2025 POWER Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: POWER's Market Position and Investment Value

Power Protocol (POWER) serves as an incentive layer that bridges mainstream applications to Web3 by converting user behavior and app revenue into on-chain rewards. Launched alongside Fableborne—one of the first Web3-enabled mobile titles to achieve mass-market metrics—POWER has garnered backing from global gaming and Web3 leaders including Delphi, Spartan, Mechanism, and Sky Mavis. As of December 18, 2025, POWER has achieved a market capitalization of $76.88 million, with a circulating supply of 210 million tokens and a current price of $0.3661. This innovative asset, designed to transform user engagement into real economic value, is playing an increasingly vital role in connecting millions of Web2 users to meaningful on-chain experiences through games, consumer applications, and creator platforms.

This article will conduct a comprehensive analysis of POWER's price dynamics and market trends, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies for informed decision-making in the evolving cryptocurrency landscape.

POWER Protocol (POWER) Market Analysis Report

I. POWER Price History Review and Current Market Status

POWER Historical Price Development

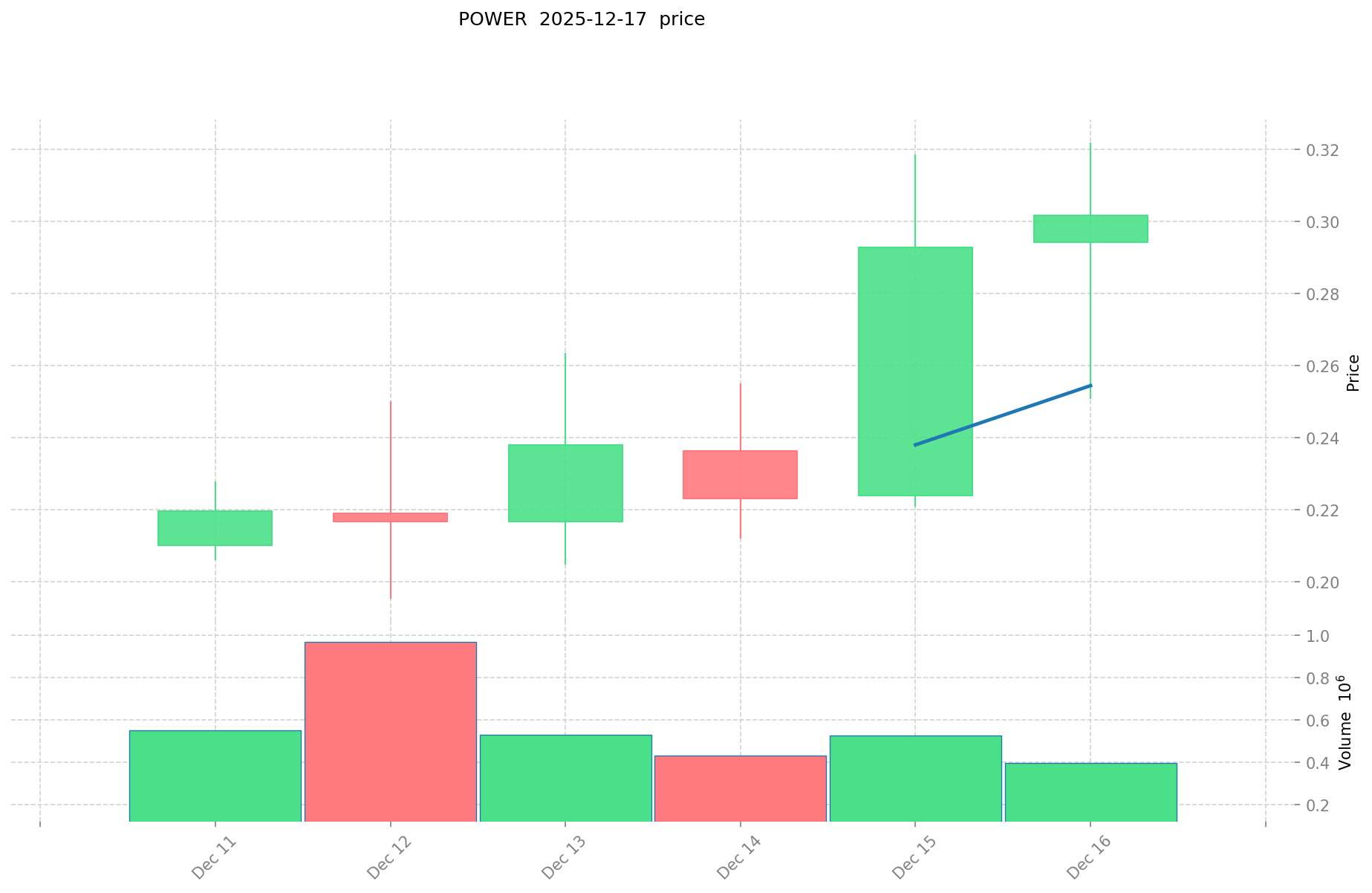

Based on the most recent market data as of December 18, 2025, POWER has demonstrated significant price momentum:

- December 12, 2025: All-time low reached at $0.1953, marking the beginning of a strong recovery phase

- December 17, 2025: All-time high achieved at $0.4595, representing a 135% increase from the low point in just 5 days

- Recent Rally: The token has gained 346.92% over the past 30 days, indicating sustained upward momentum since its launch

POWER Current Market Status

As of December 18, 2025 at 01:27:33 UTC, POWER is trading at $0.3661, reflecting a 24-hour price increase of 32.18% from $0.2755. The token's 7-day performance shows a gain of 63.65%, demonstrating strong market interest and bullish sentiment.

Key Market Metrics:

| Metric | Value |

|---|---|

| Current Price | $0.3661 |

| 24H Volume | $389,568.15 |

| Market Cap | $76,881,000 |

| Fully Diluted Valuation | $366,100,000 |

| Circulating Supply | 210,000,000 POWER |

| Total Supply | 1,000,000,000 POWER |

| Circulation Ratio | 21% |

| Market Ranking | 396 |

| Active Holders | 243 |

The token is currently trading significantly below its all-time high of $0.4595, with an intraday low of $0.2755 and intraday high of $0.4595. POWER maintains a market dominance of 0.011% within the broader cryptocurrency market.

Click to view current POWER market price

POWER Market Sentiment Indicator

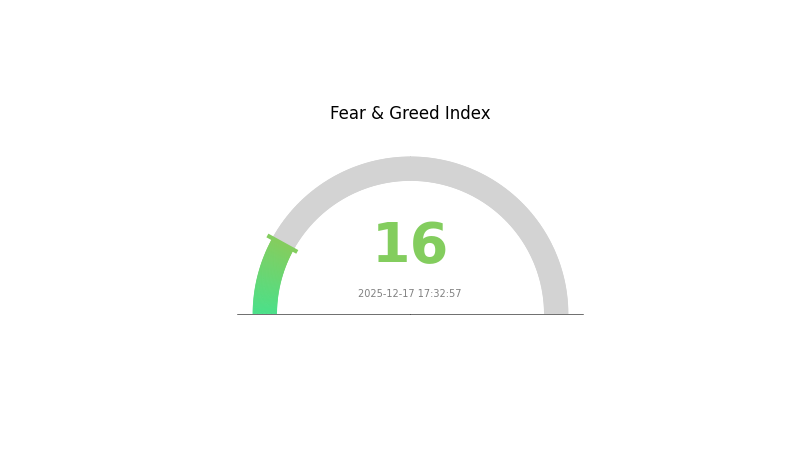

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plunging to 16. This exceptionally low reading indicates widespread investor anxiety and negative sentiment across the market. During such periods of extreme fear, experienced traders often view it as a potential buying opportunity, as historically these conditions have preceded market reversals and recovery phases. However, caution is warranted as further downside movement remains possible. Monitor key support levels closely and consider your risk tolerance carefully before making investment decisions on Gate.com.

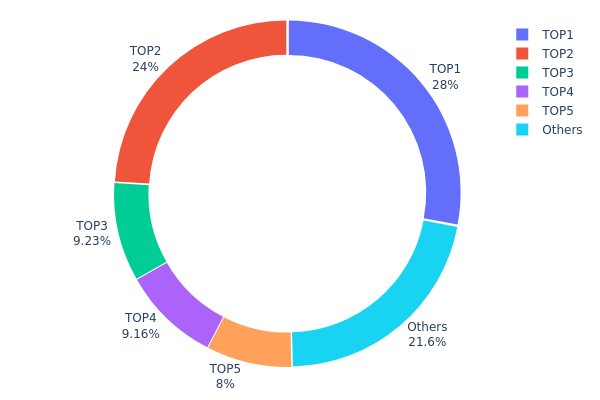

POWER Holding Distribution

The address holding distribution map illustrates the concentration of token ownership across the blockchain network by analyzing the proportion of POWER tokens held by individual addresses. This metric serves as a critical indicator of decentralization, market structure stability, and potential systemic risks associated with token concentration.

