2025 EGL1 Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Coming Year

Introduction: Market Position and Investment Value of EGL1

Eagles Landing (EGL1) is the first superhero memecoin on BSC, launched in December 2025. As of today, EGL1 has achieved a market capitalization of $18,050,000 with a circulating supply of 1,000,000,000 tokens, currently trading at $0.01805. This emerging digital asset, positioned as a "superhero memecoin," combines American cultural themes with innovative blockchain technology on the Binance Smart Chain.

This article will comprehensively analyze EGL1's price trends and market dynamics, incorporating historical performance data, supply and demand factors, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasting and practical investment strategies for the coming years.

Eagles Landing (EGL1) Market Analysis Report

I. EGL1 Price History Review and Current Market Status

EGL1 Historical Price Evolution

- December 2025: EGL1 reached its all-time high of $0.1234 on July 19, 2025, demonstrating strong early market momentum following its launch from the Fourmeme platform.

- Recent Period: The token experienced a significant correction, with prices declining approximately 85.87% from the all-time high to the current level of $0.01805 as of December 21, 2025.

- Current Phase: EGL1 has stabilized near its all-time low of $0.01731, recorded on December 11, 2025, indicating consolidation in the lower price range.

EGL1 Current Market Performance

Price Metrics:

- Current Price: $0.01805

- 24-Hour Price Range: $0.01757 - $0.01815

- Market Capitalization: $18,050,000

- 24-Hour Trading Volume: $11,959.69

- Circulating Supply: 1,000,000,000 EGL1 (100% of total supply)

Recent Price Movement:

- 1-Hour Change: +0.55%

- 24-Hour Change: +1.12%

- 7-Day Change: +3.62%

- 30-Day Change: -18.65%

- 1-Year Change: +163,358.57%

Market Position:

- Global Ranking: #912

- Market Dominance: 0.00056%

- Total Holders: 55,542

- Active Trading Pairs: 10 exchanges

Network Information:

- Blockchain: BSC (BEP-20 Token Standard)

- Contract Address: 0xf4b385849f2e817e92bffbfb9aeb48f950ff4444

- Launch Price: $0.07035

View current EGL1 market price

EGL1 Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the EGL1 index at 20. This indicates severe negative sentiment among investors, suggesting widespread panic and risk aversion. Such extreme readings typically precede market bottoms, presenting potential opportunities for contrarian investors. However, caution is advised as further downside pressure may continue. Monitor market developments closely and consider using this period to reassess your investment strategy. Gate.com provides real-time sentiment analysis to help you navigate volatile market conditions.

EGL1 Holdings Distribution

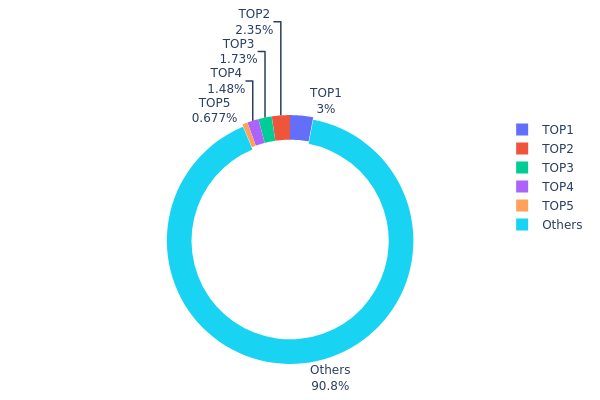

The address holdings distribution represents a quantitative measure of token concentration across the network, reflecting how EGL1 tokens are allocated among different wallet addresses. This metric serves as a critical indicator of decentralization, market structure, and potential systemic risks within the ecosystem. By analyzing the distribution patterns of top holders versus the broader holder base, investors and analysts can assess the degree of token concentration and evaluate the resilience of the network against potential manipulation or coordinated actions.

