2025 BONE Price Prediction: Expert Analysis and Future Market Outlook for Shiba Inu's Governance Token

Introduction: BONE's Market Position and Investment Value

BONE (Bone ShibaSwap) serves as the foundational token of Shibarium, a layer-two network built by the ShibArmy community. Since its launch in 2021, BONE has established itself as a governance and utility token within the ShibaSwap ecosystem. As of December 2025, BONE maintains a market capitalization of approximately $20.84 million with a circulating supply of approximately 249.89 million tokens, trading at around $0.08338 per token. This token, recognized for its role as the governance mechanism of the ShibaSwap ecosystem, is playing an increasingly important function in facilitating Shibarium network operations, including gas payments, validator voting, and node rewards.

This article will comprehensively analyze BONE's price trajectory through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

BONE (Bone ShibaSwap) Market Analysis Report

I. BONE Price History Review and Current Market Status

BONE Historical Price Evolution

-

July 2021: BONE launched on ShibaSwap as the governance token of the Shiba ecosystem's layer-2 network Shibarium. The token reached its all-time high of $15.5 on July 7, 2021, marking the peak of initial market enthusiasm for the Shiba ecosystem expansion.

-

August 2021: Following the initial surge, BONE experienced a significant correction. The token fell to its all-time low of $0.077 on August 13, 2021, reflecting a sharp decline of approximately 99.5% from its peak, indicating high volatility in the early market phase.

-

2021-2025: Over the subsequent years, BONE has maintained a relatively depressed valuation compared to its historical peak, declining approximately 82.08% year-over-year as of December 2025.

BONE Current Market Status

As of December 20, 2025, BONE is trading at $0.08338, reflecting a slight positive movement of 0.76% over the past 24 hours. The token's 24-hour trading range spans from $0.08141 (low) to $0.08533 (high), demonstrating relatively modest daily volatility.

Market Capitalization and Supply Metrics:

- Market Cap: $20,835,997.86

- Fully Diluted Valuation: $20,844,950.12

- Circulating Supply: 249,892,034.74 BONE

- Total Supply: 249,999,401.82 BONE

- Maximum Supply: 250,000,000 BONE

- Circulating Ratio: 99.96%

Trading Activity:

- 24-Hour Trading Volume: $37,128.25

- Market Dominance: 0.00065%

- Active Holders: 94,070

- Available on 11 exchanges

Price Performance Trends:

- 1-Hour Change: +0.13%

- 24-Hour Change: +0.76%

- 7-Day Change: -10.02%

- 30-Day Change: -13.42%

- 1-Year Change: -82.08%

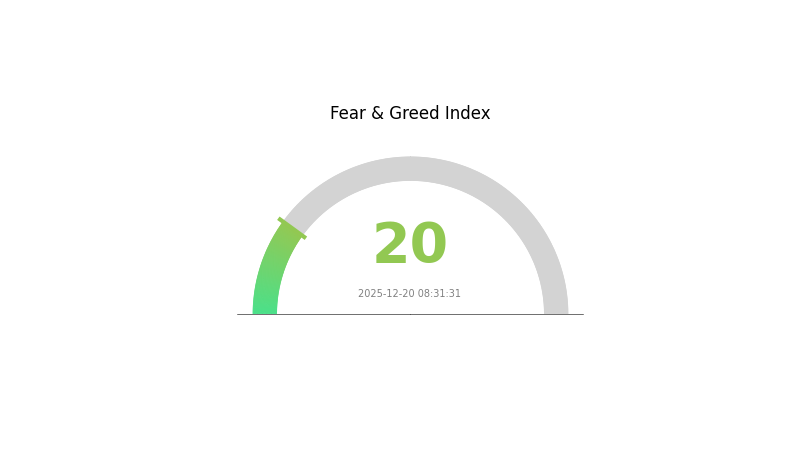

The short-term price action shows modest gains in the most recent trading periods, while intermediate and long-term trends reveal sustained downward pressure. The market sentiment reflects extreme fear with a VIX reading of 20, suggesting heightened risk aversion across crypto markets.

Click to view current BONE market price

BONE Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The BONE market is currently in a state of extreme fear, with the Fear and Greed Index at 20. This indicates significantly heightened market anxiety and pessimism among investors. During such extreme fear periods, markets often experience sharp declines as panic selling dominates. However, contrarian investors may view this as a potential buying opportunity, as historically extreme fear has preceded market recoveries. It is crucial to maintain rational decision-making and avoid being swayed by short-term market volatility. Monitor market developments closely and consider your risk tolerance before making investment decisions.

