2025 XDB Price Prediction: Expert Analysis and Market Outlook for the Year Ahead

Introduction: Market Position and Investment Value of XDB

XDB (XDB), the native token of XDB CHAIN and classified as a Real World Asset (RWA), has been powering a protocol-layer blockchain designed to empower brands and consumers since its launch in 2019. As of December 2025, XDB has achieved a market capitalization of approximately $4.73 million with a circulating supply of approximately 17.06 billion tokens, currently trading at $0.0002519. This innovative asset, recognized for its deflationary "Buyback and Burn" (BBB) mechanism, is playing an increasingly crucial role in facilitating fast and affordable transfers of consumer digital assets such as branded tokens (BCO), NFTs, and stablecoins.

This article will provide a comprehensive analysis of XDB's price trends and market dynamics, incorporating historical performance data, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the period ahead.

XDB CHAIN (XDB) Market Analysis Report

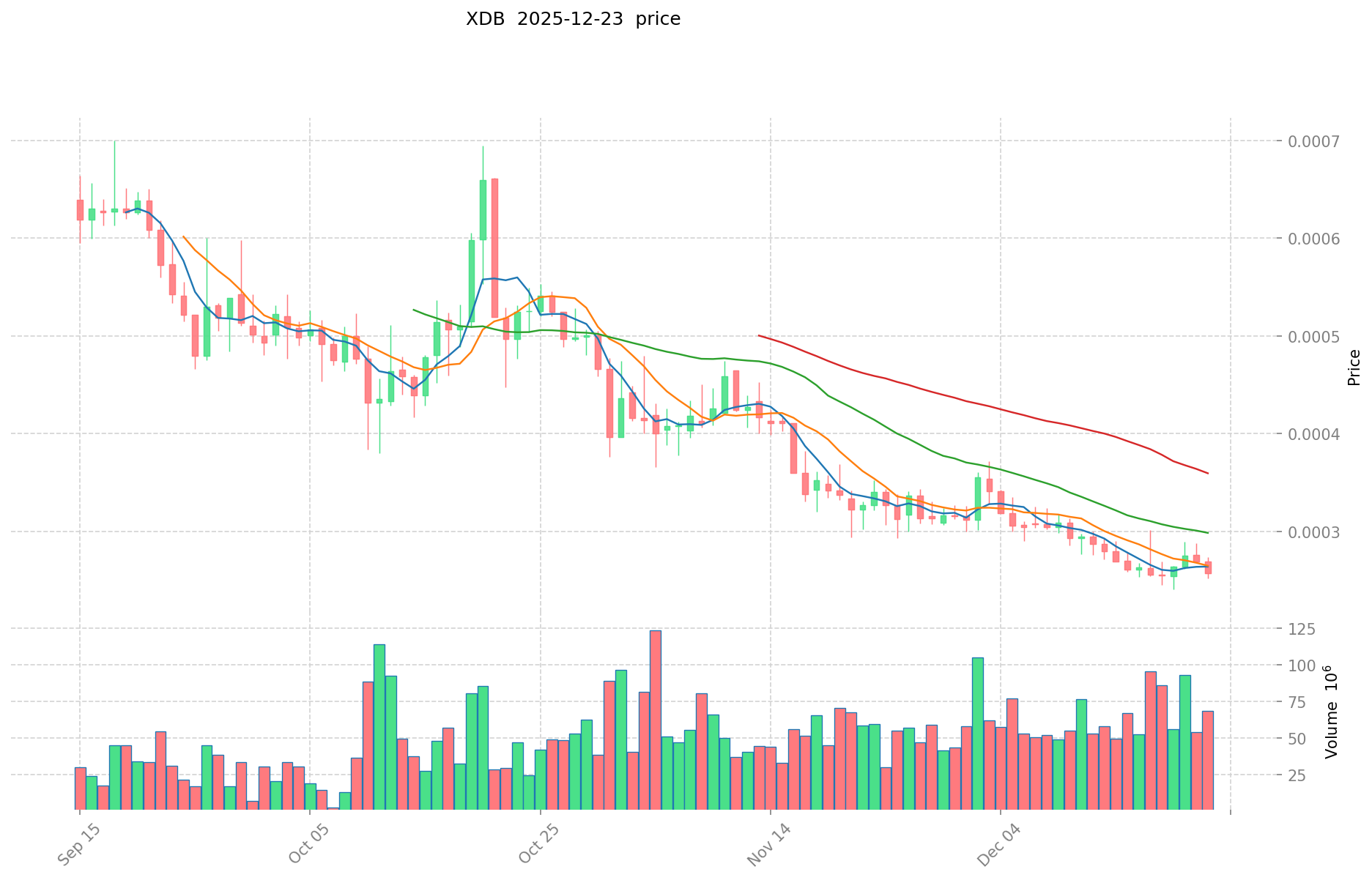

I. XDB Price History Review and Current Market Status

XDB Historical Price Trajectory

- 2021: XDB reached its all-time high of $0.850722 on November 22, 2021, representing the peak of the project's early market cycle.

- 2024-2025: The token experienced significant depreciation, declining from historical highs to reach its all-time low of $0.00021539 on November 4, 2024, marking a substantial correction phase.

XDB Current Market Performance

As of December 24, 2025, XDB is trading at $0.0002519, reflecting ongoing market challenges for the token. The 24-hour price movement shows a -1.09% decline, while the broader performance metrics reveal sustained downward pressure:

- 1-hour change: +0.04%

- 7-day change: -4.67%

- 30-day change: -24.49%

- 1-year change: -68.44%

