A Scarcity Engine and the Synthetic Shadows

In my predecessor piece, I laid out the broad battlefield: a clash of monetary architectures with Bitcoin at the center. Now it’s time to move deeper into the mechanics.

This follow-up is about giving you the concrete levers and structural dynamics that may explain what’s unfolding. We’re going under the hood to see how the derivative complex and new financial products fit into this emerging framework.

The full shape of this story is coming into view:

Bitcoin is the battlefield.

MicroStrategy is the signal.

And the conflict is a confrontation between the Financialists and the Sovereignists.

This isn’t an argument about asset allocation. It’s the early phase of a multi-decade transition… the monetary equivalent of tectonic plates grinding beneath society until the cracks finally surface.

Let’s walk onto the fault line.

I. Two Architectures Colliding

Matt @ Macrominutes gave us the strongest framing to date.

The Financialists

Since a shady backroom deal in 1913, the Financialists have had full control of the playing field. This faction includes:

- the Federal Reserve,

- JPMorgan and the U.S. banking cartel,

- European banking dynasties,

- globalist elites,

- an ever-increasing number of compromised politicians,

- and the derivative-based scaffolding that has guided global capital flows for over a century.

Their power rests on synthetic money signals… the ability to conjure credit, shape expectations, alter price discovery, and mediate every major form of settlement.

Eurodollars, swaps, futures, repo facilities, forward guidance - these are their tools. Their survival depends on controlling the abstraction layers that obscure the underlying monetary base.

The Sovereignists

On the other side you find the Sovereignists… those seeking sound money with fewer distortions. This group isn’t always aligned; it comprises friends and foes, individuals and nations, different political instincts and ethical frameworks.

This group includes:

- nation-states seeking monetary independence,

- institutions and corporations frustrated by banking bottlenecks,

- and individuals opting out of the credit-based system in favor of self-sovereignty.

They see Bitcoin as the antidote to centralized monetary power. Even if many don’t yet grasp its full implications, they intuitively understand the core truth:

Bitcoin breaks the monopoly on monetary reality.

And that is intolerable to the Financialists.

The Flashpoint: Conversion Rails

The war now centers on the conversion rails… the systems that convert fiat into Bitcoin and Bitcoin into credit.

Whoever controls the rails controls:

- the price signal,

- the collateral base,

- the yield curve,

- the liquidity pathways,

- and ultimately the rise of the new monetary regime out of the old.

This battle is not hypothetical anymore.

It is already here… and it appears to be accelerating.

II. The Last Time This Happened (1900-1920)

We’ve been here before… not with Bitcoin, but with a technological transformation so disruptive that it forced a total reconstruction of American finance, governance, and society.

Between 1900 and 1920, America’s industrial elites faced:

- populist anger,

- antitrust pressure,

- political hostility,

- and the potential collapse of their monopolies.

Their response wasn’t retreat.

It was centralization.

Examples of these efforts, vibrate through today’s societal fabric:

Medicine

The Flexner Report (1910) standardized medical education, wiping out millennia-old alternative healing traditions and birthing the Rockefeller medical regime that became the backbone of modern U.S. pharmaceutical power.

Education

Industrialists funded a standardized school system designed to produce compliant workers for centralized industrial production… a framework still in place today, now optimized for services rather than manufacturing.

Food & Agriculture

Agribusiness consolidation created a cheap-calorie, low-nutrient food infrastructure riddled with preservatives and chemicals. It reshaped American health, incentives, and political economy for a century.

Monetary Architecture

In December 1913, the Federal Reserve Act imported Europe’s central banking model.

Ten months earlier, the federal income tax (a mere 1% on incomes above $3,000 (~$90,000 in 2025)) created a permanent revenue pipe to service federal debt.

The foundation for today’s fiat debt-based system was born.

This was the last great pivot… a silent reorganization of American power around a centralized monetary core, controlled by an institution independent of elected government and governed by opaque mandates.

We are now living through the next pivot.

But this time, the substrate is decentralized… and incorruptible.

That substrate is Bitcoin.

The players are familiar: echoes of the industrial Caesars on one side, and Jeffersonian-style populists on the other. But the stakes are higher. The Financialists are fortified by a century of synthetic-suppression gimmicks and narrative control, while the Sovereignist bloc is fragmented yet deploying tools the legacy system never anticipated.