Current EGL1 holdings data reveals a relatively healthy distribution profile. The top five addresses collectively hold approximately 8.21% of total supply, with the largest holder accounting for only 3.00%. This structure indicates a moderate level of decentralization, as no single entity maintains overwhelming control over the token supply. The dominance of the "Others" category at 90.79% suggests that the majority of EGL1 tokens are distributed across a broad base of smaller holders. This fragmented ownership pattern significantly reduces the likelihood of price manipulation through coordinated large-holder actions and provides a more stable foundation for market dynamics.

The current distribution architecture demonstrates favorable characteristics for long-term ecosystem sustainability. With the top five addresses holding less than 10% of the total supply combined, EGL1 exhibits reduced concentration risk compared to tokens where leading holders command disproportionate influence. The dispersed holder base strengthens network resilience and promotes genuine decentralization, while minimizing the potential for sudden supply shocks that could trigger significant price volatility. This distribution pattern reflects a mature and stable on-chain structure.

Visit EGL1 Holdings Distribution on Gate.com for real-time data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x93f5...260e7b | 30000.10K | 3.00% |

| 2 | 0x73d8...4946db | 23495.12K | 2.34% |

| 3 | 0x6d76...2ee2be | 17333.20K | 1.73% |

| 4 | 0xd79c...76d236 | 14788.02K | 1.47% |

| 5 | 0x9cab...3b0638 | 6771.42K | 0.67% |

| - | Others | 907612.14K | 90.79% |

II. Core Factors Affecting EGL1's Future Price

Supply Mechanism

-

Dynamic Price Adjustment Model: If collected revenue exceeds the permitted threshold, future prices will be adjusted upward to reflect excess collection. Conversely, if collected revenue falls below the threshold, future prices will be adjusted downward to reflect insufficient collection. This mechanism ensures price stability based on actual revenue performance.

-

Current Impact: The revenue-based adjustment framework creates a self-stabilizing mechanism where price fluctuations are tied directly to collection performance metrics, reducing speculative volatility.

Ecosystem Growth and Market Dynamics

-

Platform Traffic and User Adoption: Ecosystem traffic serves as a core leverage point affecting capital flows, narrative development, and price movements. Strong user engagement metrics directly correlate with price stability and growth potential.

-

Liquidity Depth: Institutional capital inflow, capital mobility, and exit mechanisms are critical hard indicators. Platforms that ensure smooth capital entry, movement, and exit demonstrate stronger market fundamentals and price resilience.

Three、2025-2030 EGL1 Price Forecast

2025 Outlook

- Conservative Forecast: $0.01441-$0.02539

- Neutral Forecast: $0.01801

- Bullish Forecast: $0.02539 (consolidation phase expected)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and growth phase with incremental momentum building

- Price Range Forecast:

- 2026: $0.01476-$0.02496

- 2027: $0.01353-$0.02776

- Key Catalysts: Ecosystem development acceleration, institutional adoption expansion, market sentiment improvement, and sustained protocol upgrades

2028-2030 Long-term Outlook

- Base Case: $0.02120-$0.03653 (assuming moderate ecosystem growth and steady adoption trajectory)

- Bullish Case: $0.03104-$0.03259 (contingent on accelerated mainstream adoption and enhanced utility cases)

- Transformational Case: $0.04709 (contingent upon breakthrough ecosystem milestones, major partnership announcements, and sustained market-wide growth conditions)

- 2030-12-21: EGL1 reaches $0.04709 (long-term value appreciation milestone achieved)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02539 | 0.01801 | 0.01441 | 0 |

| 2026 | 0.02496 | 0.0217 | 0.01476 | 20 |

| 2027 | 0.02776 | 0.02333 | 0.01353 | 29 |

| 2028 | 0.03653 | 0.02555 | 0.0212 | 41 |

| 2029 | 0.03259 | 0.03104 | 0.01986 | 71 |

| 2030 | 0.04709 | 0.03181 | 0.01972 | 76 |

EGL1 Professional Investment Strategy & Risk Management Report

IV. EGL1 Professional Investment Strategy and Risk Management

EGL1 Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Retail investors with moderate risk tolerance seeking long-term exposure to emerging memecoin projects with community-driven momentum