The token's market capitalization stands at approximately $4,296,674.08, with a fully diluted valuation of $4,727,095.59. Current trading volume over 24 hours is $14,061.69, indicating relatively modest liquidity. XDB maintains a market dominance of 0.00014% within the broader cryptocurrency ecosystem and ranks #1621 by market cap.

The circulating supply comprises 17,057,062,634 XDB out of a maximum supply of 20,000,000,000 tokens, representing 85.29% circulation ratio. The token is held by approximately 5,068 token holders and is currently available on 2 exchanges.

Check XDB Price on Gate.com

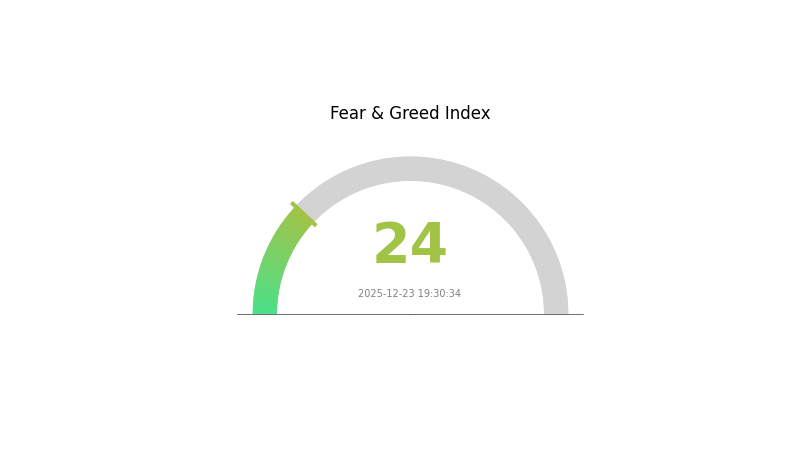

XDB Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 24. This indicates significant market pessimism and investor anxiety. During such periods, market volatility tends to increase as traders react to negative sentiment. However, extreme fear often creates contrarian opportunities for experienced investors who view dips as potential entry points. Monitor key support levels closely and consider your risk tolerance before making trading decisions on Gate.com.

XDB Holdings Distribution

Click to view current XDB holdings distribution

The address holdings distribution chart serves as a critical analytical tool for evaluating the concentration and decentralization characteristics of token ownership across the blockchain network. This metric examines how XDB tokens are distributed among individual addresses, providing insights into market structure, potential manipulation risks, and the overall health of the ecosystem. By analyzing the top holders and their proportional stakes, researchers can assess whether token ownership follows a healthy decentralized model or exhibits concerning concentration patterns that could pose systemic risks to price stability and market integrity.