And for the first time since 1913, the fight is spilling into the streets.

III. STRC: The Great Conversion Mechanism

In July, MicroStrategy launched STRC (“Stretch”). Most observers shrugged, assuming it was just another eccentric Saylor invention… a quirky corporate lending vehicle or a fleeting attention experiment.

They missed what STRC truly represents.

“STRC is the Great Conversion mechanism for the capital markets. It’s the first key incentive realigner.”

STRC is the first scalable, regulatory-compliant mechanism that:

- sits inside the existing financial system,

- interfaces with capital markets natively,

- and converts yield-starved fiat savings into Bitcoin-collateralized real return.

When Saylor called STRC “MicroStrategy’s iPhone moment,” many brushed it off.

But from a conversion-rails perspective?

STRC may actually be Bitcoin’s iPhone moment - the point where Bitcoin’s price dynamics achieves reflexive equilibrium providing stable footing for the Administration to reveal the pivot.

STRC connects:

Bitcoin the asset,

- → to

the collateral base,

- → to

- Bitcoin-powered credit and yield.

This matters because: in inflationary and debasement regimes, value is quietly siphoned from the unsuspecting. Those who understand what’s happening now have access to pristine collateral… a way to store and protect their life’s energy, their accumulated savings, across time and space.

Ultimately, when trust collapses, people instinctively seek truth… and Bitcoin is mathematical truth. - (If this doesn’t yet resonate, it simply means your journey down the rabbit hole hasn’t begun.)

Ultimately when trust collapses, people seek truth…. and Bitcoin represents mathematical truth. STRC turns this principle into a financial engine.

It doesn’t merely offer yield.

It channels suppressed fiat liquidity into an upward-spiraling Bitcoin collateral loop.

The Financialists feel threatened. Some may even understand the threat to their exploitative system.

They sense what happens if this loop scales.

IV. The Positive-Feedback Loop the Financialists Fear

When the U.S. attempts to “grow its way out” of fiscal dominance (with monetary expansion and yield curve control) savers will chase real returns as inflation resurges.

But traditional channels can’t deliver them:

- Banks can’t.

- Bonds can’t.

- Money market funds can’t.

But Bitcoin can.

MicroStrategy constructed a corporate-scale monetary loop:

- Bitcoin appreciates.

- MicroStrategy’s collateral base strengthens.

- Borrowing capacity expands.

- Cost of capital falls.

- STRC delivers compelling Bitcoin-backed yield.

- Capital flows from fiat → STRC → Bitcoin collateral.

- Bitcoin float tightens.

- The loop repeats at a higher base.

This is the Scarcity Engine - a system that strengthens as fiat weakens.

The ARB (the gap between fiat’s suppressed returns and Bitcoin’s structural IRR) becomes a monetary black hole.

If STRC scales, the Financialists risk losing control over:

- interest rates,

- collateral scarcity,

- monetary transmission,

- liquidity channels,

- and the cost of capital itself.

This is the context for the first attack.

V. The Coordinated Drawdown

(Pattern, not proof.)

After Bitcoin peaked on October 6th:

- BTC fell from 126k to the low 80s

- MSTR fell from the 360s to the high 100s

- STRC held par during broad crypto turbulence

- It only cracked on November 13th during a sudden liquidity vacuum

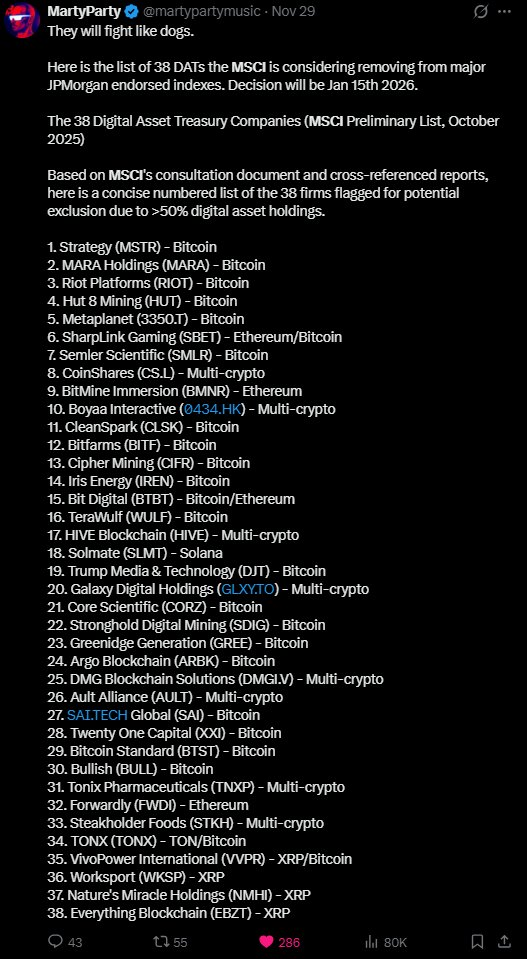

- Days later, the MSCI “delisting” narrative was refloated… aimed squarely at MSTR

This sequence does not look organic. It has the markings of the first coordinated strike on the conversion rail. Again (pattern, not proof) but the pattern is hard to ignore.

When STRC held par, it revealed what a functioning Bitcoin-collateralized credit engine could become.

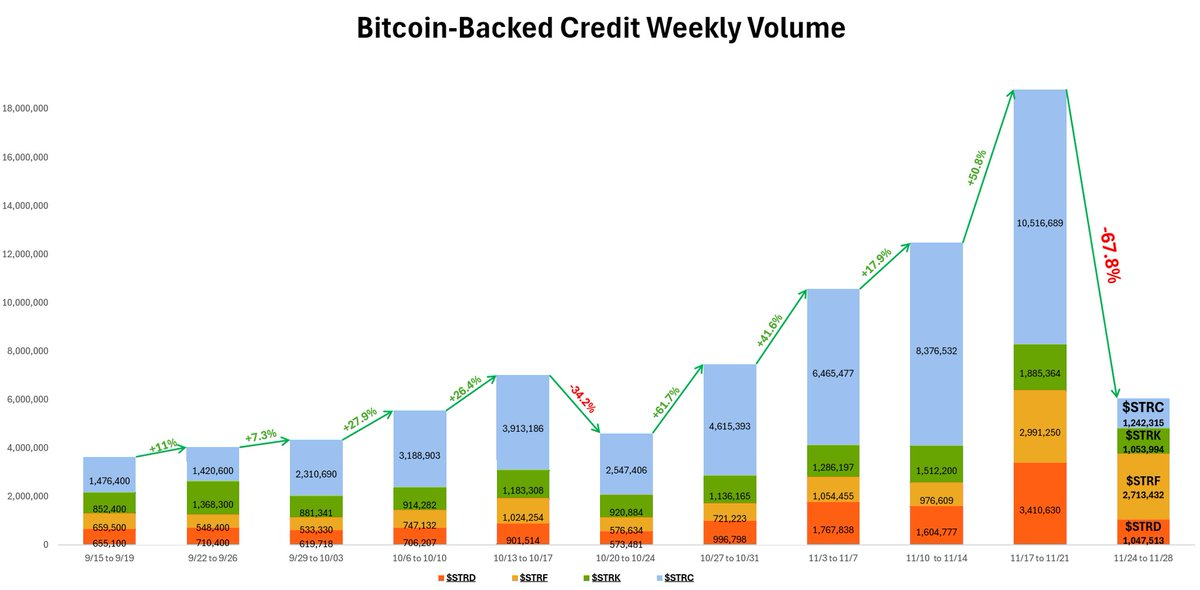

The data from the first two weeks was small in size but enormous in implication:

- Nov 3–9: $26.2M BTC purchased off $6.4B volume

- Nov 10–16: $131.4M BTC purchased off $8.3B volume

Don’t focus on the dollar figures. The mechanics are what matter.

Scale those mechanics, and the reaction of the Financialists becomes self-explanatory.

If STRC scales:

- money markets lose relevance

- repo loses dominance

- derivative price suppression weakens

- bank-manufactured yield collapses

- capital flows bypass the banking system

- Treasury loses control over domestic savings

- the USD monetary base begins to split

MicroStrategy was not simply launching a product.

It was building a new conversion rail.

And JPMorgan responded immediately.

VI. JPMorgan’s Counterattack: A Synthetic Shadows

(Pattern, not proof.)