Current analysis of POWER's top holders reveals a pronounced concentration pattern. The top two addresses collectively control 52.00% of the total supply, with the leading address alone commanding 28.00%. The top five addresses account for 78.39% of all POWER tokens, while the remaining addresses hold only 21.61%. This distribution demonstrates significant concentration in token ownership, suggesting that a relatively small number of stakeholders possess substantial influence over the network's token dynamics.

The elevated concentration levels present notable implications for market structure and stability. High token concentration increases vulnerability to potential price manipulation and creates liquidity risks, as sudden selling pressure from major holders could trigger significant price volatility. Additionally, the centralized holding pattern may constrain the network's decentralization objectives and limit organic price discovery mechanisms. Stakeholders should monitor the movement of these major addresses, as their trading decisions could materially impact market conditions and investor sentiment. The current distribution reflects a market structure that remains relatively immature from a decentralization perspective, with governance and market dynamics substantially influenced by a limited number of major token holders.

For current POWER Holding Distribution data, click here.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9eba...0363df | 280000.00K | 28.00% |

| 2 | 0x4e0a...07e140 | 240000.00K | 24.00% |

| 3 | 0x00e1...4f0a37 | 92317.13K | 9.23% |

| 4 | 0xa714...b48612 | 91636.97K | 9.16% |

| 5 | 0x7eee...ac2921 | 80037.24K | 8.00% |

| - | Others | 216008.67K | 21.61% |

Core Factors Influencing POWER's Future Price

Supply Mechanism

-

Fixed Total Supply Framework: Power Protocol has established a fixed supply structure with a total supply of 1 billion tokens. Initial circulation allocation details were shared prior to Token Generation Event (TGE), with vesting and distribution schedules published in the official tokenomics documentation.

-

Current Impact: The token distribution mechanism, including allocation to community incentives, liquidity provisions, and ecosystem growth, will directly influence early price discovery. Market liquidity and exchange listing timing—particularly the December 5, 2025 deposit/withdrawal schedule—represent critical catalysts for price formation during the initial trading period.

Ecosystem Adoption and Application Demand

-

Web3 Gaming Integration: Power Protocol is positioned as an infrastructure and economic layer designed to empower consumer Web3 entertainment, primarily focused on gaming and live-streaming interactive applications. The token is designated as a utility asset for staking, in-app purchases, governance, and protocol fees.

-

Multi-Application Value Aggregation: The core thesis centers on the ability to consolidate value across multiple applications into a unified economy. Successful implementation of on-chain reward routing, staking, referral systems, and progress mechanisms will be essential to generating cross-application, durable demand that extends beyond individual game cycles.

-

Flagship Applications: Pixion's Fableborne is positioned as the flagship gaming application utilizing POWER. The success of this and subsequent developer ecosystem projects through Power Labs will be critical in demonstrating real user adoption and retention.

Market Catalysts and Adoption Factors

-

Active User Metrics: Real-world price performance will depend on sustained multi-application demand, verifiable tokenomics execution, and transparent on-chain behavior. Key indicators include active wallet counts associated with POWER-enabled games and daily transaction volumes, which can be tracked through DApp activity reports and in-game telemetry data.

-

Regulatory Environment: Regulatory clarity and monitoring of securities law compliance represent important factors in achieving centralized exchange listings and institutional adoption. Regulatory uncertainty in major markets may create friction for expansion beyond initial trading channels.

-

Market Sentiment and Liquidity: Short-term price movement will be dominated by listing liquidity, early speculative interest, and token unlock mechanisms. Medium to long-term performance will depend on real user retention rates and developer ecosystem adoption.

Three、2025-2030 POWER Price Forecast

2025 Outlook

- Conservative Forecast: $0.24-$0.36

- Neutral Forecast: $0.36-$0.53

- Optimistic Forecast: $0.50-$0.53 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation and development phase with moderate growth trajectory, characterized by strengthening fundamentals and increasing adoption.

- Price Range Forecast:

- 2026: $0.31-$0.63 (22% potential upside)

- 2027: $0.47-$0.63 (47% potential upside)

- 2028: $0.48-$0.67 (60% potential upside)

- Key Catalysts: Ecosystem expansion, strategic partnerships, technological upgrades, and growing market recognition within the decentralized finance sector.

