O que é Dash?

O que é Dash (DASH)?

Dash (símbolo: DASH) é uma criptomoeda voltada para pagamentos, criada para funcionar como “dinheiro digital” em transações cotidianas e transferências online. Operando em uma rede blockchain descentralizada—sem controle de uma única entidade sobre validação de transações ou manutenção do livro-razão—Dash utiliza o registro distribuído da blockchain para documentar transações em ordem cronológica.

Os principais diferenciais do Dash são confirmações rápidas, baixas taxas, privacidade opcional e governança conduzida pela comunidade. Além dos mineradores, a rede adota um sistema de masternodes, que garante confirmações instantâneas e votação de governança, oferecendo uma experiência de pagamento semelhante ao uso de cartão ou aplicativo móvel.

Preço atual, capitalização de mercado e oferta de Dash (DASH)

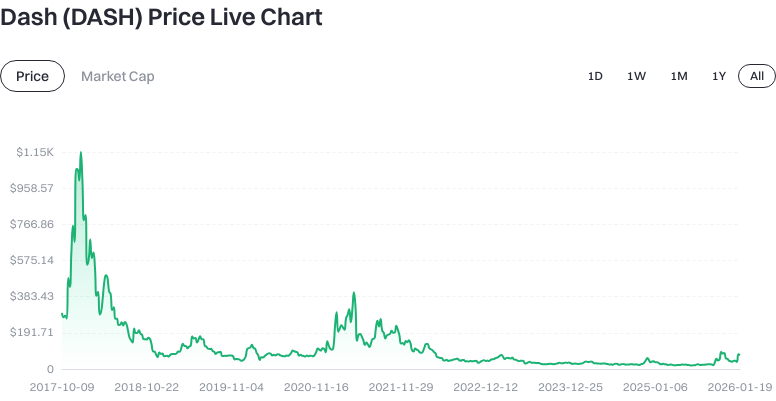

Em 20 de janeiro de 2026, o Dash está cotado a US$ 74,18, com capitalização de mercado circulante de cerca de US$ 931,52 milhões e volume de negociação de 24 horas em torno de US$ 6,46 milhões. O fornecimento circulante atual é de 12.557.189,526285 DASH, com fornecimento total de 12.557.595,115829 DASH e limite máximo de 18.920.000 DASH—o que significa que Dash não está sujeito à inflação ilimitada. O valor de mercado totalmente diluído é de aproximadamente US$ 931,52 milhões, calculado com base no preço atual e no fornecimento máximo.

Clique para ver o preço DASH USDT

Variações de preço no curto prazo: 1 hora: -0,62%, 24 horas: -10,19%, 7 dias: +62,89%, 30 dias: +89,059%.

Clique para ver a última movimentação de preço do DASH

“Capitalização de mercado” é o preço multiplicado pelo fornecimento circulante. “Valor de mercado totalmente diluído” estima o valor total se todos os tokens forem emitidos ao preço atual.

Fonte dos dados: Dados de referência desta página, atualizados em 20 de janeiro de 2026.

Quem criou o Dash (DASH) e quando?

Dash foi lançado em 17 de janeiro de 2014, inicialmente como XCoin, depois rebatizado para Darkcoin antes de se tornar Dash (“Dinheiro Digital”). Evan Duffield foi um dos principais responsáveis pelo projeto. Por meio do desenvolvimento comunitário, Dash estabeleceu o sistema de masternodes, governança on-chain e mecanismo de tesouraria.

Essa trajetória explica a abordagem técnica “focada em pagamentos” e o conjunto de funcionalidades do Dash, com várias evoluções que aprimoraram confirmações instantâneas e resistência a ataques à rede.

Fonte: Materiais públicos do projeto Dash e documentação comunitária em outubro de 2024.

Como funciona o Dash (DASH)?

Dash utiliza consenso Proof of Work (PoW)—mineradores competem usando poder computacional para proteger a rede ao empacotar blocos. O algoritmo X11 é adotado, priorizando eficiência energética e segurança multi-hash.

Além dos mineradores, os “masternodes” são nós com alta disponibilidade, banda suficiente e exigência de colateral (historicamente 1.000 DASH). Os masternodes oferecem:

- InstantSend: Masternodes bloqueiam entradas de transações para confirmação rápida—normalmente em segundos—proporcionando alta confiança na liquidação.

- PrivateSend: Recurso opcional de privacidade que mistura múltiplas transações e divide fundos, dificultando rastreamento na blockchain.

- ChainLocks: Masternodes bloqueiam rapidamente blocos para reduzir risco de reorganização e evitar ataques de 51%.