Without sufficient data in the provided holdings table, a comprehensive concentration assessment cannot be completed at this time. However, the analytical framework for evaluating XDB's holder distribution would typically focus on identifying whether a small number of addresses control a disproportionate percentage of total supply, which could indicate centralization risks. If the distribution data becomes available, particular attention should be directed toward whether the top 10, 50, or 100 addresses maintain excessive control, as extreme concentration could facilitate potential market manipulation, sudden liquidation pressures, or price volatility triggered by large holders' trading decisions.

The current address distribution patterns significantly influence market microstructure and price discovery mechanisms. A highly concentrated holder base may result in reduced market liquidity and increased vulnerability to whale-driven volatility, while a more distributed holder base typically suggests a more robust and resilient market ecosystem. As additional holdings data becomes available, continuous monitoring of distribution trends will remain essential for understanding XDB's evolution toward sustainable decentralization and identifying structural shifts that could affect long-term market stability.

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting XDB's Future Price

Supply Mechanism

-

Maximum Supply Cap: XDB token has a maximum supply of 20 billion tokens, which creates a fixed upper limit on token issuance and establishes scarcity parameters for the asset.

-

Current Impact: The defined maximum supply of 20 billion tokens establishes predictable supply dynamics that can influence long-term price trajectory, as market participants factor in the known supply constraints when evaluating valuation levels.

Market Dynamics

XDB's price is influenced by multiple common factors present in blockchain and cryptocurrency markets, with supply and demand dynamics playing a significant role in price determination, similar to other digital assets in the market.

III. 2025-2030 XDB Price Forecast

2025 Outlook

- Conservative Forecast: $0.0002-$0.00025

- Neutral Forecast: $0.00025

- Optimistic Forecast: $0.00036 (requiring sustained market momentum and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental price appreciation driven by ecosystem development and market maturation

- Price Range Forecast:

- 2026: $0.00018-$0.00037 (21% upside potential)

- 2027: $0.00033-$0.00038 (35% upside potential)

- 2028: $0.00019-$0.00039 (43% upside potential)

- Key Catalysts: Platform expansion, increased liquidity on Gate.com and other major trading platforms, institutional interest growth, and broader market recovery

2029-2030 Long-term Outlook

- Base Case: $0.00023-$0.00042 (49% upside by 2029, assuming steady adoption and market stabilization)

- Optimistic Case: $0.00034-$0.00054 (57% upside by 2030, assuming accelerated ecosystem development and positive macro conditions)

- Transformational Case: $0.0005+ (requiring breakthrough technological advancement, major partnership announcements, or significant market-wide capital inflows into the asset class)

- December 24, 2025: XDB consolidating near mid-range levels, establishing foundation for potential 2026 advance

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00036 | 0.00025 | 0.0002 | 0 |

| 2026 | 0.00037 | 0.00031 | 0.00018 | 21 |

| 2027 | 0.00038 | 0.00034 | 0.00033 | 35 |

| 2028 | 0.00039 | 0.00036 | 0.00019 | 43 |

| 2029 | 0.00042 | 0.00038 | 0.00023 | 49 |

| 2030 | 0.00054 | 0.0004 | 0.00034 | 57 |

XDB CHAIN Investment Strategy and Risk Management Report

IV. XDB Professional Investment Strategy and Risk Management

XDB Investment Methodology

(1) Long-term Holding Strategy

-

Target Audience: Investors with 1-3+ year investment horizons seeking exposure to real-world asset (RWA) tokenization trends and blockchain infrastructure development.

-

Operational Recommendations:

- Accumulate XDB during market downturns when volatility peaks, given the current -68.44% year-over-year decline represents potential accumulation zones for conviction holders.

- Dollar-cost averaging (DCA) approach over 3-6 month periods to reduce timing risk and mitigate volatility exposure.

- Monitor the adoption of XDB CHAIN's branded token (BCO) ecosystem and buyback-and-burn (BBB) mechanism effectiveness as key performance indicators for long-term value realization.

