2025 SOON Price Prediction: Expert Analysis and Future Market Outlook for the Upcoming Year

Introduction: SOON's Market Position and Investment Value

SOON (SOON) has established itself as an innovative blockchain infrastructure project, currently ranked among the top 400 cryptocurrencies by market capitalization. As of December 18, 2025, SOON's market cap has reached $322.6 million, with a circulating supply of approximately 235 million tokens trading at around $0.3226 per unit. The project distinguishes itself through its comprehensive ecosystem featuring the SOON Stack—the first SVM Rollup Stack bringing Solana compatibility across multiple ecosystems—along with the InterSOON messaging protocol for seamless cross-chain communication and the Simpfor.Fun copy trading platform.

This article will comprehensively analyze SOON's price trajectory and market dynamics, examining historical price patterns, market supply and demand factors, and ecosystem development trends to provide investors with professional price forecasts and actionable investment strategies for the coming period.

SOON Price History Review and Market Status

I. SOON Price History Review and Market Status

SOON Historical Price Evolution Trajectory

- November 14, 2025: SOON reached its all-time high of $5.5368, marking the peak of the token's valuation since launch.

- May 23, 2025: SOON touched its all-time low of $0.05, representing the lowest point in the token's trading history.

- December 18, 2025: SOON has experienced significant downward pressure, with a 78.33% decline over the past 30 days, trading at $0.3226.

SOON Current Market Situation

As of December 18, 2025, SOON is trading at $0.3226, reflecting a 24-hour decline of 3.67%. The token shows continued weakness with a 1-hour drop of 1.89% and a 7-day decline of 27.80%. The 30-day performance is particularly concerning, with a sharp 78.33% decrease.

The token maintains a market capitalization of approximately $75.83 million with a fully diluted valuation of $322.6 million, placing it at rank 400 in the cryptocurrency market. The circulating supply stands at 235,065,446 SOON out of a total supply of 1 billion tokens, representing a circulation ratio of 23.51%. Trading volume in the past 24 hours reached $234,202.68, indicating moderate market activity across 31 exchanges where SOON is listed.

The 24-hour price range spans from $0.3164 to $0.3508, demonstrating ongoing volatility within a narrow band. Market sentiment appears cautious, with the current market emotion indicator at 1, suggesting bearish conditions.

Click to view current SOON market price

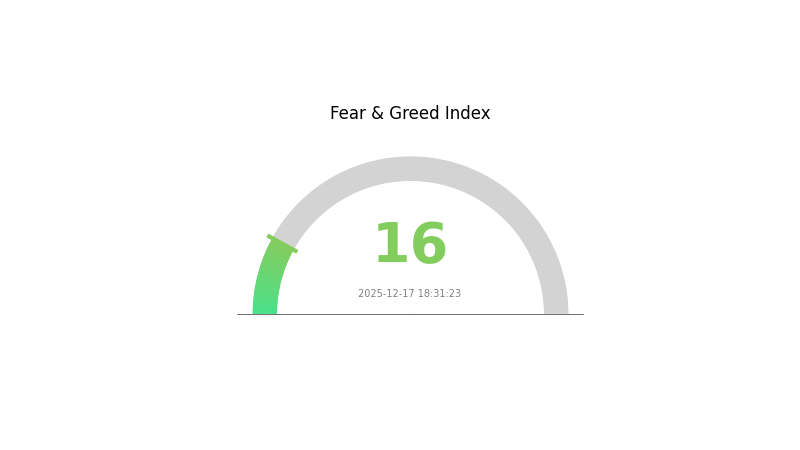

SOON Market Sentiment Index

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 16. This represents one of the lowest sentiment levels, indicating widespread pessimism among investors. During such periods, market volatility tends to increase as selling pressure dominates. However, extreme fear often creates contrarian opportunities for long-term investors seeking favorable entry points. Traders should exercise caution and implement proper risk management strategies. Monitor market developments closely on Gate.com to identify potential turning points as sentiment may shift rapidly.

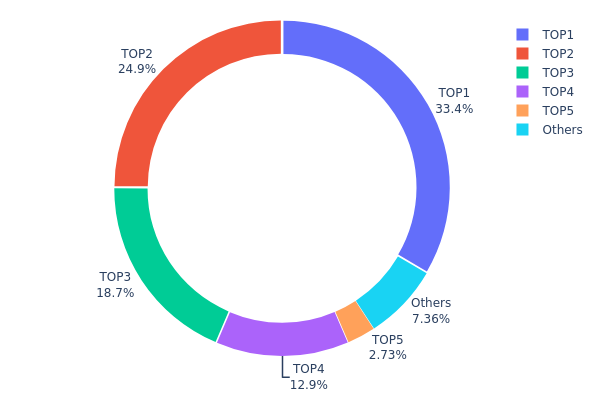

SOON Holdings Distribution

The holdings distribution map illustrates the concentration of SOON tokens across blockchain addresses, revealing the degree of decentralization and potential market structure risks. By analyzing the top holders and their respective percentages of total supply, we can assess whether token ownership is widely distributed or concentrated among a limited number of entities, which has direct implications for market stability and governance dynamics.