-

Operational Recommendations:

- Dollar-cost averaging (DCA) into EGL1 positions over 3-6 month periods to reduce timing risk

- Establish a core position during periods of relative price stability and hold through market cycles

- Monitor community engagement metrics and project development activity as fundamental indicators

(2) Active Trading Strategy

-

Market Analysis Tools:

- Price action analysis: Track the 24-hour and 7-day volatility patterns; EGL1 showed 1.12% gains in 24 hours and 3.62% over 7 days as of December 21, 2025

- Volume analysis: Monitor daily trading volume against the 24-hour volume of approximately 11,959.69 USD to identify liquidity conditions

-

Swing Trading Key Points:

- Trade around support levels near the 30-day low of 0.01757 USD

- Utilize resistance levels near recent highs of 0.01815 USD for take-profit targets

- Implement trailing stop losses to protect gains during volatile market conditions

EGL1 Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.0% of total portfolio allocation

- Active Investors: 1.0-2.5% of total portfolio allocation

- Professional Traders: 2.5-5.0% of total portfolio allocation (with strict position sizing rules)

(2) Risk Mitigation Approaches

- Position Sizing Discipline: Never allocate more capital to EGL1 than you can afford to lose completely; memecoin investments carry extreme volatility risk

- Stop-Loss Implementation: Set hard stops 10-15% below entry points to limit downside exposure

- Profit-Taking Strategy: Lock in gains at predetermined levels (25%, 50%, 75%) rather than holding for maximum upside

(3) Secure Storage Solutions

- Hot Wallet Security: For active trading, maintain only necessary liquidity in exchange wallets (Gate.com recommended for trading pairs)

- Self-Custody Best Practices: Store long-term holdings in personal wallets with strong private key management and multi-signature security where possible

- Critical Security Precautions: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify smart contract addresses before transactions to prevent token impersonation scams

V. EGL1 Potential Risks and Challenges

EGL1 Market Risk

- Extreme Volatility: As a newly launched memecoin, EGL1 exhibits significant price swings; the token experienced a 30-day decline of -18.65% despite a 1-year gain of 163,358.57%, indicating highly unpredictable market sentiment

- Liquidity Risk: With a market cap of only 18,050,000 USD and 10 trading pairs across exchanges, large transactions may face significant slippage and difficulty exiting positions

- Speculative Concentration: Memecoin valuations are heavily dependent on social media hype and community engagement rather than fundamental utility; sentiment shifts can trigger rapid value destruction

EGL1 Regulatory Risk

- Blockchain Jurisdiction Uncertainty: BSC-based tokens operate in a regulatory gray zone; potential future restrictions on memecoin trading or community-driven tokens could impact market access

- Exchange Listing Volatility: Projects may face delisting if regulators determine they lack sufficient legitimate utility or pose consumer protection concerns

- Compliance Risk for Platforms: Gate.com and other supporting exchanges face evolving regulatory scrutiny that could affect token availability

EGL1 Technology Risk

- Smart Contract Vulnerability: As a BEP-20 token on BSC, EGL1 is subject to potential smart contract exploits; no technical audit documentation was identified in available materials

- Network Congestion: During periods of high BSC network activity, transaction failures or delays could prevent timely entry or exit from positions

- Token Contract Immutability: Any flaws in the original smart contract cannot be corrected, potentially leading to permanent value loss if vulnerabilities are discovered

VI. Conclusion and Action Recommendations

EGL1 Investment Value Assessment

EGL1 represents a high-risk, speculative memecoin positioned primarily on community enthusiasm and thematic appeal (American superhero narrative) rather than demonstrated utility or sustainable business fundamentals. While the project achieved significant 1-year returns of 163,358.57%, this metric reflects the volatile nature of newly launched tokens and should not be extrapolated as a reliable performance indicator. The recent 30-day drawdown of -18.65% and proximity to all-time lows (ATL: 0.01731 USD, set December 11, 2025) demonstrate the downside vulnerability of memecoin investments. Investors should approach EGL1 purely as a speculative position with capital they are prepared to lose entirely.

