opening downward and short-term bearish momentum dominating. Overall, the recent price has pulled back from the high above the 94,000 level, hitting a low at 90,822 before stopping the decline, forming a double top pattern. The increased trading volume indicates concentrated selling pressure, and market sentiment is leaning cautious. The current short-term support is at the lo

View OriginalLooking at the previous market trend, the 1-hour chart shows that BTC is currently in a volatile downtrend, with the Bollinger Bands opening downward and short-term bearish momentum dominating. Overall, the recent price has pulled back from the high above the 94,000 level, hitting a low at 90,822 before stopping the decline, forming a double top pattern. The increased trading volume indicates concentrated selling pressure, and market sentiment is leaning cautious. The current short-term support is at the lo

- Reward

- like

- Comment

- Repost

- Share

Midday Bitcoin and Ethereum Operation Suggestions and Direction Sharing for December 5

Good afternoon, everyone. Reviewing the early morning Bitcoin market, Bitcoin started to strongly pull back from the high of around 93,100 after meeting resistance, dropping to around 90,822 before stabilizing. The drop was nearly 2,000 points, showing a clear short-selling trend. After the decline, it began to rebound and recover, currently fluctuating around the 92,400 level. Ethereum moved in sync with Bitcoin, falling from the early morning high of 3,227 to a low of 3,061 before stabilizing, also showing

View OriginalGood afternoon, everyone. Reviewing the early morning Bitcoin market, Bitcoin started to strongly pull back from the high of around 93,100 after meeting resistance, dropping to around 90,822 before stabilizing. The drop was nearly 2,000 points, showing a clear short-selling trend. After the decline, it began to rebound and recover, currently fluctuating around the 92,400 level. Ethereum moved in sync with Bitcoin, falling from the early morning high of 3,227 to a low of 3,061 before stabilizing, also showing

- Reward

- like

- Comment

- Repost

- Share

December 4 Afternoon Bitcoin and Ethereum Trading Suggestions and Direction Sharing

From the current market situation, the market has recently experienced a strong V-shaped rebound. Looking at the daily chart of Bitcoin, the bearish candles have ended the two-day consecutive bullish rebound. The daily opening continued the upward momentum, testing the 94,000 level. Although it broke through and stabilized briefly, there is still pressure above, and it has entered a retracement phase. The Bollinger Bands are narrowing, with the short-term moving average crossing upward with the middle band. The

View OriginalFrom the current market situation, the market has recently experienced a strong V-shaped rebound. Looking at the daily chart of Bitcoin, the bearish candles have ended the two-day consecutive bullish rebound. The daily opening continued the upward momentum, testing the 94,000 level. Although it broke through and stabilized briefly, there is still pressure above, and it has entered a retracement phase. The Bollinger Bands are narrowing, with the short-term moving average crossing upward with the middle band. The

