Trenches Healing Session 101

All memecoins are designed to decline eventually. They are a tokenized reflection of a trend, and trends are, by definition, born to be replaced. In rare cases they mirror a movement, but movements in human history also come and go. Only in extremely rare cases do they survive the test of time ( $DOGE , $SPX etc)

Ghiblification craze 25/03/25 - 27/03/25

Shitcoins are the basement of the crypto building, and will always have pvps, rugs, grfits, bundles, insiders - just the nature of it. Those parts are also why we love that basement, because without risk, there is no edge, and edge is the foundation of the super competitive market we love to participate in. This article wont change the weather, but it might change the ground under our feet.

Point of view of the average counter party

Monetary conditions and innovation are the two forces that set the tone for every cycle. Policy determines how much oxygen the market has and innovation determines if there is anything worth breathing. Right now policy is tight and other than the ai chip rush in the real world there isn’t much new to chase in ours (maybe privacy and perp dexes which are far from trenches) so the environment behaves as expected.

0:00 / 0:51

The ruling world order btw

Before sharing your opinions please ask yourself prior how much of your view is affected by fear of your bag losing value or your company losing revenue. This article isn’t an attack on @ Pumpfun , @ AxiomExchange or others infrastructure providers in our industry, I appreciate @ a1lon9 and I work closely to other talented founders in the same field Im going to discuss.

My goal is to empower us, the users with knowledge that might be the foundation of the next competitive environment which will eventually produce fairness and heal the fixable parts in our field (things which aren’t 1,2,3 above)

Cant wait for the key opinion leaders

The Problem

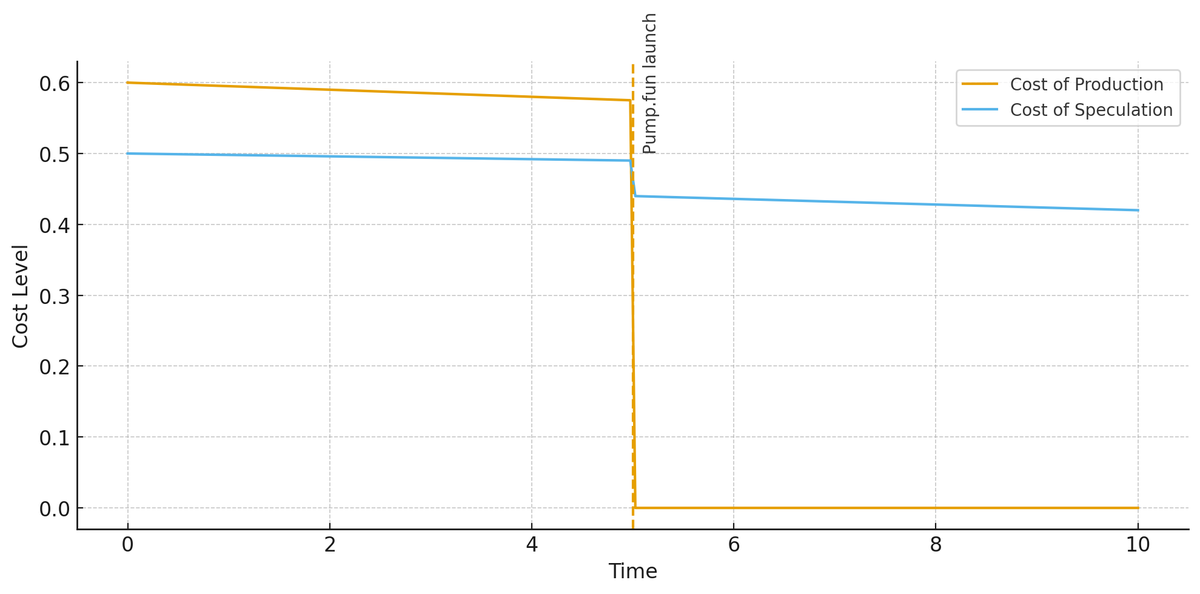

The problem in the current memecoin environment is the massive gap between the cost of production and cost of speculation.

Zero-cost token production introduced many positive things like better onboarding to builders from outside, removed the monopoly from tech edge holders, and overall contributed to a more competitive and free market.

Having said that, the gap it created between production and speculation is unsustainable. Its a structural drain on the system - a setup where value leaks faster than it can form.

Cost of production vs cost of speculation pre and post the bonding curve era

It isn’t just the launchpad or the terminal - its at the project level as well.

AI collapsed the barrier that once separated competent specialists from everyone else. What used to take a Harvard-trained technocrat three months can now be executed by a random Australian skater in his mothers basement in a week (which is cool). The multi decade correlation between labor and growth has broken.

