2025 DENT Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: DENT's Market Position and Investment Value

DENT (DENT) is a blockchain-based mobile data trading platform token built on Ethereum, designed to facilitate global mobile data resource sharing between telecom users and operators. Since its launch in August 2017, DENT has established itself as a bridge connecting consumers with telecommunications services while helping to eliminate roaming fees and optimize data purchasing. As of December 20, 2025, DENT has a market capitalization of approximately $21.45 million, with a circulating supply of 95.65 billion tokens trading at $0.0002145 per unit. This innovative token represents a unique intersection of blockchain technology and telecommunications infrastructure.

This article will provide a comprehensive analysis of DENT's price trajectory and market dynamics, examining historical price patterns, market supply-demand dynamics, ecosystem developments, and relevant economic factors to deliver professional price forecasts and practical investment guidance for the 2025-2030 period.

DENT Price History Review and Market Status

I. DENT Price Historical Review and Current Market Conditions

DENT Historical Price Evolution Trajectory

-

January 9, 2018: DENT reached its all-time high (ATH) of $0.1006, representing the peak of its market valuation during the early cryptocurrency bull market.

-

March 13, 2020: DENT hit its all-time low (ATL) of $0.00007065, marking the bottom of its price cycle during the broader market downturn.

DENT Current Market Status

As of December 20, 2025, DENT is trading at $0.0002145, with a 24-hour trading volume of $15,562.11. The token's market capitalization stands at approximately $20.52 million, with a fully diluted valuation of $21.45 million. DENT maintains a circulating supply of 95.65 billion tokens out of a total supply of 100 billion tokens, representing 95.65% circulation ratio.

Recent Price Performance:

- 1-hour change: +0.27%

- 24-hour change: +2.14%

- 7-day change: -13.88%

- 30-day change: -40.52%

- 1-year change: -81.27%

DENT currently ranks 859th by market capitalization with a market dominance of 0.00067%. The token is listed on 24 exchanges and held by approximately 75,332 wallet addresses. Market sentiment indicators show extreme fear (VIX: 20).

Click to view current DENT market price

DENT Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates significant market pessimism and heightened investor anxiety. Such extreme fear conditions often present contrarian opportunities for long-term investors, as panic-driven sell-offs may create potential entry points for strategic accumulation. However, traders should exercise caution and conduct thorough research before making investment decisions. Market volatility remains elevated, and it's crucial to implement proper risk management strategies. Monitor key support levels and market developments closely during this period of extreme sentiment.

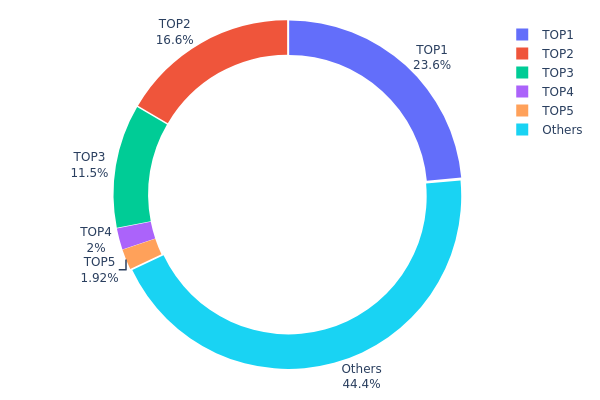

DENT Holdings Distribution

The address holdings distribution chart represents the concentration of DENT tokens across different wallet addresses on the blockchain. This metric reveals how the token supply is distributed among holders and serves as a critical indicator of network decentralization, market structure stability, and potential vulnerability to price manipulation. By examining the top holders and the proportion of tokens they control, investors and analysts can assess the degree of concentration risk and the overall health of the token's ecosystem.

DENT's current holdings distribution exhibits moderate concentration characteristics. The top three addresses collectively control 51.67% of the total token supply, with the largest holder (0xf977...41acec) commanding 23.55% alone. The second and third largest addresses hold 16.58% and 11.54% respectively. This concentration level raises considerations regarding market structure stability, as a significant portion of liquidity is concentrated in relatively few hands. However, the remaining 44.42% of tokens distributed among other addresses suggests that DENT maintains a reasonably fragmented ownership base, mitigating extreme centralization risks compared to projects where top holders control over 70% of the supply.

The concentration pattern observed in DENT's distribution carries important implications for market dynamics and price stability. While the top three holders possess substantial influence over trading volumes and market sentiment, the presence of a meaningful "Others" segment (44.42%) provides a degree of counterbalance that reduces the probability of coordinated price manipulation. Nevertheless, any significant movement or liquidation by top holders could trigger considerable price volatility. From a decentralization perspective, DENT demonstrates intermediate characteristics—not highly concentrated like newly launched tokens, yet not as distributed as established layer-one cryptocurrencies. This structural configuration suggests a maturing project with ongoing participation from both institutional and retail stakeholders, though continued monitor of holder concentration trends remains warranted for assessing long-term ecosystem robustness.