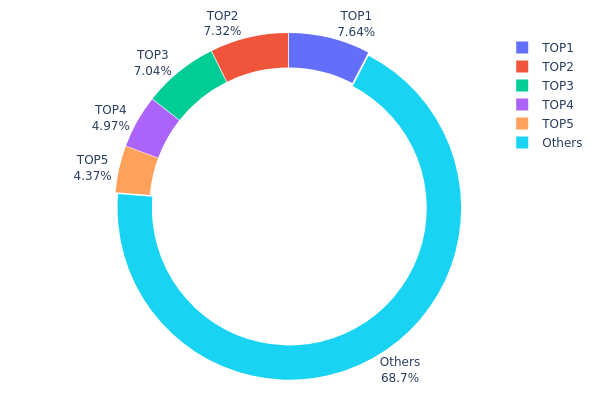

BONE Holdings Distribution

The address holdings distribution chart visualizes the concentration of token ownership across the blockchain network by displaying the proportion of total BONE tokens held by individual addresses. This metric serves as a critical indicator for assessing market structure, decentralization levels, and potential systemic risks related to wealth concentration. By analyzing the top holders and the distribution of remaining addresses, investors and analysts can evaluate the token's vulnerability to price manipulation and market volatility.

Current BONE holdings exhibit moderate concentration characteristics. The top five addresses collectively control approximately 31.32% of total token supply, with the leading address holding 7.63% and the second-largest holder accounting for 7.32%. This distribution pattern suggests that while significant capital is concentrated among a limited number of stakeholders, the remaining 68.68% of tokens are dispersed across a broader base of addresses. The relatively balanced distribution between top holders indicates that no single entity maintains dominant control, though the combined influence of the top five addresses warrants careful monitoring from a governance and market stability perspective.

This holdings structure reflects a moderately decentralized network with reasonable risk mitigation. The absence of extreme concentration in any single address reduces the immediate threat of coordinated market manipulation or sudden price shocks from large-scale liquidations. However, the cumulative 31.32% stake held by the top five addresses suggests that coordinated actions among major stakeholders could potentially influence market dynamics. The substantial proportion of tokens held by dispersed addresses demonstrates healthy ecosystem participation, though ongoing monitoring of address accumulation patterns remains essential for tracking potential future consolidation trends.

Visit the current BONE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf585...0509a0 | 19095.38K | 7.63% |

| 2 | 0x3cc9...aecf18 | 18311.38K | 7.32% |

| 3 | 0xbab4...225e96 | 17600.00K | 7.04% |

| 4 | 0x885f...32c995 | 12428.70K | 4.97% |

| 5 | 0xefb4...20a477 | 10920.88K | 4.36% |

| - | Others | 171643.07K | 68.68% |

II. Core Factors Affecting the Future Price of BONE

Market Sentiment and Trading Dynamics

-

Investor Confidence: BONE's price movement is directly influenced by investor sentiment and confidence levels. Positive market sentiment regarding widespread BONE adoption or major technical breakthroughs can drive price appreciation, while negative sentiment can trigger selling pressure.

-

Trading Volume: Transaction volume plays a critical role in price volatility. Higher trading volumes typically indicate stronger market interest and can amplify price movements in either direction.

-

User Adoption Trends: The expansion of BONE's user base and adoption across the ShibaSwap ecosystem directly correlates with long-term price potential. Growing user engagement signals strengthening fundamentals.

Macroeconomic Environment

-

Interest Rate Changes: Broader macroeconomic conditions, particularly fluctuations in interest rates and overall liquidity conditions, impact cryptocurrency valuations. Changes in monetary policy by central banks can influence investor allocation to digital assets.

-

Market Liquidity: Availability of liquidity in cryptocurrency markets affects BONE's price stability and trading efficiency. Periods of tight liquidity can exacerbate price volatility.

Note: The provided research materials contain limited specific information about BONE's supply mechanisms, institutional holdings, enterprise adoption, national policies, inflation hedging characteristics, geopolitical factors, and technological development roadmap. To provide a comprehensive analysis of these sections, more detailed information regarding BONE's tokenomics, ecosystem development initiatives, and regulatory environment would be required.

III. BONE Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.0810-$0.0835

- Neutral Forecast: $0.0835-$0.0900

- Optimistic Forecast: $0.0900-$0.1044 (requires sustained ecosystem development and increased institutional adoption)

Mid-term Period (2026-2028) Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery and accumulation, characterized by moderate volatility as the project establishes utility and market positioning.