The current SOON distribution exhibits significant concentration concerns. The top four addresses collectively control 89.89% of the total token supply, with the leading address alone holding 33.44%. This distribution pattern reflects a highly concentrated ownership structure where decision-making power is concentrated in relatively few hands. Notably, the top two addresses account for 58.37% of all SOON tokens, while the remaining 7.39% distributed among other addresses highlights an acute imbalance. Such extreme concentration typically emerges during early-stage projects or in cases where substantial token allocations are held by project teams, early investors, or strategic reserves.

This pronounced concentration introduces material risks to market structure and price dynamics. The concentrated holdings create potential liquidity constraints and susceptibility to significant price volatility should large holders execute substantial transactions. Additionally, the current distribution suggests limited participation from retail investors and a decentralized community, which may constrain organic market development and governance resilience. The governance architecture remains vulnerable to decisions by principal stakeholders, potentially limiting the project's progression toward true decentralization. Monitoring whether these concentrated holdings gradually disperse over time will be critical for evaluating SOON's long-term market maturity and structural stability.

Click to view the current SOON Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0978...924642 | 179166.67K | 33.44% |

| 2 | 0xcc48...3fe0f7 | 133571.43K | 24.93% |

| 3 | 0xb798...55f5d4 | 100000.00K | 18.66% |

| 4 | 0xa370...9c1060 | 68888.89K | 12.86% |

| 5 | 0xffa8...44cd54 | 14609.42K | 2.72% |

| - | Others | 39411.52K | 7.39% |

II. Core Factors Affecting SOON's Future Price

Technology Development and Ecosystem Building

-

Modular Architecture: SOON implements a modular architecture design that achieves high performance and scalability, positioning it as a potential Layer 2 solution capable of competing with similar projects in the space.

-

Application Diversity and User Experience: The platform prioritizes application diversity and user-friendly design to attract developers and users. Rich ecosystem applications are being developed to enhance the platform's utility and adoption.

-

Ecosystem Growth: Market participants focus on the project's innovation capacity and ecosystem construction quality as key indicators for assessing SOON's long-term value and competitiveness.

Market Sentiment and Investor Focus

-

Market Demand and Technical Progress: SOON's future price is primarily influenced by market demand, technological development trajectory, and competitive positioning relative to other Layer 2 solutions.

-

Investment Attention Points: Investors closely monitor the project's innovation level, ecosystem building progress, and overall development direction when evaluating the token's investment potential.

-

Policy and Market Sentiment: Changes in market sentiment and regulatory policy adjustments represent critical factors that can significantly impact SOON's price movements and market performance.

III. 2025-2030 SOON Price Forecast

2025 Outlook

- Conservative Forecast: $0.2776 - $0.3228

- Base Case Forecast: $0.3228

- Optimistic Forecast: $0.3777

2026-2027 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with sustained growth momentum

- Price Range Forecast:

- 2026: $0.1821 - $0.4413 (8% upside potential)

- 2027: $0.2968 - $0.4789 (22% cumulative growth)

- Key Catalysts: Ecosystem development maturation, increased institutional adoption, and strengthened on-chain activity metrics

2028-2030 Long-term Outlook

- Base Case Scenario: $0.4067 - $0.6429 (steady growth trajectory with 35% appreciation by 2028)

- Optimistic Scenario: $0.5401 - $0.7561 (accelerated adoption driving 67% gains by 2029)

- Transformation Scenario: $0.4083 - $0.8814 (breakthrough network utility and market expansion achieving 100% growth by 2030)

Note: Price forecasts represent analytical projections based on current market data. Investors are advised to conduct independent research on Gate.com and other reputable platforms before making investment decisions. Actual market outcomes may differ materially from these predictions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.37768 | 0.3228 | 0.27761 | 0 |

| 2026 | 0.4413 | 0.35024 | 0.18212 | 8 |

| 2027 | 0.47888 | 0.39577 | 0.29683 | 22 |

| 2028 | 0.64287 | 0.43732 | 0.40671 | 35 |

| 2029 | 0.75613 | 0.5401 | 0.37267 | 67 |

| 2030 | 0.88144 | 0.64812 | 0.40831 | 100 |

SOON Token Investment Strategy and Risk Management Report

IV. SOON Professional Investment Strategy and Risk Management

SOON Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in Solana ecosystem expansion and cross-chain interoperability solutions