-

Storage Solutions:

- Hardware wallet solutions for holdings exceeding $10,000 USD equivalent to ensure key custody security.

- Gate.com Web3 wallet for active trading and smaller holdings requiring liquidity access.

- Multi-signature wallet configurations for institutional or significant personal allocations.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Identify momentum shifts and potential trend reversals, particularly relevant given the -4.67% 7-day decline and volatile intraday movements (+0.04% 1-hour).

- Relative Strength Index (RSI): Monitor overbought/oversold conditions to time entry and exit points around the $0.000251-$0.000259 trading range.

-

Range Trading Key Points:

- Establish support and resistance levels using 24-hour trading range ($0.0002501-$0.0002594) and 52-week volatility patterns.

- Execute accumulation near historical lows (ATL: $0.00021539 on 2024-11-04) and profit-taking near local resistances.

- Exploit low 24-hour volume ($14,061.69) for price-efficient entry and gradual position building.

XDB Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% portfolio allocation maximum, focusing on small speculative positions within risk-managed portfolios.

- Active Investors: 2-5% allocation, balanced with stablecoin reserves for tactical rebalancing opportunities.

- Professional/Institutional Investors: 3-8% allocation with derivatives hedging strategies and regulatory compliance frameworks.

(2) Risk Hedging Solutions

- Stablecoin Reserve Strategy: Maintain 30-50% of intended XDB allocation in stablecoins (USDT, USDC) on Gate.com to capitalize on sudden price dips without constant monitoring.

- Portfolio Diversification: Limit XDB exposure to <5% of total cryptocurrency holdings, balancing with established Layer-1/Layer-2 protocols and diversified sector exposure.

(3) Secure Storage Solutions

- Self-Custody Wallets: Hardware wallet storage for amounts exceeding $5,000 USD equivalent provides maximum security against exchange-based counterparty risks.

- Exchange Custody: Gate.com provides qualified custody services for trading amounts while maintaining insurance protections for platform-held assets.

- Security Considerations: Enable two-factor authentication (2FA), maintain backup seed phrases in physically secure locations, and never share private keys or recovery phrases. Verify all transactions on the XDB CHAIN explorer (https://explorer.xdbchain.com/) before confirming transfers.

V. XDB Potential Risks and Challenges

XDB Market Risks

-

Extreme Price Volatility: YTD decline of -68.44% from current levels demonstrates significant downside exposure. All-time high of $0.850722 (2021-11-22) versus current trading price of $0.0002519 represents a 99.97% drawdown, indicating extreme market risk and potential for further value erosion.

-

Low Trading Liquidity: 24-hour volume of $14,061.69 across only 2 exchange listings creates illiquidity risks for large position exits. Small market cap ($4.3M circulating) limits institutional capital entry and increases price manipulation susceptibility.

-

Insufficient Market Adoption: Despite RWA focus, the project shows limited ecosystem traction with only 5,068 token holders. Absence of major enterprise partnerships or BCO ecosystem adoption documentation raises concerns about commercial viability and demand drivers for token value.

XDB Regulatory Risks

-

RWA Classification Uncertainty: Real-world asset tokenization remains subject to evolving regulatory frameworks globally. Regulatory reclassification could require protocol modifications or restrict market access in key jurisdictions.

-

Securities Law Exposure: Depending on regulatory interpretation, XDB tokens may face classification as unregistered securities in certain markets, particularly if deemed to offer economic interest in BCO or BBB mechanism revenues.

-

Jurisdiction-Specific Restrictions: XDB's presence on only 2 exchanges suggests potential regulatory barriers in major markets. Geographic expansion constraints could limit adoption and liquidity expansion.

XDB Technical Risks

-

Unproven Consensus Mechanism: Limited public documentation on XDB CHAIN's technical architecture, validator requirements, or consensus security parameters creates uncertainty regarding network resilience and attack vectors.

-

Smart Contract Risks: Limited information regarding BCO token standards, NFT compatibility, and stablecoin integration mechanisms. Unaudited contract code could expose users to exploit vulnerabilities.