- Price Range Forecast:

- 2026: $0.0667-$0.0968

- 2027: $0.0792-$0.1049

- 2028: $0.0681-$0.1302

- Key Catalysts: Enhanced smart contract functionality, strategic partnerships within the Shiba Inu ecosystem, improved liquidity across major trading platforms including Gate.com, increased community engagement and adoption metrics.

Long-term Outlook (2029-2030)

- Base Case Scenario: $0.1152-$0.1690 (assumes steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.1690-$0.1890 (assumes successful protocol upgrades and mainstream DeFi integration)

- Transformational Scenario: Above $0.1890 (assumes breakthrough adoption, significant technological advancement, and substantial increase in total value locked within the ecosystem)

- 2030-12-20: BONE at $0.1890 (projected mid-to-long-term resistance level with 68% estimated upside potential from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1044 | 0.08352 | 0.08101 | 0 |

| 2026 | 0.09678 | 0.09396 | 0.06671 | 12 |

| 2027 | 0.10491 | 0.09537 | 0.07916 | 14 |

| 2028 | 0.13018 | 0.10014 | 0.06809 | 19 |

| 2029 | 0.16698 | 0.11516 | 0.07025 | 37 |

| 2030 | 0.18903 | 0.14107 | 0.07618 | 68 |

BONE (Bone ShibaSwap) Professional Investment Analysis Report

IV. BONE Professional Investment Strategy and Risk Management

BONE Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Crypto ecosystem believers and governance participants interested in Shibarium ecosystem development

- Operational Recommendations:

- Accumulate during market downturns when BONE trades below key support levels; the token has declined 82.08% over the past year, presenting potential accumulation opportunities for long-term holders

- Participate actively in Doggy DAO governance voting to maximize voting weight and influence on ecosystem proposals

- Hold tokens on secure infrastructure while monitoring Shibarium network developments and ecosystem expansion milestones

(2) Active Trading Strategy

-

Market Analysis Approach:

- 24-Hour Price Action: Current trading range between $0.08141 and $0.08533; monitor intraday volatility for entry and exit points

- Technical Support/Resistance Levels: Historical all-time high of $15.50 (July 2021) and recent floor around $0.077 (August 2021) provide context for long-term price discovery

-

Wave Trading Key Points:

- Monitor weekly performance trends showing -10.02% decline; this downward pressure may create oversold conditions suitable for tactical entries

- Track trading volume at $37,128.25 (24-hour) relative to historical averages; volume spikes may indicate sentiment shifts

- Watch monthly performance (-13.42% decline) for broader trend confirmation before initiating positions

BONE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.0% of total crypto portfolio

- Active Investors: 1.5-3.0% of total crypto portfolio

- Professional Traders: 3.0-5.0% with hedging strategies in place

(2) Risk Hedging Solutions

- Ecosystem Diversification: Balance BONE holdings with broader Shibarium ecosystem exposure through SHIB positions, as governance tokens are inherently concentrated bets on project success

- Dollar-Cost Averaging (DCA): Implement systematic purchases over time rather than lump-sum investments, given the token's significant historical volatility and 82.08% annual decline

(3) Secure Storage Solutions

- Custody Options: Store BONE on Gate.com with security protocols enabled for active traders requiring liquidity, or utilize professional custody solutions for larger positions

- Self-Custody Approach: Transfer BONE to secure personal wallets for long-term governance participation, ensuring full control over voting rights

- Security Considerations: Enable two-factor authentication on exchange accounts; never share private keys or seed phrases; verify all transaction addresses on official Shibarium explorers before transfers

V. BONE Potential Risks and Challenges

BONE Market Risk

- Extreme Volatility and Price Depreciation: BONE has experienced an 82.08% annual decline with all-time high of $15.50 versus current price of $0.08338, indicating severe historical volatility and potential for further downside if ecosystem adoption falters

- Low Trading Volume: 24-hour volume of $37,128.25 against market cap of $20.84 million suggests limited liquidity; large transactions could significantly impact price

- Market Cap Concentration: Fully diluted valuation closely aligned with circulating market cap (99.96% ratio) indicates minimal growth potential from supply mechanics alone

BONE Regulatory Risk

- Governance Token Classification Uncertainty: Regulatory bodies may classify BONE as a security despite its governance utility, leading to potential trading restrictions or compliance requirements

- Evolving DeFi Regulations: Shibaswap operations and ShibArmy governance activities face increasing regulatory scrutiny from global financial authorities