EGL1 Investment Recommendations

✅ Beginners: Start with minimal allocation (0.25-0.5% of portfolio) through Gate.com's spot trading, use strict position sizing, and never trade on margin or leverage until comprehensive market understanding is achieved

✅ Experienced Investors: Consider swing trading strategies around identified support/resistance levels (0.01757 - 0.01815 USD range), maintain disciplined stop-losses, and supplement technical analysis with community sentiment tracking

✅ Institutional Investors: Avoid direct position-taking; if exposure is required, implement derivatives-based strategies with defined risk parameters or maintain minimal allocation for portfolio diversification experiments only

EGL1 Trading Participation Methods

- Spot Trading on Gate.com: Purchase and hold EGL1 directly through the BSC network contract (0xf4b385849f2e817e92bffbfb9aeb48f950ff4444), suitable for long-term holders

- Active Trading: Execute buy/sell transactions on Gate.com across multiple trading pairs to capitalize on intraday or weekly price movements

- Community Participation: Engage with the EGL1 community through official channels (Twitter: @EGLL_american, Website: eagles.land) to monitor project developments and sentiment shifts

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. Consult qualified financial advisors before committing capital. Never invest funds you cannot afford to lose entirely, especially in memecoin assets with speculative valuations and limited utility.

FAQ

What is EGL1 crypto?

EGL1 is a digital cryptocurrency that operates as a blockchain-based digital asset. It functions as a decentralized token within the Web3 ecosystem, enabling peer-to-peer transactions and smart contract interactions. EGL1 serves the DeFi community with utility in governance and ecosystem participation.

How much is the EGL1 token?

EGL1 is currently trading at $0.01774 with a 24-hour trading volume of $7,799,810. The token has shown a 1.01% price increase in the last 24 hours, demonstrating stable market activity and investor interest in this asset.

What factors influence EGL1 token price?

EGL1 token price is influenced by market supply and demand, trading volume, investor sentiment, broader market trends, project developments, and macroeconomic conditions affecting the crypto sector.

What is the price forecast for EGL1 in 2025?

Based on market analysis, EGL1 is projected to reach approximately $0.1486 in 2025, representing a potential increase of 722.13% from current levels.

What are the risks of investing in EGL1?

EGL1 carries extreme volatility risk as a crypto asset. Market price fluctuations, liquidity changes, and regulatory uncertainties are primary concerns. Early-stage projects may face development risks, and investors should only allocate capital they can afford to lose.

2025 TURBO Price Prediction: Analyzing Market Trends and Future Valuation Prospects in the Evolving Cryptocurrency Ecosystem

2025 WOJAK Price Prediction: Analyzing Market Trends and Future Valuation Prospects for the Popular Meme Token

2025 WHYPrice Prediction: Market Analysis and Growth Potential for Investors

2025 DON Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 QUACK Price Prediction: Will This Meme Coin Soar or Crash in the Crypto Market?

2025 MUBARAK Price Prediction: Expert Analysis and Future Market Outlook for the Emerging Digital Asset

Leading Retailers Embracing Bitcoin Payments by 2026

Safest and Most Convenient Cryptocurrency Wallet for Web3 & DeFi Trading

What is Avalanche (AVAX): Understanding its three-chain architecture, use cases, and core technology

Exploring the Future Prospects and Revival Potential of XRP

How do crypto derivatives market signals predict price movements: analyzing futures open interest, funding rates, and liquidation data?