2029-2030 Long-term Outlook

- Base Case: $0.55-$0.90 (72% potential upside by 2029, assuming stable market conditions and consistent protocol development)

- Optimistic Scenario: $0.67-$1.03 (109% potential upside by 2030, contingent upon mainstream adoption and breakthrough network utility milestones)

- Transformative Scenario: $1.03+ (extreme bullish conditions with exponential adoption acceleration and macro market tailwinds favoring digital assets)

- December 18, 2030: POWER projected at $0.76 average (mid-cycle maturation phase with established market position)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.53042 | 0.3633 | 0.24341 | 0 |

| 2026 | 0.63454 | 0.44686 | 0.30833 | 22 |

| 2027 | 0.63262 | 0.5407 | 0.465 | 47 |

| 2028 | 0.67466 | 0.58666 | 0.48106 | 60 |

| 2029 | 0.90184 | 0.63066 | 0.54867 | 72 |

| 2030 | 1.03444 | 0.76625 | 0.6743 | 109 |

Power Protocol (POWER) Professional Investment Strategy and Risk Management Report

I. Executive Summary

Power Protocol (POWER) is an incentive layer that bridges mainstream applications to Web3 by converting user behavior and application revenue into on-chain rewards. Launched alongside Fableborne, a Web3-enabled mobile game achieving mass-market metrics, the protocol has secured backing from industry leaders including Delphi, Spartan, Mechanism, and Sky Mavis. As of December 18, 2025, POWER trades at $0.3661 with a market capitalization of $76.88 million and a fully diluted valuation of $366.1 million.

II. Market Performance Overview

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.3661 |

| 24H Change | +32.18% |

| 7D Change | +63.65% |

| 30D Change | +346.92% |

| Market Cap | $76,881,000 |

| Fully Diluted Valuation | $366,100,000 |

| 24H Trading Volume | $389,568.15 |

| Market Rank | #396 |

| Circulating Supply | 210,000,000 POWER |

| Total Supply | 1,000,000,000 POWER |

| All-Time High | $0.4595 (December 17, 2025) |

| All-Time Low | $0.1953 (December 12, 2025) |

Price Volatility Analysis

POWER demonstrates significant volatility with a 135.2% price swing from ATL to ATH within a 5-day period. The 30-day performance of +346.92% indicates strong upward momentum, though the token remains in an early price discovery phase given its recent launch.

III. Project Fundamentals

Core Protocol Architecture

Power Protocol functions as an incentive layer designed to tokenize user engagement across Web2 applications and convert it into on-chain economic value. The protocol's primary mechanisms include:

- User Behavior Monetization: Routes user interactions into smart contract-based rewards

- Application Revenue Sharing: Enables apps to distribute tokenized rewards to users

- Multi-Channel Ecosystem: Operates across gaming, consumer applications, and creator platforms

Backed Ecosystem Integration

The protocol launched in coordination with Fableborne, positioning itself as one of the first Web3 games to achieve mainstream adoption metrics. Strategic backing from Delphi, Spartan, Mechanism, and Sky Mavis (Axie Infinity's parent company) provides both technical credibility and distribution networks.

Token Economics

- Total Supply: 1 billion POWER tokens

- Circulating Supply: 210 million POWER (21% of total)

- Circulating Ratio: 21%

- Token Standard: ERC-20 on Ethereum

- Contract Address: 0x9dc44ae5be187eca9e2a67e33f27a4c91cea1223

IV. POWER Professional Investment Strategy and Risk Management

POWER Investment Methodology

(1) Long-Term Holding Strategy

Target Investors: Protocol believers, gaming ecosystem participants, Web3 adoption advocates

Operational Recommendations:

- Accumulation Phase: Consider dollar-cost averaging over 6-12 months given current price discovery phase to reduce timing risk

- Position Sizing: Allocate only capital you can afford to lose entirely, given protocol's early stage status

- Lock-Up Consideration: Research any lockup periods or vesting schedules associated with early token distribution

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Monitor key technical levels at $0.2755 (24H low) and $0.4595 (ATH) for breakout trading opportunities

- Volume Analysis: Track 24H trading volume relative to average; spikes above $400K may indicate trend validation

Wave Trading Key Points:

- Entry Strategy: Wait for pullbacks to support levels with volume confirmation

- Exit Discipline: Set predetermined profit-taking levels at 20%, 50%, and 100% gains

POWER Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-2% of total portfolio (minimal exposure to high-risk Web3 protocols)

- Active Investors: 2-5% of total portfolio (moderate position with defined exit strategy)

- Professional Investors: 5-10% of portfolio (full due diligence required with hedging mechanisms)

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance POWER holdings with established layer-1 tokens and stablecoins

- Stablecoin Reserves: Maintain 20-30% of allocated capital in USDC/USDT for opportunistic rebalancing

(3) Secure Storage Solutions

- Web Wallet Security: Use Gate Web3 wallet for active trading and staking activities with hardware security keys enabled

- Cold Storage Approach: Transfer long-term holdings to secure offline storage after substantial gains