- Reward

- like

- Comment

- Repost

- Share

12.4 Morning Bitcoin and Ethereum Operation Suggestions and Direction Sharing

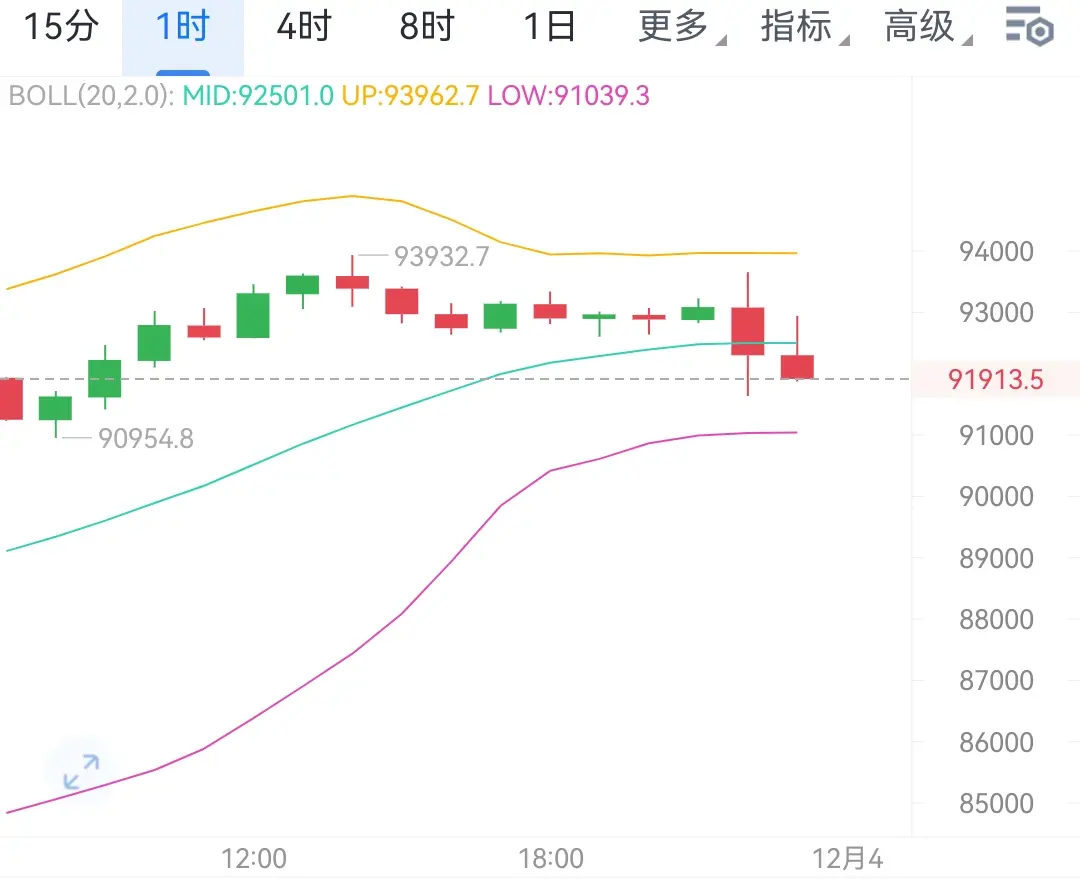

Looking at the previous market, the 1-hour chart shows that the current trend is weak and fluctuating. The price is moving narrowly around the middle band of the Bollinger Bands, with upper resistance at 93,700 and lower support at 92,100. Recently, the candlesticks have alternated between bullish and bearish. There was a short-term breakout above the upper band, but no consolidation, indicating a clear divergence between bulls and bears. However, the price has not broken out of the Bollinger Bands' range, so short-t

View OriginalLooking at the previous market, the 1-hour chart shows that the current trend is weak and fluctuating. The price is moving narrowly around the middle band of the Bollinger Bands, with upper resistance at 93,700 and lower support at 92,100. Recently, the candlesticks have alternated between bullish and bearish. There was a short-term breakout above the upper band, but no consolidation, indicating a clear divergence between bulls and bears. However, the price has not broken out of the Bollinger Bands' range, so short-t

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and Ethereum Operational Recommendations and Direction Sharing in the Early Morning of December 3

From the current market situation, the 1-hour chart shows that the market is currently in a consolidation phase, with prices fluctuating narrowly around the middle Bollinger Band near the 92,600 level. Recently, the candlesticks have alternated between bullish and bearish, indicating obvious divergence between bulls and bears, but there has not been an effective break below the lower band support. In the short term, the range-bound consolidation continues. Looking at the Bollinger Bands, t

View OriginalFrom the current market situation, the 1-hour chart shows that the market is currently in a consolidation phase, with prices fluctuating narrowly around the middle Bollinger Band near the 92,600 level. Recently, the candlesticks have alternated between bullish and bearish, indicating obvious divergence between bulls and bears, but there has not been an effective break below the lower band support. In the short term, the range-bound consolidation continues. Looking at the Bollinger Bands, t

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and Ethereum Operation Recommendations and Direction Sharing for Midnight, December 3