Click to view the latest DENT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 23551173.90K | 23.55% |

| 2 | 0x5a52...70efcb | 16580000.00K | 16.58% |

| 3 | 0x5e37...8c8103 | 11540729.04K | 11.54% |

| 4 | 0x4368...26f042 | 1995537.96K | 1.99% |

| 5 | 0x1918...d243ed | 1920839.59K | 1.92% |

| - | Others | 44411719.50K | 44.42% |

II. Core Factors Influencing DENT's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Market expectations for 2025 suggest that the bull market will be driven by institutional investment, regulatory clarity, and blockchain technology maturation. However, DENT needs to demonstrate practical adoption to benefit from these trends.

-

Market Sentiment: Investor sentiment plays a crucial role in price fluctuations, influenced by macroeconomic trends, regulatory policies, and technological innovation across multiple dimensions.

Three、2025-2030 DENT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00017 - $0.00022

- Neutral Forecast: $0.00022

- Optimistic Forecast: $0.00026 (requiring sustained market momentum and increased adoption)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual accumulation, transitioning toward recovery trends as utility adoption expands

- Price Range Predictions:

- 2026: $0.00017 - $0.00033 (11% upside potential)

- 2027: $0.00017 - $0.00033 (33% cumulative growth from 2025 baseline)

- Key Catalysts: Enhanced mobile connectivity adoption, increased enterprise partnerships, expansion of DENT's data-sharing ecosystem, and broader market sentiment recovery

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00027 - $0.00038 (42% growth by 2028, driven by steady network expansion and normalized market conditions)

- Optimistic Scenario: $0.00034 - $0.00051 (59% growth by 2029, assuming accelerated global telecommunications integration and successful platform scaling)

- Transformative Scenario: $0.00034 - $0.00053 (97% growth by 2030, contingent upon mainstream adoption of decentralized data networks, regulatory clarity, and significant increases in transaction volume through Gate.com and other platforms)

- December 20, 2030: DENT projected at $0.00042 average valuation (base case scenario assuming moderate market conditions and sustained ecosystem development)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00026 | 0.00022 | 0.00017 | 0 |

| 2026 | 0.00033 | 0.00024 | 0.00017 | 11 |

| 2027 | 0.00033 | 0.00029 | 0.00017 | 33 |

| 2028 | 0.00038 | 0.00031 | 0.00027 | 42 |

| 2029 | 0.00051 | 0.00034 | 0.00024 | 59 |

| 2030 | 0.00053 | 0.00042 | 0.00034 | 97 |

DENT Investment Strategy and Risk Management Report

IV. DENT Professional Investment Strategy and Risk Management

DENT Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Long-term believers in mobile data democratization and blockchain-based telecommunications solutions

- Operational Recommendations:

- Establish positions gradually over time to average out entry costs, considering DENT's current 95.65% circulating supply ratio and established market presence since 2017

- Hold through market volatility cycles, as the project addresses structural inefficiencies in global mobile data markets

- Participate in any platform updates or expansion announcements that enhance the DENT ecosystem utility

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor historical price points around $0.0002145 (current) and previous resistance zones to identify entry and exit opportunities

- Volume Analysis: Track the 24-hour volume of 15,562.11 DENT to identify momentum shifts and validate price movements

- Wave Operation Key Points:

- Capitalize on the recent 2.14% 24-hour gain and monitor for continuation patterns

- Be aware of the significant 40.52% decline over 30 days, which may indicate ongoing downward pressure requiring careful position timing

DENT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total cryptocurrency portfolio

- Active Investors: 2-5% of total cryptocurrency portfolio

- Professional Investors: 5-10% of total cryptocurrency portfolio, with systematic rebalancing protocols

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine DENT holdings with established blockchain projects and stablecoins to reduce overall portfolio volatility exposure

- Position Sizing: Implement strict position limits based on individual risk tolerance, given DENT's $21.45M market cap and lower liquidity profile

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 wallet for active trading and frequent transactions with built-in security features

- Cold Storage Approach: Transfer long-term holdings to offline storage solutions to eliminate counterparty risks

- Security Considerations: Enable two-factor authentication, use strong passwords, never share private keys, verify contract addresses before transactions (DENT Ethereum contract: 0x3597bfd533a99c9aa083587b074434e61eb0a258)

V. DENT Potential Risks and Challenges

DENT Market Risk

- Extreme Price Volatility: DENT has experienced an 81.27% decline over one year and traded down 13.88% in the past week, indicating significant market uncertainty and limited price stability