- Security Precautions: Enable multi-factor authentication, use hardware security keys, maintain offline backup of recovery phrases, never share private keys

V. Potential Risks and Challenges

POWER Market Risks

- Liquidity Concentration: With 243 token holders and limited exchange availability (12 exchanges), significant liquidity risk exists; large withdrawals could trigger sharp price declines

- Price Discovery Volatility: The 135% swing from ATL to ATH within 5 days demonstrates extreme price volatility typical of newly launched tokens

- Market Sentiment Dependency: Early-stage protocols are highly susceptible to social media trends and influencer commentary rather than fundamental developments

POWER Regulatory Risks

- Gaming Classification Uncertainty: Regulatory bodies may classify POWER rewards as gambling or gaming revenue, triggering compliance requirements

- Jurisdictional Restrictions: Multiple countries restrict or monitor crypto gaming incentives; regulatory crackdowns could impact protocol adoption

- Securities Determination: Ongoing SEC and global regulatory scrutiny on token distribution mechanisms could reclassify POWER as a security

POWER Technical Risks

- Smart Contract Vulnerabilities: As a new protocol, undetected vulnerabilities in incentive layer mechanics could lead to fund loss

- Scalability Limitations: Current Ethereum-only deployment may face congestion during high-demand periods, increasing transaction costs

- Dependency Risk: Protocol success heavily depends on Fableborne's continued user growth and adoption; game failure would directly impact token utility

VI. Conclusion and Action Recommendations

POWER Investment Value Assessment

Power Protocol addresses a significant gap in Web2-to-Web3 transition mechanisms by creating economic incentives for mainstream app adoption. The protocol's backing from established gaming firms (Sky Mavis) and venture capital (Delphi, Spartan) provides credibility. However, the token remains in early price discovery with extreme volatility, limited liquidity depth, and unproven sustained demand. Success heavily depends on Fableborne's ability to achieve sustained mass-market adoption beyond initial launch enthusiasm. The 21% circulating ratio indicates 79% future supply dilution risk, which could pressure valuations during distribution periods.

POWER Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of portfolio) after researching the Fableborne game mechanics; only invest capital you can afford to lose completely; avoid using leverage or margin trading.

✅ Experienced Investors: Establish positions during 10-15% pullbacks from resistance levels; set strict stop-losses at -25% from entry; take profits at 50% and 100% gains; monitor developer activity and Fableborne user metrics monthly.

✅ Institutional Investors: Conduct deep technical audits of smart contracts before position sizing; negotiate OTC transactions on Gate.com; establish positions across multiple entry points; reserve 30% cash for opportunistic accumulation; implement quarterly rebalancing protocols.

POWER Trading Participation Methods

- Spot Trading on Gate.com: Direct POWER/USDT or POWER/ETH trading pairs with real-time price execution

- Market Research: Monitor official channels (Twitter: @PowerPrtcl, Discord community) for development updates and partnership announcements

- Position Tracking: Use Gate.com portfolio tools to monitor holdings and set price alerts for key technical levels ($0.25, $0.35, $0.45, $0.55)

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and are strongly advised to consult professional financial advisors. Never invest more capital than you can afford to lose completely. Past performance does not guarantee future results. Crypto markets operate 24/7 with minimal circuit breakers; losses can occur rapidly and unexpectedly.

FAQ

What is the forecast for power prices?

Power prices are projected to rise gradually over the next 20 years driven by increasing demand and infrastructure expansion costs, reflecting long-term market fundamentals.

Will power prices go up?

Yes, power prices are expected to rise. Increasing electricity demand, driven by AI data centers and growing consumption, combined with higher natural gas costs and substantial infrastructure investments needed for grid expansion, will likely push prices upward.

What is the power price forecast for the US?

The US power price forecast for 2025 indicates rising electricity and natural gas prices driven by increased demand and geopolitical factors. Expect continued market volatility throughout the year.

Will Texas electricity rates go down in 2025?

Texas wholesale electricity prices may decrease in 2025, but retail rates could still fluctuate due to market demand changes. No guaranteed rate reduction is expected for consumers.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

USELESS vs XLM: A Comprehensive Comparison of Two Contrasting Cryptocurrency Projects

What is GIGGLE: A Comprehensive Guide to Understanding This Emerging Technology Platform

What is RECALL: A Comprehensive Guide to Understanding Information Retrieval and Memory Performance Metrics

What is ESPORTS: A Comprehensive Guide to Professional Gaming and Competitive Video Gaming Industry

What is LRC: A Complete Guide to Lyric Synchronization Format