- Operation Recommendations:

- Accumulate SOON during market downturns, particularly when prices approach support levels near $0.30

- Hold positions through product development milestones, especially SOON Stack expansion and InterSOON protocol adoption

- Maintain positions for 12-24 months to capitalize on potential ecosystem growth

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor key price points at $0.30 (recent support), $0.35 (24H high), and $0.45-$0.50 (recovery targets)

- Volume Analysis: Track the 24H trading volume of approximately $234,202 to identify breakout opportunities when volume exceeds 50% of average

- Wave Trading Key Points:

- Capitalize on short-term volatility given the -1.89% 1H change and -3.67% 24H decline

- Set profit targets at 15-25% gains during recovery phases from local lows

SOON Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Aggressive Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Balance SOON holdings with established Solana ecosystem tokens to reduce single-asset risk

- Position Sizing: Use trailing stop-loss orders at 15-20% below entry points to limit downside exposure

(3) Secure Storage Solutions

- Hot Wallet: Gate.com Web3 wallet for active trading and frequent transactions

- Cold Storage: Hardware wallets for long-term holdings exceeding 6 months

- Security Precautions: Enable two-factor authentication on all exchange accounts, never share private keys, and regularly audit wallet permissions

V. SOON Potential Risks and Challenges

SOON Market Risks

- Extreme Price Volatility: SOON has experienced significant drawdowns, including -78.33% over 30 days, indicating high volatility and potential for substantial losses

- Low Market Liquidity: With a 24H trading volume of only $234,202 against a $322.6M market cap, liquidity is relatively thin, which can lead to slippage on larger trades

- Competition from Established Solutions: Other SVM Rollup and cross-chain messaging protocols may capture market share, reducing SOON's competitive advantage

SOON Regulatory Risks

- Evolving Regulatory Environment: Increased regulatory scrutiny on cryptocurrency projects could impact SOON's operations and token value

- Compliance Requirements: Changes in securities regulations may require protocol modifications or geographic restrictions on token trading

- Jurisdiction-Specific Restrictions: Certain regions may restrict access to SOON trading or related services

SOON Technology Risks

- Rollup Stack Adoption Risk: The success of SOON Stack depends on developers building and maintaining chains, which may face technical or economic hurdles

- Cross-Chain Security: InterSOON protocol security is critical; any vulnerabilities could expose users to hacks or fund loss

- Scalability Challenges: As the number of SOON chains increases beyond the current 5, maintaining network stability and performance becomes increasingly complex

VI. Conclusion and Action Recommendations

SOON Investment Value Assessment

SOON presents an interesting opportunity within the Solana ecosystem expansion narrative, with three distinct product offerings: SOON Stack for SVM Rollups, InterSOON for cross-chain messaging, and Simpfor.Fun for copy trading. However, the token faces significant challenges including extreme price volatility (down 78.33% in 30 days), relatively low trading liquidity, and unproven product adoption. The project is ranked 400th by market cap at $322.6M with only 23.51% of tokens circulating, suggesting substantial dilution risk. Investors should carefully evaluate whether the long-term vision justifies the current risks and volatility.

SOON Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of portfolio) using Gate.com's spot trading feature to familiarize yourself with SOON price dynamics before committing larger amounts

✅ Experienced Investors: Consider dollar-cost averaging during price dips below $0.30, while employing technical analysis to time entries around identified support levels

✅ Institutional Investors: Conduct thorough due diligence on SOON Stack adoption metrics and InterSOON protocol security audits before significant allocation decisions

SOON Trading Participation Methods

- Spot Trading on Gate.com: Purchase SOON directly using fiat or other cryptocurrencies through Gate.com's spot market with standard trading pairs

- Token Swaps: Exchange SOON between Solana (SOL) and Binance Smart Chain (BSC) networks using the provided contract addresses

- Copy Trading via Simpfor.Fun: Participate in the SOON ecosystem's native copy trading platform to mirror professional traders' positions

Cryptocurrency investment carries extreme risk and volatility. This report is not investment advice. Investors should make decisions based on their individual risk tolerance and circumstances. Always consult with a qualified financial advisor. Never invest more than you can afford to lose completely.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

2025 RECALL Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 GIGGLE Price Prediction: Analyzing Market Trends and Future Growth Potential for the Emerging Cryptocurrency Token

2025 LRC Price Prediction: Expert Analysis and Future Outlook for Loopring Token

2025 WAVES Price Prediction: Expert Analysis and Market Outlook for the Next Bull Run

2025 USELESS Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Next 12 Months