That topic has far broader implications, but in the context of this article, it deepens the same gap: production is not only easy and cheap at the token-creation level, but at the project / content level too.

The correlation between labor and growth has broken and with it a slop pandemic arrived to a chain near you

Current Speculation Landscape

Trading terminals like @ AxiomExchange, @ gmgnai or telegram bots like @ SigmaTrading ( which I’m proudly advising ) @ MaestroBots and others charge 1%, Launchpads like @ Pumpfun fees hover around 1% until the token hits a 3-4m market cap (which vast majority never cross) Four.meme sits at 1% until migration. According to @ bonkfun website, last 24h they saw 2.4m volume with $23.11K fees - roughly a 1% tax again.

The industry standard for speculation in trenches is 2% (1% launchpad fee + 1% terminal fee)

bUt oNly herE yOu cAn makE a 300x

For reference, lets compare that to spot trading for BTC and other majors:

@ binance 0.10% / 0.10%

@ krakenfx 0.16% / 0.26%

@ okx 0.08% / 0.10%

Now before reaching conclusions, yes I’m aware of the kickbacks big volume makers and KOL’s get as a bait to keep them as consumers (nice proof that competition always creates fairness) as well as the fact that you need specific volume amounts to unlock lower fee tiers on cexes.

Lets be generous and adjust both ends of the comparison:

the multiple still sits around 10–15x.

So the average trencher pays 10-15x more to buy cheap assets (easy to produce) than crypto investors pay to buy expensive assets (hard to produce)?

if you don’t see why its a major problem, you can tab back to your Fortnite game.

num num num

Why The Current Setup Exists?

There are many reasons, network effect barriers for competition, the early stage of the market, the lack of consumer experience of its young participants, grifty or incompetent builders and more.

After looking deeper, I found that the main reason is the nature of the niche itself.

Most tokens are “trends,” and holding them is like being on a “team,” “movement,” or “culture.”

Participants mistakenly extend those principles to the infrastructure level. They value culture and history over efficiency and fairness.

Founders understand that, and use that against us and in favor of their revenue.

Its like a primitive small football club in eastern Europe that would rather buy flags and merch instead of building a roof over their stadium, happy to watch games while getting soaked in rain half the time, losing future ticket revenue from those who prefer a dry experience.

Imagine BTC maxis paying 15x more fees just to buy from an exchange called “thereisnosecondbest.com” to prove a point. Silly isn’t it.

Who needs a game when you can set a stadium on fire?

The Solution

For a sick body, knowing the disease is crucial for healing, and while there is no perfect or single solution, it still feels empty to point fingers without offering a real outlook on a possible cure.

Will divide my suggestions into two: the user and the provider.

For users, the responsibility is collective. Digest and share more posts like this, demand better by understanding what “better” can be.

Welcome competition by giving new builders a chance. Test their platforms, offer ways to improve. You might even stumble into the next retirement referral program. A competitor offers you lower fees? get on, if we all do they will spiral to fair value.

For providers the pill is harder to swallow:

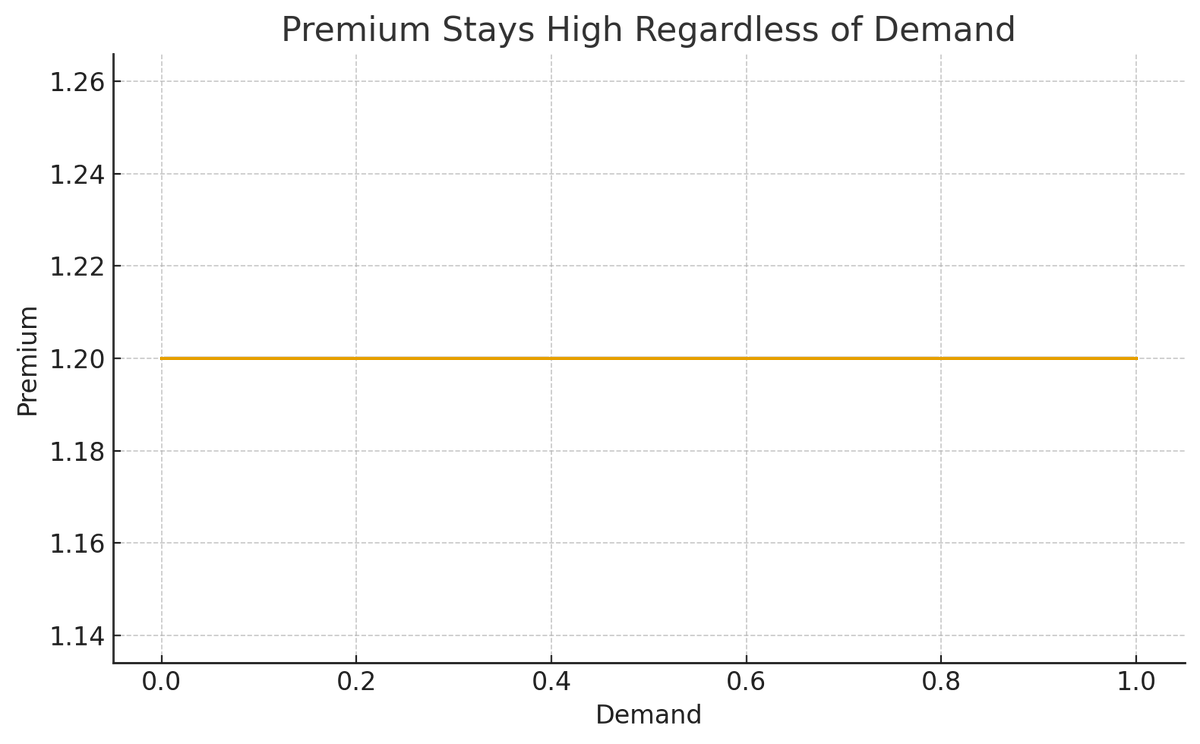

Launchpads and trading terminals will eventually compress fees to 0.1% flat, aligning with broader capital market standards. While inevitable, this expectation is likely premature, so ill offer the following:

Launchpads and DEX’s should reformat their fee structure to match the logic used across many financial and everyday services -

Align premium with demand.

Hotel rooms cost more during holidays.

Electricity costs more during heatwaves.

Food delivery during storms.

Shipping containers during trade spikes.

Short positions during an exploit.

Even on BTC, ETH and SOL when the network has high demand transactions cost more.

Countless examples shaped by modern capitalism to balance and sustain entire business and technological models for both consumers and producers.

So why the hell are we paying 2% for $ piss-dog-poo when nobody wants it?

To properly judge “demand,” a simple formula like: volume ÷ time × market cap of an asset. This gives a snapshot of how desired an asset is at any given moment. yes, volume is the main factor of demand - not market cap or price, because we are talking about TRADE DEMAND not ASSET DEMAND.

If the asset is desired to trade - apply a premium.

If it’s highly desired - apply a higher premium.

If it’s uncrowded and only a few see its potential - make it free to speculate on.

This approach creates different effects in parallel:

- Incentivizes believers of unpolished gems - assets with more unseen potential than hype by low fees at j curve phase 2

- Incentivizes hunters of early coins - you found it before everyone else? enjoy the benefit.

- Incentivizes teams to deliver their milestones, roadmaps and catalysts as they are paid by demand.

- Redirects speculation toward quality - empty, low-demand assets become cheaper to explore, while hyped bullcrap pays for its own intensity.

- Push longevity to price action - reduce fomo by creating an incentive to wait for hype to settle > reduce volatility and expand lifetime

For trading terminals and bots, the pill is even harder to swallow.

As @ vnovakovski changed the perp DEX landscape with @ Lighter_xyz - Introduce a free / premium model, free for the normie small guy- premium for the hardcore user.

Want better latency? join premium

Want API access? Join premium

Want 49 multi wallet support?…

Want to accumulate points for our airdrop?

Tons of more options, ill let you figure it out.

Dear terminal, lets face it unlike launchpads and DEX’s, the loyalty of the trencher to his terminal is around 0, and since most terminals are down 90%+ from their ATH rev, when the 2nd wave hits - it will be either you or your destroyer who will introduce fair value to use the same code, nodes and servers quality that the other 400 offer.

“ I’m a pig, i dont fight for honor i fight for a paycheck “ (hire me)

The End.

The next major jackpot for providers will go to those who resist greed. Charge less to earn more, Its a force of nature in modern capitalism. The platforms that align with the natural user demand of fairness will capture the largest share of the future.

Users must demand better, and demanding better requires understanding better. The blame doesn’t sit with current providers. its the consumers who need to evolve - the providers will adapt.

There are more possible solutions than the ones outlined here. These are not the only paths, just those I believe in the most.

I’ll always be grateful for Pumpfun, Trojan, and Banana Bot - they gave me the infrastructure I grew up on, but seasons change, and with that comes a different responsibility.

My main point is to establish and rush the inevitable.

Thank you for reading.

This article wont change the weather, but it might change the ground under our feet.

Disclaimer:

- This article is reprinted from [0xIT4I]. All copyrights belong to the original author [0xIT4I]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Top 10 Meme Coin Trading Platforms

Review of the Top Ten Meme Bots

What's Behind Solana's Biggest Meme Launch Platform Pump.fun?

Introduction to Raydium

What is Dogwifhat? All You Need to Know About WIF