- Governança e tesouraria: Masternodes votam em propostas; a tesouraria distribui orçamentos mensais para iniciativas do ecossistema e desenvolvimento.

As recompensas de bloco são distribuídas proporcionalmente entre mineradores, masternodes e tesouraria, assegurando segurança contínua da rede e crescimento do ecossistema.

Fonte: Documentação técnica do Dash e recursos comunitários em outubro de 2024.

O que você pode fazer com Dash (DASH)?

- Pagamentos a comerciantes e compras online: Usuários podem pagar via QR Code de carteira móvel com baixas taxas e confirmação rápida, tornando Dash ideal para cafés, e-commerces e outros estabelecimentos.

- Remessas internacionais: Para transferências globais, Dash evita atrasos bancários e altas taxas; destinatários recebem fundos rapidamente para conversão local.

- Micropagamentos e gorjetas: Transações de baixo valor aproveitam o baixo custo e liquidação ágil do Dash.

- Participação na governança: Detentores de tokens que operam masternodes podem votar em propostas que influenciam o desenvolvimento do produto e o crescimento da comunidade.

Carteiras Dash (DASH) e extensões do ecossistema

Carteiras populares incluem Dash Core para desktop e Dash Wallet para celular, ambas suportando envio, recebimento e configurações de privacidade. Algumas carteiras físicas (Ledger, Trezor) oferecem armazenamento offline de chaves privadas para maior segurança. Para comerciantes, aplicativos POS e plugins de e-commerce (como extensões WooCommerce da comunidade) permitem integração rápida.

Sempre baixe de fontes oficiais ou confiáveis e verifique checksums de assinatura e logs de atualização antes de usar.

Fonte: Recursos oficiais e comunitários em outubro de 2024.

Principais riscos e considerações regulatórias para Dash (DASH)

- Volatilidade de preço: Os preços de criptomoedas sofrem grandes oscilações devido ao sentimento do mercado e liquidez; recomenda-se gestão prudente de fundos.

- Regulação de recursos de privacidade: Funções como PrivateSend podem enfrentar fiscalização mais rígida em algumas jurisdições, impactando conformidade ou listagem em exchanges.

- Concentração de masternodes e governança: Exigências de colateral podem introduzir risco de centralização; votação de propostas e alocação de orçamento podem ser controversos.

- Segurança de rede e carteiras: Malware, links de phishing ou endereços incorretos podem causar perda de ativos; práticas rigorosas de segurança são essenciais.

- Riscos de conta e exchange: Controles de risco de plataforma, limites de saque ou incidentes de segurança podem impactar a experiência do usuário—sempre ative recursos de segurança e mantenha backups.

- Tributação e conformidade: A declaração e o tratamento fiscal de ativos cripto variam conforme a jurisdição; siga as regulamentações locais.

Como comprar e armazenar Dash (DASH) com segurança na Gate

Passo 1: Cadastre-se e conclua a verificação de identidade. Acesse o site da Gate para criar uma conta e realizar os procedimentos KYC para habilitar depósitos e negociações.

Passo 2: Prepare fundos. Compre USDT via gateways fiat na Gate ou deposite USDT de sua própria carteira, garantindo saldo suficiente e reserva para taxas.

Passo 3: Selecione o par de negociação e faça seu pedido. Procure por “DASH” na Gate para acessar o par spot DASH/USDT. Escolha entre ordens a mercado ou limite conforme necessário; fique atento a slippage e taxas—dividir negociações pode ajudar a gerenciar volatilidade.

Passo 4: Saque para carteira de autocustódia. Para manter ou gastar a longo prazo, acesse a página de saque da Gate, selecione a mainnet do Dash e cole seu endereço Dash. Teste com valor pequeno antes do saque total; confirme seleção de rede, formato do endereço e configurações de taxa de mineração.

Passo 5: Reforce a segurança. Ative autenticação em dois fatores (2FA) e configure whitelist de saques; faça backup da frase de recuperação da carteira offline—nunca armazene em fotos ou drives na nuvem.

Passo 6: Manutenção contínua. Mantenha-se informado sobre atualizações da rede Dash e das carteiras; verifique regularmente a usabilidade dos backups e pratique recuperação de endereço/assinatura quando necessário.

Como Dash (DASH) difere do Litecoin?

- Algoritmo técnico: Dash utiliza X11 PoW; Litecoin usa Scrypt PoW—ambos empregam Proof of Work, mas com algoritmos distintos.

- Mecanismo de confirmação: Dash oferece InstantSend e ChainLocks via masternodes para confirmações rápidas e confiáveis; Litecoin acelera velocidade com blocos de ~2,5 minutos, mas não possui camada instantânea de masternodes.