From the previous structure, the 4-hour level shows that the price is currently in a sustained pullback phase with two consecutive bullish candles. The Bollinger Bands have not changed, and the pullback trend remains to be confirmed as a reversal. The KDJ indicator is above 80, suggesting that the short-term bullish trend may have peaked, increasing the possibility of a confirmed pullback. On the 1-hour chart, the Bollinger Bands are showing signs of contraction with all three bands moving sideways, a

View OriginalFrom the previous structure, the 4-hour level shows that the price is currently in a sustained pullback phase with two consecutive bullish candles. The Bollinger Bands have not changed, and the pullback trend remains to be confirmed as a reversal. The KDJ indicator is above 80, suggesting that the short-term bullish trend may have peaked, increasing the possibility of a confirmed pullback. On the 1-hour chart, the Bollinger Bands are showing signs of contraction with all three bands moving sideways, a

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and Ethereum Trading Suggestions and Direction Sharing for the Evening of December 3

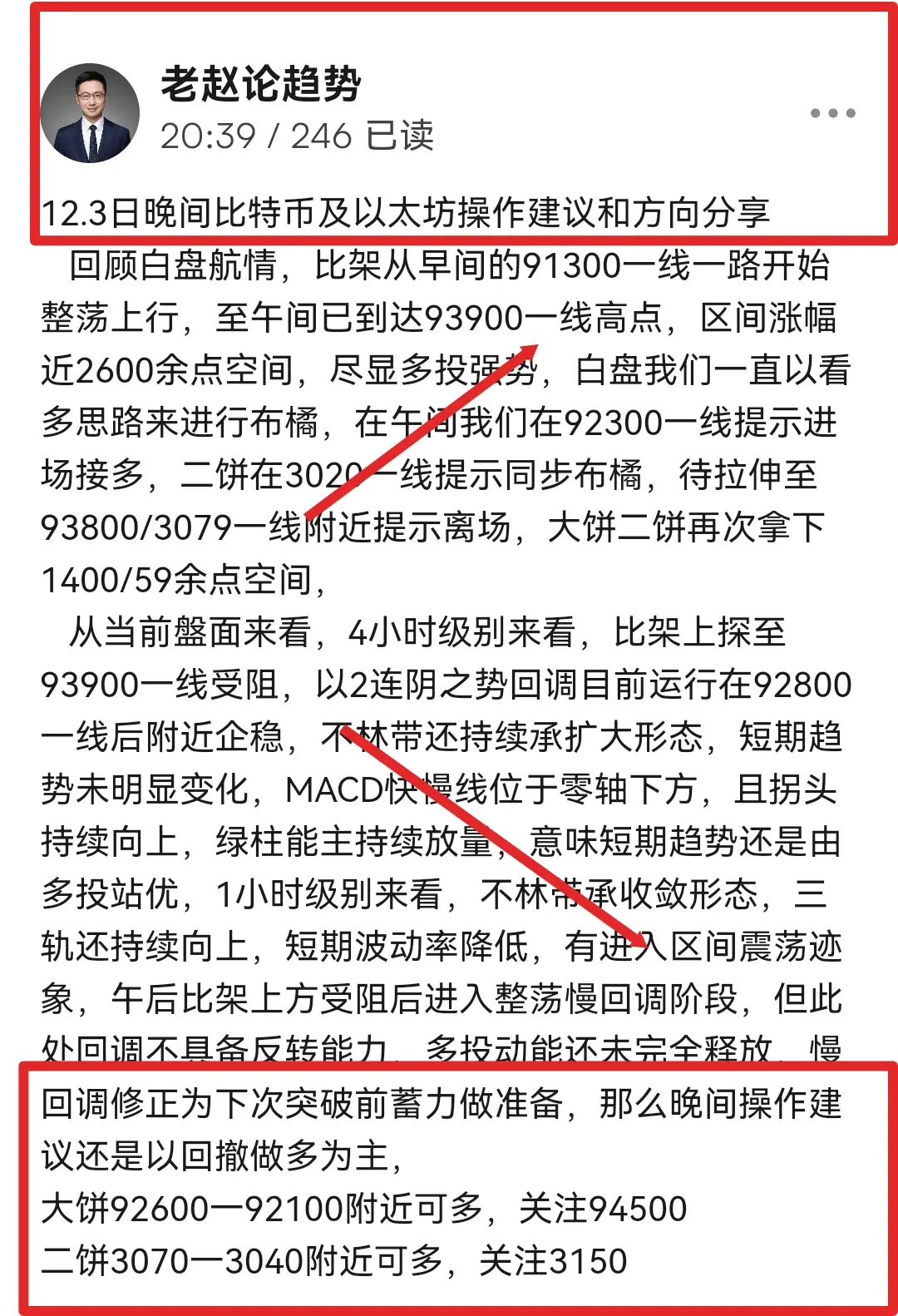

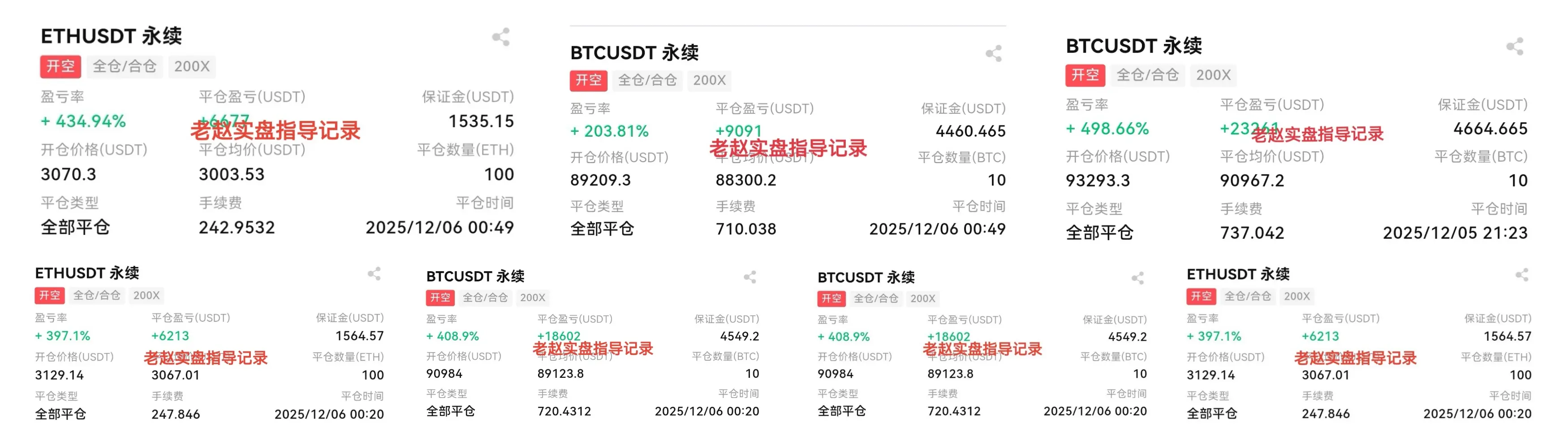

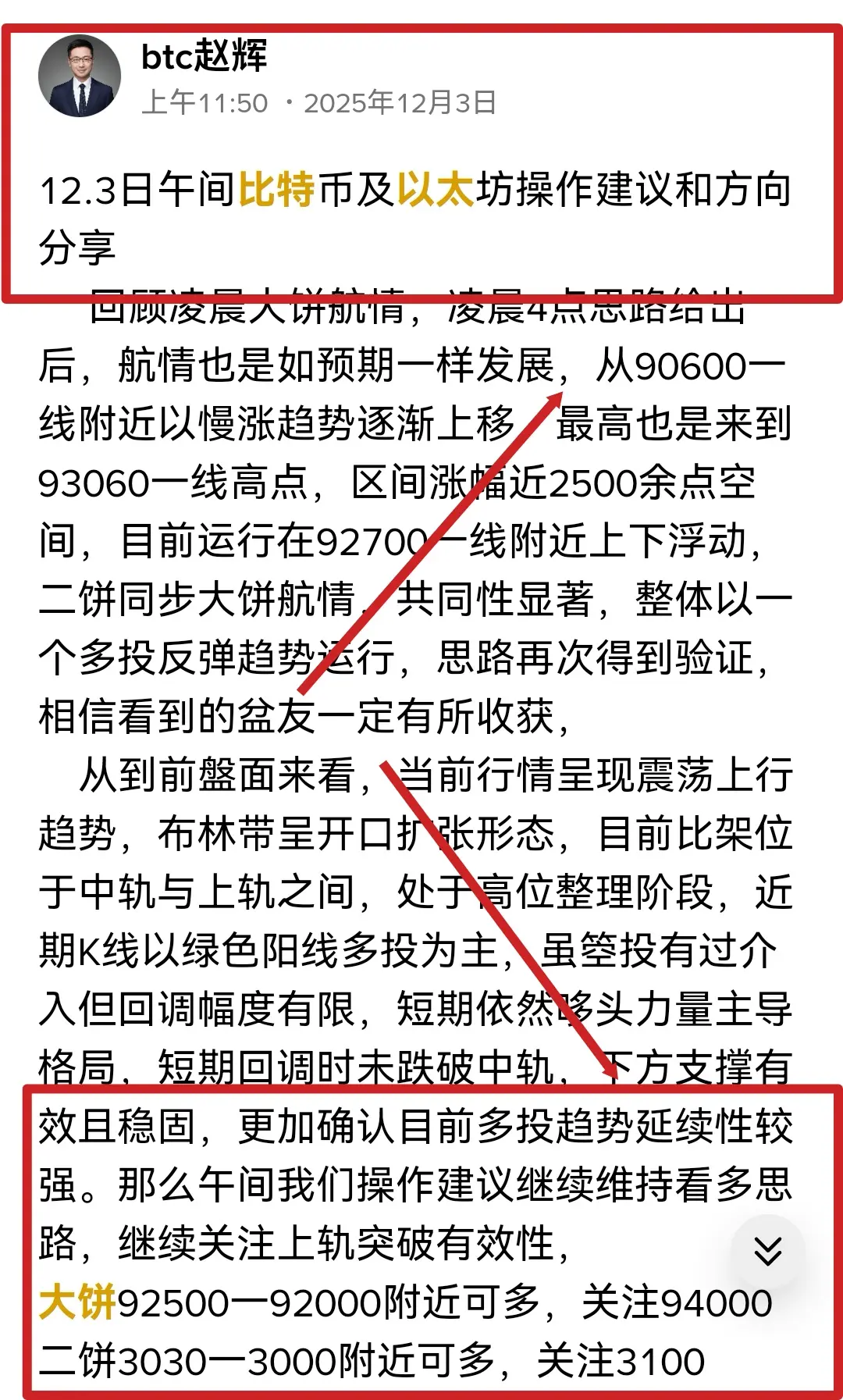

Reviewing the daytime market, BTC started consolidating upwards from around 91,300 in the morning, reaching a high of 93,900 by noon, with a range increase of nearly 2,600 points, fully displaying the strength of the bulls. Throughout the day, our strategy was to remain bullish. At noon, we suggested going long around 92,300 for BTC, and simultaneously placing positions around 3,020 for ETH. We advised closing positions near 93,800/3,079 after the rally, securing another 1,400/59 points for BTC and ETH

View OriginalReviewing the daytime market, BTC started consolidating upwards from around 91,300 in the morning, reaching a high of 93,900 by noon, with a range increase of nearly 2,600 points, fully displaying the strength of the bulls. Throughout the day, our strategy was to remain bullish. At noon, we suggested going long around 92,300 for BTC, and simultaneously placing positions around 3,020 for ETH. We advised closing positions near 93,800/3,079 after the rally, securing another 1,400/59 points for BTC and ETH

- Reward

- like

- Comment

- Repost

- Share