2025 SMART Price Prediction: Analyzing Market Trends and Future Growth Potential for Blockchain's Smart Contract Platform

Introduction: SMART's Market Position and Investment Value

SMART (SMART), as the main network coin of the Smart blockchain, has achieved significant progress since its inception. As of 2025, SMART's market capitalization has reached $42.87 billion, with a circulating supply of approximately 9 billion coins, and a price hovering around $0.0047636. This asset, known as the "Smart Network Token," is playing an increasingly crucial role in decentralized network creation and token integration.

This article will comprehensively analyze SMART's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. SMART Price History Review and Current Market Status

SMART Historical Price Evolution

- 2024: SMART reached its all-time low of $0.0003871791 on March 9, marking a significant bottom in its price history.

- 2025: The project saw a substantial recovery, with the price reaching an all-time high of $0.011835 on August 13.

- 2025: SMART experienced volatility, with the price currently stabilizing around $0.0047636 as of December 15.

SMART Current Market Situation

As of December 15, 2025, SMART is trading at $0.0047636, showing a 4.95% increase in the last 24 hours. The token has demonstrated strong performance across various timeframes, with a 56.04% gain over the past week and a 35% increase in the last 30 days. The year-to-date performance is particularly impressive, with SMART recording a 176.99% price appreciation.

SMART's market capitalization currently stands at $42,872,448,588.72, ranking it 8th in the cryptocurrency market with a 1.31% market share. The circulating supply matches the total supply of 9,000,010,200,000 SMART tokens, indicating full distribution.

Trading volume in the past 24 hours reached $85,901.99, reflecting active market participation. The token is trading significantly above its all-time low but remains below its recent all-time high, suggesting potential for further price discovery.

Click to view the current SMART market price

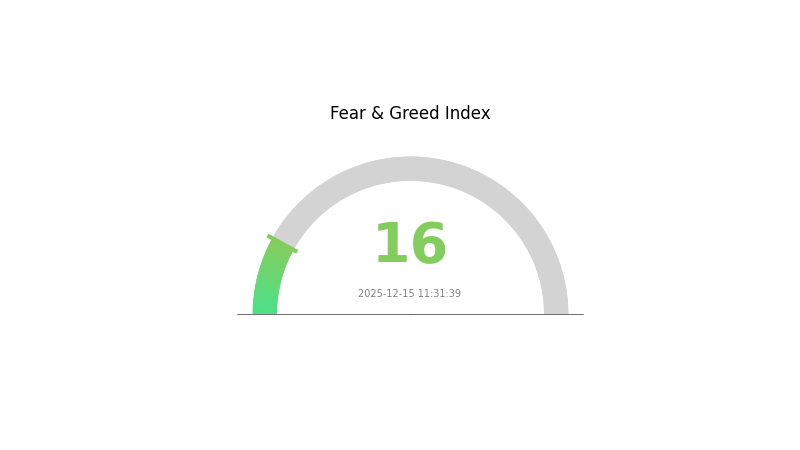

SMART Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders should consider dollar-cost averaging and thorough research before making any decisions. Remember, while fear can create opportunities, it's crucial to manage risk and stick to your long-term investment strategy. Stay informed and trade wisely on Gate.com.

SMART Holdings Distribution

The address holdings distribution data for SMART reveals a highly concentrated ownership structure. The top address holds an overwhelming 78.22% of the total supply, equivalent to 587,918,441.96K SMART tokens. This is followed by three addresses, each holding approximately 6.65% of the supply, or 50 million tokens each. The fifth largest holder possesses 0.69% of the supply, while all other addresses combined account for only 1.14%.

This extreme concentration raises significant concerns about the decentralization and market stability of SMART. With nearly 80% of tokens controlled by a single address, there is a substantial risk of market manipulation and price volatility. The top holder has the potential to exert undue influence over the token's governance and market dynamics. Furthermore, the presence of three addresses with identical holdings (6.65% each) suggests possible strategic token distribution or potential affiliated entities.

Such a centralized distribution structure may undermine the project's claims of decentralization and could deter potential investors concerned about fair market practices. It also exposes the SMART ecosystem to increased vulnerability should the largest holder decide to liquidate their position or if their address security is compromised.