- Cross-Chain Compliance: Token existence on Ethereum and Shibarium networks creates multi-jurisdictional regulatory exposure

BONE Technical Risk

- Shibarium Network Dependency: BONE utility directly tied to Shibarium layer-2 network performance, security, and adoption; network failures or technical issues would severely impact token value

- Smart Contract Risk: ShibaSwap smart contracts and governance mechanisms remain subject to potential exploits or bugs despite community oversight

- Liquidity Pool Risks: Decentralized exchange liquidity on ShibaSwap may suffer from impermanent loss and slippage during volatile market conditions

VI. Conclusion and Action Recommendations

BONE Investment Value Assessment

BONE functions as the governance token and gas utility for the Shibarium ecosystem, positioning it as a critical infrastructure component for the ShibArmy community. However, the token faces significant headwinds: an 82.08% annual price decline, relatively low trading liquidity, and concentrated value in governance participation rather than fundamental cash flows. The token's success remains entirely dependent on Shibarium adoption and continued ShibArmy engagement. Current pricing near historical lows presents contrarian accumulation opportunities for believers in the ecosystem, but also reflects substantial market skepticism about long-term viability.

BONE Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1.0% of crypto portfolio) only if committed to active governance participation; this is not a passive investment but requires ongoing ecosystem engagement

✅ Experienced Investors: Consider dollar-cost averaging into positions during continued weakness if bullish on Shibarium adoption; use technical analysis to identify oversold conditions near the $0.077 floor level

✅ Institutional Investors: Exercise extreme caution regarding regulatory classification; conduct thorough due diligence on Shibarium technology and ShibArmy governance structure before institutional allocation

BONE Trading Participation Methods

- Exchange Trading: Access BONE trading pairs on Gate.com with spot trading and margin options available for active traders requiring leverage or short exposure

- Governance Participation: Hold BONE in compatible wallets to participate in Doggy DAO voting on ecosystem proposals and future token launches within the ShibaSwap ecosystem

- Liquidity Provision: Supply liquidity to BONE trading pairs on ShibaSwap to earn trading fees, though this strategy carries impermanent loss risk during volatile market movements

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

Is BONE crypto a good investment?

BONE demonstrates strong growth potential with increasing adoption in the Shiba Inu ecosystem. Its recent price momentum and expanding utility make it an attractive option for investors seeking exposure to community-driven DeFi projects.

Can Shiba Inu reach $1 dollar by 2040?

Reaching $1 by 2040 is highly unlikely. Best-case scenarios suggest SHIB could reach $0.001 by 2040, depending on utility development and ecosystem growth. Realistic price targets remain significantly lower than $1.

Is BONE a meme coin?

No, BONE is not a meme coin. It is the governance token of ShibaSwap, the decentralized exchange within the Shiba Inu ecosystem. BONE serves important utility functions including governance and staking rewards for platform participants.

Will SHIB hit 10 cents?

Reaching 10 cents is highly unlikely due to SHIB's massive circulating supply. Such an extreme price surge would require unprecedented market conditions and adoption levels that remain unrealistic in the foreseeable future.

What are the key factors that could affect BONE token price in the future?

BONE token price is influenced by market sentiment, community engagement, cryptocurrency market trends, and project developments. Trading volume, partnership announcements, and ecosystem updates significantly impact price movement.

How does BONE compare to other governance tokens in terms of price potential?

BONE demonstrates strong price potential through its major exchange listings and limited supply. Its unique market positioning and tokenomics offer competitive advantages over comparable governance tokens, supporting notable upside growth prospects.

What is BONE: A Comprehensive Guide to Understanding the Decentralized AI Protocol and Its Applications in Web3

Is Bone ShibaSwap (BONE) a good investment?: A Comprehensive Analysis of Risk, Returns, and Market Potential in 2024

What is VELODROME: The Revolutionary Cycling Track Transforming Professional Racing and Urban Recreation

What Is the Long-Term Fundamental Value of Shiba Inu (SHIB) in 2030?

What is KNINE: Exploring the Advanced AI-Powered Robotic Dog System

2025 KNINE Price Prediction: Bullish Trends and Potential Growth in the Cryptocurrency Market

2025 OORT Price Prediction: Expert Analysis and Market Forecast for the Next Generation Storage Token

2025 SEND Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 PSG Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Understanding the Worth of Testnet Tokens in Cryptocurrency

2025 OAS Price Prediction: Market Analysis and Expert Forecasts for the Coming Year