- Recursos de privacidade: Dash oferece funcionalidades opcionais de coin-mixing; a cadeia principal do Litecoin não possui privacidade mixing nativa.

- Governança e tesouraria: Dash possui governança on-chain com orçamento de tesouraria; Litecoin depende principalmente de governança comunitária/fundação off-chain.

- Limite de oferta: Dash tem oferta máxima de ~18.920.000 moedas; Litecoin possui limite de ~84.000.000 moedas.

Ambas são criptomoedas voltadas para pagamentos—usuários podem escolher conforme preferências de velocidade de confirmação, opções de privacidade ou estrutura de governança.

Fonte: Materiais públicos do projeto e documentação técnica em outubro de 2024.

Resumo de Dash (DASH)

Posicionada como “dinheiro digital”, Dash combina Proof of Work com uma camada de masternodes para viabilizar transações rápidas, baixas taxas, privacidade opcional, governança on-chain e oferta limitada. Seu preço e capitalização de mercado são altamente voláteis; usuários devem priorizar segurança de conta/carteira, requisitos de conformidade e riscos regulatórios ligados à privacidade ao utilizar Dash. Ao comprar pela Gate, faça transações-teste pequenas, negocie em lotes, confira detalhes de rede/endereço, ative 2FA/whitelist de saques e faça backup seguro das frases de recuperação. Acompanhar adoção do ecossistema, propostas de governança e atualizações técnicas ajuda a avaliar utilidade e perfil de risco-retorno no longo prazo.

Perguntas frequentes

O que é Dash?

Dash é uma criptomoeda focada em privacidade e pagamentos. Permite transações anônimas via PrivateSend, combinando descentralização do Bitcoin com velocidades superiores de transação. Voltada para pagamentos do dia a dia, Dash opera uma rede de masternodes que recompensa participantes do ecossistema.

Como Dash difere do Bitcoin?

Ambas são criptomoedas, mas Dash prioriza proteção de privacidade e usabilidade. Dash oferece transações muito mais rápidas (confirmações quase instantâneas) e recurso opcional de privacidade PrivateSend; transações de Bitcoin são totalmente transparentes e liquidadas mais lentamente. Além disso, Dash utiliza governança por masternodes, enquanto Bitcoin depende apenas de mineração.

Como negociar Dash na Gate?

Você pode comprar e negociar Dash diretamente na plataforma Gate. Cadastre-se e conclua a verificação; busque pares de negociação DASH (como DASH/USDT) nos mercados spot; escolha comprar ou vender; insira quantidade/preço e confirme sua ordem. Iniciantes são recomendados a começar com valores pequenos enquanto aprendem a plataforma.

Como funciona o recurso PrivateSend do Dash?

PrivateSend é o mecanismo de privacidade do Dash, usando coin-mixing para ocultar históricos de transação e fluxos de fundos. Ao ser ativado por usuários que buscam anonimato, múltiplas transações são misturadas, impedindo que observadores externos rastreiem a origem dos fundos—ideal para quem prioriza privacidade.

Dash é adequado para manter a longo prazo?

Como criptomoeda de utilidade, com comunidade ativa e desenvolvimento contínuo, Dash oferece recursos de privacidade e pagamentos para cenários específicos. Contudo, investimentos em cripto envolvem riscos—decida conforme sua tolerância. Isto não é aconselhamento de investimento; sempre confira preços/notícias atualizadas na Gate ou outras plataformas antes de participar.

Glossário rápido de Dash (DASH)

- Transação privada: Recurso que oculta dados de remetente/destinatário e valores usando coin-mixing.

- Masternode: Nó que executa software especializado, mantém a rede e recebe recompensas; exige colateral definido em DASH.

- Pagamentos instantâneos: Confirmação rápida de transações via rede de masternodes—liquidação em segundos.

- Coin mixing: Técnica de privacidade que mistura múltiplas transações para dificultar rastreamento na blockchain.

- Proof of Work: Mecanismo de consenso onde mineradores solucionam cálculos para validar transações e receber recompensas.

- Votação de governança: Processo democrático em que operadores de masternodes votam em atualizações de rede e alocação de recursos.

Leitura adicional e referências sobre Dash (DASH)

-

Site oficial / Whitepaper:

-

Desenvolvimento / Documentação:

-

Mídia / Pesquisa autoritativa:

Artigos Relacionados

O que é a Carteira HOT no Telegram?

O que é o PolygonScan e como você pode usá-lo? (Atualização 2025)