-

Ecosystem Dependency: Platform viability depends heavily on BCO adoption and third-party brand integration. Failure to achieve critical mass of branded token issuance threatens the entire tokenomic model supporting BBB deflation.

VI. Conclusion and Action Recommendations

XDB Investment Value Assessment

XDB CHAIN presents a speculative opportunity within the real-world asset tokenization sector but faces substantial execution and market adoption risks. The protocol's core proposition—facilitating branded token (BCO), NFT, and stablecoin transfers through a deflationary BBB mechanism—addresses a genuine market need, but commercial traction remains unproven.

The token's 99.97% decline from all-time highs, combined with minimal liquidity ($14K daily volume) and small holder base (5,068 addresses), suggests early-stage or abandoned project status rather than mature market opportunity. The absence of documented enterprise partnerships or significant ecosystem growth indicators contradicts the "empowering brands and consumers" mandate. Short-term outlook remains bearish given continued downward pressure (-4.67% weekly, -24.49% monthly). Long-term value depends entirely on successful BCO ecosystem development and demonstrable adoption metrics currently not evident in available data.

XDB Investment Recommendations

✅ Beginners: Avoid direct XDB investment. If interested in RWA concepts, consider established infrastructure protocols with proven adoption metrics and superior liquidity before exploring XDB.

✅ Experienced Investors: Limit to 1-3% speculative portfolio allocation only if you possess high risk tolerance and extended investment horizon (3+ years). Use DCA into support levels near $0.00021539 if fundamental adoption metrics improve. Prioritize trading on Gate.com where available.

✅ Institutional Investors: Conduct comprehensive due diligence on XDB CHAIN's technical infrastructure, validator governance, and BCO ecosystem development before position consideration. Require regulatory clarity on RWA classification and obtain legal opinions on securities law compliance. Allocations, if any, should remain sub-1% with full hedging strategies.

XDB Trading Participation Methods

-

Spot Trading on Gate.com: Direct XDB/USDT trading pairs enabling immediate position entry/exit with competitive fee structures and reliable execution.

-

DCA Investment Program: Automated recurring purchases via Gate.com to reduce timing risk and accumulate positions systematically during extended bear markets.

-

Limit Order Strategy: Set buy orders near historical support levels ($0.00021539 ATL region) to capture downside moves without constant price monitoring.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and are strongly advised to consult qualified financial advisors before committing capital. Never invest more than you can afford to lose completely. Past performance does not guarantee future results.

FAQ

Will XDB recover?

XDB's recovery depends on market conditions and project development. With strong fundamentals and active community support, XDB has potential to recover. Monitor project updates and trading volume for better insights into its price trajectory.

What is the all time high of XDB coin?

The all-time high of XDB coin is $0.843, reached on November 21, 2021. This represents the peak price since the coin's inception in the market.

Is DigitalBits a good investment?

DigitalBits offers solid investment potential with its strong use case and blockchain infrastructure. The project shows promising fundamentals for long-term growth, making it an attractive option for crypto investors seeking exposure to enterprise-grade digital asset solutions.

What is the XDB coin for?

XDB powers the DigitalBits blockchain, enabling network security and operations. It facilitates transactions and supports the robustness of the entire blockchain ecosystem through its utility functions.

2025 WHITEPrice Prediction: Analysis of Market Trends and Future Value Potential

SIX vs QNT: Analyzing Performance Metrics of Two Leading Blockchain Technology Platforms

EL vs HBAR: Comparing the Performance and Applications of Different Quantum Computing Architectures

2025 BST Price Prediction: Analyzing Market Trends and Potential Growth Factors

What Will ONDO Price Be in 2025? Analyzing Historical Trends and Market Predictions

2025 PLUME Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Cryptocurrency

Top Secure Platforms for Buying Cryptocurrencies in 2025

Exploring Decentraland $MANA: A Top Metaverse Coin for Future Investment

The remarkable surge of an AI-powered cryptocurrency: Is this the beginning of a new era?

What is UOS: A Comprehensive Guide to the Unified Operating System

What is POR: A Comprehensive Guide to Plan of Record in Project Management