- Low Trading Liquidity: With 24-hour volume of only 15,562 DENT, the market shows limited depth, potentially causing slippage on larger transactions

- Prolonged Bear Market Pressure: The token trades at only 0.21% of its all-time high ($0.1006 from January 2018), reflecting sustained market skepticism about the project's commercial viability

DENT Regulatory Risk

- Telecommunications Regulatory Uncertainty: The project operates at the intersection of blockchain and telecommunications, facing potential regulatory challenges from telecom authorities and governments worldwide

- Securities Classification Risk: Regulatory bodies may reinterpret DENT tokens as securities in certain jurisdictions, triggering compliance requirements and market restrictions

- Cross-Border Compliance: International expansion faces varying regulatory frameworks across different countries, potentially limiting the platform's global reach and utility

DENT Technology Risk

- Smart Contract Vulnerabilities: As an Ethereum-based platform, DENT remains exposed to potential smart contract bugs, security exploits, or vulnerabilities in the underlying code

- Blockchain Infrastructure Dependency: The project's operation depends on Ethereum network stability and transaction costs, with high gas fees potentially hindering user adoption

- Platform Adoption Challenges: Limited evidence of significant merchant or telecom operator integration suggests the core value proposition has not achieved meaningful commercial traction

VI. Conclusion and Action Recommendations

DENT Investment Value Assessment

DENT presents a conceptually innovative solution to global mobile data inefficiencies through blockchain technology. However, the project faces substantial challenges: it has lost 81.27% of its value over one year, trades far below historical levels, and shows limited evidence of achieving significant commercial adoption or telecom operator partnerships. The $21.45M market cap and low trading volume indicate a low-liquidity asset with concentrated holder risk. While the 95.65% circulating supply ratio provides some clarity on token economics, the significant gap between the all-time high and current trading price suggests market skepticism about the platform's real-world viability in the highly regulated telecommunications sector.

DENT Investment Recommendations

✅ Beginners: Strictly limit exposure to 1% of your cryptocurrency portfolio or less. Only invest capital you can completely afford to lose. Focus first on understanding how the DENT platform actually operates in real markets before committing funds.

✅ Experienced Investors: Consider speculative positions only if you have strong conviction about telecommunications sector disruption and can tolerate potential total loss. Implement strict stop-loss orders and dollar-cost averaging strategies to manage downside risk.

✅ Institutional Investors: Conduct thorough due diligence on telecom operator partnerships, regulatory compliance frameworks, and market adoption metrics before considering any allocation. Verify actual platform usage data and revenue generation capabilities.

DENT Trading Participation Methods

- Spot Trading: Purchase and hold DENT directly on Gate.com, the crypto exchange offering DENT trading pairs with multiple cryptocurrencies

- Technical Analysis-Based Trading: Use Gate.com's advanced charting tools to identify entry points based on technical levels and volume patterns

- Portfolio Integration: Incorporate DENT as a small speculative allocation within a diversified cryptocurrency portfolio on Gate.com's trading platform

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely. The cryptocurrency market is highly volatile and speculative; past performance does not guarantee future results.

FAQ

Will dent reach $1?

Dent reaching $1 is highly unlikely. It would require a market cap of $100 billion, which is unrealistic given current adoption levels and circulating supply of 100 billion coins. A price of $0.10 is more achievable.

How much is a dent coin worth?

As of December 20, 2025, DENT is trading at approximately $0.0002134 per coin. The price reflects recent market movements with modest daily fluctuations. For real-time pricing, check major cryptocurrency data platforms.

What is a dent coin used for?

DENT coins enable users to buy and sell mobile data globally. Users can exchange DENT for fiat currency or other cryptocurrencies, facilitating seamless data transactions within the Dent ecosystem.

Crypto Crash or Just a Correction?

Pi to PHP: Current Exchange Rate and Conversion Guide (2025)

2025 KSM Price Prediction: Analyzing Market Trends and Future Growth Potential of Kusama Network

2025 DCR Price Prediction: Analyzing Decred's Future Potential Amid Evolving Market Dynamics

2025 MAG7SSI Price Prediction: Analyzing Market Trends and Future Valuation Prospects for Magnificent Seven Semiconductor Index

EXT Price Meaning: What It Is and How to Understand It

Exploring the Timeline of Ethereum 2.0 Transition

Exploring the Causes and Impact of USDC Depegging

Is B3 Base (B3) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Outlook for 2024

Is Storj (STORJ) a good investment?: A Comprehensive Analysis of Decentralized Cloud Storage and Market Potential

Bitcoin vs. Altcoins: Key Differences Explained