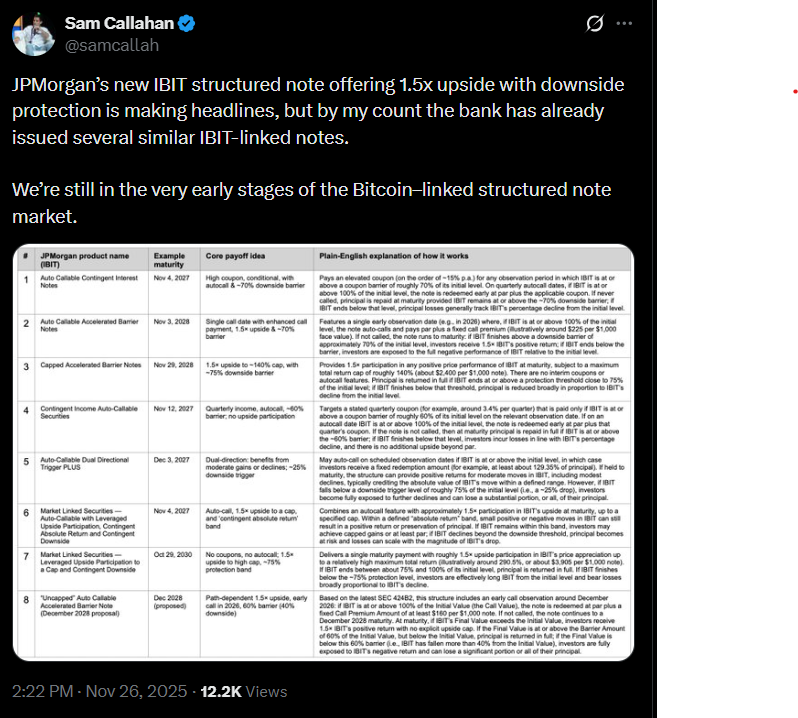

During a holiday-shortened week… ideal for quiet structural maneuvers - JPMorgan loudly unveiled a “Bitcoin-linked” structured note.

Its design reads like a confession:

- tied to IBIT instead of spot

- cash-settled

- no Bitcoin purchased

- no float reduced

- capped upside

- convexity kept by the bank

- downside pushed to the client

However, as @ Samcallah uncovered, the true magnitude is more sinister:

JPM has recently unleashed a series of IBIT-linked structured products.

This is not innovation. This is the centralized playbook - keep the gains for the architects and socialize the losses.

This is recapture… an attempt to yank Bitcoin exposure back inside the banking system without ever touching real BTC.

It is the rebirth of the paper-gold system. Where:

The Synthetic Shadows = undetectable amounts of paper Bitcoin.

In contrast:

- STRC requires real Bitcoin

- STRC tightens float

- STRC strengthens the Scarcity Engine

Two products.

Two paradigms.

One future, one past.

VII. Why MicroStrategy Is the First Target

(Pattern, not proof.)

MicroStrategy threatens the Financialist model because it is:

- the largest public Bitcoin balance sheet,

- the first corporate Bitcoin reserve bank,

- the only firm monetizing Bitcoin collateral at institutional scale,

- the only regulated entity offering Bitcoin-collateralized real yield,

- the only bridge circumventing all synthetic exposure channels.

This helps explain the pattern of pressure:

- MSCI penalizing Bitcoin-heavy firms - see the post from @ martypartymusic below:

(note how they conveniently left out Coinbase, Tesla or Block)

- Credit Rating Agencies (a Wall Street construct) reluctantly rating MSTR’s preferreds and then conveniently targeting Tether - both attempts to minimize sound money as legitimate collateral

- Rumors of JPMorgan obstructing MSTR share transfers

- Synchronized BTC/MSTR drawdowns around MSCI headlines

- Sudden policymaker attention, both positive and negative

- Banks racing to recreate synthetic Bitcoin exposure to pull demand back inside the legacy system

MicroStrategy isn’t under attack because of Michael Saylor.

It’s under attack because its balance-sheet architecture breaks the Financialists’ system.

This remains a pattern (not definitive proof)… but the signals rhyme.

VIII. The Sovereign Layer - Where This Ultimately Leads

Zoom out, and the larger architecture becomes clear:

- Stablecoins will dominate the front end of the curve.

- BitBonds will stabilize the long end.

- Bitcoin reserves will anchor sovereign balance sheets.

- MicroStrategy is the prototype for a capital-markets-level Bitcoin reserve bank.