Click to view the current SMART holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | sfFprP...MxFCQh | 587918441.96K | 78.22% |

| 2 | sLbzsn...ZYZGmJ | 50000000.00K | 6.65% |

| 3 | sdvURG...nkcLcL | 50000000.00K | 6.65% |

| 4 | sbTUVh...oy7ogc | 49999998.01K | 6.65% |

| 5 | sfNdvr...jUg4Qg | 5198994.00K | 0.69% |

| - | Others | 7650569.64K | 1.14% |

II. Key Factors Influencing SMART's Future Price

Supply Mechanism

- Token Burning: Regular token burning events to reduce circulating supply

- Historical Pattern: Previous burns have generally led to short-term price increases

- Current Impact: Upcoming burns expected to provide modest price support

Institutional and Whale Dynamics

- Institutional Holdings: Growing interest from institutional investors, with some major firms accumulating SMART

- Corporate Adoption: Several tech companies exploring SMART integration for blockchain solutions

- Government Policies: Increasing regulatory clarity in major markets, potentially enabling broader adoption

Macroeconomic Environment

- Monetary Policy Impact: Expected interest rate cuts in 2026 could increase appetite for risk assets like SMART

- Inflation Hedging Properties: SMART showing some correlation with inflation, attracting investors seeking diversification

- Geopolitical Factors: Global economic uncertainties driving some investors towards crypto assets as alternative investments

Technical Development and Ecosystem Growth

- Scalability Upgrade: Planned implementation of layer-2 solutions to improve transaction throughput

- Cross-chain Interoperability: Development of bridges to enhance connectivity with other major blockchains

- Ecosystem Applications: Growing number of DApps and DeFi projects building on the SMART network

III. SMART Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00272 - $0.00400

- Neutral prediction: $0.00400 - $0.00500

- Optimistic prediction: $0.00500 - $0.00562 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00410 - $0.00612

- 2028: $0.00423 - $0.00744

- Key catalysts: Technological advancements, partnerships, and market expansion

2029-2030 Long-term Outlook

- Base scenario: $0.00605 - $0.00700 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00700 - $0.00788 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $0.00788 - $0.00850 (assuming breakthrough innovations and widespread integration)

- 2030-12-31: SMART $0.00668 (average price prediction for 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00562 | 0.00476 | 0.00272 | 0 |

| 2026 | 0.00545 | 0.00519 | 0.0041 | 9 |

| 2027 | 0.00612 | 0.00532 | 0.0041 | 11 |

| 2028 | 0.00744 | 0.00572 | 0.00423 | 20 |

| 2029 | 0.00678 | 0.00658 | 0.00605 | 38 |

| 2030 | 0.00788 | 0.00668 | 0.00574 | 40 |

IV. SMART Professional Investment Strategy and Risk Management

SMART Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and long-term vision

- Operation suggestions:

- Accumulate SMART tokens during market dips

- Set price targets and take partial profits at predetermined levels

- Store tokens in secure hardware wallets or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Use dollar-cost averaging to enter positions gradually

SMART Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Use of stablecoins: Convert a portion of SMART holdings to stablecoins during high volatility periods

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Cold storage solution: Paper wallets for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for SMART

SMART Market Risks

- High volatility: Price fluctuations can be extreme

- Limited liquidity: May impact ability to execute large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

SMART Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax laws may impact profitability

SMART Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: May face issues with network congestion

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

SMART Investment Value Assessment

SMART presents a high-risk, high-potential investment opportunity. Its innovative blockchain model and integration capabilities offer long-term value, but short-term volatility and regulatory uncertainties pose significant risks.

SMART Investment Recommendations

✅ Beginners: Start with small, regular investments to learn about the market ✅ Experienced investors: Consider allocating a portion of portfolio, with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider SMART as part of a diversified crypto portfolio

SMART Trading Participation Methods

- Spot trading: Buy and sell SMART tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options using SMART tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

DeepSnitch AI is predicted to give 1000x returns. It uses AI to find crypto opportunities and stands out among other projects.

Which crypto will reach $1000 in 2030?

XRP has the potential to reach $1000 by 2030, according to predictions from a former Goldman Sachs analyst. This would require significant growth from its current price levels.

Will AI Doge reach $1?

Based on current trends, AI Doge is unlikely to reach $1 soon. Predictions suggest it may reach $0.5 within a month, but $1 remains a distant target.

What is smart crypto?

Smart crypto refers to smart contracts, self-executing agreements on blockchain that automatically enforce and execute terms when conditions are met, ensuring transparency and security.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

RON vs RUNE: A Comprehensive Comparison of Two Major Blockchain Tokens

Comprehensive Overview of EIP 4337: Implementing Account Abstraction in Web3

Understanding NFT Rarity: A Comprehensive Scoring Guide

Tomarket Daily Combo 17 december 2025

Is Linea (LINEA) a good investment?: A Comprehensive Analysis of the Layer 2 Ethereum Solution's Potential and Risks