The Sovereignists may not consciously articulate this plan, but they are converging toward it.

And STRC is the upstream catalyst.

Because STRC is not actually a debt or equity product.

STRC is a jailbreak mechanism.

A derivative that forces a violent chemical reaction where fiat dissolves into scarcity.

It breaks the monopoly on:

- yield,

- collateral,

- and monetary transmission.

And it does so from inside the legacy system - using the system’s own regulatory scaffolding as leverage.

IX. The Moment We’re In

At this point, the embedded debasement of fiat is simple and undeniable math… increasingly obvious to the masses. Should Bitcoin be leveraged by the Sovereignists as a tool, the Financialist architecture could collapse as quickly as the Berlin Wall.

Because in the end, truth conquers quickly when it’s allowed to surface.

Bitcoin is the battlefield.

MicroStrategy is the signal.

STRC is the bridge.

The war unfolding now (openly, visibly, undeniably) is the war for the conversion rails between fiat and Bitcoin.

This war will define this century.

And for the first time in 110 years, both sides are showing their hands.

What an extraordinary time to be alive.

@ DarkSide2030_ @ Puncher522 @ jacksage_

Note to Readers:

If these concepts feel unfamiliar or complex, here’s a simple way to understand them:

Copy the text.

Open GROK (or your preferred AI assistant).

Paste the text and use this prompt:

“Please summarize the key concepts and ideas. Explain them in a way that an average person can easily understand. Describe the potential implications for individuals and society as a whole. Finally, highlight the most important ideas I should take away.”

Authors Comments:

This article was completed using Original Thought, Chat Enhanced or “OTCE”. I’m not a professional writer and don’t aspire to become one. My goal is to present both familiar and novel ideas with a twist, making them easy for readers to digest and understand. Whenever possible, I will provide credit to the original source of ideas.

The questions and concepts explored here reflect my personal thoughts about what the future might hold for my family. None of my articles should be considered financial advice. Instead, I encourage you to engage actively with the content: copy the article into your preferred LLM, activate voice mode, and have a dynamic conversation. Feel free to ask questions, explore the implications, or challenge the ideas presented.

Like you, I’m simply a pleb navigating the next steps. Individually, we are each just a part of the broader collective. Together, we form the hive mind, and it is this collective intelligence that will propel us into the next evolution.

— MarylandHODL

Greater Thesis & Additional Works:

While the piece above is a follow-up article responding to recent events, it also ties directly into the broader thesis I’ve been developing through a series on my Substack - The Transition | Substack

So far, I’ve completed:

Preface: The Coup We Never Voted For

Part 1: Coup to Code - The End Run Around the Fed

Part 2: Unlocking the Sovereign Flywheel

I’m now working on the final two sections:

Part 3: BitBonds - The Structural Innovation

Part 4: The Great Incentive Alignment and the End of the Great Distraction

As @ martyBent puts it, “Fix the money, fix the world.”

Within my framework, Bitcoin doesn’t just protect the individual… it realigns incentives across an entire society distorted by broken money.

Bitcoin is extraordinarily powerful, yet its full potential remains invisible to most because its true impact lies on the far side of an unfolding monetary and productive paradigm shift.

Our current industrial-era economic model is built on debt, which requires perpetual growth and inflation to survive. The coming AI revolution, by contrast, will be deeply deflationary. These two systems are antithetical to one another. A world run by AI and robotics demands an intangible, deflationary monetary foundation… which will be anchored by Bitcoin.

As @ jeffbooth often notes, it’s nearly impossible for an individual to grasp what exists beyond a paradigm shift… and we’re facing two at once.

Put simply, I believe Bitcoin may be the first tool capable of reducing the death and destruction that typically accompany a Fourth Turning. By realigning monetary and ethical incentives, it can help guide our civilization into “The Age of Abundance” - a world where AI (and its embodied forms) drive marginal costs toward zero and render many industrial-era models obsolete.

A world where money (of every form) holds little value, even Bitcoin once the transition is complete.

What if Bitcoin’s true purpose is to inject trust back into society at the most foundational level?

I’ll be sharing much more about this framework in the coming weeks and months, something I call Post-Scarcity Monetary Theory (“PSMT”).

Disclaimer:

- This article is reprinted from [MarylandHODL]. All copyrights belong to the original author [MarylandHODL]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?